CASE – Connected, Autonomous/Automated, Shared and Electric was centered at AUTOMOTIVE WORLD this year. Following the topic, LEDinside visited several LiDAR and LiDAR component companies participating the event and learnt the latest trends and development in ADAS and self-driving technology.

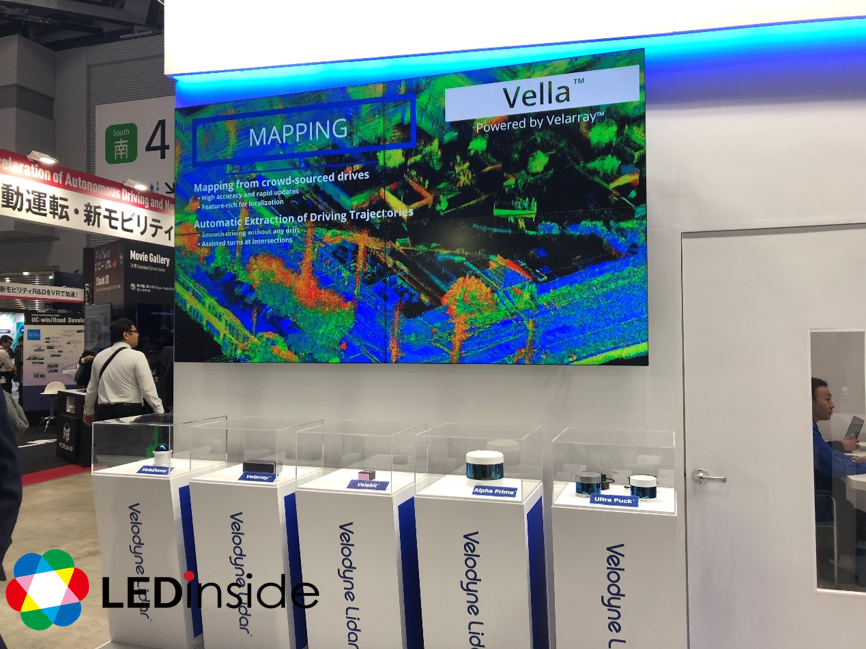

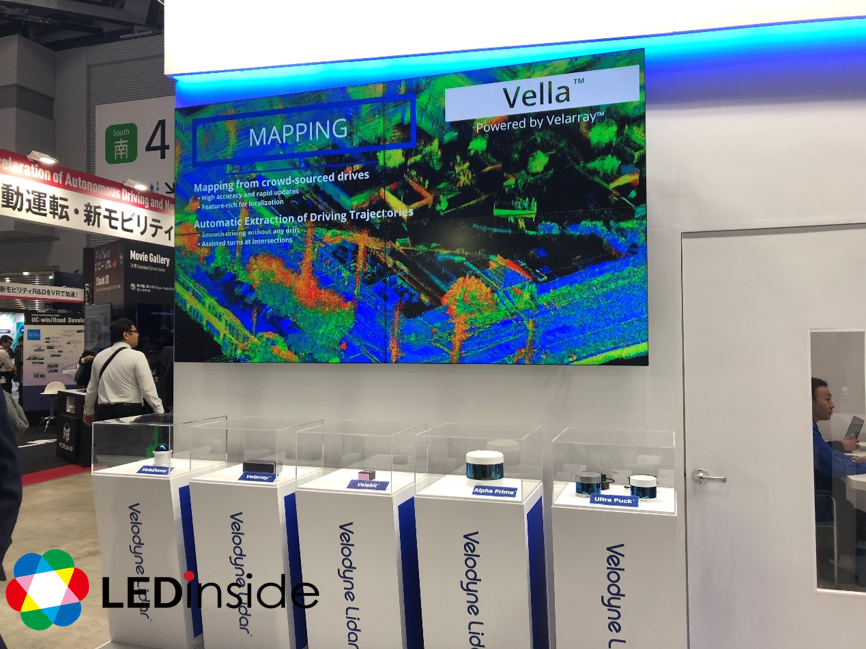

Velodyne Lidar showcased the full portfolio to support progresses in ADAS and autonomous driving. Its Alpha Prime carries a sensing range up to 200 meters and 360 degree horizontal FOV, making the highest specification in the industry. Velarray can be installed behind windshield with sensing range of 200 meters as well. The product will be adopted in ADAS system and autonomous vehicle this year.

With MEMS technology, Innoviz developed two type of LiDAR, InnovizPro and InnovizOne. The Israeli LiDAR company reported its collaboration with BMW in 2018 and its InnovizOne will be adopted in BMW’s electric vehicle which is scheduled to launch in 2021.

Canadian LiDAR solution provider LeddarTech debuted 3D Flash LiAR, Leddar Pixell- Cocoon LiDAR, for autonomous bus.

AEye employs MEMS LiDAR with RGB camera to achieve artificial perception system with a sensing range of 200 meters. The company also works together with LG and Hella on ADAS and driverless vehicles.

AEye and Luminar both adopt 1,550nm light source which features eye safety, long sensing distance and its sensing results are less interrupted by the sun. Sensing range of Luminar’s H-Series is 250 meters with less than 10% refection rate.

XenomatiX, a Belgium LiDAR company, launched XenoTrack and XenoLidar for the automotive market. XenoLidar has a sensing range of 200 meters with 20% reflection rage, targeting the automotive market. On the other hand, XenoTrack uses two LiDAR to measure road surface with ToF.

Cepton Technologies uses its unique Micro-Motion Technology to tackle the defect of scanning LiDAR. With its series products, Vista and Sora, the company not only aims for the automotive market but also plans to move towards smart transportation, crowd control and analysis, and more.

