Flash LEDs in smartphones have evolved from being a “marketing gimmick” to “standard equipment.” LED usage in smartphones have also jumped up from single to dual flash LEDs, and it is increasingly common for flash LEDs to be found in latest smartphone models.

Ample business opportunities lurk behind the proliferation of flash LEDs in the smartphone market, and whoever is most sensitive to market changes will be the first to acquire market share.

|

|

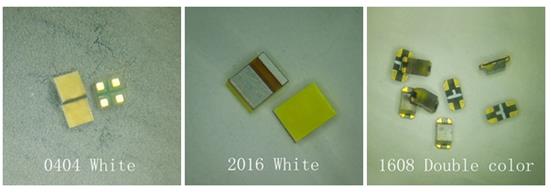

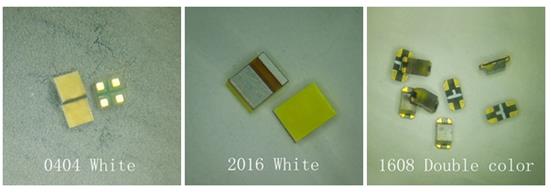

Harvatek's flash LED products. (Harvatek/LEDinside) |

LEDinside analysts estimate global flash LED market value soared 64% Year-on-Year to US $786 million in 2014, and flash LED shipment volume will peak to 2.04 billion pcs by 2018. In general flash LED revenue will increase from US $561 million in 2013 to about US $759 million by 2018, according to analysts estimations.

Vying the lucrative flash LED market, Harvatek Opto has been one of the latest Chinese LED manufacturers to join the ranks of Hongliopto, Jinko Solar, and Jufei Optoelectronics.

The company is especially developing 2016 series LED products for flash LED applications, said Weizheng Lin, Vice General Manager of R&D Center, Harvatek Opto, at the company’s product launch press conference on July 8, 2015. Most 2016 series on the market use EMC and ceramic leadframes, but Harvatek’s latest 2016 LEDs use its patented copper and polyimide substrates. The material’s thermal conductivity can reach 200 w/m.k, which is equivalent to AlN ceramic substrates thermal dissipation performance, and outperforms Al₂O₃.

As for the much concerned cost issues, copper and PI substrate costs are about half of EMC products, and only a third of ceramic substrate prices, said Lin. The 2016 series LED products can be applied in smartphones, cameras, DV flash lights, indoor and outdoor lighting, as well as automotive lighting sectors.

Worth noting, Harvatek Opto is already in the early phases of partnering with Chinese smartphone manufacturers to introduce 2016 series products into their products. The company started sending small volume samples to smartphone makers. Chinese LED manufacturer Unionwaltron Optoelectronics is leading the adoption of 2016 series flash LEDs, and has signed a procurement agreement for the product series with Harvatek Opto at the product launch.

Aside from the 2016 series flash LEDs, Harvatek is also releasing 0404 and 1608 series LED products onto the increasingly competitive small pitch LED display market. Compared to standard three chip RGB LEDs, Harvatek Opto’s 0404 series products are four chip Red Green Green Blue (RGGB) products that are mainly applied in pitch (P) 1.2 and below small pitch displays. RGGB products can easily achieve white balance, offer smoother color tuning, and achieve a pitch smaller than P0.8 through virtual pixel technology.

The 1608 dual color series now include red/white or blue/green options. The series red light can compensate white light’s CRI measurements to achieve a brighter white light. By combining red/white with green/blue color LEDs, manufacturers can achieve a full color range backlight, and offer a wider color range compared to RGB products making the display effect more realistic and richer in details.

(Author: Sophie Liu, Editor, LEDinside China/ Translator: Judy Lin, Chief Editor, LEDinside)