AIXTRON SE has a number of stock option programs in place that grant employees the right to purchase AIXTRON shares under certain conditions.

Under the terms of the stock option plan 2007, stock options can currently be exercised at strike prices between EUR 4.17 and EUR 26.60 per share. New shares resulting from exercised options of the above mentioned option plan are not entitled to a dividend for fiscal year 2017 and will be traded on the Frankfurt Stock Exchange under the separate ISIN DE000A2LQHL9 until and including the day of the Annual General Meeting 2018 on May 16, 2018.

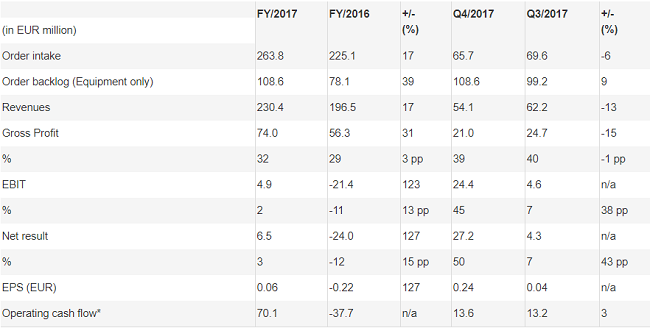

The company in February announced its financial results for fiscal year 2017 and the fourth quarter 2017.

Driven by the continued demand for MOCVD systems for the production of surface emitting lasers (VCSEL, Vertical-Cavity Surface-Emitting Laser) and other lasers, red-orange-yellow (ROY) and special LEDs as well as power electronics and memory chips, order intake including spare parts and service in 2017 amounted to EUR 263.8m, 17% higher than in the previous year.

The equipment order backlog as of December 31, 2017 increased to EUR 108.6m, an increase of 39% over the previous year's figure and 9% over the value per September 30, 2017.

|

Key Financials |

|

|

(Source: AIXTRON) |

The positive development in order intake and order backlog was also reflected in revenues, which rose by 17% year-on-year to EUR 230.4m in 2017. The largest revenue contribution came from MOCVD systems for the production of LEDs with 42% of equipment revenues, including red-orange-yellow and specialty LEDs, followed by systems for the production of optoelectronics with 25%.

Gross profit and gross margin also improved significantly year-on-year in 2017 to EUR 74.0m or 32%. In the sequential quarterly comparison of Q4/2017 to Q3/2017, both figures were almost stable.

The operating result (EBIT) improved year-on-year totaling EUR 4.9m in the financial year 2017. In Q4/2017, EBIT rose sequentially to EUR 24.4m.

Net result in the financial year 2017 improved to EUR 6.5m and in Q4/2017 exceptionally rose to EUR 27.2m in the sequential quarter-on-quarter comparison. Included in that figure were positive special effects from the sale of the ALD/CVD product line which brought the company to the profit zone one year earlier than planned.

In 2017, a cash flow from operating activities of EUR 70.1m was recorded (2016:

EUR -37.7m). The improvement in operating cash flow in 2017 is mainly driven by the improved profitability, reductions in working capital and the sale of the ALD/CVD product line.

Cash and cash equivalents (including cash deposits with a maturity of more than 90 days) increased to EUR 246.5m as of December 31, 2017 compared to EUR 203.9m as of September 30, 2017. Compared to EUR 160.1m as of December 31, 2016, the difference of EUR 86.4m is mainly attributable to the positive business development in combination with the sale of the ALD/CVD product line of EUR 51.0m.

Business Development

Last year, AIXTRON implemented the Company's reorientation while concluding fiscal year 2017 with a net profit of EUR 6.5m, thanks to the sale of the ALD/CVD product line. For 2018, AIXTRON continues to pursue its goal of returning to sustainable profitability in its operating business. This process is supported by the continuing market demand for MOCVD systems for the production of VCSEL and other laser applications, ROY and special LEDs as well as for power electronics.

On October 1, 2017, APEVA SE, a wholly-owned subsidiary of AIXTRON SE for its OLED deposition technology, officially commenced operations. AIXTRON is currently negotiating with potential industrial and financial partners to form a joint venture with APEVA.

Last year, the company's cost structure continued to improve. In 2017, although cost of sales increased year-on-year they did not increase as fast as revenues, which grew by 12% from EUR 140.2m to EUR 156.4m. This was mainly due to a larger portion of higher margin products which more than offset a number of effects. Those included low margin sales of AIX R6 tools from inventory as well as write downs from having frozen further technology development of products for three-five on silicon materials (TFOS: EUR 1.0m in Q1/2017) as well as for thin film encapsulation (TFE: EUR 1.3m in Q2/2017). Consequently, 2017 cost of sales relative to revenues decreased to 68%.

At EUR 69.1m, total operating expenses in 2017 were 11% lower than the previous year's figure (2016: EUR 77.7m). The operating costs included restructuring effects of EUR 12.8m from the previously described freezing of TFOS and TFE activities as well as positive effects from the sale of the ALD/CVD product line for memory chips. The operating costs relative to revenues decreased in 2017 to 30% (2016:40%).

Guidance

For 2018, the Executive Board expects growth in its core business, in particular from MOCVD systems for the production of lasers for applications in 3D sensor technology or optical data transmission. In the medium term, the adoption of power components based on the wide-band gap materials SiC and GaN (silicon carbide, gallium nitride) opens up further potential.

Based on the current corporate structure and estimated orders, Management expects both revenues and total orders in a range between EUR 230m and EUR 260m for 2018 at the budget rate of USD/EUR 1.20. This represent a growth between 20% and 35% based on the revenues of the continuing business of EUR 191.6m, excluding the sold ALD/CVD product line. Hence, AIXTRON expects to achieve a gross margin of 35% to 40% and an EBIT of 5% to 10% of revenues in 2018.

Furthermore, Management expects to achieve a positive operational cash flow which will be lower compared to 2017. This is due to the positive effects from the sale of the ALD/CVD product line in the amount of EUR 51.0m which were included in cash flow 2017. Cash flow in 2018 will include the settlement of liabilities towards third parties of the ALD/CVD business in the amount of EUR 11.7m. These expectations for 2018 include the results of the AIXTRON subsidiary APEVA with all planned investments to further develop the OLED activities.