In 2026, the TV industry will see rising costs in memory, display panels, and precious metals, according to TrendForce’s latest TV shipment survey. This will intensify the struggle between maintaining profit margins and capturing market share among brands.

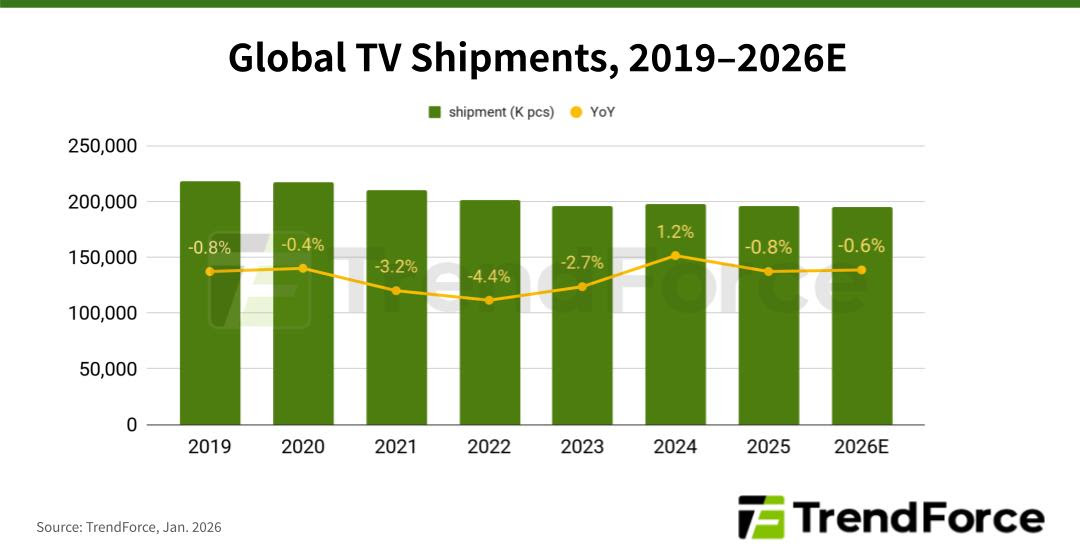

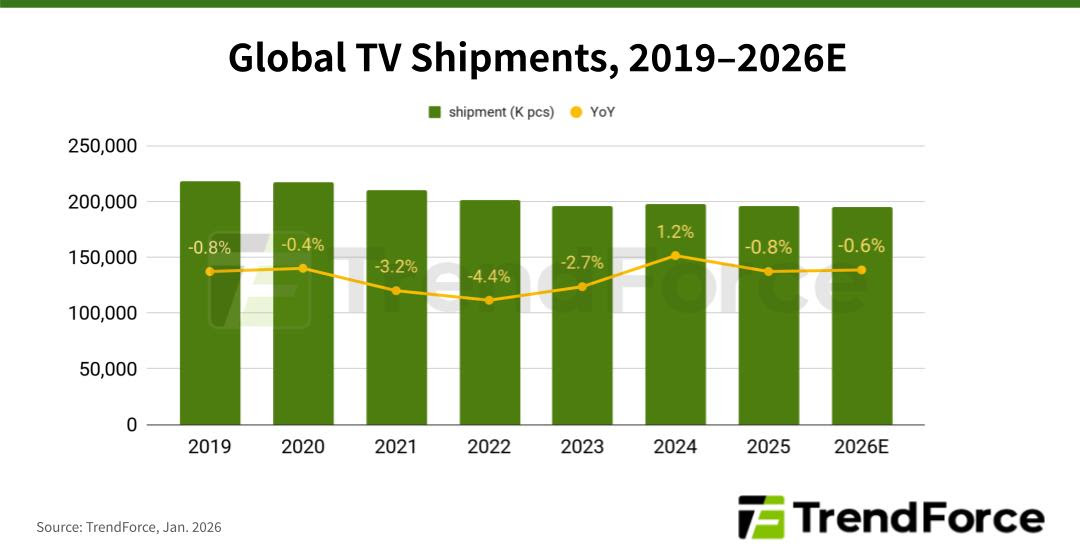

TrendForce has revised its 2026 global TV shipment forecast downward, from an earlier estimate of a 0.3% decrease to a 0.6% YoY decline, projecting 194.81 million units. Additionally, due to current cost structures no longer supporting the previous low-price strategies, retail price increases for new TV models are now considered unavoidable.

Starting in early 2025, uncertainty over U.S. tariff policies pushed TV brands to accelerate procurement and stockpile inventory. By late 2Q25, they had begun adjusting their inventories, which caused shipments during the usual 3Q peak to be weaker than expected, with quarterly shipments dropping below 50 million units for the first time. Despite efforts in 4Q25 to boost shipments to meet annual goals and protect against rising memory prices, global TV shipments in 2025 still fell by 0.8% YoY to approximately 196.2 million units.

In the first half of 2026, promotional events such as the U.S. Super Bowl, tax refund season, the FIFA World Cup, Lunar New Year, and the 618 Shopping Festival are likely to provide some support. Nonetheless, as brands expect ongoing monthly increases in memory and panel prices, they have already sped up future procurement. This is projected to boost 1Q26 shipments by 2% YoY to 46.51 million units, although the risk of experiencing another subdued peak season in the second half of 2026 remains.

Display panels make up about 40–50% of the overall TV manufacturing cost and panel prices increased in January 2026. Meanwhile, the supply of TV memory has been squeezed by competing demand from HBM and server applications. This has kept memory prices on a sustained upward trajectory since the second half of 2025. For instance, contract prices for the widely used 4GB DDR4 in 4K TVs have more than quadrupled over the past year and are projected to grow by over 60% QoQ in 1Q26.

DRAM made up just 2.5–3% of a TV’s BOM cost before the recent price rise. Since then, this share has rapidly increased to 6–7%, putting considerable pressure on brand profitability. Smaller brands with less scale and resources are likely to bear a heavier burden.

Looking toward the positives, China’s subsidy programs in 2026 are expected to continue, with eligibility restricted to top-tier energy-efficient products. This will benefit Mini LED TVs. Leading brands also showcased RGB TV technologies at CES 2026 and are bringing these products into more affordable 55- to 75-inch sizes, intensifying competition.

TrendForce has raised its forecast for Mini LED TV penetration in 2026 to 10%, estimating shipments will approach 20 million units. Backed by comprehensive vertical integration in materials and manufacturing, TCL is expected to sustain its market leadership in Mini LED TVs, holding over 30% market share and setting a new industry benchmark.

TrendForce 2025 Global Mini LED Backlight Market Trends and TV Brand Shipment Analysis

Release Date: 30 September 2025

Languages: Traditional Chinese / English

Format: PDF

|

If you would like to know more details , please contact:

|