After years of research and planning in fields of the industry, academia, and research, Micro LED, known as the ultimate display technology, is entering a new stage of development this year. Micro LED applications for large-size displays and wearables are beginning to enter the mass production stage. However, it will still require a considerable amount of time for Micro LED to mature and be commercialized on a large scale.

At the TrendForce-organized seminar “Next-gen Display Technologies and Trends”, Eric YB Chiou, senior research vice president at TrendForce, introduced the latest development of Micro LED in various applications, taking a chronological approach to the subject.

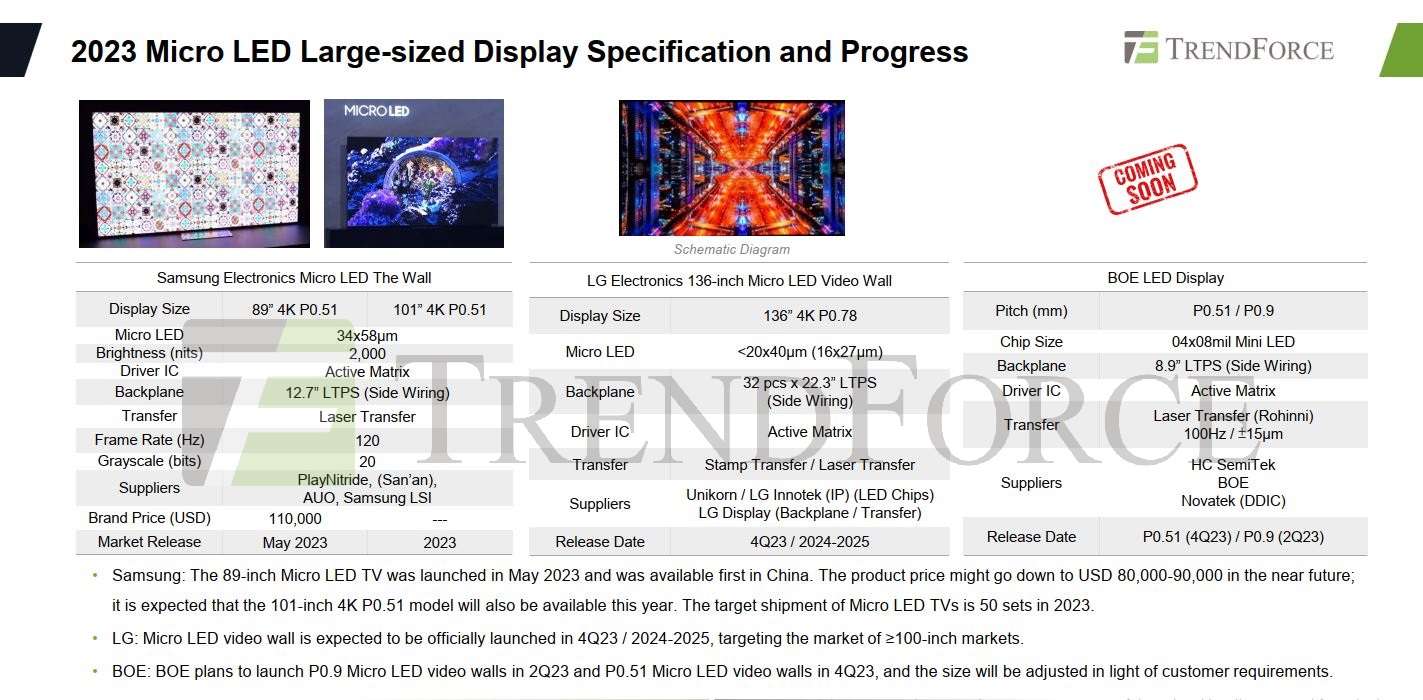

Large-size displays (video walls) are currently the major application for Micro LED, which is also the focus of most LED and display manufacturers.

Chiou indicated that 2023 has been the most celebratory year for this new display technology, as companies worldwide are endeavoring to promote the mass production of large Micro LED displays and have made several breakthroughs.

