(Author: Judy Lin, Chief Editor, LEDinside)

Chinese LED chip manufacturer San’an Opto is in talks of acquiring Osram group, German magazine Wirtschaftswoche reported Thursday, without indicating information sources.The acquisition talks are more than just business transacations, but reveal Chinese government's industry policies, analyzed LEDinside.

The Xiamen-based San’an Opto plans to acquire the German lighting giant for EUR 70 (US $77.78) per share, which a Reuters report estimated would amount to about EUR 7.2 billion.According to an LEDinside industry source,

According to a LEDinside industry source, San'an Opto is mostly looking into acquiring Osram Opto, the LED component business of the German lighting group, separate talks might be scheduled at a later date for the absorption of the group’s automotive lighting and specialty lighting business.

San'an Opto is mostly looking into acquiring Osram Opto, the LED component business of the German lighting group, and might carry out separate talks to absorb the group's automotive lighting and other specialty lighiting businesses.

Several Chinese groups have shown interest in investing in Osram including San’an Opto and investment group Go Scale Capital have expressed interests in acquiring the company.

Chinese government involvement in San’an Opto’s acquisition of Osram

“Chinese investors have been approaching Osram for some time regarding acquisition talks,” said Roger Chu, Director of Research Department at LEDinside. “If San’an Opto intends to acquire Osram, though, it will probably require funding from the Chinese government.”

San’an Opto reported a gross profit of 42.44% for its LED business in 2015, with total revenue from this business sector reaching RMB 4.50 trillion (US $674.66 million).

Despite a 49.90% peak in monetary assets for fiscal year of 2015 compared to 2014 to RMB 5.22 trillion, there is still a large financing gap left for the Chinese company to reach EUR 7.2 billion on its own.

San’an Opto would have to turn to other investors to meet its financing needs for Osram, and as a top receiver of Chinese government funding in LEDs, IC and power device technologies, there is a high probability that Chinese government will provide monetary support.

Another reason that San’an Opto might need help from investment groups is in the case if Osram asks for a higher bidding offer.

According to analyses by Peter Reilly, an analyst at Jefferies the current offer by San’an Opto is too low if the Osram is confident that its investment in its Malaysian fab will pay off.

Osram’s value could reach EUR 80 per share if the company takes into account its investments in Malaysia.

The German lighting company’s share prices have jumped about 10% in value on Thursday shortly after the Wirtschaftswoche report to reach EUR 60.17.

Siemens disapproval of Osram strategy creating opportunities for new investors

Osram CEO Olaf Berlien's announcement of investing EUR 3 billion largely in general lighting and white LEDs at its new fab in Malaysia led to rifts between largest shareholder Siemens last October.

Siemens disapproval of Osram’s latest business strategies has given Chinese, Korean and even Taiwanese investors ample opportunities.

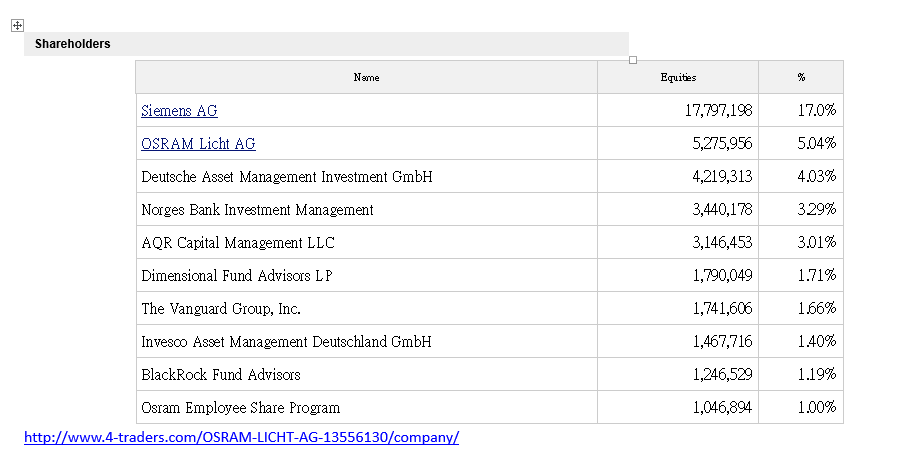

The German lighting company’s largest shareholder Siemens, which holds a 17% stake in Osram was rumored to be in talks of selling its shares to Chinese investor Go Scale Capital in September 2016.

Go Scale Capital nearly acquired Philips LED component business Lumileds for US $3.3 billion before the deal was blocked by U.S., which has increasingly raised the industry’s concerns on how governments will respond to such acquisitions.

Germany’s Economy Ministry has denied claims that San’an Opto will takeover Osram, but spoke in late September that it will be closely monitoring developments of Chinese acquisitions of German companies.

In the WirtschaftsWoche anonymous sources noted the German government did not express concerns or plans to scupper a Chinese acquisition of Osram.

San’an Opto eying Osram’s automotive lighting business

Osram’s strong market position in the automotive lighting industry and near monopoly in the automotive market has barred Chinese, Taiwanese or Korean lighting manufacturers from entering the market sector, analyzed Ivan Lin, Head of Content Development, LEDinside.

“By acquiring Osram, San’an Opto will get the entry ticket into the automotive lighting market,” wrote Lin.

Osram also has strong product portfolio in IR LED technology, good distribution channels and comprehensive LED patent portfolio.

All these are attractive assets for Chinese manufacturers that want to gain market access or larger international market share, which also fits into Chinese government’s strategic vertical integration policies for industries, he wrote.

By acquiring Osram, China’s LED industry will be able to raise its international visibility, and raise its market scale to exceed U.S. and Japanese competitors.

“This is a very interesting move for San’an Opto and might be a successful one so they can generate high synergies with Osram,” said an industry source. “Basically the same synergies Osram is trying to generate with its Kulim investment (in Malaysia), but a lot faster.”

References:

CN

TW

EN

CN

TW

EN