San Jose-based LED chip manufacturer Lumileds has continued to thrive in the increasingly harsh cutthroat pricing LED market environment, by focusing on its LED technology development, introducing more cost effective CSP technology, and refining its mid-power and CoB market strategy, said the company CEO Pierre-Yves Lesaicherre during an exclusive interview with LEDinside at Guangzhou International Lighting Exhibition (GILE), China from June 9-12, 2015.

|

|

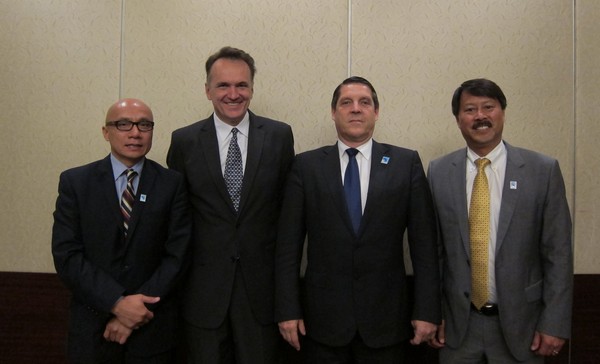

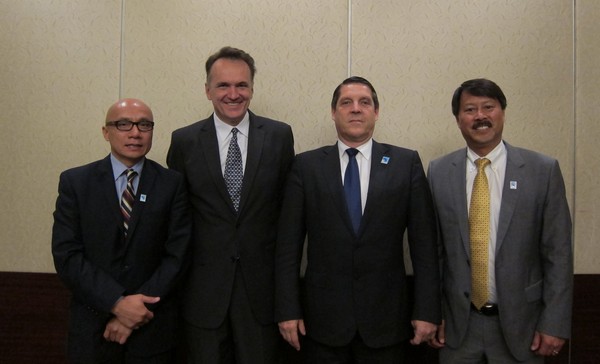

Lumileds CEO Pierre-Yves Lesaicherre (second right) and Emmanuel Dieppedalle, Senior VP Sales and Marketing, Lumileds (second left). (LEDinside) |

Lumileds stays ahead of competition with advanced LED technology

LED sales comprise about 60% of the company revenue. Exact figures on Lumileds production capacity are hard to come by, since the number of MOCVDs in its ownership is classified as confidential information. The company has annual capex of about US $100 million, and prefers not to disclose its expenditure, said Lesaicherre.

He did offer some clues about company performance and production capacity growth. According to Lesaicherre the company has been expanding its production capacity every three to six months, and has been adding capacity globally including in its MOCVD factory in San Jose, U.S.,LED die fab in Singapore and packaging factory in Penang, Malaysia to especially expand its CSP, mid-power and COB production capacity.

In fact, business has been so good for Lumileds over the past year that the company currently has run into some production capacity issues, said Emmanuel Dieppedalle, Senior VP Sales and Marketing at Lumileds. “There is so much demand,” explained Lesaicherre.

So what sets Lumileds apart from competitors?

The company has a very strong LED technology foundation including its capacity to in-house develop and manufacture phosphors, said Lesaicherre adding the company develops its own ceramic phosphor technology for Automotive LED applications. Moreover, the company has continued to make red LEDs while other manufacturers have withdrawn, and makes red, blue and white LEDs.

To maintain its market position in the high power LED market, the company which already manufactures 0.5 mm2 and 1 mm2 CSP products will be adding larger 2 mm2 and 4 mm2 chip sizes to its CSP product portfolio, said Lesaicherre.

|

|

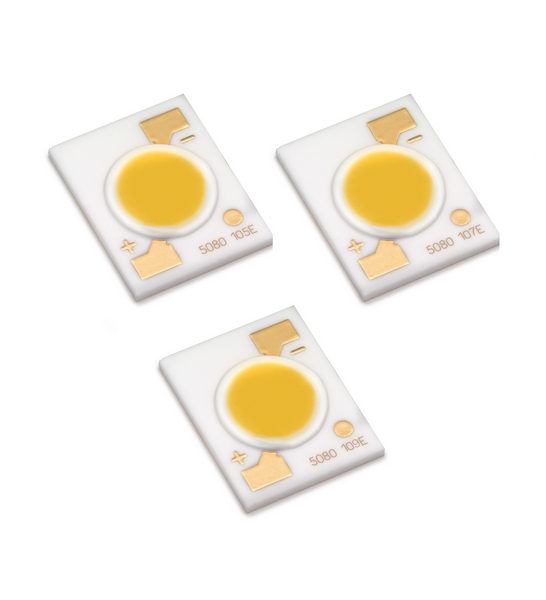

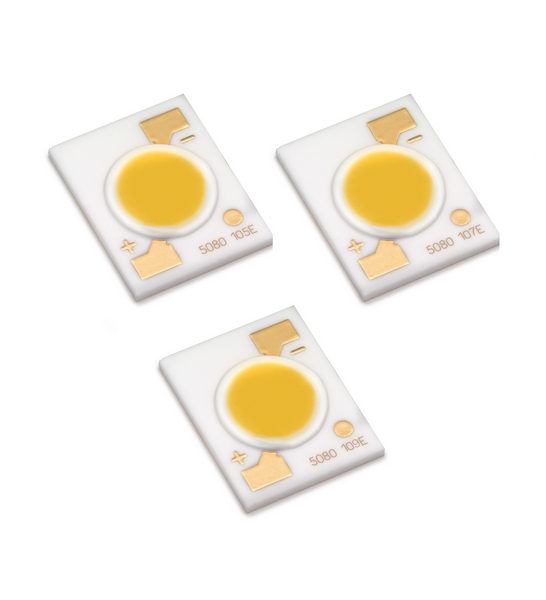

Lumileds LUXEON CoB Compact Range. (Photo Courtesy of Lumileds) |

Lumileds to expand low brightness and high brightness COB LED products

“Two years ago, we did not do COB, but today we are one of the large players in the COB market”, said Dieppedalle. “The COB market is growing very quickly. My expectation is it will continue to grow to 25% in the overall lighting market by 2018, and mid-power LED will be the bulk of the market, at least 50% to 60%.”

Lumileds first developed 1,000 to 3,000 lumens (lm) COB products for the downlight sector, but following the product success they realized there was a market demand for lower brightness products including 500 lm, 600 lm, 700 lm and 900 lm. “This year we’ve expanded in compact COB,” said Lesaicherre.

Another market highlighted by Lumileds CEO was high power COB applications specifically for high bay lights, stadium lights and large downlights, which have high luminosity demands ranging between 5,000lm to 10,000 lm. For medium lumen LED luminaires such as 1,000 to 3,000 lumen output, COBs with a smaller LES (Light Emitting Surface) are preferred, explained Lesaicherre. The smaller LES size gives a narrower beam angle that is easier to control for usage in shops and hotels

In a short time frame, Lumileds has diversified its COB LED product portfolio to meet different applications for food lighting in supermarkets, to restaurants, to clothing in the retail sector. The company’s phosphor technology advantages has allowed it to enhance colors including red and white using its Crisp White LED technology, and optimizing green for vegetable lighting, said Lesaicherre. The company’s advantages in the COB market include patent and intellectual property (IP) protection, production capacity and quality, added Dieppedalle.

Asked whether the company was employing CSP LED chips for its compact COB products, Lesaicherre remarked only in small volumes. “Today we are still using lateral die,” he said. “When we use CSP chip it is mostly for high-end.”

Higher costs of CSP dies has prevented it from being widely used in applications where few LED dies are required. However, in high brightness LED applications such as luminaires with a 5,000 lumen output or more where there can be around “300 lateral dies and 600 wire bonds, and reliability become a concern, this is where you use CSP”, explained Lesaicherre. The company is in talks with some companies in high end CSP applications. “You will be seeing CSP for quality purposes,” said Dieppedalle.

According to Lesaicherre, the company in-house manufactures high power COB products and those requiring product differentiation, while lower costing COB solutions are outsourced to manufacturers in China, Malaysia, Taiwan or Korea.

|

|

Lumileds booth at Guangzhou International Lighting Exhibition (GILE) 2015. (LEDinside) |

Lumileds develops cost effective CSP technology

In terms of CSP technology, Lumileds developed an architecture in which the sapphire is left on the LED chip, said Lesaicherre. “We are mostly introducing CSP with sapphire left on,” he added. The new CSP production method that leaves CSP on is more cost effective than the previous method. “Less production steps, and uses a whole less die,” said Dieppedalle.

While CSP chips might not be widely applied in general lighting products, Lumileds has been applying the technology in flash and Automotive LEDs. “We have been using it in flash and Automotive LED products for about a year and a half, nearly two years.” said Lesaicherre. CSP is defined by the size of the emitting die being equal to the size of the package, he added.

The company also noted some smartphone manufacturers were starting to increase the number of flash LEDs in their phone designs, a Chinese smartphone manufacturer has started to incorporate three LEDs in their phones. One HTC phone for instance is using two flash LEDs in the front and two in the back, every manufacturer has done it differently, but the main purpose is mostly for color tuning, noted Lesaicherre.

“We are the largest CSP producer in the world, we have already produced over half a billion CSP” said Lesaicherre. “People question that but if you do the reverse engineering it’s right there.”

|

|

Lumileds mid power LED LUXEON 3535L. (Photo courtesy of Lumileds) |

Lumileds positions itself in mid-power LED applications

Building on top of its technology strengths and strong market position in the high power LED segment, Lumileds is continuing to increase its presence into the mid-power LED market. The company’s plan to enhance its mid-power LED in-house manufacturing capacity with the aid of partners can be attributed to the gravitational shift in LED applications towards mid-power LEDs. “Some of the markets are very heavy in high power, but some will completely shift to mid power,” said Lesaicherre.

Lumileds LED product portfolio is currently targeting four major application markets including illumination which encompasses all LED lamp applications, flash LEDs for smartphone applications, automotive lighting, and finally LEDs for display backlight, added Lesaicherre.

About 30% of the company’s LEDs manufactured are for automotive lighting applications, while illumination 40%, and other consumer flash LED and TV applications the remaining 30%, he explained.

Illumination is shifting rapidly to mid power but with pockets in high power, directional lighting, street lighting, industrial lighting, and some of the color is still high power. Some front Flash LEDs which were initially high power (LED) are now mid-power, and the same trend could be observed in AlInGaP LED market for automotive lighting applications where mid-power LEDs have gained traction.

An interesting trend, though, has been observed in display backlight applications. “In the beginning it was display-high power direct (direct-type LED TV) , then it went to mid power edge (edge-lit LED TV), and coming back to high power direct,” said Lesaicherre. “Very interesting market.”

Lumileds warns competitors of potential patent infringement lawsuits

Throughout the interview, Lumileds mentioned several times the importance of manufacturers to acquire intellectual property or patent protection for lighting products.

Having developed flip chip LED technology some 10 years ago, the company projected potential patent infringement lawsuits as some Taiwanese, Chinese and Korean manufacturers have not acquired patent licenses from the company. “Some are licensed by us, some are not and they should worry,” said Lesaicherre. Moreover, Asian LED luminaire manufacturers shipping products to Europe and U.S. markets should ensure their products are IP protected, or they might face potential lawsuits from Lumileds or other major LED suppliers in the future.

(Authors: Roger Chu, Director, Research Division, LEDinside and Judy Lin, Chief Editor, LEDinside)