On March 17, Shenzhen MTC held the “2023 MTC Display Rally” in Nanchang of Jiangxi Province, China. During the campaign, heads from Nanchang Municipal Committee and Municipal Government accompanied the company’s chairman Gu Wei to witness MTC Display’s dealership signing involving 1100 COB production lines.

Gu Wei, MTC chairman

Jumping from 100 production lines in 2021 to 1600 this year, MTC has largely and quickly expanded production capacity and signaled its determination to thrive in the Mini/Micro LED display market using COB technologies. Despite the economic turmoil throughout 2022 globally, the LED manufacturer did not change its mind. What is it planning to do anyway?

Focusing on COB Display Panels, MTC Develops Mini/Micro LED Markets in Three Ways

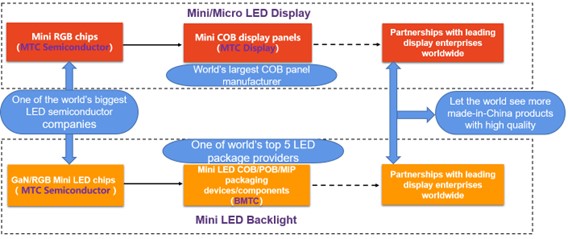

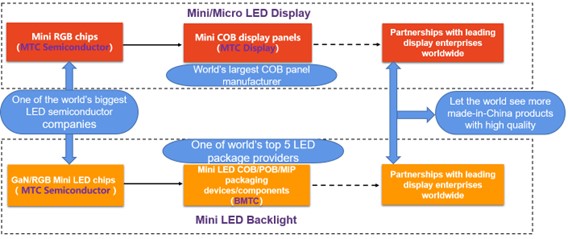

As one of the few listed companies covering the entire LED manufacturing process, MTC boasts mature core technologies and manufacturing processes from epi-wafers, chips, packages, modules to end-market applications. Considering its marketing focus on Mini/Micro LED displays, MTC develops both backlight and RGB direct-view displays. The two segments have clear and separate targets, while being able to complement each other at the same time.

The company’s Mini LED backlight production line currently covers chips and packaging devices/components, which are mostly produced by its subsidiaries Jiangxi MTC Semiconductor (hereinafter MTC Semiconductor) and BMTC. As LEDinside reported, MTC is planning to assign the production of TVs to original design manufacturers (ODMs), indicating its intention to integrate Mini LED backlight supply in the midstream and downstream sectors. If the plan works well, MTC will increase brand awareness in the consumer market by offering products with good value and utilizing its resources and distribution channels in the smart home appliance sector, and ultimately enhance the penetration rate of Mini LED-backlit TVs.

The Mini/Micro LED display segment comprises the production of chips, packages and displays, with MTC Semiconductor being responsible for chip-making and MTC Display for package and display production. The latter centers on COB display panels for Mini/Micro LED applications, with Mini LED COB being the current focus considering its maturity and Micro LED COB the mid- and long-term goal.

Considering the enormous potential of COB packages for fine-pitch and ultra-fine pitch applications, MTC Display plans to secure more shares in the Mini/Micro LED display market in three steps: 1) penetrating the P1.0-P2.0 face-up market, 2) expanding to the market of P1.0 microdisplays and those with higher density, and 3) covering high-end Micro LED TVs with a pixel pitch of P0.5 and smaller.

MTC Display aims to penetrate the fine-pitch and ultra-fine pitch LED display markets in the short run and, in the long run, expand its business to 80" and bigger TVs with a pixel pitch of P0.5 in the consumer market.

MTC Dominates LED Industry with Home Appliance Mindset, Determined to Be the World’s Largest COB Panel Maker in Three Steps

Sheng-bin He, vice president at Shenzhen MTC and MTC Display’s general manager, revealed that MTC is embracing a “home appliance mindset” as it expands its LED business and is determined to become the world’s largest COB panel manufacturer by transforming the Chinese city Nanchang into a global hub for display manufacturing.

Sheng-bin He, Vice president at Shenzhen MTC and general manager at MTC display

With strong determination to achieve its goal, MTC Display has proposed different plans that will be accomplished in three stages. First, the company will found technological laboratories focusing on Mini and Micro LED. Next, it will create six major product lines. Finally, COB production lines will be expanded.

First step: research and development. As He indicated, Mini/Micro LED is the world’s only cutting-edge display technology where Chinese companies have absolute advantages in global supply chain and intellectual property. Accordingly, MTC will separately establish Mini LED and Micro LED industrialization laboratories. Therefore, the company can develop more talents and facilitate Mini LED and Micro LED usage in different sectors as well as creation of products sitting between the two technologies in terms of size, ultimately reframing the “Made in China” notion.

Second step: product design. The research and development center of MTC Display is about to roll out six product lines, namely the Real Pixel, Meta Visual, Glasses-Free 3D, TV, Education Display, and Creative Display lines.

The Real Pixel products are mostly made of Mini LEDs. So far, MTC Display has massed produced P0.78, P0.93, P1.25, P1.56 P1.87 Mini RGB 4K displays. The manufacturer plans to roll out fine-pitch P0.39-P2.5 Mini RGB 4K/8K models in 2023. Meta Visual (VE technology) refers to products engineered with subpixel rendering that can create visual experiences with higher resolution within the same space.

Based on the said technologies, MTC Display announced a plan to roll out 77", 89", 99", 110" and 146" Mini LED TVs with a 2K or 4K resolution in hopes of entering the consumer market. In the supply chain, MTC Display’s self-developed COB displays are equivalent to panels in the TV industry.

Glasses-free 3D, education, and creative displays have been moved into the spotlight in the LED industry over the past two years. Financial statements of listed display enterprises show that outdoor glasses-free 3D displays, smart LED all-in-one machines and creative displays have been critical sources of revenue with rising market size. Therefore, it is the right time that MTC Display decides to expand its product lines as the plan will enable the manufacturer to capture more market shares thanks to its advantages in costs, distribution channels and business size.

Third step: production expansion. Since 2021, MTC has been expanding its COB production lines. In November 2022, the company launched production in its Nanchang plant, where the number of COB production lines was boosted to 600. Signing a deal adding up to 1100 COB production lines this year indicates that MTC Display is about to have a total of 1600 production lines by 1Q23. In the future, the manufacturer is aiming to create more than 5000 lines.

He said that as Haitz’s law predicts, the light efficacy of LEDs has increased by 20 times with a 90% slump in costs. In addition to production expansion, MTC Display has been striving to enhance first pass yield and reduce production and final-product costs, gradually building a barrier to competition.

Conclusion

As MTC Display develops the COB Mini/Micro LED business, its performance also escalates in both quantity and quality. This growth pattern also applies to the entire MTC group. The LED manufacturer—in addition to its greater business size—has seen its market share and profitability grow in recent years. From the perspective of business performance, MTC suffered a drop in revenue in 1H22, but gross margin inched up from 17.40% in 2H20 to 22.7%, demonstrating an improvement of quality.

On the way to becoming the biggest COB panel manufacturer worldwide, MTC Display will help MTC Group gain influence in the global display market through hard power in technology, manufacturing process, product design, production capacity and cost management as well as soft power contributed by its clouding system.

(By Janice from LEDinside)

2023 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 28 September 2022

Language: Traditional Chinese / English

Format: PDF

Page: 238

If you would like to know more details , please contact:

CN

TW

EN

CN

TW

EN