Veeco Instruments Inc. (Nasdaq: VECO) announced its financial results for the second quarter ended June 30, 2011. Veeco reports its results on a U.S. generally accepted accounting principles (“GAAP”) basis, and also provides results excluding certain items. Please refer to the attached table for details of the reconciliation between GAAP operating results and Non-GAAP operating results. All results presented herein are for Veeco’s “Continuing Operations” which excludes the Metrology business sold to Bruker Corporation on October 7, 2010.

Strong Second Quarter Results and MaxBright Adoption

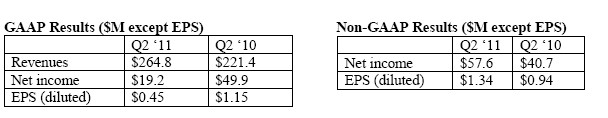

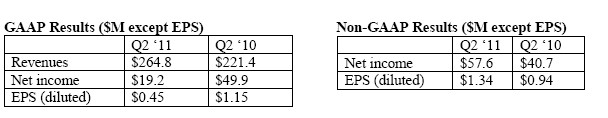

John R. Peeler, Veeco’s Chief Executive Officer, commented, “Veeco reported a solid second quarter, with revenues of $265 million, non-GAAP net income and earnings per share of $58 million and $1.34, respectively. Revenues were up 4% sequentially, and up 20% from the prior year second quarter. LED & Solar revenues were $219 million, including $206 million in MOCVD, and Data Storage revenues were $46 million, the highest quarterly level in five years. Veeco met our quarterly guidance, yet timing of revenue continues to be impacted by the longer order-to-revenue cycle times associated with the high percentage of MOCVD business currently coming from China, primarily due to customer facility readiness and credit tightening.”

“Veeco’s second quarter bookings were a record $311 million,” continued Mr. Peeler, “up 35% sequentially. LED & Solar orders were a record $273 million, with MOCVD orders up 34% sequentially to $250 million. While China was again the main region for new systems purchases, Korea showed signs of improvement, including a multi-system MaxBright™ MOCVD order from an important LED industry leader. Veeco also reported a strong MBE bookings quarter of $24 million. Data Storage orders were $38 million, up 15% sequentially. The Company’s Q2 2011 book-to-bill ratio was 1.17 to 1, and quarter-end backlog was $558.2 million.”

Mr. Peeler added, “We have seen spectacular customer reaction to our new MaxBright MOCVD system – in the second quarter we booked over $100 million of MaxBright systems – 40% of our total MOCVD bookings. We believe customers are clearly recognizing that MaxBright is simply the best tool on the market to drive down LED manufacturing costs.”

CIGS Solar Systems Business Update

Mr. Peeler commented, “Veeco has decided to exit the CIGS Solar Systems business for various reasons, including the improved performance of mainstream solar technologies and the lower than expected end market acceptance for CIGS technology to date. While CIGS remains an important thin film solar technology, we have determined that the timeframe and cost to successful commercialization are not acceptable to Veeco.”

Mr. Peeler added, “Veeco intends to transfer our R&D facility, pilot line, technology and key personnel in Clifton Park, New York to the College of Nanoscale Science and Engineering (CNSE) in order to support their planned CNSE/SEMATECH Photovoltaic Manufacturing Consortium (PVMC). We believe the PVMC is much-needed to drive CIGS industry roadmaps, collaboration, market acceptance and commercialization.”

Veeco’s second quarter GAAP results were negatively impacted by approximately $51 million in asset impairment and restructuring charges related to this business (refer to attached table). In addition, approximately $20 million in CIGS deposition systems has been removed from Veeco’s backlog. Effective third quarter 2011,Veeco will treat its CIGS Solar Systems business, which operated at a loss, as a discontinued operation. Mr. Peeler added, “The closure of our CIGS Systems business is expected to have an immediate and positive impact to Veeco’s profitability.” Veeco will continue to sell CIGS deposition components and remains the top supplier of MOCVD and MBE tools to the concentrator photovoltaic (CPV) market.

Veeco Repurchases Shares, Eliminates Convertible Debt and Invests in Technology

During the second quarter, under its Board authorized share buy-back program, Veeco purchased $7.8 million in stock at an average price of $46.91 per share. Veeco also completed the redemption of its outstanding Convertible Subordinated Notes for $98.1 million aggregate principal amount and completed the purchase of a privately-held company which supplies certain critical components to our MOCVD business for $28.3 million. Mr. Peeler commented, “In addition to paying off our convertible debt and making a small technology purchase, Veeco recently utilized cash to buy-back our shares, reflecting our continued confidence in the long-term outlook for the Company.”

Veeco purchased an additional $71.9 million of stock, at an average price of $42.21 per share, so far during the month of July (as of 7/26/11). Since the $200 million buy-back program was authorized last August, Veeco has repurchased a total of 3 million shares for $117.8 million.

Third Quarter 2011 Guidance & Outlook

Regarding Veeco’s business outlook, Mr. Peeler commented, “Quoting activity in MOCVD remains robust and we are experiencing extremely positive customer reaction to MaxBright. MOCVD order patterns will continue to fluctuate from quarter to quarter depending upon the timing of customer deposits. In the short term, orders will likely be impacted by several headwinds that have been widely reported including weak near-term LED industry end market demand and global macro-economic concerns. We therefore currently forecast that Veeco’s third quarter 2011 bookings will be lower than our record second quarter.”

Veeco’s third quarter 2011 revenue is currently forecasted to be between $235 and $285 million. Earnings per share are currently forecasted to be $0.92 to $1.32 on a GAAP basis and $1.00 to $1.40 on a non-GAAP basis. Please refer to the attached financial table for more details. Mr. Peeler added, “We expect to have a great 2011 and are on track to deliver on our guidance of over $1 billion in revenue and over $5.25 in non-GAAP earnings per share. We are confident that the Company can perform well during any short-term fluctuations in business thanks to our variable cost model and strong cash position.”

LED Growth Opportunity

“While short-term business conditions are uncertain, there is a fantastic growth opportunity ahead of us as LED lighting market adoption is expected to increase in 2012 and 2013,” commented Mr. Peeler. “We believe lighting market penetration will accelerate due to a variety of factors including ban the bulb legislation in Europe and the U.S., Japan’s move to stimulate LED adoption, significant investment by Korean and Taiwanese leaders who have already introduced lighting products in the sub-$15 range, China’s emergence as a major LED industry player, and rapidly declining LED prices. In fact, we estimate that over 50% of our first half 2011 MOCVD

shipments were for lighting, up from 28% in 2010. While accurately predicting industry investment cycles is difficult, our forecast of an MOCVD market opportunity of 5,000 reactors from 2011 to 2105 appears conservative given the industry’s growth potential.”

Conference Call Information

A conference call reviewing these results has been scheduled for 5:00pm ET today at 1-888-389-5979 (toll free) or 1-719-457-2689 using passcode 4992731. The call will also be webcast live on the Veeco website at www.veeco.com. A replay of the call will be available beginning at 8:00pm ET today through midnight on August 11, 2011 at 888-203-1112 or 719-457-0820, using passcode 4992731, or on the Veeco website.

About Veeco

Veeco makes equipment to develop and manufacture LEDs, solar panels, hard disk drives and other devices. We support our customers through product development, manufacturing, sales and service sites in the U.S., Korea,Taiwan, China, Singapore, Japan, Europe and other locations. Please visit us at www.veeco.com.