How are Chinese LED Companies Tapping into Overseas Markets?

Overseas Markets Become a Crucial Driving Force for LED Display Manufacturers

Most LED display companies delivered satisfactory performances in 2023.

Unilumin expects to achieve a net profit attributable to shareholders of between 130.7262 million yuan and 169.9441 million yuan in 2023, a year-on-year increase of 105.46% to 167.09%.

Liantronics forecasts a net profit attributable to shareholders of between 7.5 million yuan and 11.25 million yuan in 2023, compared to a loss of 57.9503 million yuan in 2022, achieving a turnaround.

Absen reported total operating income of 4.0447564 billion yuan in 2023, a year-on-year increase of 44.66%; net profit attributable to shareholders was 322.6424 million yuan, a year-on-year increase of 58.92%.

These announcements indicate that overseas markets are becoming an important driver of growth for LED display makers.

Unilumin stated that thanks to the continuous efforts in developing the international market for many years, early development of relevant sales channels, and brand advantages, the revenue contribution from its overseas business has continued to grow.

Absen implemented a “bilateral” strategy in 2023, strengthening business expansion in both overseas and the Chinese markets through a series of effective measures.

Ledman’s overall performance was under pressure in 2023, but it still achieved a slight increase in the gross profit margin of its international display business.

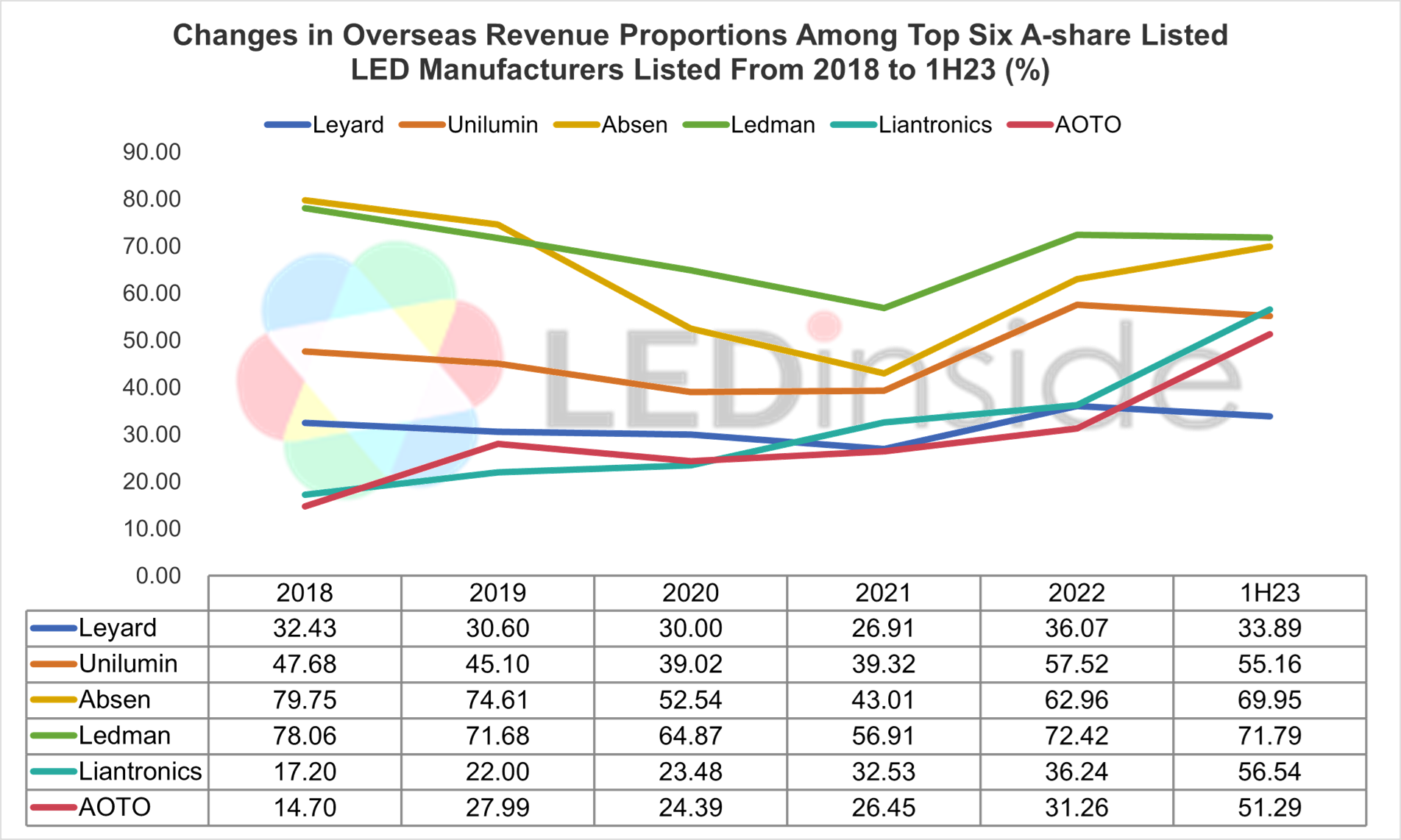

While Leyard has not disclosed its performance for 2023, during a survey on March 11, it indicated that the revenue proportion of its LED intelligent display business was 85%, with overseas revenue accounting for approximately 35%.

Combined with the earnings of major screen enterprises previously announced, the importance of overseas markets is evident.

