Nov. 8, 2022 ---- BOE has become the largest shareholder in HC Semitek following a RMB 2.1 billion capital investment deal, and they are now in a partnership with respect to the development of Micro/Mini LED businesses. BOE has been involved in Micro/Mini LED since 2017 and now possesses related offerings such as displays and backlight solutions. In 2020, BOE established BOE MLED Technology as a subsidiary dedicated to the R&D and manufacturing of Micro/Mini LED products. As for HC Semitek, it is a major Chinese LED chip supplier and has an overarching presence across the LED chip industry chain. Hence, it produces not only LED chips but also LED epi wafers, sapphire substrates, etc. According to the data from market intelligence firm TrendForce, HC Semitek took fourth place in the 2021 ranking of LED chip suppliers by external sales revenue. Besides this achievement, HC Semitek is also at the forefront of advanced LED technologies including Micro/Mini LED. In a ranking of LED chip suppliers based on the revenue that is solely from sales of Mini LED chips, HC Semitek is currently in third place following Epistar and San’an.

Looking at this deal from BOE’s perspective, LED chips represent a critical section of the display industry chain. For end products, the quality of LED chips directly affects their displays in terms of cost, production yield rate, and quality. This connection between chips and end products is also noticeable in the Micro LED industry. For instance, RGB Micro LED chips are already regarded as a key component among the leading brand manufacturers. At the same time, these brand manufacturers have taken actions to secure a stable supply of RGB Micro LED chips. For instance, Samsung has invested in PlayNitride in order to advance its Micro LED solutions. Also, TCL CSOT has formed a joint venture named Xiamen Extremely PQ Display Technology with San’an. Another example is Ennostar’s partnership with AUO and Innolux for the development of Micro LED displays. Turning to BOE and HC Semitek, the former hopes that by joining forces with the latter, it will be able to further strengthen its already advantageous position in the field of Micro/Mini LED. Furthermore, in BOE’s efforts to develop related technologies, HC Semitek is going to provide significant support going forward.

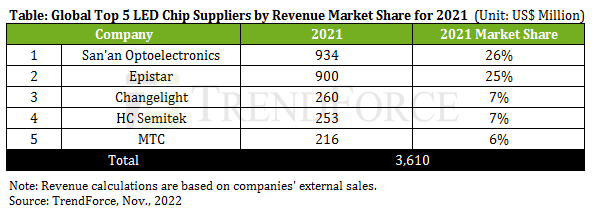

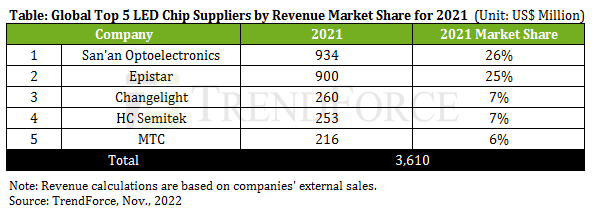

In HC Semitek’s view, the competition in the LED chip industry has become fiercer in recent years as suppliers such as MTC, San’an, and Changelight release new production capacity. This year, the situation in the LED chip market is particularly challenging because of factors such as the resurgence of local COVID-19 outbreaks in China, the Russia-Ukraine military conflict, and the ongoing global inflation. With a sharp drop in the demand for end products, the LED chip market has shifted to oversupply, and most LED chip suppliers now operate at a loss. Over these years, HC Semtek has been expanding into the high-end market segments such as Mini LED solutions and automotive LED solutions. However, this move has come at the expense of abandoning some parts of the low-end market segments. Therefore, the company has also lost some market share. TrendForce’s data reveal that HC Semitek’s global market share for LED chips came to 7% in 2021, down by 2 percentage points from 2020.

TrendForce points out that BOE is among the investors that HC Semitek has targeted in its latest share placement that aims to raise a total of around RMB 2 billion. The proceeds are to be used to build a base for not only the production of Micro LED wafers but also the packaging and testing of Micro LED chips. This capacity expansion project, in turn, is expected to raise market share and generate profit for HC Semitek. Additionally, by forming a close partnership with BOE, HC Semitek will be able to develop technologies that are more suited for the needs of end customers. Simultaneously, BOE will serve as a major sales channel for HC Semitek’s Micro/Mini LED chips.

Gold+ Member Report

|

Report Name |

Content |

Format |

Release |

|

LED Industry Demand and Supply Database |

Demand Market Forecast: |

PDF / Excel |

1Q (March) /

3Q (September)

|

|

2022-2026 Demand Market Forecast |

|

(Backlight and Flash LED / General Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / Horticultural Lighting / UV LED / IR LED / Micro LED / Mini LED) |

|

Supply Market Analysis: |

|

1. LED Chip Market Value (External Sales, Total Sales) |

|

2. WW New GaN LED and AS/P LED MOCVD Chamber Installation Volume /

WW Accumulated GaN LED and AS/P LED MOCVD Chamber Installation

|

|

3. GaN LED and AS/P LED Wafer Market Demand (By Region / By Wafer Size) |

|

4. GaN LED and AS/P LED Market Sufficiency Analysis |

|

LED Player Revenue and Capacity |

LED Chip Market Analysis: |

PDF / Excel |

2Q (June) /

4Q (December)

|

|

Top 10 LED Chip Manufacturer Revenue and Wafer Capacity |

|

LED Package Market Analysis: |

|

LED Package Manufacturer Revenue, LED Revenue, and Capacity |

|

Top 10 LED Package Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED |

|

LED Industry Price Survey |

Price Survey- Sapphire / Chip / LED Package (Backlight, Lighting, Automotive, Video Wall, UV LED, IR LED, VCSEL) |

Excel |

1Q (March) /

2Q (June) /

3Q (September) /

4Q (December)

|

|

LED Industry Quarterly Update |

Major Players Quarterly Update: |

PDF |

1Q (March) /

2Q (June) /

3Q (September) / 4Q (December)

|

|

EU / U.S- Lumileds, ams OSRAM, CREE LED (Smart Global Holdings) |

|

JP- Nichia, Citizen, Stanley, ROHM |

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys |

|

ML- Dominant |

|

TW- Ennostar, Epileds, Everlight, LITEON, AOT, Harvatek, PlayNitride |

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, ChangFang Lighting, MLS |

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN