Philips announced on Sept. 23, 2014, it would separate its health care and lighting businesseses into a twonew companies, each ofy which would continue to leverage the Philips brand.

“I do appreciate the magnitude of the decision we are taking, but the time is right to take the next strategic step for Philips, as we continue on our transformation,” said Frans van Houten, chief executive officer of Royal Philips. “At the same time, giving independence to our lighting solutions business will better enable it to expand its global leadership position and venture into adjacent market opportunities. Both companies will be able to make the appropriate investments to boost growth and drive profitability, ultimately generating significantly more value for our customers, employees and shareholders.”

Investors have been bullish about the Dutch firm’s restructure. Philips stock prices were up 3.5 percent (EUR 0.81) to EUR 24.31 on Sept. 23 after the company announced the spin-off of its lighting business. Philips shares were among the few on the Amsterdam bourse that increased that day.

Osram, a global lighting manufacturer and competitor of Philips, separated from its parent company Siemens before the Philips restructure and became an independently listed company. Some analysts believe Philips copied the Osram strategy. Others say Philips planned its lighting business spin-off well in advance, and that Osram’s separation from Siemens first was coincidental.

LEDinside will analyze the reasons behind Philips lighting business restructure from six different aspects to explain the logic behind the lighting giant’s decision making process:

1. Philips returns to core healthcare business, by separating less relevant lighting business

Philips’ lighting business restructure can be seen as a continuation of its long-standing business strategy, which focuses on its highly profitable health business. Indeed, over the past decade, Philips has focused on that health business, and ended its chip manufacturing and TV businesses. With the lighting business now a stand-alone company, Philips can channel resources to its health-care business, which has a higher entry threshold.

Refocusing on core businesses emphasizes the correlation between a company’s core businesses and capabilities, requiring a firm to concentrate its resources in its most vital business lines. Companies are still diverse after implementing a core business strategy, but distinct company business lines become more relevant and competitive advantages more pronounced.

2. Spin off of subsidiaries to save costs as benefits of economics of scale become less evident. The two independent companies will have their own independent decision-making mechanisms to quickly respond to market changes.

Large enterprises tend to enjoy economics of scale, but at the same time massive size can be a liability and even damage profits. Philips Group has more than 113,000 employees worldwide, but its massive corporate structure has attracted much criticism in recent years. Stifling bureaucracy in the company’s multi-level organizational structure has offset benefits from Philips’ economies of scales.

By splitting the less relevant lighting and health care business, the two new companies will become more streamlined, allowing Philips to respond to market activity in a more flexible manner. The Dutch firm estimated the new operating structure would enable cost savings of EUR 100 million in 2015, and a further EUR 200 million by 2016.

3. Brands: company moves from a multi-brand platform to one of individual branding, enhancing brand influence in the respective fields.

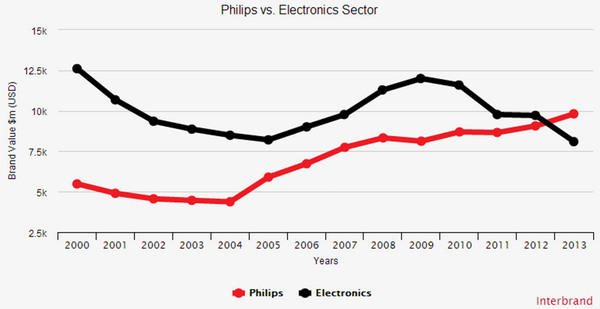

Philips brand value was up 8 percent to US $9.81 billion in 2013, and was ranked by Interbrand in the world’s top 40 brand again.

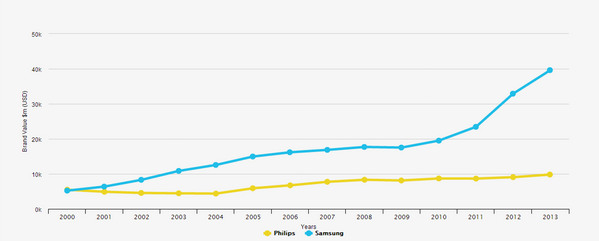

However, the growth of Philips’ brand equity over the past decade is dwarfed by competing Asian manufacturers such as Samsung.

