Some of the advantages of third-generation semiconductors SiC and GaN include their ability to operate under high voltages, high temperatures (for SiC), and high frequencies(for GaN). Not only do these advantages allow manufacturers to significantly reduce the physical sizes of chips, but peripheral circuit designs can also be simplified as a result, thereby further reducing the sizes of modules, peripheral components, and cooling systems. That is why SiC and GaN have become important strategic focuses of the global semiconductor industry.

As part of its ongoing goal of semiconductor independence, China has been accelerating the development of third-generation semiconductors in recent years

From the perspective of substrate development, countries find it difficult to procure SiC substrates due to the lack of production capacities worldwide. Hence, the ability to control the supply of SiC substrates equals having more influence in the semiconductor industry. The current ranking of geographical regions that control the supply of SiC substrates is, in order, the US (Cree and II-VI), Japan (Rohm), and Europe (STM).

It should be pointed out that China’s overall standing in the third-generation semiconductor industry is hindered by its insufficient supply of substrates. Hence, Chinese companies are slightly lagging behind other global companies in this industry. At the moment, both TankeBlue and Shanxi Shuoke have successfully developed 8-inch SiC wafers, though their scale of mass production is yet to catch up to global leader Cree.

Despite the vast majority of GaN substrate suppliers being Japanese and European companies, Chinese companies have been making an aggressive push to enter this market. Regarding substrates, Nanowin, Sino Nitride, and Eta Research are all currently investing in R&D and mass production, though their current focuses are limited to 2-inch and 4-inch wafers. Regarding epitaxy, Enkris, GLC, and Genettice have been similarly making progress on R&D and mass production.

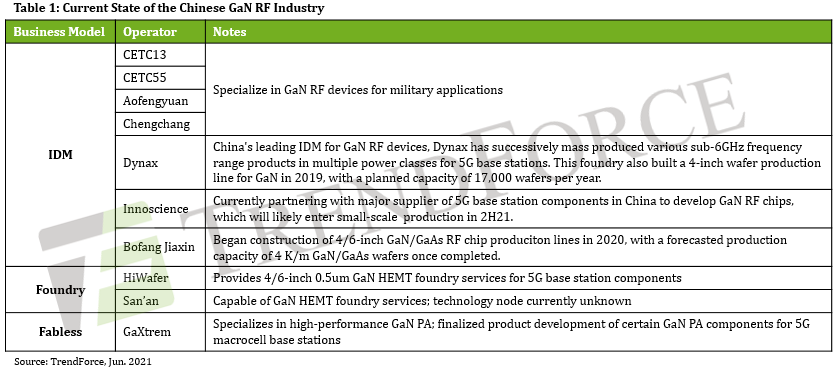

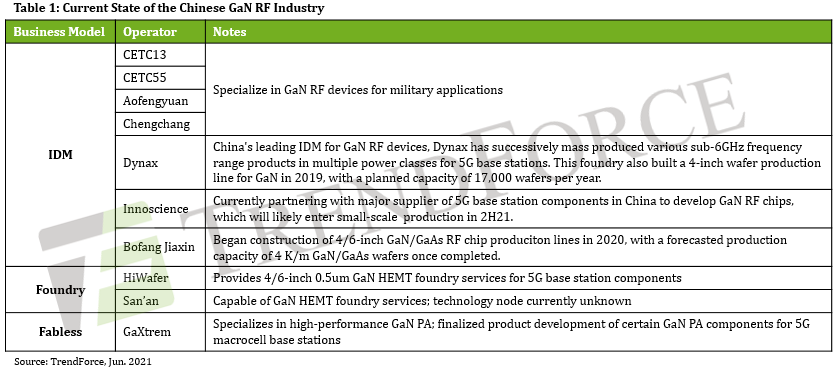

Furthermore, Chinese companies are farther ahead in the development and manufacturing strategies for GaN substrates compared to SiC substrates. For the GaN RF segment, Chinese companies span the entire supply chain, including IDM(CETC, Aofengyuan, Chengchang, Dynax, Innoscience, Bofang Jiaxin), foundries(HiWafer and San’an), and fabless IC design companies(GaXtrem).

(Cover image source: TSMC)