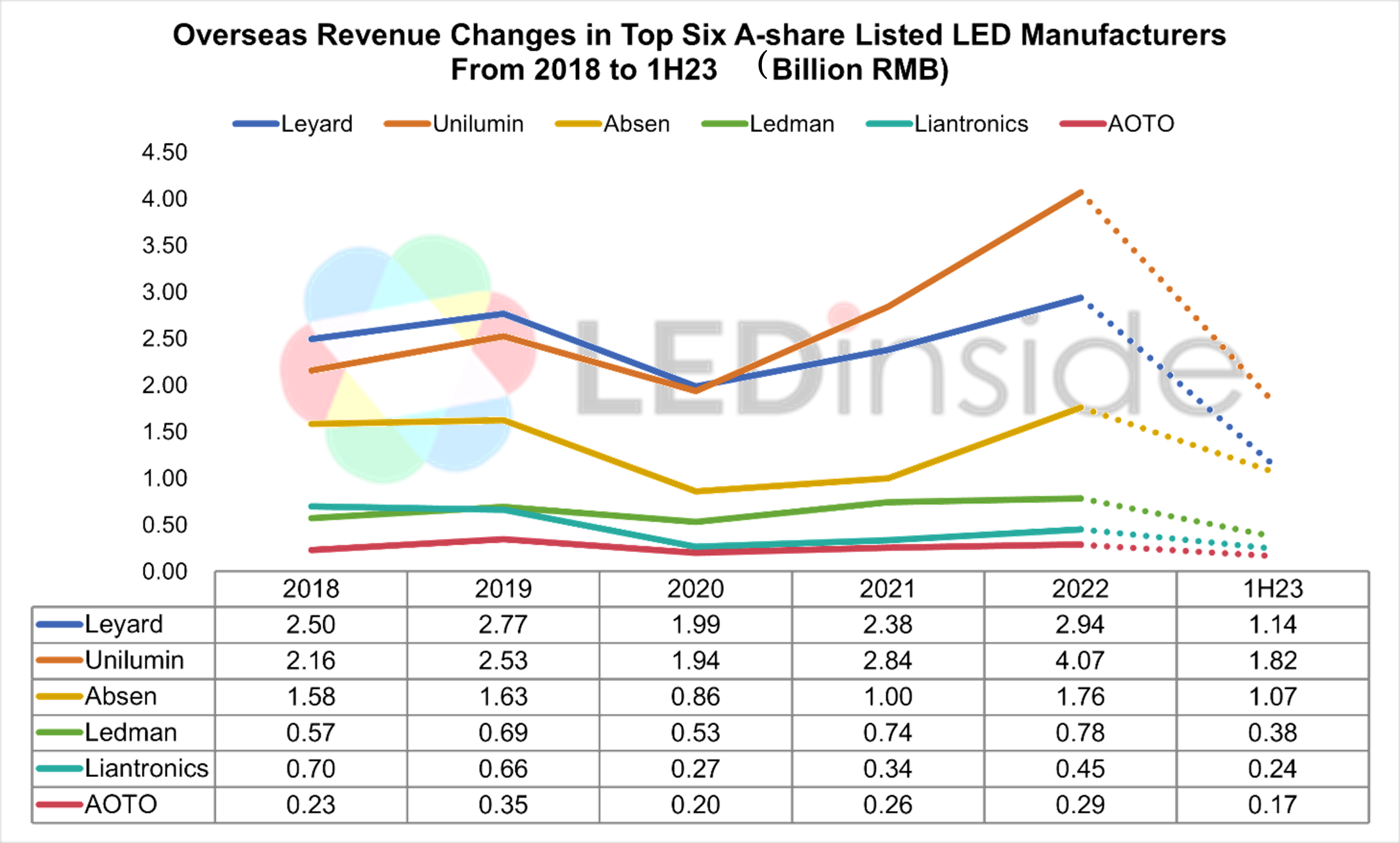

Note: Revenues for 1H23 are shown as dotted lines (half-year data).

Chinese LED display makers have been running exports business for more than ten years. Entering 2024, after a short period of downturns due to unexpected incidents in previous years, overseas revenue has once again become an important part of business income. However, the current market demand is different from before.

Firstly, virtual production has become a major growth driver for LED displays. Despite the slowdown in end market growth in 2023 due to the Hollywood strike, in the long run, as more and more manufacturers enter the virtual production LED display market and the supporting industry chain matures, virtual production applications will extend to movies, television, theater, music, and advertising shoots. The overseas market, which is relatively mature and characterized by numerous projects, large demand, and strong purchasing power, is a strategic high ground that cannot be overlooked.

Sports events are also stimulating the demand for LED displays. LED displays have long been used in sports venues. In February, the NBA announced that in addition to the All-Star Game, all individual events and Celebrity Game during the 2024 All-Star Weekend will be held on an LED court. This further proves the capability of LED displays for diversified applications.

LED screens combined with intelligent AI and AR/VR have been used in data presentation, event playback, commercial advertising, and other scenarios in sports events, continuously enhancing the entertainment and viewing experience of sports events. The year 2024 is full of major events like the Olympics, UEFA Euro, Copa America, Asian Cup, the four Grand Slam tournaments, Thomas Cup and Uber Cup, World Aquatics Championships, and World Ice Hockey Championships, which is particularly advantageous for the sports display industry.

Additionally, rental displays are making a strong comeback. LED rental screens have always been a more active area in the LED display industry, covering large-scale cultural performances, major sports events, and even high-end conferences and exhibitions in the business sector. With the increasing maturity of the fine-pitch industry chain, the barriers to entry for the rental display market are gradually decreasing. Whether pioneers or latecomers, there is ample room for development in this market.

Chinese enterprises are actively developing rental screens for the overseas market, including Unilumin, Absen, AOTO, Liantronics, and other listed companies, as well as non-listed ones such as INFiLED, LP Display, YES TECH, Gloshine, Cedar, LongRun LED, and AET.

LED Lighting: Segmented and Overseas Markets Have Become Hot Spots

In comparison to the LED display industry, the performance of the LED lighting industry is somewhat disappointing.

As the penetration rate of LED lighting is already high, the market has reached a bottleneck in future growth space, leading to a slowdown in industry growth year by year. On the other hand, the global economic downturn has caused the lighting market to enter a phase of M&A, with overall lighting demand remaining flat.

For example, companies like Ever-tie reported decreases in revenue and net profit, with OKTECH expecting a 69.80% to 77.71% drop in net profit attributable to shareholders. Cnlight, KINGSUN, and Beijing New Space Technology are all expected to incur losses. Although DP Lighting expects a net profit attributable to shareholders of 38 to 46 million yuan, it indicated that the increase is caused by the company’s sale of real estate in this period, with the affected amount ranging between 45 million and 50 million yuan.

Additionally, the performance of companies producing LED driver ICs, an important component of lighting fixtures, has also been affected. Companies like Nationstar and SM Micro posted losses in 2023. In terms of driver power supply, Inventronics expects a loss, while SESON, although still profitable, is expected to see a 65.36% to 73.06% plunge in net profit attributable to shareholders.

Conversely, manufacturers’ developments in niche areas are driving the revenue of related players.

TOSPO achieved operating income of 4.697 billion yuan in 2023, an increase of 0.86% year-on-year. Its automotive business generated 624 million yuan in revenue, up 43.74% from the same period last year.

Pak Lighting posted operating income of 2.353 billion yuan in 2023, a 3.95% increase year-on-year. It has not yet announced the revenue of each business segment, but in 1H23, the lighting company indicated that the growth rates of municipal transportation, hotel lighting, and smart lighting in the commercial lighting segment were relatively fast. Moreover, Pak is ramping up investments in the research and development of intelligent technology to further improve the intelligence level and competitiveness of its products.

The overseas market is also an important driving force for corporate performance.

For example, MLS expects to achieve a net profit attributable to shareholders of 427 million to 506 million yuan in 2023, a YoY surge of approximately 120.20% to 160.94%. Apart from the rapid growth of its Mini LED packaging business, this growth is also attributed to the assistance from LEDVANCE.

LEDVANCE has long been running its business in the European and American lighting markets, with products covering four major areas: home and office lighting, industrial lighting and industrial lighting systems, smart home, and human-centric lighting. In 1H23, LEDVANCE posted revenue of 5.283 billion yuan, with its revenue proportion increasing from 58.94% in 1H22 to 63.54%. Currently, the company’s business operations remain stable.

In fact, an increasing number of Chinese LED lighting companies have begun to focus on the vast overseas market and tap into relevant demand. According to statistics from the General Administration of Customs in China, the total export value of Chinese lighting products in 2023 was $58.2 billion. Specifically, the export value of LED lighting products was $43.3 billion, accounting for 74% of the total.

Going Global Remains Difficult for Chinese LED Manufacturers

Whether it is the display industry branching out into various niche areas to develop more market space or the lighting industry seeking alternative routes under the pressure of sluggish demand, “going global” has become a consensus in the industry.

However, from a broader perspective, the global economic recovery still faces ongoing challenges, and the prevalence of trade protectionism and geopolitical conflicts will continue to constrain the development of Chinese enterprises for a considerable period in the future. On a narrower perspective, every market has its unique consumer culture, different products thrive in different environments, and different markets have different marketing strategies. These are all inevitable challenges that companies will face when “going global.”

LEDinside analyzes the international market and makes the following conclusions on the current situation:

In terms of displays, the North American market continues to show a growth trend, with outdoor displays, retail and exhibition, and virtual production being the main drivers of market demand growth. The European region is experiencing a slowdown in market demand due to factors such as geopolitical conflicts and inflation. Emerging economies in Asia, Africa, and Latin America, after experiencing rapid growth in 2022, are expected to see increases in demand.

Regarding lighting, in 2024, 5.788 billion LED light sources and luminaires will reach the end of their service life, leading to a considerable demand for secondary replacement, which is expected to reverse the downturn in the LED lighting market. In addition, the demand for high-quality lighting, human-centric lighting, and smart lighting will enter a rapid development stage. Moreover, the agricultural LED lighting market will continue to witness penetration rate growth, promising a bright future. (by Lynn from LEDinside; Translator: Jane)

TrendForce 2024 Global LED Lighting Market Analysis

Release Date: 01 February / 31 July 2024

Language: Traditional Chinese / English

File format: PDF and EXCEL

Number of pages: 100 (in each publication)

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN