The TrendForce report on the "2024 Global LED Video Wall Market Outlook and Price-Cost Analysis" indicates a recovery in the Chinese LED display market and growth trends in the overseas markets including North America, Asia, Africa, and Latin America in 2023. In terms of technology, COB displays are experiencing rapid development, while the demand for MiP LED displays is growing.

Overall, the global LED display market continued to grow in 2023, although the LED chip-making and LED packaging markets in the upstream showed mixed performance. Looking ahead to 2024, with the promotion of fine-pitch and Mini LED displays, the global LED display market is expected to continue growing.

As Mini LED Grows Rapidly, Market Size of LED Display Chips Will Further Go Up in 2024

In the upstream segment, the global LED chip market size dropped to $2.5 billion in 2023, down 9% from a year earlier, due to the decline in Mini LED backlight demand and the increase in the proportion of mid-to-low-end lighting chips, according to TrendForce’s initial estimation. Particularly, Taiwanese companies experienced a more significant decline in revenue.

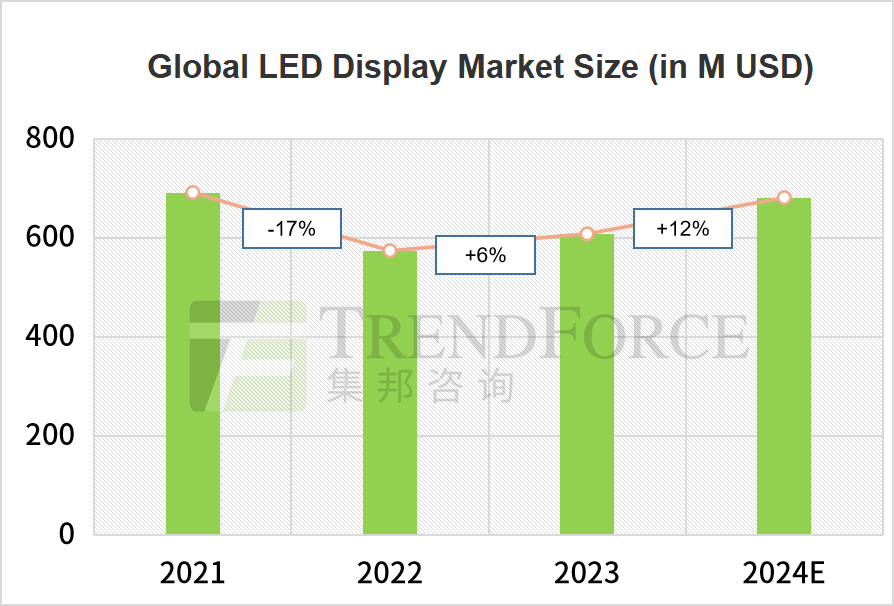

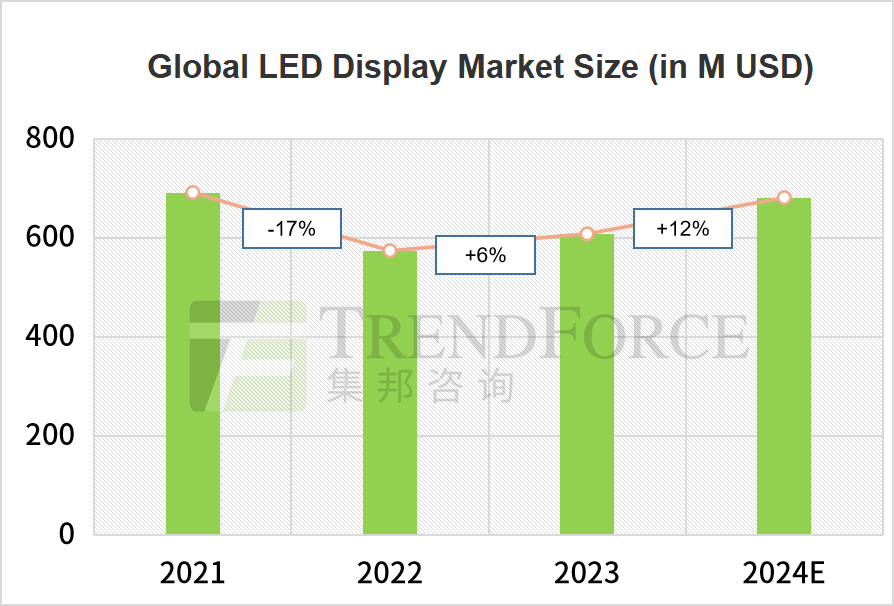

Driven by the recovery in end-user demand and the rapid growth of Mini LED chips, the market size of LED display chips grew to $600 million, a 6% increase compared to the year earlier period. The LED display end market is expected to continue growing in 2024, with further growth expected in Mini LED display chip demand thanks to the advancement of COB and MiP, which is likely to sustain the growth of the LED display chip market.

Data source: TrendForce (compiled in March 2024)

Driven by End-User Demand, LED Display Package Market Likely to Grow in 2024

In 2023, despite the growing demand for LED display packages, prices continued to fall due to excess capacity. Additionally, the demand for particular types of SMD LED display packages declined due to the rapid development of COB technology.

According to preliminary statistics from TrendForce, the global LED display package market was approximately $1.4 billion in 2023, a decrease of 4% compared to the previous year. Looking ahead to 2024, the proportion of MiP products is expected to increase despite the rapid advancement of COB technology. With the drive from end-market demand, the LED display package market is expected to grow.

Data source: TrendForce (compiled in March 2024)

Fueled by Mini LED Demand, LED Display Poised for Long-Term Growth

In 2023, the demand for LED displays in China bounced back, and other regions, especially Asia, Africa, and Latin America, continued to grow. While some markets like all-in-one machines and virtual production saw slower growth, the outdoor rental market experienced noticeable expansion. Despite the ongoing competition in various technologies causing LED display prices to drop, the global LED display market still enjoyed growth in 2023.

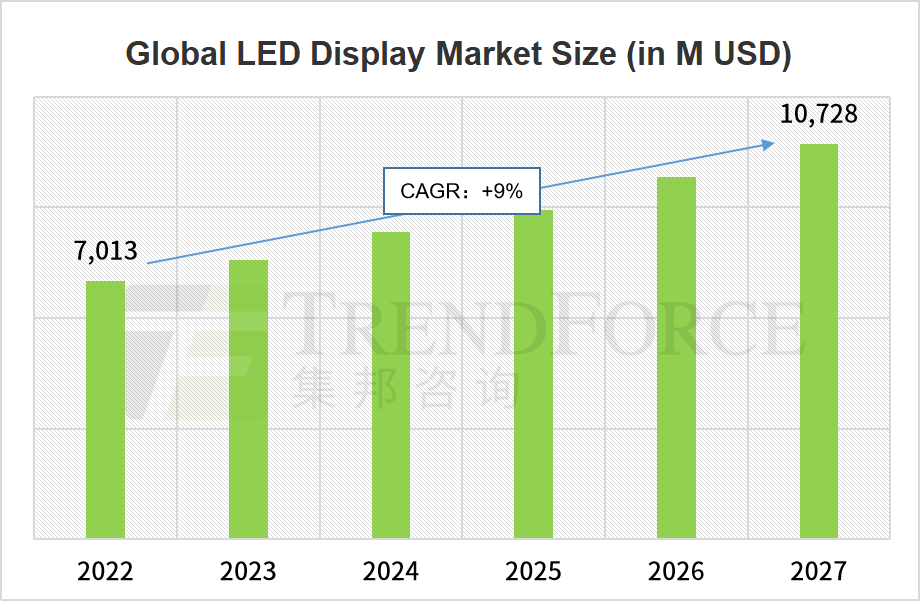

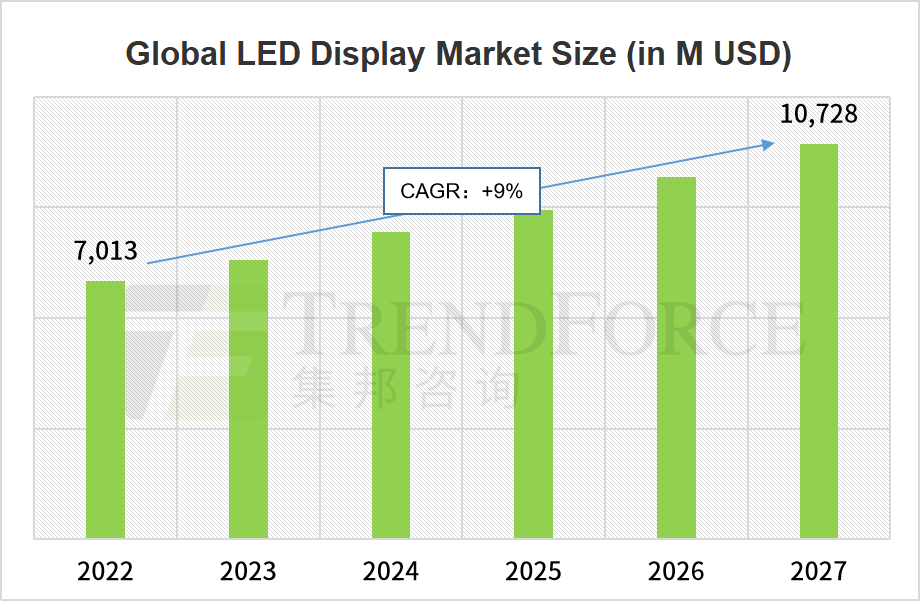

TrendForce remains optimistic about the long-term development of the LED display market. Despite the faster-than-expected declines in LED display prices, both the Chinese and other markets, driven by fine-pitch and Mini LED devices, will see increasing demand for LED displays. The market size is projected to reach $10.7 billion by 2027.

Data source: TrendForce (compiled in March 2024)

Rise of Virtual Pixel Technology: Opportunities and Challenges Ahead

In 2023, the virtual pixel technology became a hot topic throughout the LED display industry. Also known as shared pixels or dynamic pixels, the technology allows each LED to be shared by 2/3/4/6/8 pixel points, namely the 2/3/4/6/8 times amplification scheme. A 4x amplification scheme, for example, can rapidly send four times the number of pixels of the physical pixels to the physical pixels for display in odd-even columns and rows, effectively achieving a resolution four times higher than before while cutting the pixel pitch by half.

The technology significantly reduces the number of LEDs installed, thereby lowering the cost of LED displays. With the virtual pixel technology, the markets of devices like all-in-one machines, home theater screens, and ultra-fine pitch displays (P≤1.0), which have not developed as expected in recent years, are likely to grow rapidly.

However, the technology also presents challenges. Currently, the main supporters of virtual pixels are COB-oriented manufacturers, whose COB LED display products are mostly concentrated in devices with a P1.2 pixel pitch and below. The cost competitiveness of the physical pixel technology is declining in displays with a >P1.2 pixel pitch. Therefore, the COB-focused manufacturers also hope to use virtual pixels to develop their >P1.2 display business.

This will inevitably intensify the competition in the market of >P1.2 LED displays, meaning that the competition between COB and SMD will extend from the current P1.2 market to other sectors such as P1.5, P1.6, P1.8, and even P2.0. Therefore, it is hoped that the industry will focus on exploring new applications using virtual pixel rather than focusing on the existing ultra-fine pitch market.

(By TrendForce)

TrendForce 2024 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 28 September 2023

Language: Traditional Chinese / English

Format: PDF

Page: 273

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN