Following years of development, Mini/Micro LED new display technologies have made critical breakthroughs, with end products often being unveiled in front of the public. However, there are several challenges for Mini LED and Micro LED—each at different development stages—to overcome before becoming mainstream display technologies.

Mass Production Kicks off for Large-Size Micro LED Displays

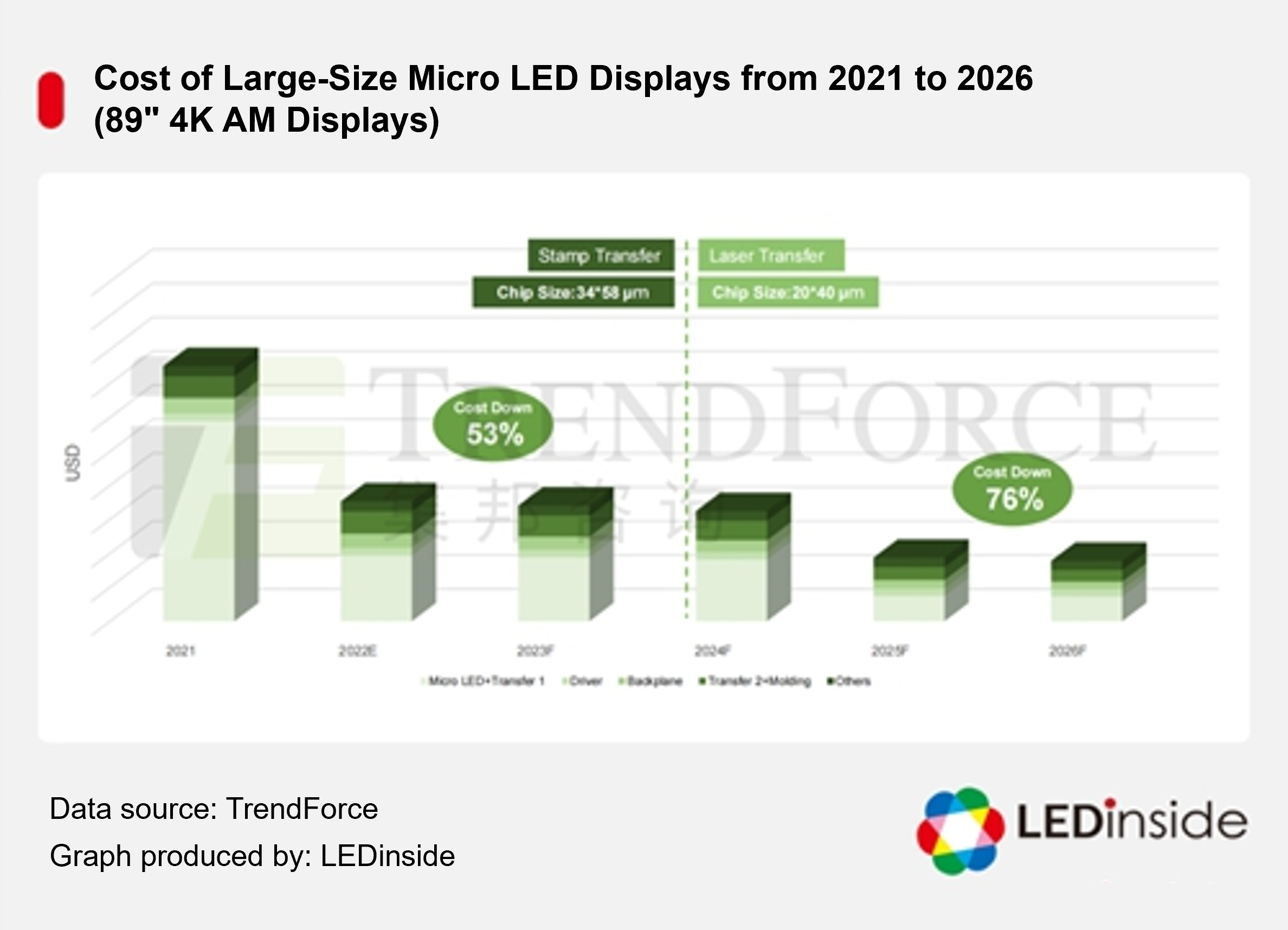

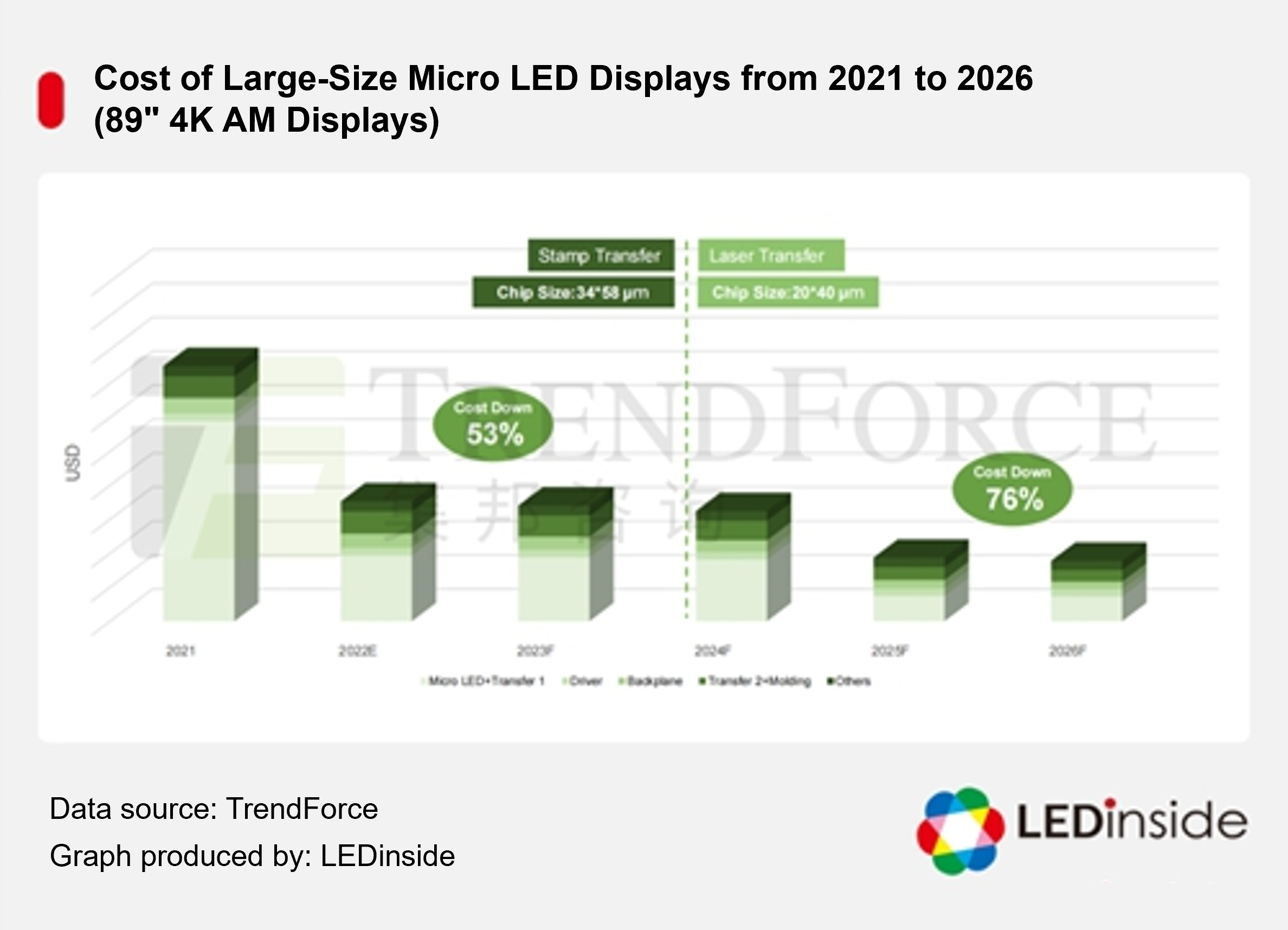

Following years of development, large-size Micro LED displays have entered the mass production stage this year, thereby stimulating the development of relevant components, equipment, and manufacturing processes. More suppliers entering the Micro LED market and the trend of display miniaturization will become keys to chip cost reduction.

The major approach to mass transfer has shifted from the current pick-and-place process to laser-based mass transfer that is faster with a better utilization rate, which can also help optimize the Micro LED manufacturing cost. Moreover, as chipmakers have built 6-inch epi-wafer plants and expanded production capacity, costs of Micro LED chips and overall production will decline as well.

With the said material, technological, and production capacity advances, the cost of an 89-inch 4K Micro LED TV will—as TrendForce predicts—sharply drop by 70% or higher between 2021 and 2026.

Smart Glasses Have Given Rise to Micro LED

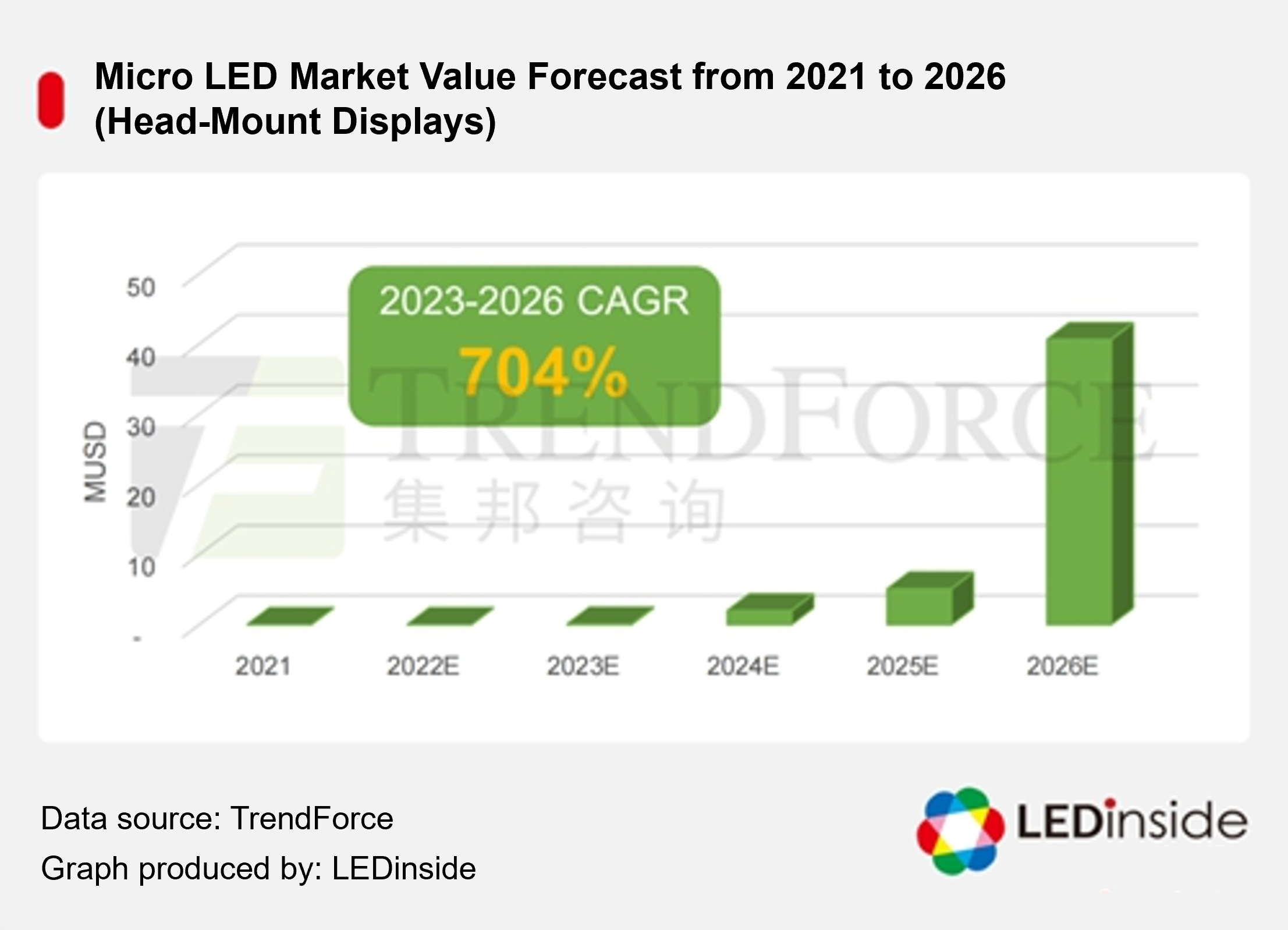

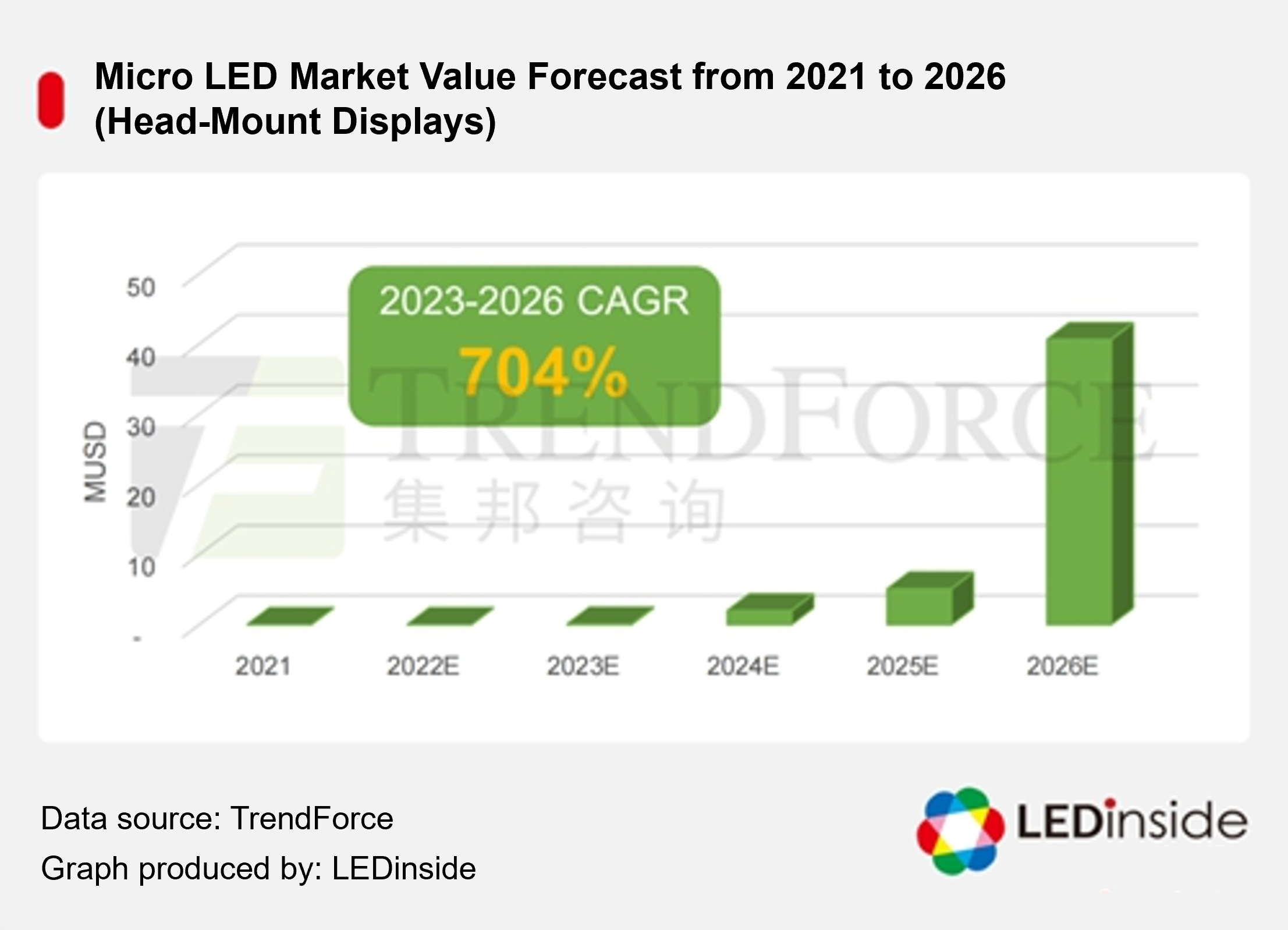

Driven by the metaverse frenzy, transparent smart glasses (AR glasses) have made Micro LED a hotly anticipated technology. However, AR glasses are faced with great challenges regarding technologies involved and potential markets.

Micro-projection and waveguide have been two major technological challenges. Currently, micro-projection technologies have difficulties in achieving desirable field of view, resolution, brightness and optical engine design, while luminance decay is still a major problem for waveguide approaches. As for market-related challenges, how much value AR smart glasses can bring to consumers and users remains uncertain.

Regarding optical engine design, AR glasses must have a high number of PPI (4,000 at least) as they emphasize features of small area and high resolution. Therefore, the size of each Micro LED must be lower than 5um to achieve miniaturization and high resolution design.

Indeed, ultra-small Micro LED is still at the introduction stage concerning luminous efficacy, full-color display and wafer bonding results, but the high brightness and long lifetime of this new component—which Micro OLED can hardly achieve—are ideal for AR glasses.

TrendForce estimates that the market value of Micro LED for AR glasses will soar between 2023 and 2026 with a 700%+ CAGR after relevant technologies improve.

In addition to its suitability for large displays and AR glasses, Micro LED boasts excellent compatibility with flexible, transparent design. Therefore, Micro LED will have a promising future in the automotive display and wearable markets, inspiring creative applications different from those powered by the existing display technologies.

Conclusion

In summary,Micro LED has reached several milestones in the large display sector, along with new opportunities arising in AR glasses, automotive displays, and wearables applications. In the long run, Micro LED, as an ultimate display solution, is highly promising concerning future applications and value.

(By TrendForce)

TrendForce 2022 Micro LED Self-Emissive Display Trends and Analysis on Supplier's Strategies

Release date: 31 May 2022 / 30 November 2022

Format: PDF

Languages: Tradional Chinese / English

Pages : 130–150 in total (subject to change)

Chapter 1 Self-Emitting Large-Size Micro LED Display: Critical Technology and Cost Development Trend

-

Development Trends in Large-Size Micro LED Displays

-

Relevance of Micro LED Chip Area to Applications

-

Key Factors Affecting the Cost of Large-Size Micro LED Displays

-

Definition of Large-Size Micro LED Display Cost

1-1 Cost Analysis of Micro LED Epitaxy Technologies

-

Factors Affecting the Epitaxy Cost of Large-Size Micro LED Displays

-

Assumed Conditions of Micro LED Epitaxy to Carrier Processes

-

Price Trends in 4" vs. 6" Micro LED Epi-wafers

-

Trends in Micro LED Epi-wafer Prices per Unit Area

-

Price Trends in 4K Resolution Micro LED Chips

1-2 Cost Analysis of Micro LED Mass Transfer Technology

-

Mass Transfer for Large-Size Micro LED Displays: Definitions and Assumptions

-

Factors Affecting the Cost of Mass Transfer for Large-Size Micro LED Displays

-

Comparison of Different Mass Transfer Technologies

-

Stamp Transfer: Comparison of Mass Transfer Heads and Transfer Counts to Wafer Utilization Rate

-

Stamp Transfer: Production Capacity Comparison of Different Transfer Head Sizes

-

Cost Comparison of Pick-and-Place Mass Transfer Processes Involving Different Settings-P0.51

-

Laser Transfer: Production Capacity Comparison of Different Laser Beam Areas

-

Cost Comparison of Laser Mass Transfer Processes Involving Different Settings-P0.51

1-3 Cost Analysis of Micro LED Backplane and Full-Color Technology

-

From Backplane to Full-Color Processes for Large-Size Micro LED Displays: Definitions and Assumptions

-

Backplane and Driving Cost Comparison: AM vs. PM Schemes

-

Backplane and Driving Price Comparison by Unit Area: AM vs. PM Schemes

-

Micro LED Full-Color Cost Comparison by Wafer Size

-

Cost Comparison between Micro LED RGB Chip and B Chip + QD Solutions

1-4 Cost Analysis of Large-Size Micro LED Displays

-

Cost Structure Trends in Large-Size Micro LED Displays: 110-inch 4K PM Type

-

Cost Structure Trends in Large-Size Micro LED Displays: 89-inch 4K AM Type

-

Cost Structure Trends in Large-Size Micro LED Displays: 101-inch 4K AM Type

-

Cost Structure Trends in Large-Size Micro LED Displays: 114-inch 4K AM Type

1-5 Large-Size Micro LED Display Leading Suppliers and Supply Chain Development Trend

-

Comparison of Micro LED Epitaxy Equipment Manufacturers

-

Comparison of Micro LED Chip Suppliers

-

Development Trends in Mass Transfer for Large-Size Micro LED Displays

-

Comparison of Businesses Specializing in Micro LED Pick-and-Place Mass Transfer

-

Comparison of Businesses Specializing in Micro LED Laser Mass Transfer

-

Comparison of Micro LED Mass Transfer Businesses

-

Development Trends in Micro LED Mass Transfer Technologies

-

Performance Comparison of AM Glass Backplanes

-

Development Trends in Glass Backplane Size

-

Development Trends in AM Scheme for Large-Size Micro LED Displays

-

Comparison of Glass Backplane Side Wiring Techniques

-

Comparison of Micro LED AM Backplane Suppliers

-

Comparison between AM and PM Schemes

-

Comparison between AM and PM Micro LEDs

-

Comparison of Large-Size Micro LED Display Leading Manufacturers

-

Major Supply Chains of Large-Size Micro LED Display Leading Manufacturers

Chapter 2 Development Trends in Critical Technology for Micro LED Micro-Display

2-1 Development trends in Transparent Smart Glasses

-

Development Challenges facing Transparent Smart Glasses

-

Design Goals of Micro-Displays for Transparent Smart Glasses

-

Optical Designs of Transparent Smart Glasses

-

Desired Specifications of Transparent Smart Glasses

-

Desired Field of View (FoV) for Transparent Smart Glasses

-

Optical Engine Properties of Transparent Smart Glasses and a Comparison of Relevant Suppliers

2-2 Micro LED for Transparent Smart Glasses: Technical Challenge Analysis

-

Overview of Challenges facing Micro LED Technologies for Transparent Smart Glasses

-

Development Trends in Size and Wavelength Uniformity of Micro LED Chips for Transparent Smart Glasses

-

Development Trends in Micro LED Epitaxy Process

-

Challenges facing GaN on Silicon Epitaxy

-

Challenges facing Micro LED Chipmaking Technologies for Transparent Smart Glasses

-

Challenges facing Micro LED Mass Transfer and Bonding Technologies for Transparent Smart Glasses

-

Challenges facing Micro LED Inspection and Repair Technologies for Transparent Smart Glasses

-

Challenges facing Micro LED Full-Color Technologies for Transparent Smart Glasses

2-3 Leading Suppliers of Transparent Smart Glasses and Supply Chain Development Trend

-

Micro LED Light Engine Company -Porotech

-

Micro LED Light Engine Manufacturer- JBD

-

Micro LED Light Engine Manufacturer- Plessey

-

Micro LED Light Engine Manufacturer- Sharp Fukuyama Semiconductor

-

Micro LED Light Engine Manufacturer- Sundiode

-

Leading Brand-Vuzix

-

Leading Brand- Xiaomi

-

Leading Brand- OPPO

-

Leading Brand- TCL FFALCON

-

Leading Brand- Google

-

Businesses Announcing Transparent Micro LED Smart Glasses

-

Partnerships involving Transparent Micro LED Smart Glasses

Chapter 3 Self-Emitting Micro LED Displays: Market Scale Analysis P86

-

2021-2026 Large-Size Micro LED Display Market Scale Analysis

-

2021-2026 Micro LED Automotive Display Market Scale Analysis

-

2021-2026 Micro LED Head-Mounted Display Market Scale Analysis

-

2021-2026 Micro LED Wearable Display Market Scale Analysis

-

2021-2026 Micro LED Mobile Display Market Scale Analysis

-

2021-2026 Micro LED MNT Display Market Scale Analysis

-

2021-2026 Micro LED Display Development Trends

Touch Taiwan 2022 Exhibition :Current Development of Self-Emitting Micro LED Displays

-

Micro LED Chip Company-PlayNitride-(1/3)

-

Micro LED Chip Company-PlayNitride-(2/3

-

Micro LED Chip Company-PlayNitride-(3/3)

-

Micro LED Chip Company-Ennostar Group

-

Micro LED Chip Company-Porotech

-

Micro LED Panel Company-AUO-(1/2)

-

Micro LED Panel Company-AUO-(2/2)

-

Micro LED Panel Company-Innolux

-

Micro LED Equipment Company-Coherent

-

Micro LED Equipment Company-Stroke PAE

-

Micro LED Equipment Company-Contrel

|

If you would like to know more details , please contact:

|