Power management company Eaton announced that operating earnings per share, which exclude charges of US $0.01 per share to integrate recent acquisitions, were $0.97 for the third quarter of 2015, down 25% from the third quarter of 2014. Sales in the third quarter of 2015 were $5.2 billion, down 9% from the same period in 2014. The sales decline consisted of 6 percent from negative currency translation and 3% from a decline in organic sales.

Alexander M. Cutler, Eaton chairman and chief executive officer, said, “Our sales in the third quarter were approximately $300 million lower than we had expected at the start of the quarter, with organic sales lower by $240 million and negative currency translation reducing sales by $60 million.

|

|

(Source: Eaton) |

“The majority of our markets experienced weaker conditions in the quarter, which makes us cautious about the sales outlook looking forward,” said Cutler.

“As we had announced when we issued second quarter earnings, we implemented a substantial restructuring program in the third quarter,” said Cutler. “We incurred restructuring costs of $113 million, while our savings in the quarter from the actions were $15 million.

“Our operating cash flow in the third quarter was $973 million, a quarterly record, reflecting strong cost control and tight management of working capital,” said Cutler. “During the quarter, we repurchased $284 million of our shares, making our repurchases so far in 2015 a total of $454 million, approximately 1.5% of our outstanding shares at the beginning of the year. Given the weak stock price performance for U.S. dollar denominated industrials, we would expect to continue our strong bias toward deploying our excess cash flow over the next year for share repurchases.

“We anticipate operating earnings per share for the fourth quarter of 2015, which exclude an estimated $14 million of charges to integrate our recent acquisitions, to be between $1.05 and $1.15,” said Cutler. “We expect to incur restructuring charges of $10 million in the fourth quarter, while savings in the quarter from our restructuring program are expected to total $35 million.

“For the full year 2015, we now expect our operating earnings per share to be between $4.20 and $4.30, a reduction at the midpoint of 6 percent from our prior guidance,” said Cutler. “Despite the decline in earnings per share, we continue to believe we will achieve our prior forecasts for 2015 operating cash flow.

“As we begin to plan for 2016, it is apparent that markets are likely to remain soft,” said Cutler. “To deal with such weak markets, we will be expanding our 2016 restructuring program. We had been planning on this second restructuring program, in addition to the $145 million program we announced in the second quarter of 2015, to be on the order of $50 million to $60 million, but in light of current market weakness we are expanding the program to between $90 million and $100 million.”

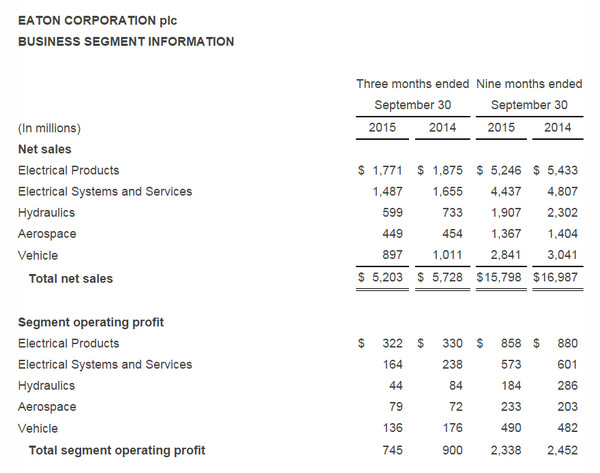

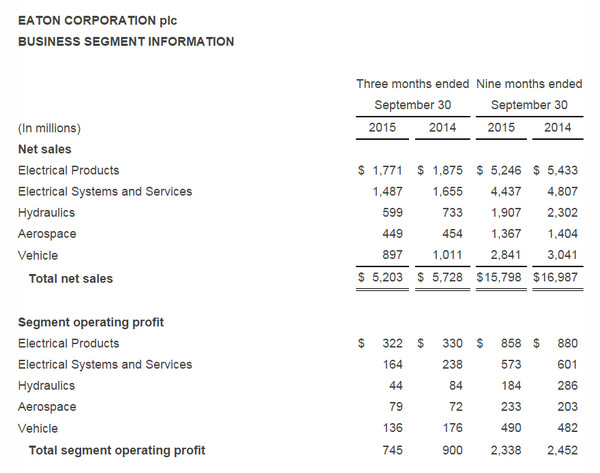

Business Segment Results

Sales for the Electrical Products segment were $1.8 billion, down 6 percent from 2014. The sales decline was almost entirely due to negative currency translation. Operating profits were $322 million. Excluding acquisition integration charges of $5 million during the quarter, operating profits were $327 million, down 3 percent from the third quarter of 2014.

“The restructuring actions we took during the quarter reduced operating profits by a net of $10 million,” said Cutler. “Without these actions, our operating margin would have been 19.0%. Our bookings in the third quarter were flat with the third quarter a year ago.

“We were pleased to acquire Ephesus Lighting in late October,” said Cutler. “Ephesus is a leader in LED lighting for stadiums and other high lumen outdoor and industrial applications. Its sales over the last twelve months were $22 million.”

Sales for the Electrical Systems and Services segment were $1.5 billion, down 10% from the third quarter of 2014. Half of the sales decline was due to negative currency translation and half due to a decline in organic sales. The segment reported operating profits of $164 million. Excluding acquisition integration charges of $3 million during the quarter, operating profits were $167 million, down 31 percent from the third quarter of 2014.

“The restructuring actions we took during the quarter reduced operating profits by a net of $24 million,” said Cutler. “Without those actions, our operating margin in the quarter would have been 12.8%.

“Bookings in the third quarter were down 3% from the third quarter of 2014,” said Cutler. “Our bookings were impacted by continued weakness in the oil and gas market and weakening conditions in the non-residential market as the quarter progressed.”

Hydraulics segment sales were $599 million, down 18% from the third quarter of 2014. Organic sales declined 10 percent and negative currency translation contributed 8 percent. Operating profits in the third quarter were $44 million, a decrease of 49%.

“The Hydraulics markets in the third quarter of 2015 continued the weak trends we have experienced all year,” said Cutler. “We took restructuring actions in the quarter to deal with this weakness, reducing operating earnings by a net impact of $22 million. Without these charges, our operating margin in the quarter would have been 11.0%. Our bookings in the quarter decreased 13 percent from the third quarter of 2014.”

Aerospace segment sales were $449 million, down 1% from the third quarter of 2014. The sales decline consisted of 1% organic growth offset by 2% from negative currency translation. Operating profits in the third quarter were $79 million, up 10% over the third quarter of 2014.

“We incurred net restructuring expense of $5 million in the quarter,” said Cutler. “Without these charges, our operating margin would have been a very healthy 18.7%. Bookings in the quarter declined 16%, driven by a decrease in OEM orders. Aftermarket orders were up 11%.”

The Vehicle segment posted sales of $897 million, down 11% from the third quarter of 2014. The sales decline consisted of 8% from negative currency translation and 3% from a decline in organic sales. The segment reported operating profits in the third quarter of $136 million, down 23% from the third quarter of 2014.

“We incurred net restructuring expense of $27 million in the third quarter in our Vehicle segment,” said Cutler. “Without that expense, our operating margin would have been 18.2%.

“North American markets were up slightly in the third quarter while South American markets showed continued weakness and the Chinese market weakened,” said Cutler. “We now expect the NAFTA Class 8 truck market in 2015 to be 325,000 units, 5,000 units lower than our previous forecast.”

Eaton is a power management company with 2014 sales of $22.6 billion. Eaton provides energy-efficient solutions that help our customers effectively manage electrical, hydraulic and mechanical power more efficiently, safely and sustainably. Eaton has approximately 99,000 employees and sells products to customers in more than 175 countries. For more information, visitwww.eaton.com.

|

|

|

|

|

|

EATON CORPORATION plc

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

Three months ended

September 30

|

Nine months ended

September 30

|

|

(In millions except for per share data)

|

2015

|

2014

|

2015

|

2014

|

|

Net sales

|

$

|

5,203

|

$

|

5,728

|

$

|

15,798

|

$

|

16,987

|

|

|

|

Cost of products sold

|

3,597

|

3,916

|

10,865

|

11,799

|

|

Selling and administrative expense

|

907

|

961

|

2,723

|

2,907

|

|

Litigation settlements

|

—

|

—

|

—

|

644

|

|

Research and development expense

|

156

|

163

|

472

|

493

|

|

Interest expense - net

|

59

|

56

|

175

|

173

|

|

Other income - net

|

(3

|

)

|

(10

|

)

|

(27

|

)

|

(181

|

)

|

|

Income before income taxes

|

487

|

642

|

1,590

|

1,152

|

|

Income tax expense (benefit)

|

42

|

|

37

|

|

143

|

|

(66

|

)

|

|

Net income

|

445

|

605

|

1,447

|

1,218

|

|

Less net loss (income) for noncontrolling interests

|

1

|

|

(3

|

)

|

—

|

|

(6

|

)

|

|

Net income attributable to Eaton ordinary shareholders

|

$

|

446

|

|

$

|

602

|

|

$

|

1,447

|

|

$

|

1,212

|

|

|

|

|

Net income per ordinary share

|

|

Diluted

|

$

|

0.96

|

$

|

1.26

|

$

|

3.09

|

$

|

2.53

|

|

Basic

|

0.96

|

1.27

|

3.10

|

2.55

|

|

|

|

Weighted-average number of ordinary shares outstanding

|

|

Diluted

|

466.4

|

477.2

|

468.5

|

478.2

|

|

Basic

|

465.1

|

474.8

|

466.8

|

475.5

|

|

|

|

Cash dividends declared per ordinary share

|

$

|

0.55

|

$

|

0.49

|

$

|

1.65

|

$

|

1.47

|

|

|

|

Reconciliation of net income attributable to Eaton ordinary shareholders to operating earnings

|

|

Net income attributable to Eaton ordinary shareholders

|

$

|

446

|

$

|

602

|

$

|

1,447

|

$

|

1,212

|

|

Excluding acquisition integration charges (after-tax)

|

7

|

|

14

|

|

22

|

|

81

|

|

|

Operating earnings

|

$

|

453

|

|

$

|

616

|

|

$

|

1,469

|

|

$

|

1,293

|

|

|

|

|

Net income per ordinary share - diluted

|

$

|

0.96

|

$

|

1.26

|

$

|

3.09

|

$

|

2.53

|

|

Excluding per share impact of acquisition integration charges (after-tax)

|

0.01

|

|

0.03

|

|

0.05

|

|

0.17

|

|

|

Operating earnings per ordinary share

|

$

|

0.97

|

|

$

|

1.29

|

|

$

|

3.14

|

|

$

|

2.70

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

|

|

|

|

EATON CORPORATION plc

|

|

BUSINESS SEGMENT INFORMATION

|

|

|

|

Three months ended

September 30

|

Nine months ended

September 30

|

|

(In millions)

|

2015

|

2014

|

2015

|

2014

|

|

Net sales

|

|

Electrical Products

|

$

|

1,771

|

$

|

1,875

|

$

|

5,246

|

$

|

5,433

|

|

Electrical Systems and Services

|

1,487

|

1,655

|

4,437

|

4,807

|

|

Hydraulics

|

599

|

733

|

1,907

|

2,302

|

|

Aerospace

|

449

|

454

|

1,367

|

1,404

|

|

Vehicle

|

897

|

|

1,011

|

|

2,841

|

|

3,041

|

|

|

Total net sales

|

$

|

5,203

|

|

$

|

5,728

|

|

$

|

15,798

|

|

$

|

16,987

|

|

|

|

|

Segment operating profit

|

|

Electrical Products

|

$

|

322

|

$

|

330

|

$

|

858

|

$

|

880

|

|

Electrical Systems and Services

|

164

|

238

|

573

|

601

|

|

Hydraulics

|

44

|

84

|

184

|

286

|

|

Aerospace

|

79

|

72

|

233

|

203

|

|

Vehicle

|

136

|

|

176

|

|

490

|

|

482

|

|

|

Total segment operating profit

|

745

|

900

|

2,338

|

2,452

|

|

|

|

Corporate

|

|

Litigation settlements

|

—

|

—

|

—

|

(644

|

)

|

|

Amortization of intangible assets

|

(102

|

)

|

(107

|

)

|

(306

|

)

|

(326

|

)

|

|

Interest expense - net

|

(59

|

)

|

(56

|

)

|

(175

|

)

|

(173

|

)

|

|

Pension and other postretirement benefits expense

|

(38

|

)

|

(31

|

)

|

(99

|

)

|

(114

|

)

|

|

Other corporate expense - net

|

(59

|

)

|

(64

|

)

|

(168

|

)

|

(43

|

)

|

|

Income before income taxes

|

487

|

642

|

1,590

|

1,152

|

|

Income tax expense (benefit)

|

42

|

|

37

|

|

143

|

|

(66

|

)

|

|

Net income

|

445

|

605

|

1,447

|

1,218

|

|

Less net loss (income) for noncontrolling interests

|

1

|

|

(3

|

)

|

—

|

|

(6

|

)

|

|

Net income attributable to Eaton ordinary shareholders

|

$

|

446

|

|

$

|

602

|

|

$

|

1,447

|

|

$

|

1,212

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

|

|

EATON CORPORATION plc

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

September 30,

2015

|

December 31,

2014

|

|

(In millions)

|

|

Assets

|

|

Current assets

|

|

Cash

|

$

|

418

|

$

|

781

|

|

Short-term investments

|

150

|

245

|

|

Accounts receivable - net

|

3,656

|

3,667

|

|

Inventory

|

2,395

|

2,428

|

|

Deferred income taxes

|

550

|

593

|

|

Prepaid expenses and other current assets

|

410

|

|

386

|

|

Total current assets

|

7,579

|

8,100

|

|

|

|

Property, plant and equipment - net

|

3,590

|

3,750

|

|

|

|

Other noncurrent assets

|

|

Goodwill

|

13,540

|

13,893

|

|

Other intangible assets

|

6,139

|

6,556

|

|

Deferred income taxes

|

246

|

228

|

|

Other assets

|

1,107

|

|

1,002

|

|

Total assets

|

$

|

32,201

|

|

$

|

33,529

|

|

|

|

Liabilities and shareholders’ equity

|

|

Current liabilities

|

|

Short-term debt

|

$

|

1

|

$

|

2

|

|

Current portion of long-term debt

|

841

|

1,008

|

|

Accounts payable

|

1,997

|

1,940

|

|

Accrued compensation

|

373

|

420

|

|

Other current liabilities

|

1,888

|

|

1,985

|

|

Total current liabilities

|

5,100

|

|

5,355

|

|

|

|

Noncurrent liabilities

|

|

Long-term debt

|

7,830

|

8,024

|

|

Pension liabilities

|

1,539

|

1,812

|

|

Other postretirement benefits liabilities

|

502

|

513

|

|

Deferred income taxes

|

820

|

901

|

|

Other noncurrent liabilities

|

997

|

|

1,085

|

|

Total noncurrent liabilities

|

11,688

|

|

12,335

|

|

|

|

Shareholders’ equity

|

|

Eaton shareholders’ equity

|

15,366

|

15,786

|

|

Noncontrolling interests

|

47

|

|

53

|

|

Total equity

|

15,413

|

|

15,839

|

|

Total liabilities and equity

|

$

|

32,201

|

|

$

|

33,529

|

|

|

|

See accompanying notes.

|

|

|

EATON CORPORATION plc

NOTES TO THE THIRD QUARTER 2015 EARNINGS RELEASE

Amounts are in millions of dollars unless indicated otherwise (per share data assume dilution).

Note 1. NON-GAAP FINANCIAL INFORMATION

This earnings release includes certain non-GAAP financial measures. These financial measures include operating earnings, operating earnings per ordinary share, and operating profit before acquisition integration charges for each business segment as well as corporate, each of which differs from the most directly comparable measure calculated in accordance with generally accepted accounting principles (GAAP). A reconciliation of each of these financial measures to the most directly comparable GAAP measure is included in this earnings release. Management believes that these financial measures are useful to investors because they exclude transactions of an unusual nature, allowing investors to more easily compare Eaton Corporation plc's (Eaton or the Company) financial performance period to period. Management uses this information in monitoring and evaluating the on-going performance of Eaton and each business segment.

During the second quarter of 2014, Eaton settled litigation matters with ZF Meritor LLC and Meritor Transmission Corporation (collectively, Meritor), Triumph Actuation Systems, LLC and other claimants (collectively, Triumph), and related litigation, resulting in pre-tax cost totaling $644. Also, during that quarter, Eaton sold the Aerospace Power Distribution Management Solutions and Integrated Cockpit Solutions businesses to Safran for $270, resulting in a pre-tax gain of $154.

Note 2. ACQUISITION INTEGRATION CHARGES

Eaton incurs integration charges related to acquired businesses. A summary of these charges follows:

|

|

|

|

|

|

|

|

Operating profit

|

|

Acquisition

|

Operating profit

|

excluding acquisition

|

|

integration charges

|

as reported

|

integration charges*

|

|

Three months ended September 30

|

|

2015

|

2014

|

2015

|

2014

|

2015

|

2014

|

|

Business segment

|

|

Electrical Products

|

$

|

5

|

$

|

8

|

$

|

322

|

$

|

330

|

$

|

327

|

$

|

338

|

|

Electrical Systems and Services

|

3

|

4

|

164

|

238

|

167

|

242

|

|

Hydraulics

|

—

|

2

|

44

|

84

|

44

|

86

|

|

Aerospace

|

—

|

—

|

79

|

72

|

79

|

72

|

|

Vehicle

|

—

|

|

—

|

|

136

|

|

176

|

|

136

|

|

176

|

|

Total business segments

|

8

|

14

|

$

|

745

|

|

$

|

900

|

|

$

|

753

|

|

$

|

914

|

|

Corporate

|

2

|

|

5

|

|

|

Total acquisition integration charges before income taxes

|

$

|

10

|

|

$

|

19

|

|

|

Total after income taxes

|

$

|

7

|

$

|

14

|

|

Per ordinary share - diluted

|

$

|

0.01

|

$

|

0.03

|

|

|

|

*Operating profit excluding acquisition integration charges is used to calculate operating margin where that term is used in this release.

|

|

|

|

|

Operating profit

|

|

Acquisition

|

Operating profit

|

excluding acquisition

|

|

integration charges

|

as reported

|

integration charges*

|

|

Nine months ended September 30

|

|

2015

|

|

2014

|

2015

|

|

2014

|

2015

|

|

2014

|

|

Business segment

|

|

Electrical Products

|

$

|

17

|

$

|

49

|

$

|

858

|

$

|

880

|

$

|

875

|

$

|

929

|

|

Electrical Systems and Services

|

10

|

43

|

573

|

601

|

583

|

644

|

|

Hydraulics

|

2

|

11

|

184

|

286

|

186

|

297

|

|

Aerospace

|

—

|

—

|

233

|

203

|

233

|

203

|

|

Vehicle

|

—

|

|

—

|

|

|

490

|

|

482

|

|

490

|

|

482

|

|

Total business segments

|

29

|

103

|

|

$

|

2,338

|

|

$

|

2,452

|

|

$

|

2,367

|

|

$

|

2,555

|

|

Corporate

|

4

|

|

19

|

|

|

Total acquisition integration charges before income taxes

|

$

|

33

|

|

$

|

122

|

|

|

Total after income taxes

|

$

|

22

|

$

|

81

|

|

Per ordinary share - diluted

|

$

|

0.05

|

$

|

0.17

|

|

|

|

*Operating profit excluding acquisition integration charges is used to calculate operating margin where that term is used in this release.

|

|

|

Business segment integration charges in 2015 and 2014 were related primarily to the integration of Cooper Industries plc (Cooper). These charges were included in Cost of products sold or Selling and administrative expense, as appropriate. In Business Segment Information, the charges reduced Operating profit of the related business segment.

Corporate integration charges in 2015 and 2014 were related to the acquisition of Cooper. These charges were included in Selling and administrative expense. In Business Segment Information, the charges were included in Other corporate expense - net.

Note 3. INCOME TAXES

The effective income tax rate for the third quarter and first nine months of 2015 was an expense of 9%, compared to an expense of 6% and a benefit 6% for the third quarter and first nine months of 2014, respectively. Excluding the litigation settlements and related legal costs as well as the gain on the sale of Eaton's Aerospace businesses, all of which represents a total pre-tax expense of $494 in the second quarter of 2014, the effective income tax rate for the first nine months of 2014 was an expense of 6%. The increase in the effective tax rate in the third quarter and first nine months of 2015 is primarily due to more income earned in higher tax jurisdictions, including the United States.

CN

TW

EN

CN

TW

EN