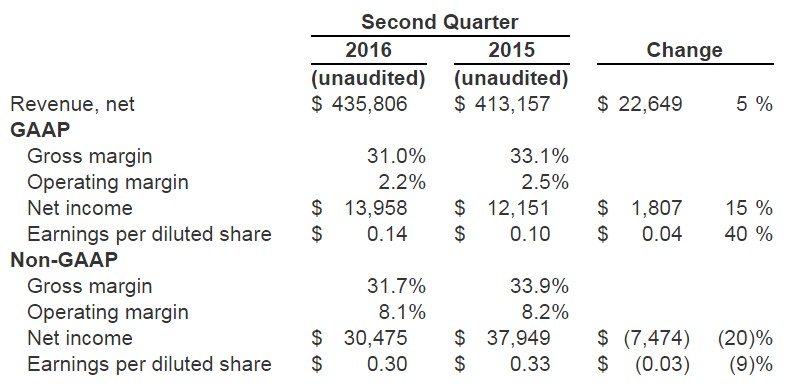

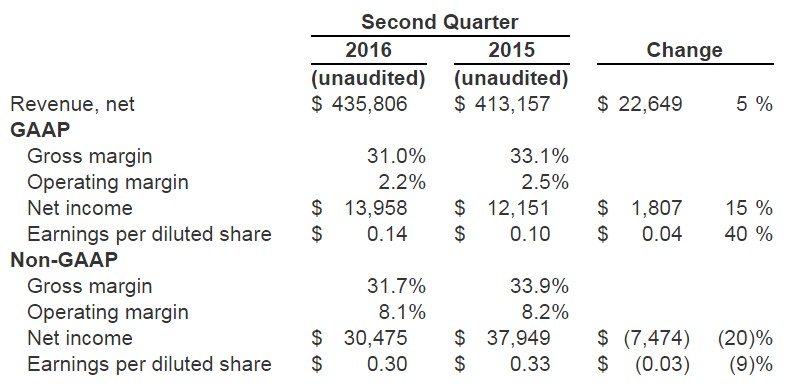

Cree, a market leader in LED lighting, today announced revenue of US $436 million for its second quarter of fiscal 2016, ended December 27, 2015. This represents a 5% increase compared to revenue of $413 million reported for the second quarter of fiscal 2015, and a 2% increase compared to the first quarter of fiscal 2016. GAAP net income for the second quarter of fiscal 2016 was $14 million, or $0.14 per diluted share, compared to GAAP net income of $12 million, or $0.10 per diluted share, for the second quarter of fiscal 2015. On a non-GAAP basis, net income for the second quarter of fiscal 2016 was $30 million, or $0.30 per diluted share, compared to non-GAAP net income for the second quarter of fiscal 2015 of $38 million, or $0.33 per diluted share.

"We delivered on our goal of building financial momentum in Q2, with earnings that exceeded our targets driven by solid revenue growth, good margins and operating expense leverage," stated Chuck Swoboda, Cree Chairman and CEO. "Our lighting business continues to grow, the LED business has stabilized, and our Wolfspeed Power & RF division continues to make progress. Overall, we had a good first half of fiscal 2016 and are well positioned for a strong second half."

Q2 2016 Financial Metrics

(in thousands, except per share amounts and percentages)

|

|

Cree's revenue performance in 2Q16. (Cree/LEDinside) |

-

Gross margin from Q1 of fiscal 2016 remained consistent at 31.0% on a GAAP basis and at 31.7% on a non-GAAP basis.

-

Cash and investments decreased by $15 million from Q1 of fiscal 2016 to $617 million.

-

Accounts receivable, net decreased by $11 million from Q1 of fiscal 2016 to $183 million, with days sales outstanding of 38.

-

Inventory decreased by $8 million from Q1 of fiscal 2016 to $281 million and represents 84 days of inventory.

-

Cash from operations was $77 million, free cash flow was $42 million and share repurchases were $62 million for Q2 of fiscal 2016.

Recent Business Highlights:

-

Released our breakthrough IG Series parking structure lights to volume production. This is the first product family to utilize our new WaveMax™ Technology, which features a revolutionary combination of control, uniformity and efficiency to deliver a superior visual experience in new form factors that are intelligent in both design and function;

-

Announced that Thermo Fisher Scientific selected Cree® to provide a turnkey LED lighting solution for their Asheville, N.C., campus. Cree Solutions designed and managed the project from start to finish, replacing more than 2,000 light fixtures to achieve a three-year payback and energy savings of up to 40 percent;

-

During the second quarter of fiscal 2016, Cree completed its LED business restructuring recognizing $3 million of expense for factory capacity and overhead costs reductions. The restructuring charges are included in the GAAP results only.

Business Outlook:

For its third quarter of fiscal 2016 ending March 27, 2016, Cree targets revenue in a range of $400 million to $430 million, with GAAP gross margin targeted to be 31.0%+/- and non-GAAP gross margin targeted to be 31.7%+/-. Our GAAP gross margin targets include stock-based compensation expense of approximately $3 million, while our non-GAAP targets do not. GAAP operating expenses are targeted to be approximately $119 million, and non-GAAP operating expenses are targeted to be approximately $100 million. The tax rate is targeted at 20%+/- for the third quarter of fiscal 2016. GAAP net income is targeted at $4 million to $11 million, or$0.04 to $0.11 per diluted share, excluding any net changes associated with Cree's Lextar investment. Non-GAAP net income is targeted in a range of $22 million to$29 million, or $0.22 to $0.29 per diluted share. The GAAP and non-GAAP per diluted share targets are based on an estimated 101 million diluted weighted average shares. Targeted non-GAAP earnings exclude $0.18 per diluted share of expenses related to stock-based compensation expense, the amortization or impairment of acquisition-related intangibles and any net changes associated with Cree's Lextar investment.

CN

TW

EN

CN

TW

EN