ams OSRAM delivers cost savings ahead of plan, EUR 12m positive FCF in FY24, Q4 revenues and profitability above mid-point of guided range and expects FY25 - FCF exceeding EUR 100m

“Our turnaround is in full swing. Focusing on the core portfolio in our semiconductor business proves right. This semi core grew approx. 7% compared to 2023, driven by a strong rebound in sensors for mobile devices based on new product ramps and a resilient auto business. Savings from our ‘Re-establish the Base’ (RtB) strategic efficiency program are ahead of plan, measures supporting the upsized target are already detailed out. We delivered positive FCF in 2024 and expect margin expansion and a positive FCF exceeding EUR 100 million in 2025 even though markets remain volatile.” said Aldo Kamper, CEO of ams OSRAM.

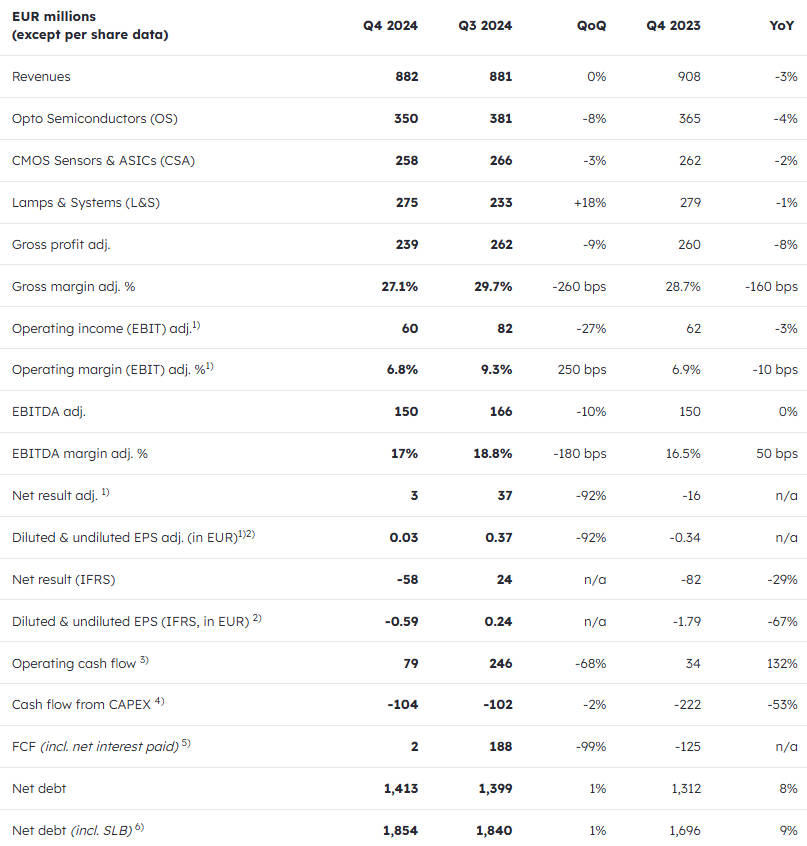

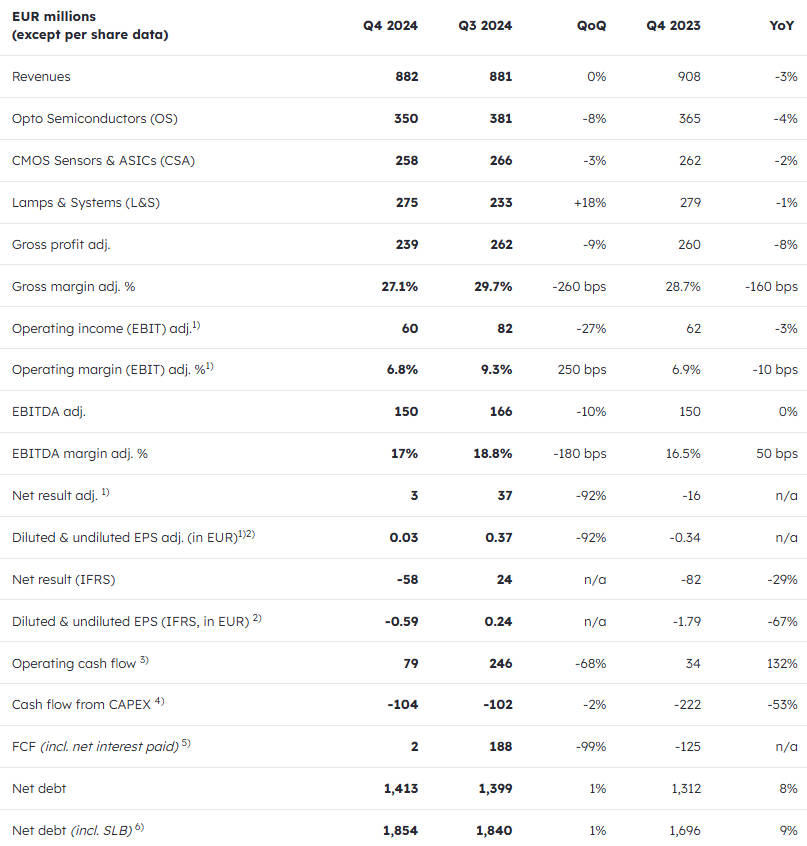

Q4/24 financial update

Revenues stayed essentially flat at EUR 882 million quarter-over-quarter in Q4/24, above the midpoint of the guided range of EUR 810 – 910 million. Strong seasonal auto lamps aftermarket sales and steady semi automotive business compensated continued weakness in industrial & medical applications and the beginning seasonal decline in semiconductor products for consumer handheld devices. The stronger USD also helped coming in above the midpoint of the guided range.

Year-over-year, Group revenues declined by 3% due to cyclical weakness in automotive and I&M semiconductor businesses and some end-of-life of OEM modules business in Lamps & Systems. The relevant semi core portfolio (excluding the exited non-core portfolio) delivered a growth of approx. 7% year-over-year.

Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation, and amortization) came in at EUR 150 million, i.e. at 17.0% adj. EBITDA margin, above the midpoint of the guided range of 15% - 18%.

Adjusted EBIT (adjusted earnings before interest and taxes) margin for the Group stood at 6.8%. Adjusted EBIT amounted to EUR 60 million.

Key reported figures

Semiconductor business update

Opto Semiconductors segment (OS)

Revenues for opto-electronic semiconductors decreased by EUR 31 million to EUR 350 million in Q4/24 compared to EUR 381 million in Q3/24. Adjusted EBITDA was EUR 51 million, representing an adjusted EBITDA margin of 14.6%, down from EUR 88m in Q3/24.

The company continues to receive non-refundable engineering payments (so called ‘NRE’) for the development of LED technologies from certain customers on a currently recurring basis, exemplifying its leading technology position.

CMOS sensors and ASICs segment (CSA)

Revenues for CMOS sensors and ASICs slightly decreased by EUR 8 million to EUR 258 million in Q4/24 compared to EUR 266 million in Q3/24 due to the typical seasonal softening in demand for components for consumer handheld devices.

Adjusted EBITDA increased further to EUR 55 million in Q4/24, driven by one-off effects, portfolio optimization and cost savings, both part of the ‘Re-establish the Base’ program, up from EUR 48 million in Q3/24, representing an adjusted EBITDA Margin of 21.3%.

Semiconductors industry dynamics

Revenues from the two semiconductor business units represented approx. 70% of Q4/24 revenues, or EUR 608 million, compared to EUR 629 million a year ago. End-markets continued to show different cyclicality in the fourth quarter.

Automotive:

The automotive business came in slightly better than expected against the backdrop of an inventory correction in the semi supply chain. Momentarily customers order on very short notice, reflecting a higher level of uncertainty at the carmakers. The company benefited from order backlog and ramping new sensor products resulting in a 3% quarter-over-quarter increase. The year-over-year decline of 14% is in line with these inventory adjustments due to demand uncertainties seen by Tier-1 and OEM customers, compared to the all-time high revenue in Q4/23.

Industrial & Medical (I&M):

The business showed a mixed performance, showing a seasonal (horticulture) and cyclical (industrial automation & mass market) 14% quarter-over-quarter decline. Revenues came in 10% lower than a year ago. However, the company believes that segments with weak demand seem to have bottomed out.

Consumer:

With the ramp of new products and healthy overall demand for consumer portable devices, the consumer segment showed a healthy 20% year-over-year increase in revenues. Quarter-over-quarter, the typical seasonal regression set in with an 8% quarter-over-quarter decline.

Lamps & Systems segment (L&S)

The Lamps & Systems segment represented approx. 30% of Q4/24 revenues, equaling EUR 275 million. A typical, strong quarter-over-quarter increase of 18%, in line with the aftermarket’s seasonal demand pattern. The slight year-over-year reduction of 3% comes mainly from discontinued OEM products.

Adjusted EBITDA in Q4/24 came in at EUR 50 million or 18.2% adjusted EBITDA margin in line with fall-through from operating leverage.

Automotive:

The automotive aftermarket business was in full swing in Q4/24. The OEM business came in as expected.

Specialty Lamps:

Lower demand and partially inventory corrections in industrial and professional entertainment markets are continuing, nevertheless revenues improved a bit quarter-over-quarter.

Q4/24 key financial figures

Gross margin

The adjusted gross margin decreased 260 basis points quarter-over-quarter with CSA coming in stronger due to better loading and OS coming in weaker due to lower loading and lower customer engineering payments. Year-over-year, adj. gross margin decreased 160 basis points in line with lower revenues, product-mix and currency effects.

Net result & earnings per share

The adjusted net result came in at EUR 3 million in Q4/24 up from EUR -16 million a year ago and down from EUR 37 million in the third quarter. Both Q4/24 adjusted basic and diluted earnings per share came in at EUR 0.03, down compared to the EUR 0.37 in Q3/24.

The IFRS net result stood at EUR -58 million in Q4/24 after EUR 24 million in Q3/24, due to various positive one-off effects in Q3/24. The company recorded approx. EUR 29 million positive one-offs related to lower microLED strategy adaption expenses. Both basic and diluted IFRS earnings per share came in at EUR -0.58 in Q4/24, after EUR 0.24 in Q3/24.

Cash flows

Operating cash flow (including net interest paid) came in at EUR 79 million in Q4/24. Cash flow from investments into PPE and intangibles, or CAPEX, came down significantly to EUR -104 million compared to EUR -222 million a year ago, stayed essentially flat compared to the previous quarter. Free cash flow – defined as operating cash flow including net interest paid minus cash flow from CAPEX plus proceeds from divestments – came in at EUR 2 million in Q4/24.

Net-debt related financial figures

The gross cash position stayed flat with EUR 1,098 million in Q4/24 after EUR 1,097 million in Q3/24. For this, the net debt position stayed also basically flat at EUR 1,413 million quarter-over-quarter after EUR 1,399 million in Q3/24. The company repaid EUR 161 million maturing loans and drew EUR 141 million new loans maturing in 2025 and 2026.

When including EUR 441 million equivalent from the Sale-and-Lease Back Malaysia transaction (booked under other financial liabilities), the net debt position stayed with EUR 1,854 million in Q4/24 on a similar level as in Q3/24.

Status of outstanding OSRAM minority shares

On 31 December 2024, the Group held approx. 86% of OSRAM Licht AG shares. The total liability for minority shareholders’ put options reduced to EUR 585 million at the end of Q4/24 compared to EUR 604 million at the end of the previous quarter.

The company has a Revolving Credit Facility (RCF) in place. The RCF is primarily in place to cover any further significant exercises under the 'domination and profit and loss transfer agreement (DPLTA)’ put option and would be sufficient to fully cover all outstanding minority shareholders’ put options. It could also be drawn for general corporate and working capital purposes.

FY24 financial and business update

The Group recorded revenues of EUR 3.43 billion in FY24 after EUR 3.59 billion in FY23, due to a decline in the L&S segment after divesting its Digital Systems business in 2023 and discontinuing some OEM module business.

Growth in the core-semiconductor portfolio

When launching its ‘Re-establish the Base’ program, the company identified a non-profitable, non-core semiconductor portfolio of approx. EUR 350 million in FY23 which was decided to be exited. During FY24, most of these product lines have been exited step by step, however, the accumulated revenues for the year still totaled approx. EUR 200 million, which had been mostly phased-out by end of December 2024. Taking this into account, the core semiconductor portfolio grew year-over-year approx. 7% - broadly in line with the growth target of the company’s target operating model.

Profitability

In 2024, the company switched its key profitability metrics to adj. EBITDA. For fiscal year 2024, adj. EBITDA came in at EUR 575 million after EUR 604 million, resulting in a stable adj. EBITDA margin of 16.8% for both years. The market weakness in automotive and I&M semis in the second half of 2024 offset improvements due to RtB, i.e. lower operating expenses and the gradual exit of non-profitable, non-core semi-portfolio, as well as customer payments for development and deconsolidation of L&S businesses.

Adjusted EBIT improved to EUR 241 million in FY24 after EUR 233 million in the previous fiscal year. In addition to the effects for the yoy development of adj. EBITDA, lower depreciation after impairment of manufacturing equipment improved adj. EBIT.

In FY24, adjusted diluted earnings per share stood at EUR 0.03 and EUR -7.94 unadjusted.

Free cash flow

In 2023, the Group reported free cash flow (incl. interest paid) of EUR -332 million driven by exceptionally high CAPEX levels associated with the microLED project. In 2024, this steeply improved coming in at a positive EUR 12 million despite significant transformation cost for the adjustment of the microLED strategy after the cancellation of the cornerstone project in February 2024. On top, the transformation costs for implementing the ‘Re-establish the Base’ program had to be borne. Key for the significant FCF improvement yoy were savings from the ‘Re-establish the Base’ program, customer pre-payments exemplifying the company’s leading technology position, and significantly reduced capital expenditures.

FY24 progress of ‘Re-establish the Base’ program

On 27 July 2023, the company announced its strategic efficiency program ‘Re-establish the Base’, which aimed at focusing the company on its profitable, structurally growing core, initially targeting approx. EUR 150 million run-rate savings by end of FY25 compared to FY23 actuals. On 7 November 2024, the company extended the program to 2026, upsizing the savings target to approx. EUR 225 million run-rate savings by end of 2026.

Until end-of-2024, the company has realized already approx. EUR 110 million savings, exceeding the EUR 75 million run-rate savings target for FY24. Recent implementation successes are especially evident when looking at the profitability improvement of the CSA segment. All measures to achieve the full savings have already been defined and will be fully implemented until end of 2026.

When it comes to the company’s non-core semiconductor portfolio (approx. EUR 350 million, in 2023, approx. EUR 200 million in 2024), it is mostly phased out by the end-of-2024. Thus, the exit is essentially complete with (a) the sale of assets of the Passive Optical Components business to Focuslight Inc. (2) the restructuring of the CMOS image sensor business, and (3) the end-of-life phase out of the remaining product-lines.

Summary of transformation costs

The company excludes transformation costs amongst other items from its operational performance measures, i.e. adj. EBITDA and adj. EBIT. Transformation costs in FY24 were mainly driven by the adjustment of its microLED strategy and its ‘Re-establish the Base’ program.

In Q4/24, the company recorded a net gain of approx. EUR 29 million by reversing certain provisions related to the microLED strategy adaption. In summary, total cost for adjusting the microLED strategy came in at EUR 576 million in FY24, significantly lower than initially expected. Within that number, there were impairment charges of EUR 490 million and transformation costs of EUR 86 million.

Transformation costs related to ’Re-establish the Base’ were approx. EUR 18 million in Q4/24. For FY24, the total amount came in with EUR 37 million.

FY24 Strong Design-Win performance in Fiscal Year

The company continues to win meaningfully new business across a wide customer base underpinning its structural growth targets in its core semiconductor business. The combined figure came in close to EUR 5 billion, supported by wins across all segments of its core semiconductor portfolio. The largest contribution came from automotive.

First quarter 2025 Outlook

The company expects muted demand for its automotive semiconductor products in Q1/25 reflecting the persisting uncertainties and corrections in the global automotive supply chain. The demand from industrial and medical markets also remains muted, although first small signals might indicate that the weakness has reached its bottom. The business with its semiconductor products for consumer handheld devices will go into its typical strong seasonal decline.

Looking at the L&S segment, the automotive aftermarket halogen lamps business will come in slightly lower – in line with its typical, seasonal demand pattern.

As a result, the Group expects first quarter revenues to land in a range of EUR 750 – 850 million. In line with fall-through and further savings from the ‘Re-establish the Base’ program coming into effect, the company expects adj. EBITDA to come in at 16% +/-1.5%. The EUR/USD exchange rate is assumed to be 1.05.

FY 2025 commentary

The company expects a meaningfully stronger second half mainly due to product ramps and to some extent, market normalization. Furthermore, the company expects improving profitability driven by its ‘Re-establish the Base’ program even in case of moderate revenue development, CAPEX spendings of less than 8% of sales (including capitalized R&D and expected investment grants, e.g. from the European Chips Act), and a positive free cash flow (incl. net interest paid) exceeding EUR 100 million due to improved earnings, lower CAPEX and similar operating NWC in FY25.

Gold+ Member Report

Gold+ Member Report

|

Report Title

|

Content

|

Format

|

Publication

|

|

LED Industry Demand

and Supply Database

|

Demand Market Analysis:

|

PDF / Excel

|

1Q (Mid Mar.)

3Q (Early Sep.)

|

|

2024-2028 Demand Market Forecast

|

|

(Backlight and Flash LED / General Lighting / Agricultural Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / UV LED / IR LED / Micro LED / Mini LED)

|

|

Supply Market Analysis:

|

|

1. LED Chip Market Value (External Sales, Total Sales)

|

|

2. WW New / Accumulated GaN LED and AS/P LED MOCVD Chamber Installations

|

|

3. GaN LED and AS/P LED Wafer Market Demand (By Region / By Wafer Size)

|

|

4. GaN LED and AS/P LED Wafer Market Demand and Supply Analysis

|

|

LED Player Revenue

and Capacity

|

LED Chip Market Analysis:

|

PDF / Excel

|

2Q (Early Jun.)

4Q (Early Dec.)

|

|

Top 10 LED Chip Manufacturers by Revenue and Wafer Capacity

|

|

LED Package Market Analysis:

|

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis

|

|

Top 10 LED Package Players by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED

|

|

LED Industry Price Survey

|

Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED,

IR LED, VCSEL)

|

Excel

|

1Q (Mid Mar.)

2Q (Early Jun.)

3Q (Early Sep.)

4Q (Early Dec.)

|

|

LED Industry

Quarterly Update

|

Major Players Quarterly Update:

|

PDF

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

EU / U.S.- Lumileds, ams OSRAM, Cree LED

(Smart Global Holdings)

|

|

JP- Nichia, Citizen, Stanley, ROHM

|

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys

|

|

ML- Dominant

|

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride

|

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS

|

|

Micro/Mini LED

Exhibit Report

|

CES 2024 / Touch Taiwan 2024 / Display Week 2024

|

PDF

|

Aperiodically;

<20 Pages

|