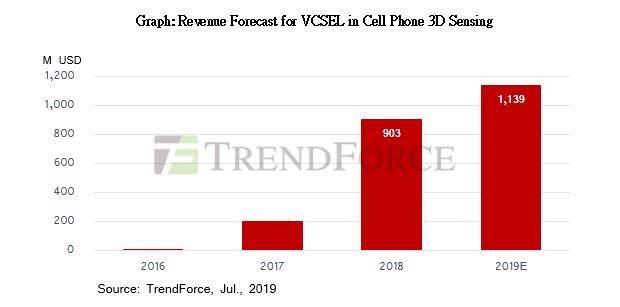

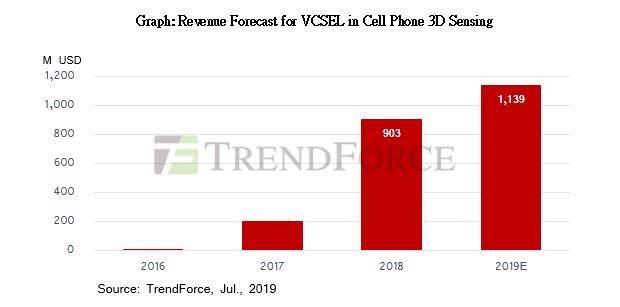

According to the latest Infrared Sensing Application Market Trend Report by LEDinside, a division of TrendForce, seeing that smartphone shipments are predicted to decline for whole 2019 year, cell phone brands will be engaging in a 'specs -contest' with their flagship devices for the second half-year, and 3D sensing modules will become an important component in that race. Market revenue for VCSELs used by cell phones utilizing 3D sensing is projected to reach US$1.139 billion as a result of this trend.

“For 2019, besides Apple, who will be implementing 3D face recognition in its iPhones wholesale, Samsung, Huawei and Sony have also scheduled implementations of world-facing 3D sensing in flagship devices in 2H. It is estimated that near to 10 high-end phones may use 3D sensing solutions in 2020, with some devices going so far as to implement the solution on both the front- and world-facing cameras and pushing up VCSEL revenue,” says TrendForce Research Manager Joanne Wu.

VCSEL Suppliers Actively Developing World-facing TOF Camera Solutions

The 3D sensing solutions currently used in the consumer market are structured light and time-of-flight (TOF). Structured light acquires the image through projected light patterns, and is able to determine depth with extreme precision, though it comes with a high cost and computational complexity. Moreover, Apple holds the patent for the technology, forming a formidable patent barrier.

TOF does not enjoy the precision and depth that structured light does, but its fast reaction speeds and detection range make up for it. TOF cameras may be divided into front-facing and world-facing versions, with front-facing cameras costing more and world -facing cameras using the higher power VCSELs. Major VCSEL-related companies currently include Lumentum, Finisar, OSRAM's Vixar, ams, WIN Semiconductors Corp., Advanced Wireless Semiconductor Company (AWSC), VIAVI Solutions Inc. etc.

Android Players Eager to Penetrate Market for Varied VCSEL Applications

Many acquisitions and investments have taken place in the VCSEL market between 2017 and 2018, demonstrating that suppliers are optimistic towards future VCSEL demand. Since Apple adopted 3D sensing features in its iPhones wholesale in 2018, using it for face recognition and face unlock, many non -Apple companies such as Xioami, Huawei and OPPO caught on and began development. Yet there are serious bottlenecks in 3D sensing technology as well as a patent barrier, causing development by members of the Android camp to be slower than anticipated. Yet many cell phone brands still see 3D sensing as a technology with much potential.

As the 3D sensing market emerges, 3D sensing technology in future cell phones will no longer be limited to simple face recognition and face unlock applications, but extend to 3D object recognition, modeling, AR and various other features.

TrendForce's latest “LEDinside 2019 Infrared Sensing Application Market Report- Mobile Sensing, LiDAR and Optical Sensing” report provides penetrating analyses into markets for IR LED, VCSEL, EEL, biometric recognition, driver monitoring systems (DMS), LiDAR and other sensing applications. For more information, please visit: https://www.ledinside.com/newsletter/2351.

2019 Infrared Sensing Application Market Trend- Mobile Sensing, LiDAR and Optical Sensing

Release Date: 01 January 2019

Languages: Traditional Chinese / English

Pages: 181

Wavelength and Application Market Analysis

Infrared Wavelength and Application Market Analysis

IR LED and IR Laser Product Power and Sensing Distance Analysis

2019 Infrared Sensing Application Market Trend

Chapter I. Infrared LED Market Scale and Application Trend

2019-2023 IR LED Market Value

2019-2023 IR LED Market Value- Security Surveillance Market

2019-2023 IR LED Market Value- Automotive Night Vision System Market

2019-2023 IR LED Market Value- Under Display Fingerprint

2019-2023 IR LED Market Value- Eye Tracking

2019-2023 IR LED Market Value- Iris and Facial Recognition

IR LED Product Specification in Surveillance and Facial Recognition Market

Chapter II. Infrared Laser Market Scale and Player Movement

2.1 Infrared Laser Market Scale

2018-2020 Mobile 3D Sensing VCSEL Market Value

2019-2023 LiDAR Laser Market Value

2.2 Infrared Laser Technology Requirement

IR VCSEL Manufacturing Process

IR EEL Manufacturing Process

Implanted and Oxidation VCSEL Analysis

LED, EEL, VCSEL Product Performance Analysis

Advantages of VCSEL Used in 3D Sensing Mobile Products

IR LED and IR Laser Product Power and Sensing Distance Analysis

2.3 Infrared Laser Player Movement

VCSEL / EEL Player List

VCSEL Manufacturers M&A and Investment Strategies

Global 35 VCSEL Players Production Capability Analysis

VCSEL v.s. EEL Player Supply Chain Analysis

2018 VCSEL / EEL Player Capacity Plan Analysis

1W VCSEL Player Product Performance and Price Analysis

2.4 Long Wavelength Infrared Technology and Market Trend

Long Wavelength VCSEL Manufacturing Process

Opportunities and Challenges for Long-wavelength IR Laser Market

Long-wavelength IR Laser and IR LED Player List

Chapter III. Mobile Biometric Sensing Market Trend

Major Biometric Methods and Its Pros and Cons

2018-2019 Major Biometrics Market Share

3.1 Iris Recognition

Iris Recognition Product is to Become a Product of History

Iris Recognition in Potential Application Markets

3.2 Fingerprint Recognition

2018-2019 Mobile Shipment and OLED Penetration Rate

2018-2019 Mobile Shipment- Optical and Ultrasonic Under Display Fingerprint

Optical and Ultrasonic Under Display Fingerprint

Optical Touch ID and IR LED Product Specification

2018-2019 Optical and Ultrasonic Under Display Fingerprint Market Share

Optical Under Display Fingerprint Recognition Supply Chain

3.3 3D Facial Recognition

Extensive Application of 3D Sensing

3D Sensing Technology Analysis

ToF Sensing Solution- Direct Type and In-Direct Type

Feasibility of 3D Sensing Technology Used in Mobile AR

Comprehensive Analysis of 3D Sensing Technology

3D Sensing Technology- Strategic Alliance and Player Status

APPLE True Depth Camera to Boost 3D Sensing Technology

Structured Lighting Depth Camera Cost and Supply Chain

Structured Lighting Depth Camera Structure and Potential Supply Chain

Time of Flight Depth Camera Cost- Front Facing

Time of Flight Depth Camera Structure and Potential Supply Chain- Front Facing

Time of Flight Depth Camera Cost- World Facing

Time of Flight Depth Camera Structure and Potential Supply Chain- World Facing

Active Stereo Vision Depth Camera Cost Forecast

Active Stereo Vision Depth Camera Structure and Potential Supply Chain

VCSEL Chip and Package Technologies Analysis

VCSEL Chip and Package Technologies- WLO Components

Key Successful Factors of VCSEL Product Analysis

VCSEL Burn in and Test Requirements in all Phases

Mobile Brands Face ID and 3D Sensing Supply Chain

2018-2020 Mobile 3D Sensing Market Scale

2018-2020 Mobile 3D Sensing VCSEL Market Value

Mobile Branding Facial Recognition and 3D Sensing Schedule

Key Factors of Mobile 3D Sensing Market Development

3.4 2D Facial Recognition

2D Face ID Principle and Market Demand

IR LED Products Used in 2D Face ID Market

Chapter IV. LiDAR Market Trend

2018 v.s. 2023 LiDAR Market Value

LiDAR Market Application Overview

LiDAR Three Major Applications Analysis

4.1 Industrial, Warehousing and Logistics Automation Market

Automated Guided Vehicle Product Introduction

Seven Navigations of Automated Guided Vehicle

Automated Guided Vehicle Market Development and Players

4.2 Automotive LiDAR Market

Advanced Driver Assistance System (ADAS)- Levels Diagram

Car Maker ADAS Roadmap

Autonomous Car Market- Merge, Investment, Strategic Cooperation Analysis

2020-2050 ADAS Market Forecast

Eight Advanced Driver Assistance Systems and Sensor Analysis

Analysis of Automotive Sensing- LiDAR, Radar and IR Camera

Scanning LiDAR Execute Process

Flash LiDAR Execute Process

Automotive LiDAR Manufacturer List- By Region

Scanning LiDAR v.s. Flash LiDAR Technology Analysis

Scanning LiDAR v.s. Flash LiDAR Player Analysis

Automotive LiDAR Market Restriction Factors

LiDAR Product Technology and Specifications Overview

Scanning LiDAR and Flash LiDAR Analysis

4.3 Drone Market

Industrial Drone Application Market Analysis

Drone Obstacle Avoidance Technologies

Drone Product Trend and Supply Chain Analysis

4.4 LiDAR Laser Market Requirement and Major Player

2019-2023 LiDAR Laser Market Value

LiDAR Three Basic Components

LiDAR End Product Requirements and Light Source Analysis

LiDAR Laser Strength Analysis and Major Suppliers

Long-wavelength IR Laser in Automotive LiDAR Market

Photodetector Product Advantages Analysis

IR Laser and Photodetector Manufacturer List

Chapter V. Mobile and In-cabin Automotive Optical Sensor Market

Mobile and Wearable Device Sensing Trend

2018-2019 Mobile and Wearable Device Shipment

5.1 Proximity Sensor Market Trend

2018-2019 Proximity Sensor Market Trend and Major Suppliers

Proximity Sensor Niche Market- AirPods Introduction

5.2 Photoplethysmography Market Trend

2018-2019 Pulse Oximetry Sensor Market- Accurate Measurement

2018-2019 Pulse Oximetry Sensor Market- Blood Glucose Trend

2018-2019 Pulse Oximeter Market Trend- Glucose Monitoring

Photoplethysmography (PPG) Business Model

Main Pulse Oximetry Sensor Supply Chain and Brand List

5.3 Spectral Sensing Market Trend

2018-2021 Spectral Sensing Market Scale

Spectral Sensing Market Trend and Application

Principle of Spectral Sensing Products

IR with Visible Light Spectrum Sensing Player and Product Trend

5.4 In-vehicle Automotive Optical Sensor Market Trend

In-vehicle Infotainment System Trend

In-vehicle Optical Sensing Three Market Trends

Facial Recognition Market and IR Product Trend

Driver Physiological Monitoring and IR Product Market Trend

Automotive Gesture Recognition and IR Product Market Trend

In-vehicle Optical Sensing Market Supply Chain

In-vehicle Optical Sensing Market Penetration Rate

Chapter VI. Optical Communication Trend

Optical Communication Market Definition

Optical Communication Major Player and Product Plan

2018-2019 Key Factors of Optical Communication Market Growth

2018-2020 Data Center Server Market Scale

100G Solutions and Light Source Product Requirements

2018 Optical Communication Emitting and Receiving Components Market

Further information, please contact: