Apple’s developments in the market are a hot topic in the technology industry, market rumors that next generation iPhones would be using OLED displays ushered in a large wave of investments in the sector in China. OLED, which was a niche market product, became a hot commodity this year because of Apple’s interest in adapting the technology in next-generation iPhones.

Micro-LEDs were also placed onto the technology industry spotlight two years ago following Apple’s acquisition of LuxVue, prior to this development micro-LEDs was under the technology industry radar for years. Could the halo effect from Apple make emerging micro-LED technology a contender to mainstream LCD or rising OLED display technologies?

|

|

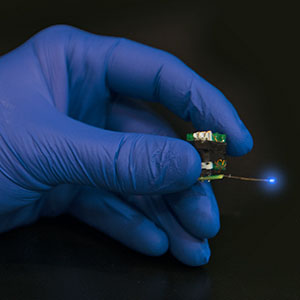

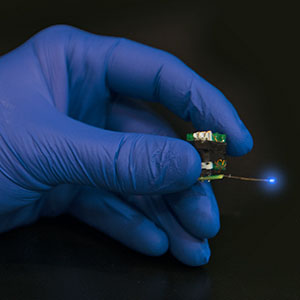

A scientist holds a micro-LED chip. |

Sony launches another micro-LED TV

If Apple is a newbie in micro-LED technology, then Sony is a veteran. The Japanese consumer electronic company studied micro-LED and related technology for years, and launched its first micro-LED TV, Crystal LED Display, at CES 2012.

Four years after the product launch, Sony went mum about micro-LED TV with no new public product releases. Why has Sony’s attitude towards micro-LED technology changed after 2012? The LED technology needed to make micro-LEDs is not an issue, since in theory LEDs can be miniaturized to several micrometers, and the accompanying chip and packaging technology is not an issue either, said Philip Chang, Analyst at LEDinside. Yet, the micro-LED technology in 2012 would require usage of 6.22 million LEDs in a FHD Crystal LED display. Leading to low efficiency, low yield rates, and overtly high costs. Commercialization of the micro-LED TV would be impractical using that technology.

It took another four years before Sony showed results from continuous investments in micro-LEDs, some spurred by Apple. Sony launched its latest addition to the Crystal CLEDIS (Crystal LED Integrated Structure) at Infocomm in June 2016. The latest product features “module splicing”, which greatly lowered the number of LED chips required, and lowered Pixel per Inch from 40 to 15. These changes have made it possible for Sony to realize mass production, and the company announced it would be able to commercialize CLEDIS in 2017.

Sony’s current micro-LED TV design is a “very stupid method,” it requires splicing the LEDs one by one, or by the thousands simultaneously, explained Zhaojun Liu, Assistant Professor at School of Electronics and Information Technology at Sun Yat-Sen University. Transferring the micro-LEDs and manufacturing period will take a long period, hence it is unsuitable for mass production. If companies want to commercialize the product, they need to be able to reach high volume production, high precision, and high transfer rates. Menglong Tu, head of R&D at Ledman Optoelectronics also noted only when the micro-LEDs first pass yield (FPY) reaches 100% can millions and billions of LEDs be freed from dead pixel issues, which takes technology maturation to achieve. It is estimated the technology will not mature next year, hence the possibility of Sony mass producing micro-LED TVs remains low next year.

Micro-LED unaffected by Chinese manufacturers developments

Apple’s entry in micro-LED not only accelerated Sony’s mass production progress, it also raised Chinese manufacturers interest in the technology. Chinese LED manufacturers are starting to develop micro-LED technology, said Chipone CEO Jingfang Zhang. Last year, Leyard Optoelectronics launched a super small pitch P0.9 mm HD seamless spliced LED wall, which has a pitch less than P1 mm LED displays sold on the market. The main application sector for the LED is still indoor surveillance displays, and unlike Apple and Sony that are both focusing on wearable devices and large TV display market sectors.

Even though China’s LEDs for commercial market reached a reputable size, Chinese manufacturers increased investments in LED equipment sped up national production, but still comprises a small revenue share. Manufacturers are increasingly focused on the commercial LED market, and have not invested as much in advanced micro-LEDs. There have also been few discussions about micro-LEDs in China. So why are Chinese manufacturers uninterested in micro-LEDs?

Apple and Sony’s micro-LEDs are made from a chip perspective, while China’s small-pitch LED displays are also tiny, the LEDs have a major size difference, said Tu. Domestically, no enterprises in China can form vertically integrated supply chain, and each company is specializing in only one segment of the supply chain. Chip manufacturers are focused on making LED chips, LED packaging, and other specialty applications. Most small pitch LEDs are in the application end, and not in upstream supply chain or chips. Mass produced small pitch LEDs in China are P1.2 to 1.5 mm, while the smallest is P0.9.

Apple and Sony’s micro-LEDs are manufactured on CMOS substrate using IC manufacturing technology to make a LED display driver. The LEDs are then aligned and arrayed on the IC using MOCVD to shrink the LED to micro display size of 100 micrometers, which still lags far behind Apple and Sony’s micro-LED volume production.

More importantly the micro-LED trend led by Apple is still in the R&D phase and far from reaching commercialization. Micro-LEDs on the market currently are similar to LCDs 30 years ago, which required a comprehensive supply chain to lower costs and raise production capacity, said Liu. For Chinese manufacturers the outlook of micro-LEDs is uncertain, companies prefer using current technology and patents. As for when micro-LEDs can really enter the market, it will depend on Apple and Sony’s technology breakthroughs and market development.

Can micro-LEDs challenge LCD and OLED technology?

Micro-LEDs have the advantages of low power consumption, high brightness, ultra-high definition, high color saturation, faster response rate, longer lifetimes and higher efficiency. Compared to LCDs and OLEDs, micro-LEDs have the advantages of higher brightness and color saturation. Indoor LED displays made using micro-LEDs can reach 1,000 to 2,000 nits, while LCD brightness reaches several hundred nits, said Tu. Additionally, micro-LEDs can use RGB or RGBW solutions to achieve wider color gamut performance, or better display effects.

Micro-LEDs can be divided into two mainstream applications, including wearable devices developed by Apple, while the other is super large TV displays represented by Sony. Potential smartwatches and smart band applications for micro-LEDs based on Apple’s current market share, if all Apple Watches used micro-LED screens, it will have larger impact on OLED wearables. If micro-LED entered the smartphone market, and had to reach higher PPI or flexibility, it would present technology challenges. Micro-LEDs would have no competitive edge against LCD and OLEDs, hence it would have minor effect on OLED industry. Wearables also have a very small market share in the OLED industry.

Meanwhile, cost competitiveness is essential in large displays, where micro-LEDs has limited advantages. There are a lot of challenges for micro-LEDs to overcome in large-sized displays, and over the years the technology had no significant advantages compared to LCDs and OLEDs, said IHS Display Search analyst Terry Yu. The extent of impact from micro-LED developments and impact were not as large as previously thought. LCDs low costs, steady yield rates makes it highly competitive, similar to LCDs and PDP. LCD and micro-LEDs market competition in the future will not be limited to technology, but also the entire supply chain and ecosystem.

Micro-LEDs have come under the limelight mainly because of Apple, but it is uncertain whether it can challenge LCD or OLEDs. Technology developments take time, so it is too early to say whether micro-LEDs will replace LCDs or OLEDs, said Professor Zheng Xu, School of Science, Beijing Jiaotong University. Hence, the industry development will still depend on periphery technology developments, for instance if there are no advancements in mask aligner technologies then it will be difficult to raise display image resolution. Micro-LEDs at most can only be described as an emerging challenger of LCD or OLED technologies.