The breakup of Philips lighting and health care businesses will not affect the company’s brand value. Instead the two companies will become market leaders in health care and lighting solutions. GE and Morgan are good examples of such a strategy succeeding. By separating the lighting business, Philips Lighting will no longer be a lighting business division of an international conglomerate, but rather a top manufacturer in the lighting industry. Impact from brand specialization is also a good business strategy to improve general brand value. Samsung, for instance, has relied on Samsung Electronics’ huge market influence to raise the group’s brand value.

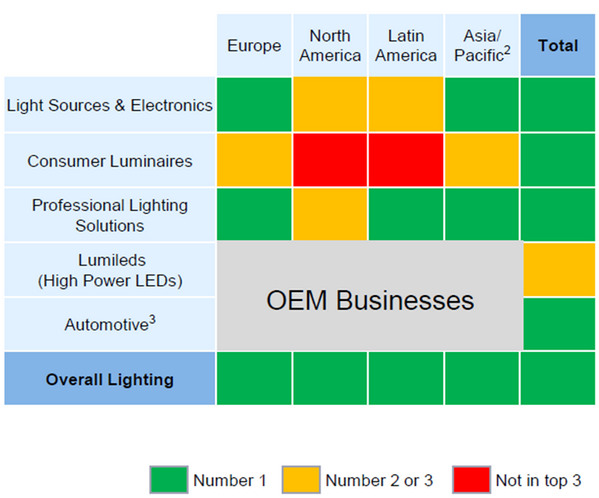

|

|

(Source: LEDinside) |

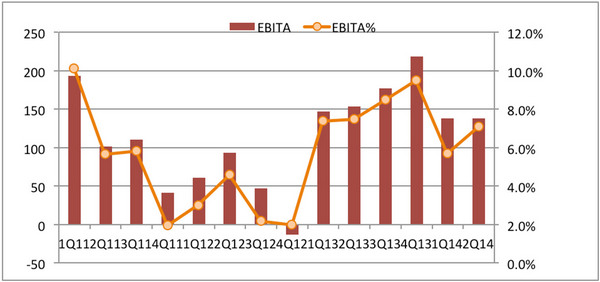

4. Profitability: Company needs stronger incentives to revive profitability

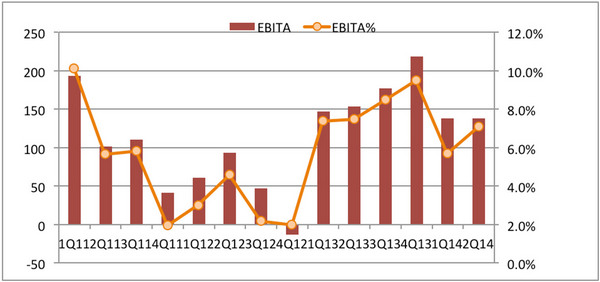

Despite being a top player in the global lighting industry and having the highest market penetration, the Dutch company’s earnings before interest, taxes and amortization (EBITA) have been less than 10 percent for some time. Several factors behind the low EBITA include intense market competition and a lack of incentives, which has made the company bureaucratic, less ambitious, and insensitive to market opportunities.

Philips Lighting will have an independent board structure after becoming a stand-alone company. To improve the company’s market competitiveness, one of the board’s first tasktasks will probably be addressing the incentive issue.