LiDAR Laser and Sensor Companies

According to LEDinside, currently the major LiDAR sensor companies are OSRAM, Excelitas, and Laser Components, using mostly edge emitting laser. LiDAR sensors include Avalanche Photodiode, APD, SPAD. Silicon Photomultiplier, SiPM) and others.

Austrian company ams demonstrated its 3D sensing solution and proactively promoted its VCSEL product for mobile 3D sensing, driver monitoring system and LiDARs. In May 2019, ams, Ibeo Automotive Systems and ZF Friedrichshafen announced their partnership in developing LiDAR products with ams providing light source and driver solution.

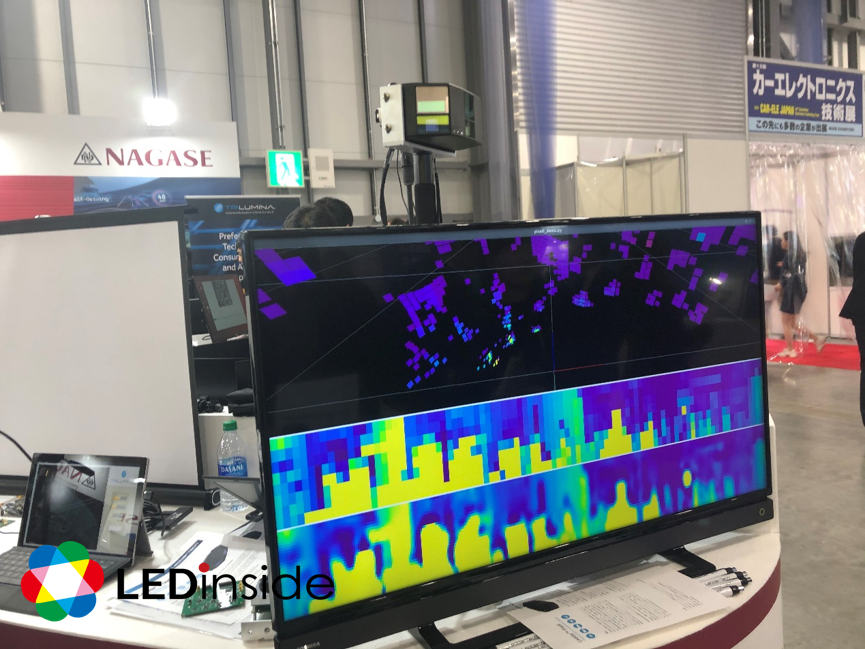

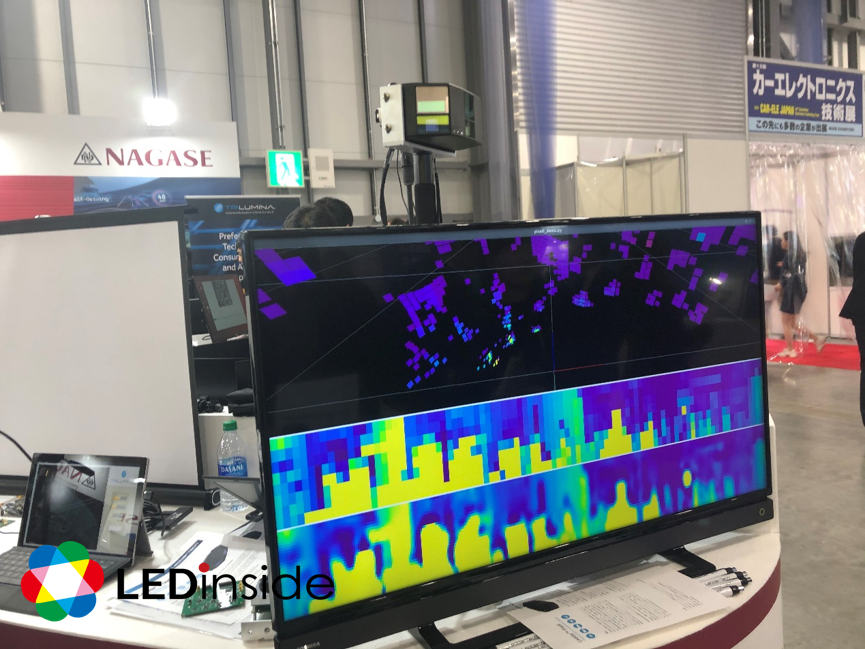

TriLumina released high power VCSEL to develop mobile phone 3D sensing applications with world facing ToF. It also introduct VCSEL array targeting the LiDAR market.

On Semiconductor’ silicon Photomultiplier, SiPM has better detective efficiency and fast response speed under a wider working temperature.

In addition, Infineon also offered 3D sensing module REAL3 ToF product for mobile phone 3D sensing and driver monitoring system.

LEDinside Insight

Despite that the global automotive market did not go as expected, automobile makers did not stop their development in ADAS and autonomous driving. SONY presented its first conceptual electric vehicle with LiDARs, ladars and cameras at CES in the beginning of 2020. BMW also announced that it will adopt LiDAR products with its electric models launching in 2021. The news indicates that leading technology builders and car makers are working hard to enter the field of alternative fuel vehicle and autonomous driving to create new business opportunities.

The latest report by LEDinside, a research division of TrendForce, titled “2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System”, will focus on the market trend of LiDAR including product features, demands of automotive LiDAR and industrial LiDAR, requirement of light source and sensing component and more. Based on the information, LEDinside will also analyze market size, opportunity and challenge, product specification and supply chain from the prospective of terminal application requirements, with an aim to provide a more comprehensive understanding of IR sensing application markets for readers.

Original article by Joanne Wu, Research Manager, LEDinside; translated and edited by Yining Chen, LEDinside

2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System

Release Date: 01 January 2020

Language: Traditional Chinese / English

Page: 153

CN

TW

EN

CN

TW

EN