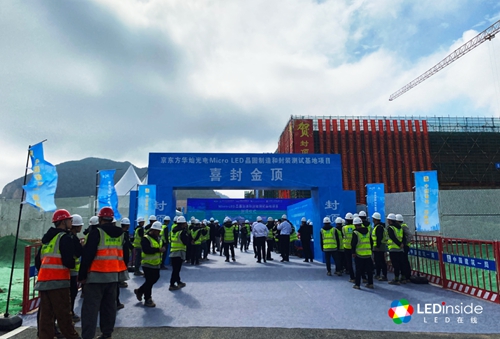

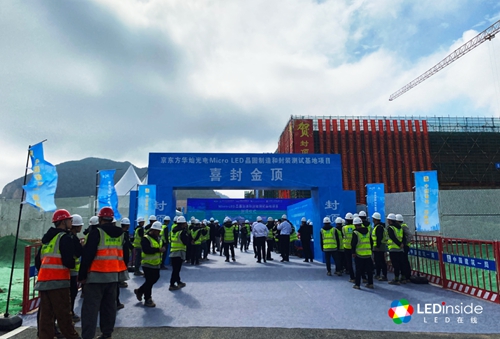

On January 31, BOE HC SemiTek celebrated the topping-out ceremony for its Micro LED wafer manufacturing, packaging and testing base in Jinwan District, Zhuhai. This marks a new phase in the development of the Chinese manufacturer’s Micro LED research, development and production.

Considering the strong support for next-gen display development from the local government of Zhuhai, BOE HC SemiTek has invested 2 billion yuan to construct a Micro LED wafer manufacturing, packaging and testing base in the city. The entire project aims to launch LED production by 3Q24, with mass production expected in December. In the future, the main focus will be on producing Micro LED chips and related devices.

Currently, BOE HC SemiTek has invested 55 million yuan to purchase production equipment from Naura, most of which will be used for Micro LED research, development and production. After the base is constructed with equipment being put into use, the manufacturing, sales and application of products will gradually come into play. Through this project, BOE HC SemiTek is set to build a complete Micro LED ecosystem.

According to the plan, once the project is completed, the manufacturing base will be able to produce 58,800 Micro LED wafers and 45,000.00kk Micro LED pixels every year. This will meet the demand for large-sized TVs, commercial displays, AR/VR headset displays and wearable devices in the field of ultra-large and ultra-small high-definition applications.

BOE HC SemiTek Has Changed its Business Models with the Supply Chain Extending Downward

Over the years, BOE HC SemiTek has positioned itself as a supplier in the upstream segment, namely epi-wafer and chip manufacturing. However, the Zhuhai project indicates that its profile will not only include chips but cover related devices, modules and small displays, meaning that BOE HC SemiTek’s industrial ecosystem is extending downstream, broadening the customer base and changing its business models.

Specifically, the Micro LED business at the Zhuhai base will operate in three models. First, it will provide Micro LED chips or offer chip-on-carrier (COC) products to customers, with mass bonding carried out by panel manufacturers such as LG, Huawei, Konka, VISTAR and BOE. Second, it will supply wafer-level packages to module manufacturers like Jingxin, Cedar and Unilumin. Third, it will deliver small-sized displays to consumer-oriented customers such as AR/VR glasses brands/OEMs, HUD manufacturers and smartwatch brands/OEMs.

In developing its customer base for Micro LED products at the Zhuhai base, the company is skipping the LED packaging market and directly engaging with module, panel and display manufacturers as well as consumer brands. By collaborating with these customers, BOE HC SemiTek will be more deeply involved with greater control over its products. Additionally, competition from different sectors has also correspondingly intensified.

For example, under the third model, BOE HC SemiTek will directly compete with companies in the micro-display market that are growing fast with high market shares, such as JBD. As micro-display technology and applications are still in early development, and the demand for end markets like AR/VR wearables, smartwatches, and in-car HUDs has not yet surged, there is significant growth potential for manufacturers, along with the promising Micro LED technology. Therefore, the number of new comers is increasing, leading to heightened competition. Leveraging its own reserves and the technical and resource advantages of BOE, BOE HC SemiTek is expected to quickly seize business opportunities in the future.

A New Scenario Has Formed in the Mini/Micro LED Market, Kicking Off a New Round of Competition among Industrial Giants

Given the challenges in mass producing Micro/Mini LED, manufacturers understand the importance of collaboration and resource sharing, leading to initiatives like BOE HC SemiTek, Hisense obtaining control of Changelight, and San’an partnering with TCL CSOT to found a joint venture called Xinying Display before reaching strategic collaborations with VISTAR and Tianma. Additionally, Ennostar has established a close partnership with Innolux and AUO, while Shenzhen MTC has strengthened strategic development throughout the global supply chain by aligning the production of various components from chips, packages, modules, displays to TVs. A new scenario has taken shape, and the manufacturing base constructed by BOE HC SemiTek is a tangible manifestation of this transformation.

For LED manufacturers, the competition remains fierce, but the number of applications have expanded. In the Micro LED domain, San’an, BOE HC SemiTek, and MTC are making relatively swift progress, particularly in video walls and small-sized displays.

The joint venture founded by San’an and TCL is focusing on the small-sized display sector. San’an is cooperating with VISTAR to target the large-size commercial display market, with a focus on in-car displays in cooperation with Tianma. Furthermore, San’an has established a longstanding partnership with Samsung in the large-sized display market. Therefore, San’an's current layout covers various applications comprehensively.

Shenzhen MTC, through its subsidiaries AMTC, BMTC, and VMTC, has formed a complete LED display industry chain. Its product output primarily revolves around modules and displays, with plans to launch TVs this year. This move will directly connect with consumer brands like Samsung, LG, TCL and Skyworth. In terms of industrial synergy, MTC has a distinct cost advantage thanks to its abundant resources.

From the technical perspective, BOE HC SemiTek and San’an—considering their current development—are expected to focus on promoting the MIP packaging solution. Although MTC is also exploring MiP, its overarching direction leans towards COB. The future competition among San’an, BOE HC SemiTek and MTC will, to some extent, revolve around the choice of technical routes.

For BOE HC SemiTek, facing both potential opportunities in emerging markets and intense competition, there are both opportunities and challenges. However, the comprehensive competitiveness of BOE HC SemiTek is significant.

On the one hand, as the controlling shareholder, BOE not only provides a gateway for BOE HC SemiTek’s products to go global but also shares its technology and resources in panel, display (MLED), equipment (BOE Pixey), and end-market applications. This collaboration aids in shortening the product development and launch cycle, opening up application markets more quickly, with vertical integration gradually emerging.

On the other hand, as the second-largest shareholder, Zhuhai Huafa Group will provide financial support for BOE HC SemiTek and is expected to concentrate more local talents and advantageous resources to facilitate long-term development.

Strategic changes and product structure upgrades are beginning to show positive results in performance. In the first three quarters of 2023, BOE HC SemiTek generated 1.985 billion yuan in revenue, a YoY increase of 12.35%. Specifically, its revenue for 3Q23 reached 849 million yuan, up 75.45% from the same period last year. Compared to revenue for 1H23—1.136 billion yuan (-11.46% YoY), it is evident that the performance in the third quarter surpassed the first half, providing an opportunity for annual revenue growth. As the proportion of high-end products increases and capacity gradually expands, the profitability of BOE HC SemiTek is expected to gradually improve.

(Author: Janice ; Translator: Jane)

TrendForce 2023 Micro LED Market Trend and Technology Cost Analysis

Release Date: 31 May / 30 November 2023

Language: Traditional Chinese / English

Format: PDF

Page: 160 / Year

If you would like to know more details , please contact:

CN

TW

EN

CN

TW

EN