(Author: Terri Wang, Analyst, LEDinsidehttp://Translator: Judy Lin, Chief Editor, LEDinside)

Proliferation of LEDs in the general lighting market has ushered the industry into a new phase of intense competition, contracting net profits, increasingly homogenous products and business models. Innovation has stagnated in the industry. To cope with these difficult market conditions, many companies have turned to niche lighting markets, such as automotive lighting which has a higher entry barrier, and higher profits. The less explored market has become a main development highlight for many companies.

LED automotive lighting has a low market penetration rate in China, due to costs, technology barriers, and market demands. However, many manufacturers have started to develop and raise the ratio of automotive LED lighting products, revealing the LED automotive lighting transition trend is increasingly obvious.

From a global automotive lighting market perspective, most joint ventures between local companies and foreign companies in China’s automotive industry have reliable automotive lighting suppliers. For instance Japanese automotive lighting suppliers include Koito Manufacturing, Stanley Electric and others, while European car light makers include Hella and Osram. Basically the above listed foreign companies or joint ventures they formed with Chinese companies have monopolized the mid to high end automotive lighting market in China.

The automotive lighting market in the country is very dispersed, with low market concentration rate. Foreign invested automotive lighting companies rely on their technology advantages and relations within the automotive market system to secure market share. Affected by technology capacity and client resources, local Chinese automotive lighting markers are more inclined to position themselves in the low to mid end passenger vehicles and aftermarket (AM). However, certain Chinese companies are also aggressively acquiring clients with low pricing strategies and solutions.

LEDinside has chosen a few important manufacturers from different parts of China’s automotive lighting market, and explained their commercial and development models in the automotive lighting market.

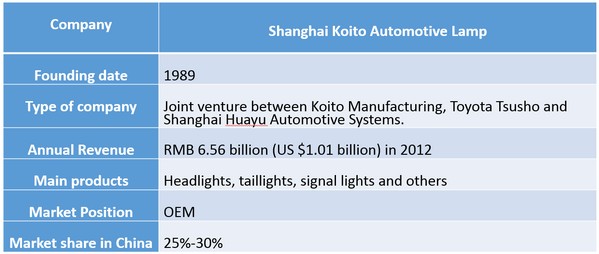

|

|

Shanghai Koito Automotive Lamp basic info. (Source: LEDinside) |

Top Automotive Lighting Joint Venture Company Shanghai Koito Automotive Lamp

Shanghai Koito Automotive Lamp (Shanghai Koito) is a joint venture between top Japanese automotive luminaire manufacturer Koito Manufacturing and Shanghai Huayu Automotive Systems. Koito Manufacturing is a member of Toyota’s vertically integrated supply chain, and has been a main automotive lighting supplier with reportedly the highest annual headlight revenue. In 1989, Koito, Toyota Tsusho and Shanghai Huayu Automotive Systems Company formed the joint venture Shanghai Koito. The three companies invested in total 20.2 billion Japanese Yen (US $ 180.25 million) in Shanghai Koito, which has a registered capital of 7.4 billion Japanese Yen.

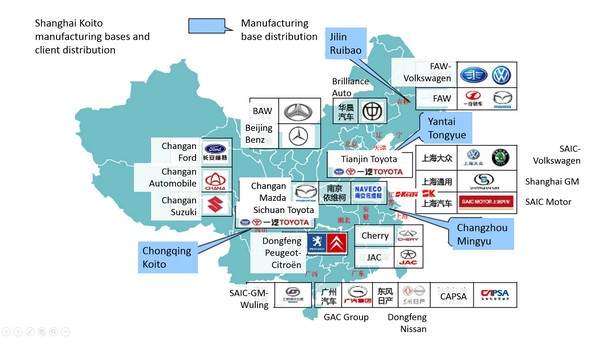

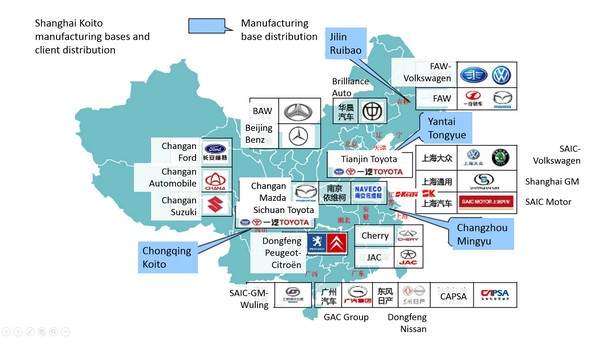

Shanghai Koito is a leading automotive lighting manufacturer in China, with an annual production capacity of 3 million headlight assembly per year, while its total automotive lighting product sales reached 39.83 million. The company has set up manufacturing bases in China in Jilin Province, and cities including Chongqing, Yantai and Changzhou. The company manufactures more than 500 types of car lights, which mostly consists of headlights, taillights, signal lights, brake lights, and all types of bulbs.

Its major clients include SAIC General Motors (car models: Buick Regal, Buick Excelle, Buick GL8, and Chevrolet Sail), SAIC Volkswagen (Passat, Polo, Golf, Santana), SAIC Motor, Tianjin Faw Toyota Motor, Faw-Volkswagen, Dongfeng Nissan, Dongfeng Motor Corporation Passenger Vehicle Company, Changfang Ford Automobile, Changan Suzuki, Chery Automobile Sales, Beijing Jeep Corporation, Sichuan Faw Toyota Motor, Yueda Group, Dongfeng Peugeot-Citroën Automobile, Naveco, and DS Automobiles. The company has also exported more than 40 types of products to international markets including Europe, U.S. and Japan.

|

|

Shanghai Koito manufacturing bases and clients. (Source: LEDinside) |

The company grabs market shares in China with localization strategy

When the company was first established, Shanghai Koito was mostly selling its products through Toyota Tsusho, and through Koito’s distributors. The company has also exported products to other markets, by late 1990s the company completed deployment of its oversea retail markets. However, the company’s exports decreased. Since the company made the most of the investment opportunity, its products possessed quality advantages over other manufacturers. Moreover, it established a manufacturing site in China much earlier than German automotive lighting manufacturer Hella. Hence, the company has grown quickly. Before Hella developed its market in China, it acquired orders from Volkswagen invested SAIC GM major suppliers.

Additionally, Shanghai Koito continued its leading localization and technology strategies, by integrating its technology with local Chinese manufacturers’ workforce resources and industry environment to reach economics of scale. Currently, the company has acquired components, modules, and localizing R&D. The company established its R&D department in 1997, and has since constructed an independent R&D system. Starting from 1999, Shanghai Koito began to acquire important Chinese government financed projects, such as The Key National Technology R&D Plan in China.

The company also is the chair of China’s Solid State Lighting Association (CSA). The company is annually allocated 30 new car models automotive lighting products, and as of late 2012 the company was granted 489 patents including 49 invention patents. It has made significant technology breakthroughs in LED headlights and light guide technology, while developing night vision and other more advanced technologies. Following technology improvements Shanghai Koito has also entered high end luxury car automotive lighting market with its debut in Audi Q5 (X88) in 2011.

|

Xingyu basic information. (Source: LEDinside)

|

Leading Chinese manufacturer Changzhou Xingyu Automotive Lighting Systems

Xingyu Automotive Lighting Systems (Xingyu) was formerly Changzhou Xingyu Automotive Lighting Systems changed its name to Xingyu shortly after becoming a listed company in 2007. The company is currently China’s biggest domestic automotive luminaire company and has an annual production capacity of 25 million lamps, its market shares gradually rose over recent years. The company currently has 15% market shares in China, and its clients include German, Japanese, American and French car brands. Its car brand clients include Faw Automotive, SAIC Volkswagen, SAIC General Motors, Chery Automobile, Nissan, GAC Motor, Dongfeng Peugeot-Citroën Automobile and others. The company also has a test center that meets UNECE regulations and can be used to test automotive lighting, reflectors, and light distribution. Currently, the company possesses more than 200 patents, in which 13 are inventor patents.

In 2014, the company’s revenue reached RMB 2.02 billion, and its automotive lighting revenue increased more than 20%. The company’s jointly invested automotive brand revenue share reached above 70%, with headlights and rear combination lamps (RCL) comprising more than 60% of its revenue. Of the new lighting projects that it acquired, headlights, RCL and fog lights combined volume reached above 40%. During the first three quarters of 2015, the company’s aggregated revenue reached RMB 1.71 billion.

The company initiated its global strategy and is entering the smart headlight market in the last two years. Xinyu started its global strategy, and in 2014 it received an Audi SUV RCL development project. After its products was approved by BMW’s supplier review committee in Germany, it started to supply turn lights, signal lights for electric chargers and other projects. Additionally, Xinyu acquired I&T in late August 2014, which has helped deploy its strategy in mid to high end luxury cars in Europe and related accessories. The company is expected to open up new opportunities in niche markets through its entry in BMW, Benz and other mid to high end luxury car models.

In terms of technology, Xingyu started to enter the smart automotive lighting market, and developed started manufacturing its first Adaptive Front Lighting System (AFS) in 2014, the product has mostly been supplied to Gaab Automotive Group’s high class SUV car models. The company aims to complete prototype samples of Adaptive Driving Beam (ADB) headlights by 2016. To meet this goal, Xinyu plans to invest RMB 1.5 billion to expand manufacturing sites in Jilin and Changchun, as well as automotive electronics and lighting R&D center. The company also made significant breakthroughs in LED automotive lights, and has continued to expand LED headlight usage in its car brands. The company’s LED automotive lighting revenue has reached above 20%, and is expected to continue to rise in the future.

Benefits from national policies, import replacements, and steady revenue growth

In 2015, The State Council of The People’s Republic of China announced an incentive of halving taxes for passenger vehicles with 1.6L swept volume engines. Car sales soared shortly after the announcement, Xinyu clearly benefited from this tax incentive policy since 90% of its products are applied in A level and above vehicles that have low swept volumes. During first half of 2015, the company was making LED luminaires for more than 31 car models, and received 61 automotive lighting R&D projects. The company has reported good revenue performance, and has stable reserve orders in the next two to three years.

Its clients FAW-Volkswagen Automobile, Denfong Nissan, Faw Toyota Motor have released new car model plans. Moreover, constructions of the company’s Foshan and Changchun factories has continued production expansions. Hence, the company’s revenue is expected to escalate in 2016, while its market strategy deployment is still mainly featuring Original Equipment Market (OEM).

In 2015, the company’s AM business revenue was about RMB 10 million, and composed about 5% of its total revenue. With motherboard factories manufacturing costs soaring, the Chinese market is under escalating pressure to replace imported components. In the import replacement market, Xinyu’s was mostly entering low end market after developing products for high end market clients, but it is gradually switching its strategy to introducing low end market technology into mid to high end products.

In terms of client structure, it has deployed a strategy as a joint venture brand that is entering the high end market, and entered top three German car brands supply chain, including Audi, BMW, and Benz. It is expected once China’s AM market regulations become more comprehensive, China’s automotive market shipment volume will soar, Xinyu still has large room for growth in the AM automotive lighting sector.

|

|

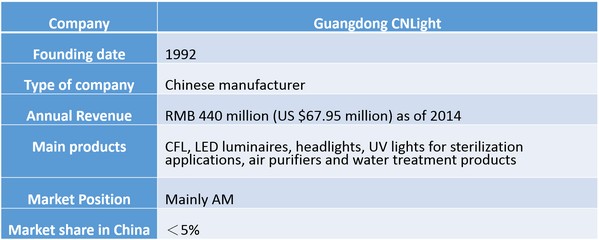

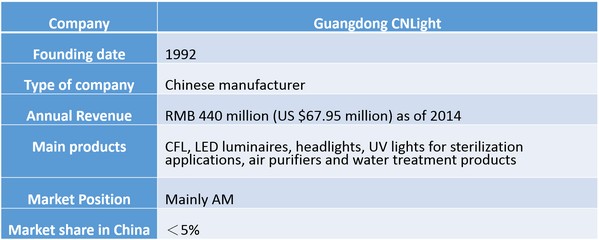

CNLIGHT basic information. (Source: LEDinside) |

Emerging AM market player CNLIGHT

CNLIGHT was established in 1992, and is based in Foshan, Guangdong Province in China. The company employs more than 2,000 employees, and has constructed a manufacturing base in Suning, Sichuan Province. The company is a pioneer in China’s HID headlight market, and its main businesses incorporates LED lighting, automotive lighting, air purifiers, water treatment, UV sterilization and other sectors. CNLIGHT ventured into the drone market sector in 2015, and its revenues for the first three quarters that year reached RMB 540 million.

The company is deploying its patents in LED automotive lighting business

As a local Chinese manufacturer CNLIGHT automotive technology possesses certain advantages in China, and it has more than 43 HID lamp patents. These patents are the only international HID intellectual property not under Philips patent system. CNLIGHT is the third international company and only Asian automotive lighting company to have passed automotive accessory OEM authorization. Hence, the company has collaborated with Chery, Jac Motors, Hawtai Automobile, Geely, Brilliance Auto Group, Changan Automobile and other car manufacturers on HID automobile lighting.

In terms of its business strategy, the company has continued to invest in the LED industry in the last two years, and has raised R&D investments for LED lighting and automotive lighting. In 2014 it acquired Fushun Optoelectronics Technology for 495 million, and invested another RMB 10.86 million to acquire 57.42% stake in Yike Optoelectronics (益科光電).

Fushun Optoelectronics Technology business is mainly LED lighting products and display systems, Yike Optoelectronics main operations has mostly been LED lighting products. The investments are aimed at assisting CNLIGHT to develop its LED automotive lighting business and manage both HID and LED automotive product lines to acquire larger market share. In the same year, CNLIGHT released its first LED automotive headlight products, which received a lot of attention from the market.

In March 2015, the company invested RMB 510,000 to establish a smart automotive lighting subsidiary that has taken over the main responsibility of selling automotive lighting products. The company’s aim in establishing the subsidiary is to create a complimentary and synergy effect with its automotive lighting business to accelerate its automotive lighting application and overall market strategies.

The company has also gradually developed R&D, and promoted smart electronic devices for automobile applications. The company is mainly building on an AM foundation, and is aggressively entering the OEM market. CNlight is aiming at the AM market and has released products including “new legend,” “ultimate decoder,” “F1 initiator,” “FBI bulb,” “Pioneer LED” and many other products. The company is one of the earlier players to have entered the AM automotive lighting market and after years of developments, it has become the largest AM luminaire manufacturer.

Previously, the Chinese AM market was rather small, due to consumers’ lukewarm response. This has changed over the past year, though. The Chinese government has started drafting AM regulations, and planning implementation in November 2015. Government officials used international AM standards as reference, and professional advice from leading automotive lighting brands. Additionally, the government has been supportive of large automotive lighting manufacturers’ developments, and directly assisting lighting manufacturers in forming supply chain partnerships with car makers.Automotive accessory manufacturer CNlight’s production standards could be used as an important reference for the government. Following the publication of the new standards,

China’s AM will slowly open up and enter a phase of fierce market competition. As a market pioneer, CNLight will be able further strengthen its advantages and market position. Aside from investing in AM automotive lighting market, CNLight’s future market strategy is to utilize its technology advantages to acquire greater market share in the mid AM sector, hence gradually entering the OEM sector and replace foreign imports.

To conclude, LEDinside projects Chinese automotive lighting manufacturers with foreign investments will stay ahead of the pack, while local manufacturers strive to raise their market position. Observations of China’s automotive lighting market competition show the main contenders in the joint venture car manufacturers passenger car automotive lighting sector are still top automotive lighting companies.

For joint ventures between international manufactures and Chinese companies, the strong partnership between the foreign investor and major Chinese OEM has given these companies a competitive edge in automotive lighting technology and branding, which is expected to keep them in the lead in automotive lighting technology and enable them to acquire larger market shares. Local automotive lighting manufacturers that have entered joint venture car brands in China, will work on raising their market share in the low to mid class passenger car automotive lighting sector, while gradually entering and raising market shares in mid to high-class passenger car automotive lighting sector.

Furthermore, the drafting of national standards and implementation will improve automobile quality in China, and there has been growing interest in the local AM automotive lighting sector, which will boost manufacturer’s market shares. The aftermarket automotive lighting sector is still very chaotic, with products of various quality, but following the establishment of AM regulations and standards in China, government support and pioneering technology should assist leading automotive lighting manufacturers in the industry to further expand .