According to TrendForce’s latest market research report

2022 Global LED Lighting Market Analysis-2H22, as TrendForce reported, the demand for residential and commercial lighting was slashed in 1H22 by gloomy economic outlook amid soaring inflation, energy cost hikes following the Russia–Ukraine war, real estate downturns, as well as the pandemic’s twist and turns. That being said, as countries in Europe and North America began reopening, returns of commercial activities boosted consumption—plus the rising demand for energy-saving revamp solutions in Europe and Japan—thereby compensating the declines in commercial lighting markets. Additionally, robust economic activities in Southeast Asia offset the serious demand slump in China. Entering the second half of 2022, the market demand will rebound starting in 4Q22 following the launch of stimulus packages. In brief, with soaring inflation and solid prices of

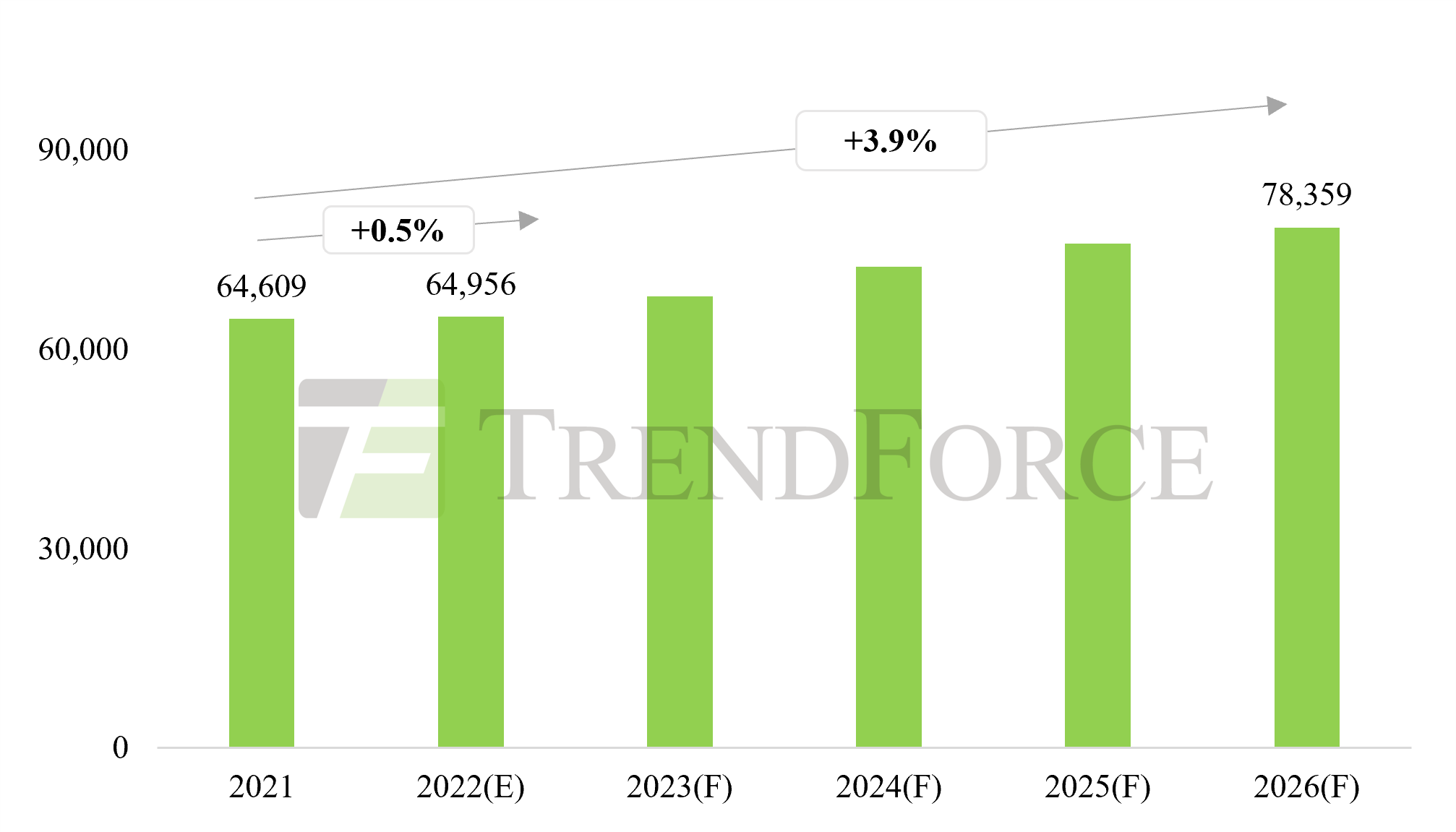

LED lighting products, TrendForce has revised down its forecast for the global

LED lighting market scale in 2022 to USD 64.95 billion (+0.5%YoY).

As for the outlook, the lighting industry will emphasize the optical quality of products (e.g., high luminous efficacy, color rendering, R9 value, and SDCM value) as well as human-centric lighting and smart functions. Accordingly, TrendForce predicts the global LED lighting market scale to hit USD 78.36 billion in 2026 with a 2021-2026 CAGR of 3.9% (Remarks: LED lighting market size adds brands and white-box products since the version of 2H21report).

Figure、2021-2026 Global LED Lighting Market Scale Forecast (Unit: Million USD)

Source: TrendForce, August 2022

LED Smart Street Lighting Market

Despite the slowdowns caused by the pandemic and Russia–Ukraine war in 1H22, the smart street light market will possibly grow 7% and hit USD 839 million in whole 2022 along with increasing government fiscal policies. Following the development of smart city construction, it is expected to start a new round of renovation for street lights in 2023. The key factor to promote the growth of smart street lights is to achieve the most important functions and demands through smart control. Thus, with the increase of LED smart light penetration, the market CAGR between 2021 and 2026 is likely to reach 15.5%.

In terms of communication protocol, the latest data compiled by TrendForce indicates that 76.6% of smart street light control technologies in 2021 were powered by PLC, followed by ZigBee (13.3%). NB-IoT has just reached maturity in actual applications, which is growing rapidly with a market share of 7.0%. Due to its advantages in covering a wide range of network infrastructure, NB-IoT can achieve low power consumption and construction cost, thus it has the potential to replace ZigBee. Additionally, the percentage of 4G-based smart street light applications has gradually increased.

LED Horticultural Lighting Market

Driven by the North America cannabis market, the LED horticultural lighting market has grown rapidly in the past 2 years. However, the market demand has begun to weaken starting in 2H21 due to supply chain woes and law enforcement efforts to tackle illegal cannabis cultivation in the continent. In 2022, growth has slowed in the horticultural lighting market due to delays in cannabis legalization across North America as well as a great slump in China. Nonetheless, the demand for replacing greenhouse LED equipment in Europe has increased plus stable prices of luminaire products. Accordingly, TrendForce has revised down the market scale to USD 1.79 billion (+6.6%YoY).

In the future, with rising awareness of food safety and global climate change, smart agriculture will move into the spotlight among governments worldwide. Additionally, the continued progress of cannabis legalization will enable the LED horticultural lighting market to enjoy stable growth. TrendForce predicts the market scale to reach USD 2.89 billion in 2026 with a 2021-2026 CAGR of 11.5%.

Lighting Manufactures Revenue

According to latest date combined by TrendForce, it is estimated that most lighting manufacturers will increase their revenue by an average of 1%-3%. It is worth noting that the increase in merger and acquisition activities of leading companies, coupled with the optimization of product mix, the revenue growth of the top 10 lighting manufacturers is expected to exceed 3%. In 2022, the Russian-Ukraine conflict is leading to rising global energy costs, and increasing demand for LED energy saving, which will accelerating the replacement of traditional lighting products. It is estimated that the average revenue growth of top 20 lighting manufacturers will be 2%-5%.

Numerous lighting firms have shifted to provide professional solutions featuring connected lighting products for customers, creating healthier and smarter lighting experiences. Such phenomenon will drive revenue growth among these lighting players. (By Christine Liu/Analyst of TrendForce Corp.)

TrendForce 2022 Global LED Lighting Market Analysis - 2H22

Release Date: August 8, 2022

File Format: PDF / Excel

Language: Traditional Chinese / English

Page: 120

Chapter 1. Global Lighting Market Trend

• TrendForce LED Lighting Market Scale- Methodology

• TrendForce LED Lighting Market- Product Definition

• TrendForce LED Lighting Market Product Definition- Lamps

• TrendForce LED Lighting Market Product Definition- Luminaires

• Connected Lighting to Create Second Growth Curve for LED Lighting Industry

• 2021-2026 Global LED Lighting Market Scale- by Product

• 2021-2026 Global LED Lighting Market Scale- by Region

• 2021-2022 Global LED Lighting Market Forecast- by Product

• 2021-2026 Global LED Lighting Market Forecast- by Application

• 2021 Global LED Lighting Market - Value Based: by Region vs. Product

• 2022 Global LED Lighting Market - Value Based: by Region vs. Product

• 2026 Global LED Lighting Market - Value Based: by Region vs. Product

Chapter 2. LED Smart Street Lighting Market Trend

• 2021-2026 Global Smart Street Light Market Scale

• 2021-2022 Global Smart Street Light Market Scale – by Technology

• Smart Street Light Regional Market Analysis

2009-2020 Installed Street Lighting Luminaire Market in China

• Smart Street Light Regional Market Analysis

2018-2020 Progress of Smart Street Light Projects in China

• Chinese Smart Street Light Main Participants Analysis

• Progress of Smart Street Light Projects in North America

• European Smart Street Light Market Status and Opportunities

• Changes in Street Light Development

• Definition of Smart Street Light

• Functions of Smart Street Light

• Major Types of Smart Street Light

• Smart Street Light Market Driver: Smart City Construction

• Smart Street Light Market Driver: Support from Government Policies

• Smart Street Light Value Chain and Main Players

• Analysis on Construction Cost and Price of Smart Street Light

• Opportunities and Challenges Facing Smart Street Light Market

Chapter 3. Lighting Market Regulations and Standards

• Effects of Policies and Regulations on the General Lighting Market

• Light Quality- CRI vs. R9

• Europe- LUX vs. UGR

• Europe- ErP New Energy Label

• Europe- EU Green Deal

• North America- DLC for General Lighting

• North America- DLC for Horticultural Lighting

• China- Low Blue Light (RG0)

• Policies- Other Regions

Chapter 4. Horticultural Lighting and LED Market Trend

4.1 LED Horticultural Lighting Market Demand

• 2021-2026 LED Horticultural Lighting Market Scale- LED Luminaire

• 2021-2026 LED Horticultural Lighting Market Scale- by Value vs. by Application

• 2021-2022 LED Horticultural Lighting Market Scale-by Value vs. by Region

• Progress of Legalizing Cannabis in North America

4.2 Overview of LED Horticultural Lighting

• Drivers of Growth in the LED Horticultural Lighting Market

• Distribution of Major Crops in the Horticultural Lighting Market

• Case Study of Plant Cultivation- Cannabis

• Case Study of Plant Cultivation- Strawberry

• DUV LED in Horticultural Lighting Market

• LED Horticultural Lighting Specification Requirements- by Applications

• Main Luminaire Categories of LED Horticultural Lighting Analysis

• Horticultural Lighting Products Specification and Price Analysis - Greenhouse

• Horticultural Lighting Products Specification and Price Analysis – Vertical Farming

4.3 LED Horticultural Lighting Supply Market

• 2021-2026 Agricultural Lighting LED Market Scale- LED Package

• 2021-2026 Agricultural Lighting LED Market Scale- by Power

• Mainstream Horticultural Lighting LED Products Analysis

Product Performance Is Steadily Being Improved Annually

• Horticultural LED Lighting Market Supply Chain

Chapter 5. Lighting Player Revenue Ranking and Strategies

• Global Major Lighting Manufacturer List

• 2020-2021 Top 20 Lighting Player Revenue Ranking: Total Lighting

• 2020-2021 Top 20 Lighting Player Revenue Ranking: LED Lighting

• 2021-2022(E) Top 20 Lighting Player Revenue Forecast: Total Lighting

• 2021-2022(E) Top 20 Lighting Player Revenue Forecast: LED Lighting

• Lighting Player Revenue and Product Strategies

Signify

Zumtobel

Fagerhult

Glamox Group

Acuity Brands

GE Current

Hubbell

Panasonic

Endo Lighting

IWASAKI

• 2021-2022(E) Top 10 Lighting Player Revenue Forecast: Total Lighting and LED Lighting

• Chinese Lighting Player Revenue and Product Strategies

MLS/LEDVANCE

Opple Lighting

NVC Lighting

Yankon Lighting

Chapter 6. Lighting Product Specification and Requirements

• Filament Light Specification Overview By Regions

• Filament Light Market- LED Specification Requirements

• Filament LED Market Trend

• Streetlight Specification Overview By Regions

• Panel Light Specification Overview By Regions

• Panel Light Market- LED Specification Requirements

• Panel Light Market Development Trend

• Troffer Light Specification Overview By Regions

• Troffer Light Market- LED Specification Requirements

• High / Low Bay Specification Overview By Regions

• High / Low Bay Market- LED Specification Requirements

• Explosion-proof Light Specification Overview By Regions

• Explosion-proof Light Market- LED Specification Requirements

Chapter 7. Lighting LED Market Scale

• 2021-2026 Lighting LED Market Scale- by Application

• 2021-2026 Lighting LED Market Scale- by Package

• 2021-2022 Lighting LED Market Scale- by Power

|

If you would like to know more details , please contact:

|