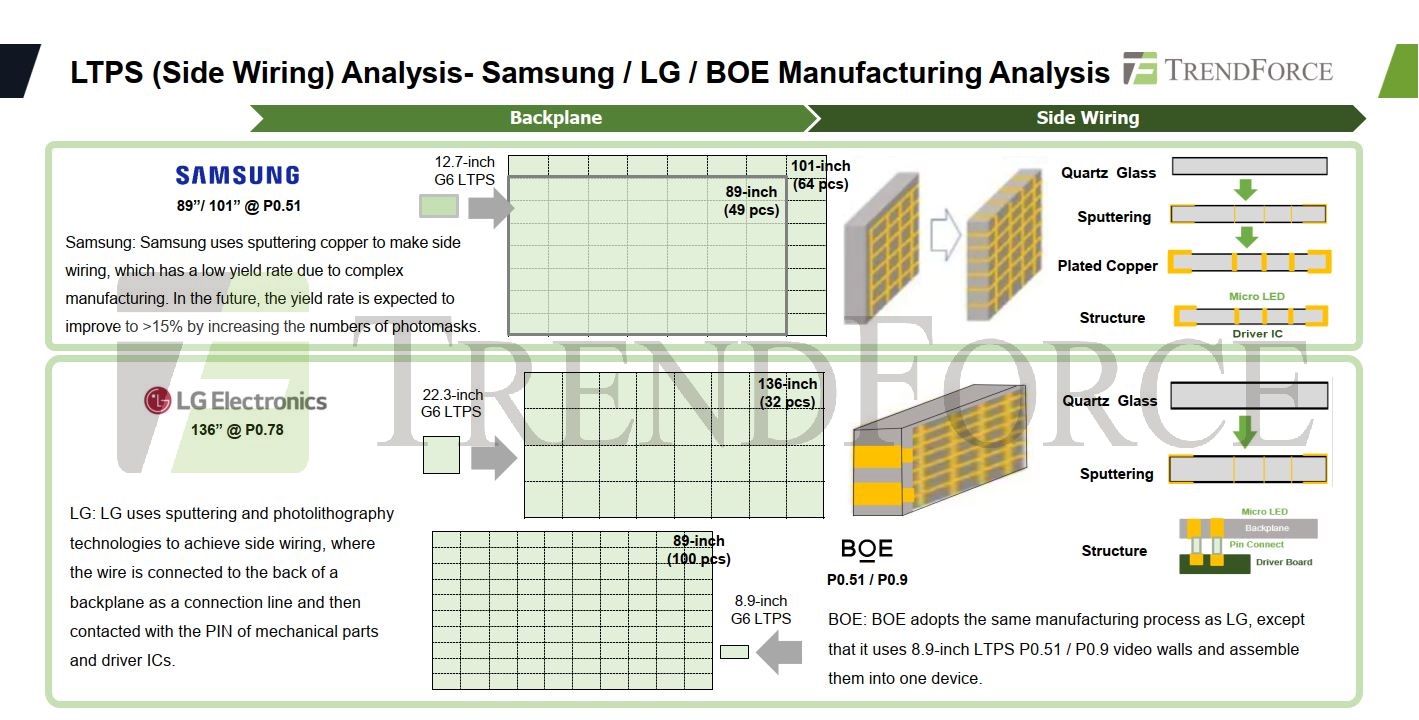

For example, Samsung mass produced its 89" spliced Micro LED TV and is scheduled to announce 101" and 140" models. LG unveiled a 118" Micro LED TV, priced at RMB 1.737 million (approx. $237,739), on September 8. The manufacturer also plans to release a 136" Micro LED display targeting business use later this year.

BOE will announce its 89" Micro LED display later this year or earlier next year. Notably, the Chinese display maker has built a comprehensive LED display industry chain, enabling independent production of Micro LED display products. This approach somewhat offers convenience for other brands entering the Micro LED market.

The mass production of large Micro LED displays indicates that their technical costs are falling constantly. TrendForce has observed that companies have started using micro-grade LED chips, indicating that small-size chips will see continuous optimization in costs and quality.

For instance, Samsung currently adopts Micro LED chips each measuring 34μm*58μm, whereas LG applies the smaller 16μm*27μm chips, marking a crucial milestone for Micro LED technology.

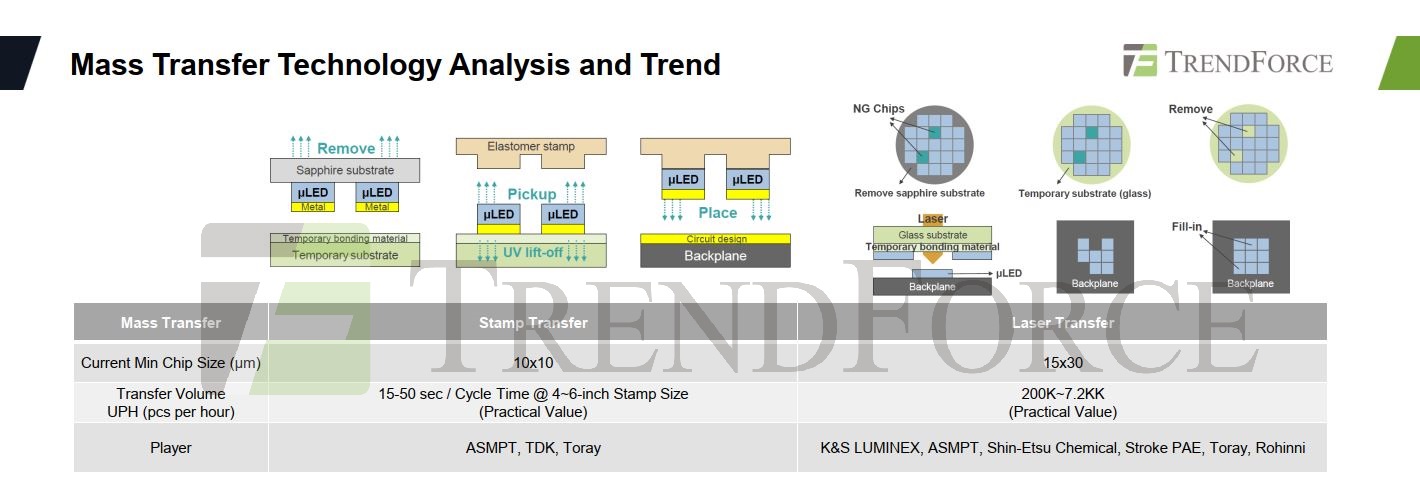

Despite the falling cost, Micro LED still faces numerous challenges. As Chiou pointed out, mass transfer and backplane technologies are two major issues that must be addressed for large-size display applications.

Specifically, a 4K display contains around 8 million pixels, requiring the transfer of more than 25 million Micro LEDs (calculated based on the number of RGB chips adopted individually). Therefore, the efficiency of transfer technology and yield rate are critical to Micro LED development.

Manufacturers have been developing rapid and accurate mass transfer processes. As each approach has its advantages and disadvantages, the Micro LED industry no longer focuses on single mass transfer approach. Instead, it has been striving to create novel transfer technologies combining different processes. For example, some LED makers combine the stamp transfer process with laser transfer, reaching a balance between efficiency and yield.

As for backplane technology, side wiring is required to achieve seamless splicing of Micro LED displays. However, such process is complex, consequently slashing the yield rate of backplane manufacturing. Businesses including Samsung and LG are still exploring new ways to enhance the yield rate of backplanes for large Micro LED displays.

To lower the prices of large-size Micro LED displays and significantly promote them in the commercial and consumer markets, solving the aforementioned problems will be vital in the next few years.

In addition to large-size displays, smartwatches are currently the most promising application for Micro LED. Earlier this year, when reports emerged that Apple was planning to use Micro LED for its Watch products, the focus on Micro LED wearables intensified.

Entering 2023, numerous display products for Micro LED smartwatches have been rolled out under the influence of corporate giants. Display makers including AUO and Innolux announced 1.4" Micro LED displays, mostly powered by 15μm × 30μm chips.

TrendForce holds that as Micro LED wearables are equipped with few chips than other applications, their requirements of mass transfer and other manufacturing processes are less strict. The mass production of Micro LED smartwatches will be possible by the end of this year.

As Chiou indicated, Micro LED is particularly well-suited for the smartwatch market. However, the application can scarcely contribute to the growth of Micro LED demand because of the following four reasons:

