MOCVD equipment is essential to

LED production, and graphite wafer carrier is a unique component of MOCVD systems. Due to technology barriers, currently there are only three graphite wafer suppliers globally: German’s SGL Group, Japan’s TOYO TANSO and Dutch company Xycarb.

In April 2017, U.S. MOVCD provider Veeco, the top vendor by global market share, filed a patent infringement case against SGL Group, alleging infringement of 4 patents (US6506252B2, US6685774B2, US6726769B2 and USD690671S1, which cover the entire MOCVD equipment and complete wafer carrier design). Veeco demanded that SGL stop selling patent-infringing products immediately and compensate for the great amount of loss suffered.

LEDinside believes this case is going to have a negative effect on MOCVD manufactures in China. This is because some of their product designs are similar to those of Veeco, so the wafer carriers they use are more of the same. The three suppliers have reportedly halts sales of the alleged products, and are seeking resolution with Veeco through settlement. Without the essential wafer carriers, Chinese MOCVD manufacturers’ production schedules will have to be postponed. They might even be unable to fulfill orders from LED epitaxy manufactures for a while.

It is hard to tell how the lawsuit will go. However, SGL Group might have to temporarily halt shipments to Chinese MOCVD manufacturers at present, which can deal a devastating blow to them considering how competitive and time-sensitive the LED industry is. In the worst case scenario, they might loss business to other MOCVD companies.

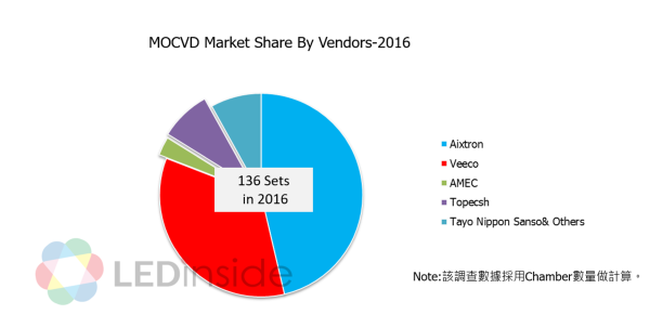

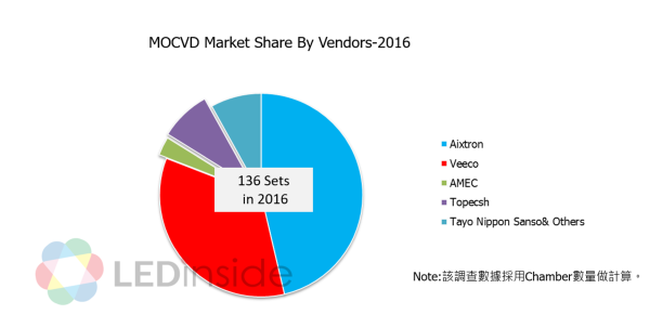

According to statistics from LEDinside, a division of TrendForce, Chinese MOCVD manufacturers, such as AMEC and Topesch, have been actively developing their businesses in recent years. Although their combined market share only accounted for 11% in 2016, their products have been validated by customers and will be used by LED chip makers in 2017 as scheduled. However, LEDinside estimates that as the Veeco case unfolds, there will be some negative impacts on Chinese manufactures, and whether their shipments will be delayed remains to be seen.

Topesch buys wafer trays from other suppliers for their MOCVD equipment, so the lawsuit will have less impact on the company. On the other hand, German semiconductor firm AIXTRON, Veeco and Japan-based TAIYO NIPPON SANSO have different MOCVD technologies and manufacturing processes, so their choice of suppliers may vary. In the ever-changing LED landscape, key players may resort to patent infringement litigation to win over potential rivals in the future.

(Ivan/ LEDinside)

CN

TW

EN

CN

TW

EN