Oversupply situations in the LED chip sector, and fierce competition in the general lighting sector over the past few years has aggravated the pricing situation in 2015. White LED chip prices for the large part have reflected a consistent downtrend over the past few years. Despite the ominous cloud hanging over the LED chip and general lighting sector, German LED chip manufacturer Osram announced last week it would be injecting in total EUR 2 billion (EUR 2.14 billion) in R&D and EUR 1 billion in LED manufacturing in the next five years.

Under the German company’s long term business strategy, the investments are directed towards building up its general lighting portfolio. The new LED plant will be constructed in Kulim, Malaysia, a production site that will be in close proximity to its older plant located in Penang. The new plant will mostly manufacture 6-inch LED wafers, but in an investor call the company’s CEO Olaf Berlien forecasted 8-inch LED wafer production was also on the table.

|

|

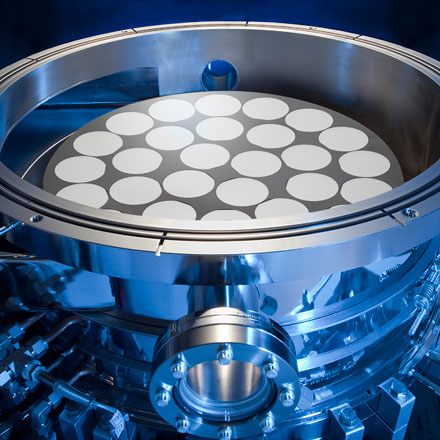

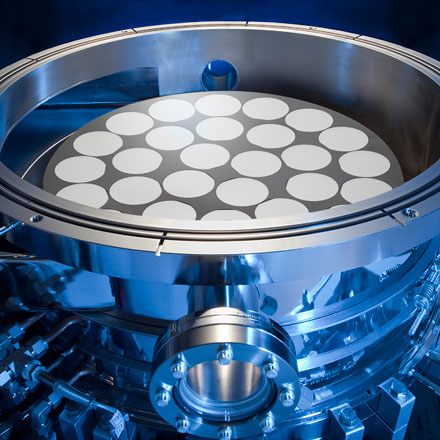

A Veeco MOCVD machine. (Veeco/LEDinside) |

The company was tight lipped about how many MOCVDs it would be installing at the new Malaysian plant, where constructions are scheduled to be completed by 2020. Deustche Bank Research Analyst Uwe Schupp estimated at the investment conference last Wednesday, if Osram’s MOCVDs were bought in bulk the cost for a single equipment would range between EUR 200 million to EUR 300 million. Assuming 30% of the EUR 1 billion investment was set aside for equipment purchases, Schupp projected the German company could be acquiring 100 MOCVDs in total from one of its U.S. MOCVD suppliers.

LEDinside’s analysts initial estimates also closely matched Schupp’s. “About 30% of the EUR 1 billion investment will go into constructing the factory, and probably 30% in chip processing,” said LEDinside research director Roger Chu, Research Director, LEDinside. “Osram might be investing around EUR 400 million in MOCVD equipment.”

However, Osram Opto Semiconductors CEO Aldo Kamper’s response to Schupp hinted the actual MOCVDs installed will be slightly lower than 100 MOCVDs. “The machines nowadays are much more productive so the number of machines might be a little less than you have, because of the high automation they normally become a bit more expensive than you (Schupp) mentioned, but it is a meaningful amount of machines,” said Kamper.

The company has not announced how many new jobs it will create at the new plant in Malaysia, but the Malaysian Investment Development Authority is fully embracing the investment. While this may be good news for Malaysian economy, one cannot help but wonder how Osram’s scale up will affect the industry as a whole?

Osram clearly stated in its investment conference call that it is competing against Nichia, and striving to replace the Japanese company to becoming the top LED chip supplier. The German company opted for a business strategy largely based on its Japanese contender strategy, such as further developing niche markets including laser, OLED, and automotive lighting technologies.

As Osram strives to keep up with Nichia and move up from its current global ranking of number two to top player, San’an Opto and other contenders are also nipping at its feet. The German company intends to keep its pack leader status through expanding its LED chip and LED package production capacity, but as it scales up production the industry will probably need to brace itself for another downturn.

“The oversupply situation in the LED chip industry will probably continue from 2017 to 2020”, said Chu.

(Author: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN