Ming-Chi Kuo, renowned analyst of Tianfeng Securities, commented that the recent market uncertainties regarding Apple’s adoption of mini LED has resulted in a revision for the stock prices of partial critical suppliers, with the most evident correction seen from TSMT. Apple has invested heavily in the development and production of mini LED, and confirmed that mini LED has taken up a critical and strategic position in the product lines of productivity tools for the medium and long term. The product will contribute significantly to the revenue and profits of critical suppliers starting from the second half of 2021. Owing to its exclusive status, TSMT became the company with the largest degree of revision in stock prices recently from the supply chain of mini LED, and Kuo believes that the company has the highest investment value among suppliers.

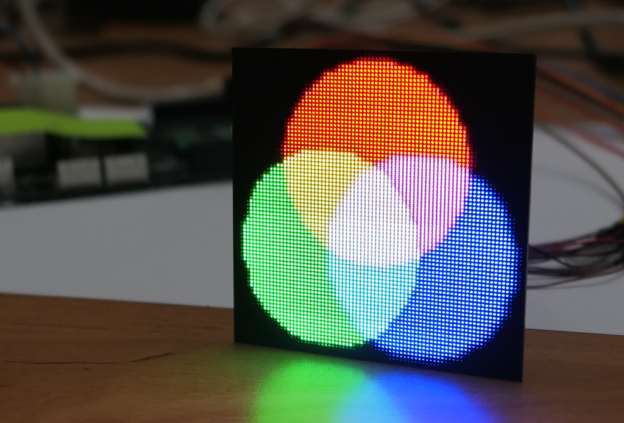

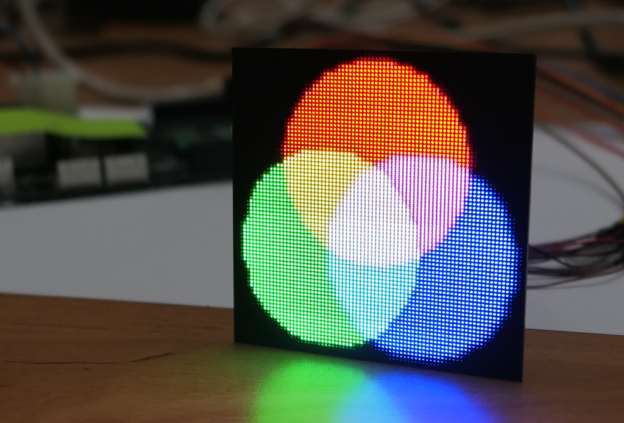

(Cover photo source: captured by TechNews)

Kuo pointed out in his report that the sizeable improvement in the product competitiveness of MacBook after the adoption of Apple’s M1 Silicon processor will generate a shipment growth that surpasses iPad for the next several years, and expects the new MacBook air in 2022 to also adopt mini LED, which will facilitate the adoption rate of mini LED of the MacBook series. In addition, the latest industry survey pointed out that Apple will be adopting OLED on its mid-to-low end iPad Air should it happen in 2022, and the high-end iPad Pro will still be configured with mini LED, for which the development will not be affected by the OLED configuration on iPad.

Apple’s adoption of mini LED for its MacBook and iPad Pro products will not only drastically reduce the production cost of mini LED, but the two critical hardware technology for Apple’s productivity devices, mini LED and the autonomously researched and developed processors (Silicon and iPad processor), will also be able to provide additional differentiated competitive advantages, as well as enhance the assimilation with software and service ecologies. Sales are expected to grow under an elevation of consumer experience.

The production yield rate and quality of mini LED has achieved the high standards of Apple, and assembly plants are expected to commence mass production of mini LED iPad after late April. Although the schedule for the mass production is later than the excessively optimistic forecast of the market in February or March, the corresponding revision in the stock prices of the supply chain will provide excellent point of purchases. The SMT yield rate for TSMT had started to improve significantly since the second quarter of 2021, and the shipment dynamics of the overall supply chain is about to amplify starting from the second half of 2021, thus it is a relatively good timing in relevant arrangement right now.

Kuo emphasized that TSMT has the highest threshold in the overall supply chain of mini LED being the exclusive SMT supplier of mini LED, and a potential second supplier of SMT will enter the supply chain in 2023 at the earliest. The aforementioned factors indicate that the exclusive position of TSMT, and the fact that it was the company that experienced the most prominent revision in stocking prices recently within the supply chain of mini LED, makes it the most worthy investment target.

(News source: TechNews)