5. Financing: Philips Lighting segregated to improve financing

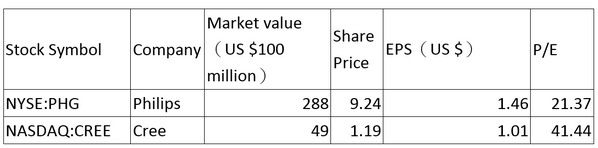

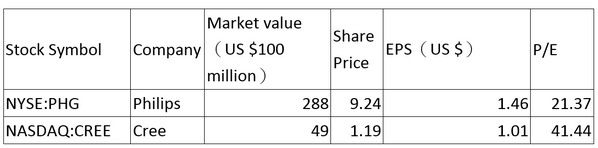

Philips Lighting is a global leader in the lighting market, and has specialized in many sectors of the field. However, as a subsidiary of the group, Philips Lighting has been unable to enjoy the same premium stock prices as other leading lighting manufacturers.

|

|

(Source: LEDinside) |

Listed U.S. LED and lighting manufacturer Cree’s Price-Earnings ratio (P/E ratio) of 41.44 is nearly double that of Philips Lighting’s 21.37. After being spin-off into a new business, Philips Lighting will still keep its title as the global LED lighting manufacturer, but its estimated value will switch from being a subsidiary under a group to becoming a semiconductor and electronics company that has a big brand with distribution channel advantages. There is a chance that Philips will sell its shares in lighting to channel financing to the healthcare sector to support its core business strategies.

|

|

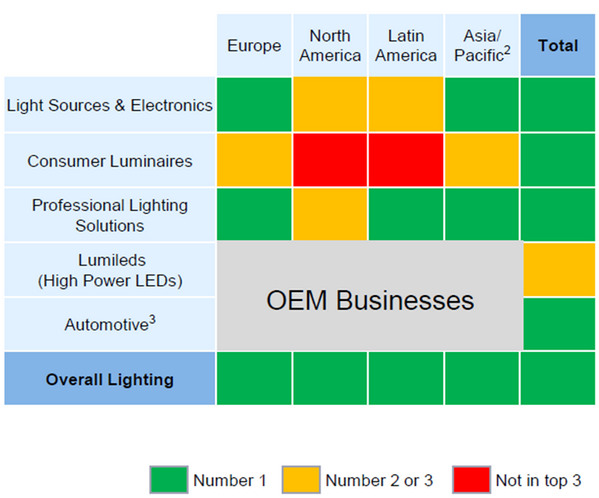

(Source: Philips) |

6. Risks: Lighting semiconductor business competition intensifies, Philips faces direct competition from Asian manufacturers

Challenges from Asia should not be overlooked. Asian manufacturersare strong in the electronics and semiconductor industries, where they enjoy, lower manufacturing costs and higher product cost/performance (C/P) ratios. As the traditional lighting sector transits to LED lighting, Philips Lighting is gradually losing its market competitiveness. Additionally, these Asian manufacturers have been able to release new products faster and at prices more acceptable to general consumers, andby shipping those products all over the globe. Asian manufacturers are challenging Philips Lighting’s market position. Compared to Asian manufacturers’ exponential growth in recent years, Philips Lighting’s revenue has been nearly stagnant.

Under the pressure, aAfter Osram split from Siemens, the company underwent large-scale layoffs, and has slashed more than 10,000 jobs in the past year. Philips will also be forced to undergo the same lay-off process after the lighting business spin-off.

Philips faces the same challenges as other corporate giants that have been slow to adapt to a new world, says a Wallstreet Journal Report cited the company CEO Frans Van Houten saying. He also referred to Nokia Corp., the Finnish mobile device maker who was unable to catch up with rivals. "We only have to look to Finland to see what can happen," he said.

The leaner, post spin-off Philips Lighting is better poised to compete strongly with Asian manufacturers. Some of the revenue risks and uncertainties in the future will be transferred to social capital.

|

|

(Source: LEDinside) |

(Author: Figo Wang, Senior Analyst, LEDinsidehttp://Editors: Judy Lin, Chief Editor, LEDinside; Matthew Fulco, Senior Editor, LEDinside)

CN

TW

EN

CN

TW

EN