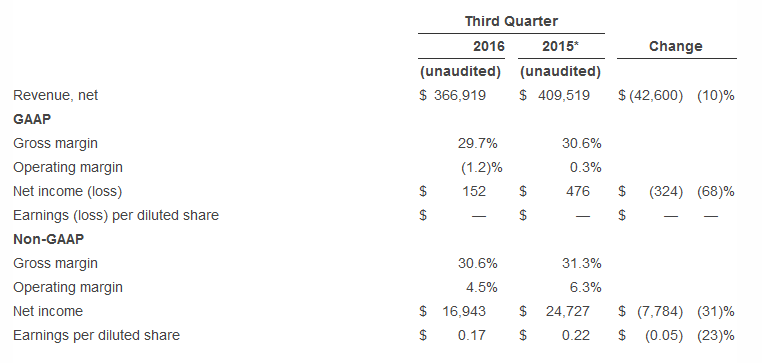

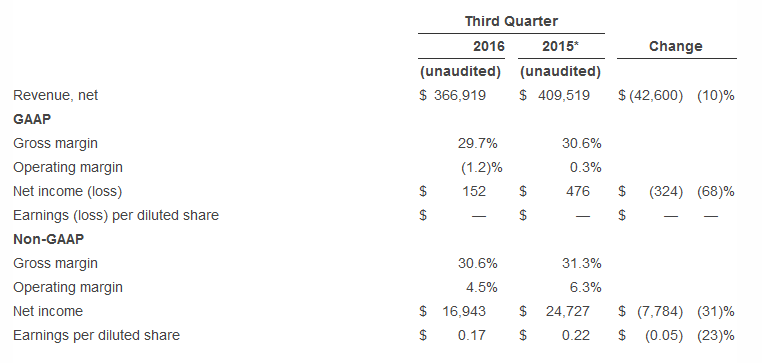

Cree, Inc. (Nasdaq: CREE), a market leader in LED lighting, today announced revenue of $367 million for its third quarter of fiscal 2016, ended March 27, 2016. This compares to revenue of $410 million reported for the third quarter of fiscal 2015, and $436 million reported for the second quarter of fiscal 2016. GAAP net income for the third quarter of fiscal 2016 was $152 thousand, or $0.00 per diluted share, compared to GAAP net income of $476 thousand, or $0.00 per diluted share, for the third quarter of fiscal 2015. On a non-GAAP basis, net income for the third quarter of fiscal 2016 was $17 million, or $0.17 per diluted share, compared to non-GAAP net income for the third quarter of fiscal 2015 of $25 million, or $0.22 per diluted share.

“Q3 operating results were in-line with the preliminary estimates we provided on April 5th,” stated Chuck Swoboda, Cree Chairman and CEO. “I believe we’ve addressed the root causes that led to our recent business challenges. We improved customer responsiveness in March, and we’re optimistic that this, combined with new product momentum, will drive sequential growth in fiscal Q4.”

Q3 2016 Financial Metrics

(in thousands, except per share amounts and percentages)

|

* As revised to reflect the correction of an immaterial error. For additional information, see the Company’s

Form 10-Q for the quarterly period ended March 27, 2016 to be filed with the Securities and Exchange Commission

on April 27, 2016.

-

Gross margin decreased from 30.8% in Q2 of fiscal 2016 to 29.7% on a GAAP basis and decreased from 31.6% to 30.6% on a non-GAAP basis.

-

Cash and investments increased by $3 million from Q2 of fiscal 2016 to $620 million.

-

Accounts receivable, net decreased by $4 million from Q2 of fiscal 2016 to $179 million, with days sales outstanding of 44.

-

Inventory increased by $18 million from Q2 of fiscal 2016 to $298 million and represents 104 days of inventory.

-

Cash from operations was $15 million, free cash flow was $(6) million and share repurchases were $18 million for Q3 of fiscal 2016.

Recent Business Highlights:

-

Expanded our lighting product portfolio with the introduction of Essentia® by Cree, a new brand of commercial lighting products that offer a broad range of high quality lighting solutions at a great value;

-

Introduced the Cree® RSWTM LED Street Luminaire, the first of a generation of streetlights that deliver LED energy savings and reliability in a warm color temperature that is preferred in many residential applications;

-

Announced SmartCast® Power over Ethernet (PoE), an intuitively simple, scalable and open platform that enables the Internet of Things (IoT) for buildings through better light, and SmartCast® Manager, innovative software that unlocks the potential of better LED technology as the engine of limitless applications beyond light;

-

Released the next generation of the XLamp® XP-G platform, the XLamp XP-G3 LED, which delivers 31 percent more lumens than our prior generation, as well as improved lumen density, voltage characteristics and reliability;

-

Announced TrueWhitePlusTM Technology, a spectral control breakthrough that sets a new standard for what is possible with LED light;

-

Introduced two new XLamp CXA2 high density LED arrays that double lumen output and deliver the highest lumen density in the industry for their LES (light emitting surface) size;

-

Announced an agreement with Pilot Flying J, the largest operator of travel centers in North America, to install indoor and outdoor LED lighting at select locations.

Business Outlook:

For its fourth quarter of fiscal 2016 ending June 26, 2016, Cree targets revenue in a range of $370 million to $395 million, with GAAP gross margin targeted to be 30.7%+/- and non-GAAP gross margin targeted to be 31.5%+/-. Our GAAP gross margin targets include stock-based compensation expense of approximately $3 million, while our non-GAAP targets do not. GAAP operating expenses are targeted to be approximately $117 million, and non-GAAP operating expenses are targeted to be approximately $98 million. The GAAP tax rate is targeted at 19%+/- and the non-GAAP tax rate is targeted at 16.0%+/- for the fourth quarter of fiscal 2016. GAAP net (loss) income is targeted at $(3) million to $3 million, or $(0.03) to $0.03 per diluted share, excluding any net changes associated with Cree’s Lextar investment. Non-GAAP net income is targeted in a range of $16 million to $22 million, or $0.16 to $0.22 per diluted share. The GAAP and non-GAAP per diluted share targets are based on an estimated 101 million diluted weighted average shares. Targeted non-GAAP earnings exclude $0.19 per diluted share of expenses related to stock-based compensation expense, the amortization or impairment of acquisition-related intangibles and any net changes associated with Cree’s Lextar investment.

CN

TW

EN

CN

TW

EN