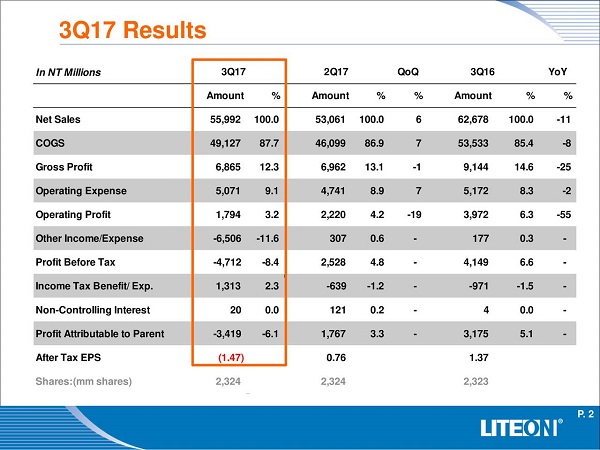

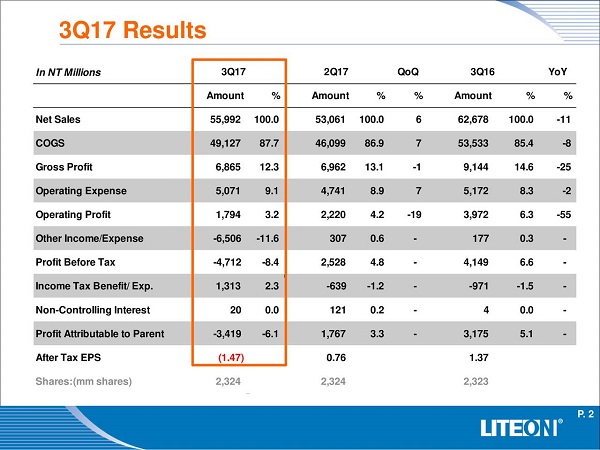

LiteOn yesterday reported its 3Q17 financial results, with a consolidated revenue of NTD 56 billion (USD 1.856 billion) following a 6% quarterly increase contributed by increased sales of power system solutions for cloud-computing data centers, AI smart home devices, IR LED, outdoor lighting, storage systems and game consoles.

|

|

(Image: LEDinside) |

The firm experienced a NTD 6.98 billion (USD 231.4 million) loss from impairment of goodwill as well as fixed assets. It also adjusted the level of its optoelectronic inventories, resulting in a 12.3% GP ratio and a 3.2% operating profit margin. Its after-tax net loss stood at NTD 3.42 billion (USD 113.4 million) and Q3 loss per share NTD 1.47.

|

|

(Source: LiteOn) |

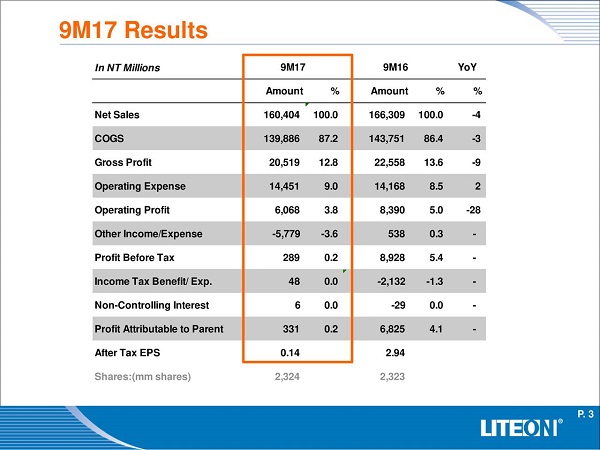

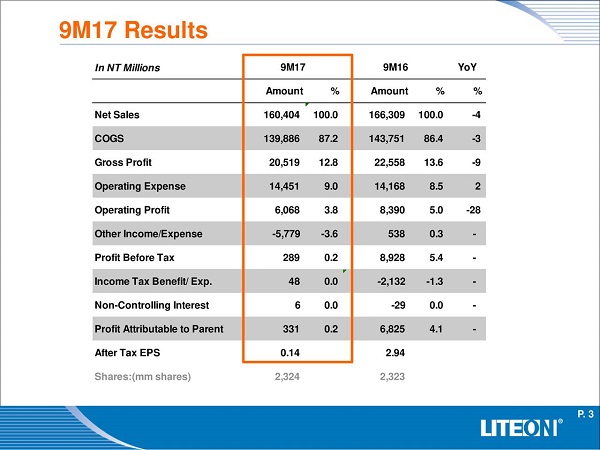

LiteOn’s 9M17 revenue amounts at NTD 160.4 billion (USD 5.318 billion), with a 12.8% GP ratio and a 3.8% operating profit margin. Its 9M17 profit before tax amounts at NTD 289 million (USD 9.58 million), profit attributable to parent NTD 331 million (USD 10.97 million), and after-tax EPS NTD 0.14.

In addition, the company pointed out its 3Q17 net cash came at NTD 26.2 billion (USD 868.6 million) after paying NTD 8.3 billion (USD 275.1 million) for dividends, employee bonus, and directors’ remuneration.

The optoelectronics segment contributed 22% of the overall 3Q17 revenue. The revenue of optoelectronics slid by 12% QoQ because of the inventory adjustment. Despite that, LiteOn keeps expanding its presence in the IR LED and LED component markets. Its supply of automotive lighting products and LED street lights also remains sustained.

IT division accounted for 56% of the overall Q3 revenue. Among that, the sales of power management systems appeared strong by virtue of increasing demands for high-end cloud computing servers; and power supplies for network communication equipment, AI smart home devices, mobile devices and game consoles.

Meanwhile, LiteOn’s share in the markets of gaming computers and multifunction peripherals increased, leading to a revenue hike of 9% QoQ.

The revenue of LiteOn’s storage division went up by 18% QoQ with the rising demand for game storage solutions, taking up to 16% of the overall 3Q17 revenue.

LiteOn concluded with expectations for its Q4 performance, projecting a higher operational efficiency and more competitive core businesses.