-

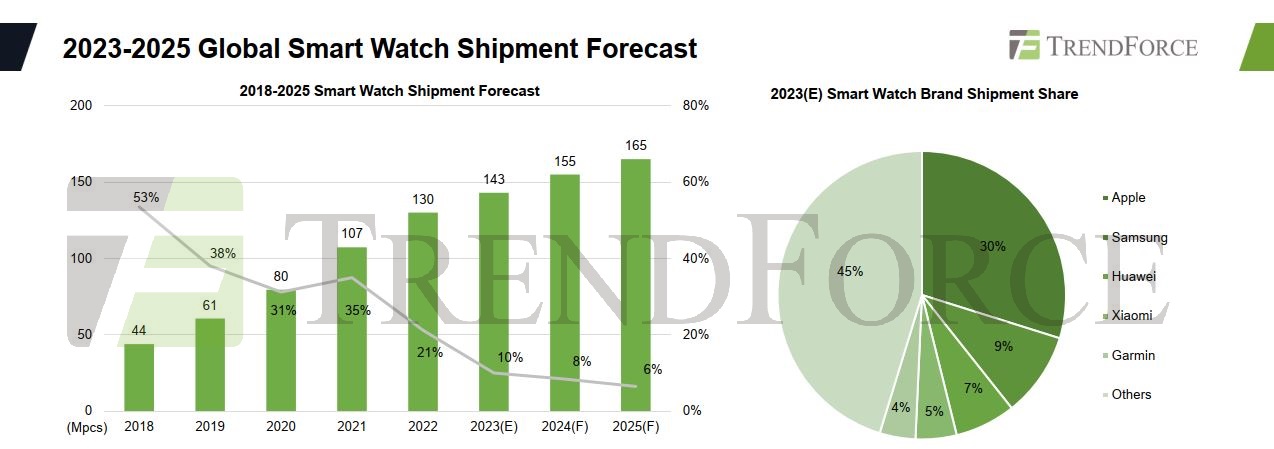

The smartwatch market size is small. TrendForce forecast smartwatch shipments to be 143 million units in 2023.

-

Smartwatches have a lower resolution compared to other applications, with screens measuring 1.4"–1.9". The demand for Micro LED chips can be small (each display panel is equipped with around 600,000 to 700,000 pcs).

-

The market concentration of smartwatches is low. Apple has captured the largest market share (30%), followed by Samsung, Xiaomi, and Huawei. Only a few brands are likely to expand the market size of Micro LED smartwatches in the future.

-

The use of Micro LED will increase prices of smartwatches. Exorbitant charges might lower consumers’ willingness to buy.

Whether smartwatches will become a crucial application for Micro LED demand to soar requires further observations.

-

Future: AR Glasses, Automotive Displays

Looking ahead, the key applications for Micro LED technology lie on AR glasses and automotive displays.

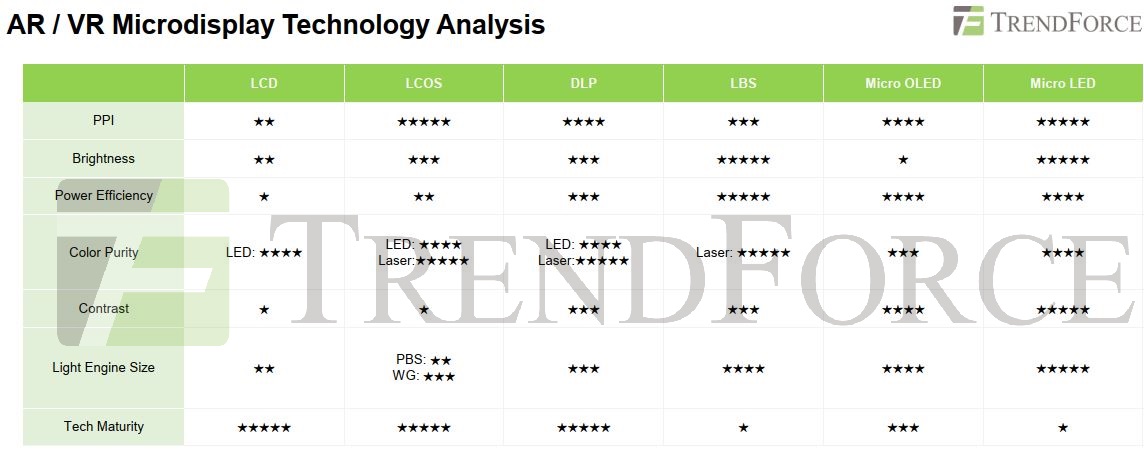

Compared to more commonly used display technologies in AR glasses like LCD, LCOS, DLP, LBS, and Micro OLED, Micro LED stands out for its characteristics of high pixel density, high brightness, high color purity and low energy consumption. Additionally, Micro LED allows for the reduction in the size of optical engines while maintaining high display performance without compromising the appearance of the glasses.

