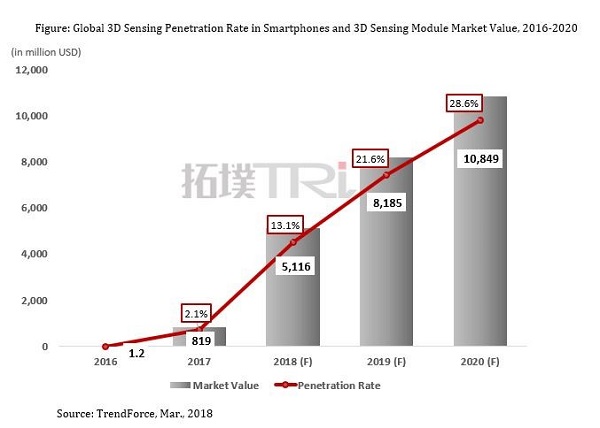

Apple’s launch of iPhone X has led to a wave of 3D sensing technology, bringing its key component—vertical cavity surface emitting laser (VCSEL)—into the spotlight. However, the number of VCSEL suppliers with mass production capacity is very limited due to technical barriers, leading to short supply of VCSELs and thus delaying Android camp’s plan to follow suit. TrendForce estimates the penetration rate of 3D sensing in smartphones will grow from 2.1% in 2017 to 13.1% in 2018, while Apple remains the major adopter.

|

|

(Image: Apple) |

Technical barriers in 3D sensing module production lead to delayed adoption by Android phones

According to Peter Huang, analyst at TrendForce, there are three major technical barriers in producing 3D sensing modules at present. First, it is not easy to manufacture high-efficiency VCSELs, and the current electrical-to-optical power conversion efficiency is only about 30% on average. Second, the production of diffractive optical elements (DOE), a necessary component of Structured Light technology, and CMOS image sensor (CIS) in infrared cameras, require sophisticated technology. Third, the issue of thermal expansion also needs to be taken into consideration, making 3D sensing module assembly even more challenging. In sum, all these factors contribute to low yield of 3D sensing modules.

In response to the market demand, a few manufacturers are undergoing plans to expand VCSEL production, but due to low yield rate there is still insufficient supply in the market. In addition, VCSEL wafer productions need to be based on 6-inch to be cost-effective, while most manufacturers only have the capability to product 4-inch or 3-inch wafers, making short supply of VCSELs even more severe.

Huawei and Xiaomi may embed 3D sensing modules in 2018 but will fall short of Apple’s version

Although Lenovo and ASUS have previously introduced mobile phones equipped with Google Tango module, the market didn’t respond well. It was not until Apple’s launch of iPhone X in 2017, which embeds its “TrueDepth” camera, that 3D sensing becomes a heated topic again. Right now, the hottest discussion in the market is which Android brand will be the first to follow suit.

A popular guess is that Huawei’s P20, which will be released on March 27th of this year, would very likely carry a rear 3D sensing module featuring enhanced AR functions rather than iPhone X’s facial recognition. This suggests that Android camp would prefer ToF before it could come up a feasible Structured Light solution.

In addition, since Apple has an exclusive agreement with Lumentum, Android brands will have to use Edge Emitting Laser (EEL) instead of VCSEL if they want to follow suit in the short term. However, EEL has lower electrical-to-optical power conversion efficiency and higher production costs, making Android’s 3D sensing solutions less competitive than Apple’s version in terms of cost and efficiency.

Therefore, it is estimated that only up to two Android phone vendors, most likely Huawei and Xiaomi, would adopt 3D sensing modules in 2018 with very limited shipments. Thus, Apple will remain the major smartphone company that adopts 3D sensing this year. It is estimated that the production volume of smartphones equipped with 3D sensing modules will reach 197 million units by the end of 2018, of which 165 million units will be iPhones. In addition, the market value of 3D sensing module in 2018 is estimated to be about US$5.12 billion, with iPhones alone accounting for 84.5% of the entire value. By 2020, the market value is estimated to reach US$10.85 billion, and the CAGR will be 45.6% from 2018 to 2020.