Micro LED faces more challenges regarding its use for AR glasses compared to other applications, such as the low efficiency of red diodes under a 5x5μm chip size and the issue of achieving full-color display. The industry is actively exploring solutions to these challenges.

Regarding full-color display, some manufacturers have followed the conventional RGB approach. For instance, JBD uses red, green, and blue chips to create the S-CUBE optical engine. To reduce the size of the engine, some manufacturers place red, green, and blue chips on the same backplane. To ensure luminous efficacy of red, green, and blue chips, MIT has stacked chips vertically to achieve full-color display.

Alternatively, some suppliers are taking a color conversion approach, using blue LEDs and adding quantum dot materials to convert them into green and red diodes, simplifying the manufacturing process for full-color display. However, issues like luminous efficacy, the lifespan of quantum dot materials, and stability still need to be addressed.

In summary, for micro-display applications like AR glasses, businesses are still seeking effective solutions for Micro LED technology. However, as time progresses, the said challenges are expected to be gradually overcome, and AR glasses are poised to remain one of the key applications for Micro LED in the future.

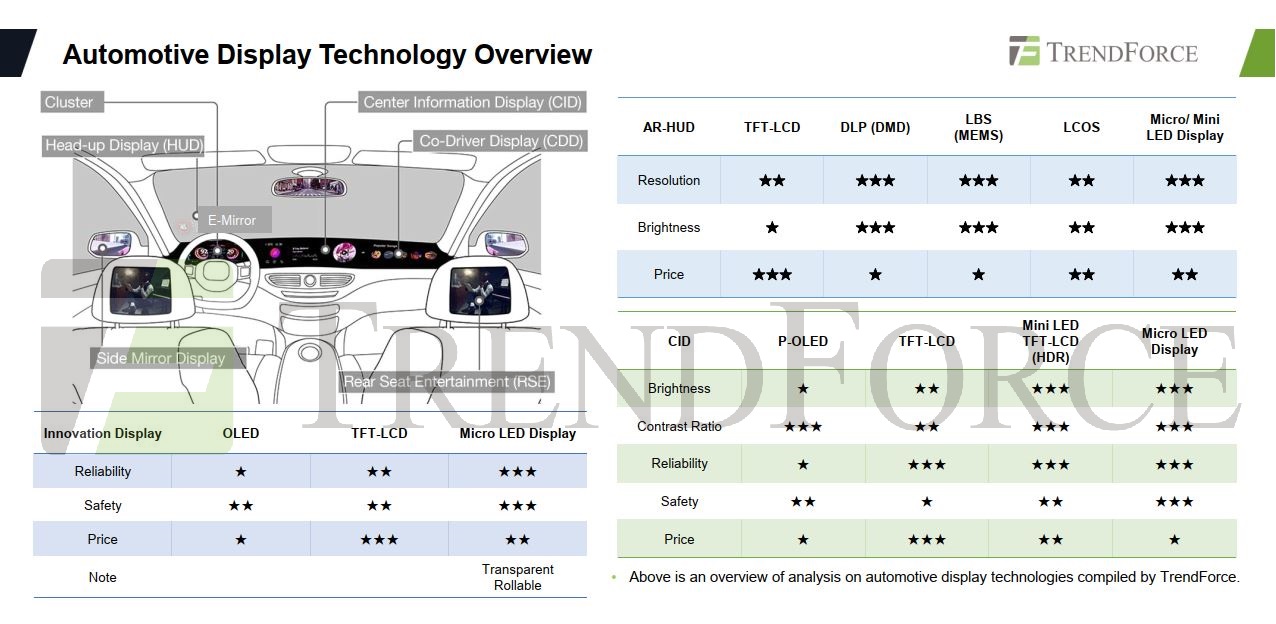

Vehicle-mount displays, as another future application of Micro LED, are also worth paying attention to. Chiou believes that Micro LED has greater cost flexibility in the automotive display sector, making it a promising pathway for the novel display technology to gain an edge throughout the market.

In recent years, panel manufacturers such as PlayNitride, AUO, Innolux and Tianma have repeatedly showcased various possibilities for transparent automotive displays powered by Micro LED.

In automobiles, Micro LED can be used for transparent window displays to convey information to passengers and pedestrians. It can also serve as a head-up display (HUD). Compared to OLED, Micro LED offers high brightness, stability, and a transmittance rate of over 70%, ensuring passenger safety while providing real-time driving information. This makes the automotive display sector a strategic focus for Micro LED in the next two to three years.

The gradual maturation of large-size displays, the rapid rise of smartwatches, and the limitless potential of AR glasses and automotive displays constitute the key drivers of growth for the Micro LED industry in the present and future.

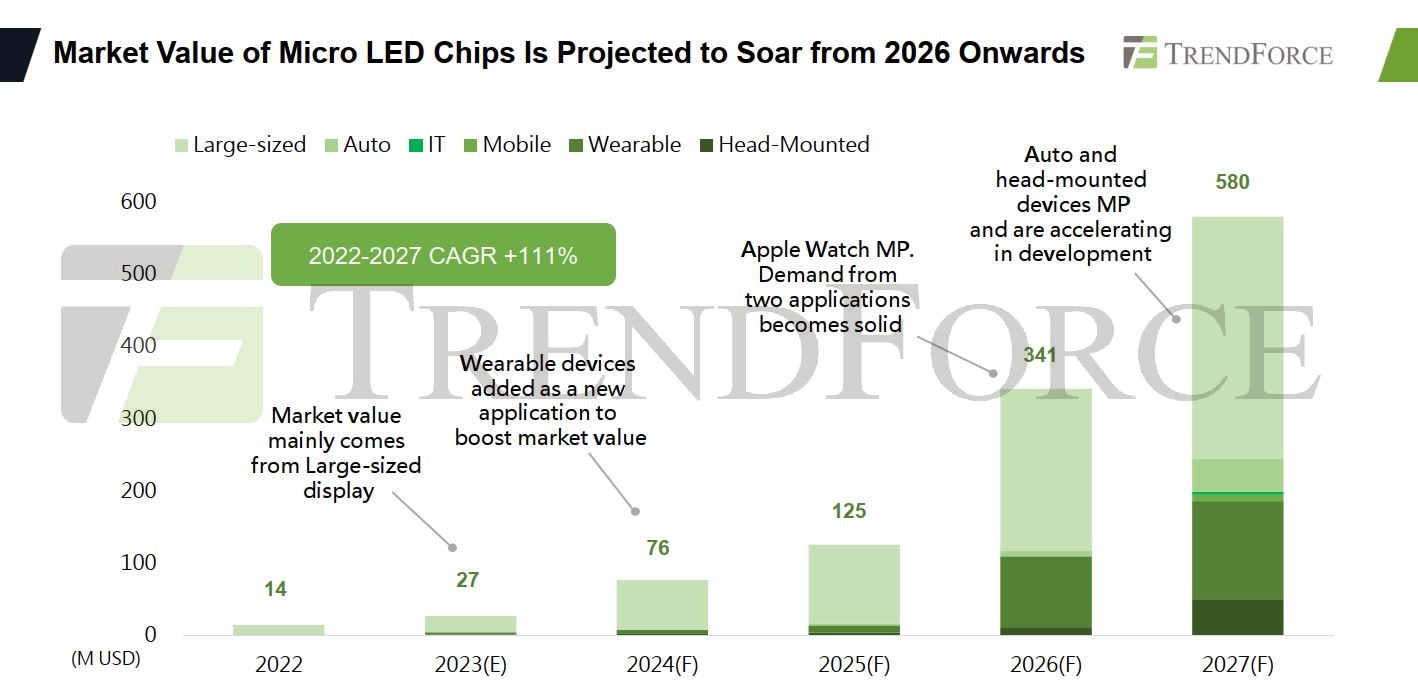

According to TrendForce’s research, driven by mass production of large-size displays and wearables, the market value of Micro LED chips is estimated to reach $27 million in 2023, with a yearly growth rate of 92%. It is estimated that in 2026, the introduction and scaling up of Apple’s Micro LED watch will boost both the adoption of Micro LED technology and investments, with the market value of such chips hitting $350 million. Predictions for 2027 indicate that Micro LED will experience growth in the AR glasses and automotive display markets, with the market value of Micro LED chips approaching $600 million by that time.

(By Irving from LEDinside)

TrendForce 2023 Micro LED Market Trend and Technology Cost Analysis

Release Date: 31 May / 30 November 2023

Language: Traditional Chinese / English

Format: PDF

Page: 160 / Year

If you would like to know more details , please contact: