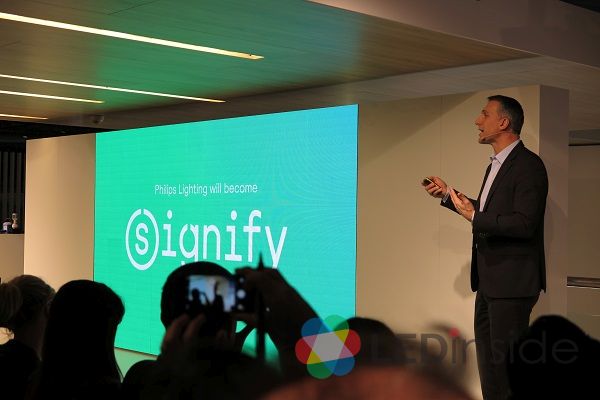

Signify released the company’s business performance result for the second quarter and first half of 2018. The highlights are as follows:

Second quarter 2018 highlights

• Sales of EUR 1,537 million; a comparable decrease of 3.4%

• LED-based comparable sales growth of 4.7%, representing 70% of total sales (Q2 2017: 63%)

• Adjusted currency comparable indirect costs down EUR 46 million, a reduction of 8%; or 150 basis points of sales

• Adjusted EBITA of EUR 130 million (Q2 2017: EUR 159 million), impacted by currency effects of EUR -22 million

• Adjusted EBITA margin of 8.4% (Q2 2017: 9.4%), including a currency impact of -80 basis points

• Net income of EUR 29 million (Q2 2017: EUR 73 million), reflecting higher restructuring costs, lower profitability and a real estate gain in Q2 2017

• Free cash flow of EUR -31 million (Q2 2017: EUR -44 million excluding real estate proceeds)

• Share repurchase program for 2018 increased from EUR 150 million to EUR 300 million

Half year 2018 highlights

• Sales of EUR 3,038 million, a comparable decrease of 3.4%; LED-based comparable sales growth of 5.3%

• Strong reduction in currency comparable indirect costs of EUR 84 million, or 120 basis points of sales

• Adjusted EBITA margin of 7.7% (H1 2017: 8.4%), including a currency impact of -60 basis points

• Working capital improved by 70 basis points to 10.5% of sales

• Free cash flow of EUR -37 million, an improvement compared with EUR -62 million, excluding real estate proceeds in H1 2017

According to Signify, the profitability improved in Lamps, LED and Professional while the performance in Home remained weak. The company has reduced significant cost base and working capital to improve cash generation. "However, given the slow start to the year and as we expect ongoing challenging market conditions, we have decided to revise our sales outlook for the year. We expect our sales growth performance to improve in the second half, but this will not be enough to deliver positive comparable sales growth for the full year. At the same time, we confirm our profitability and cash flow outlook for the year as our teams remain focused on relentlessly executing our strategy, driving down our cost base while investing in innovation and growth opportunities," said Signify CEO, Eric Rondolat.

Taking into account the anticipated cost savings in the second half of 2018, the company maintains its earlier outlook to improve the Adjusted EBITA margin from 9.6% in 2017 to 10.0-10.5% in 2018, albeit at the lower end of the range. The company also continues to expect to generate a solid free cash flow in 2018, which will be somewhat lower than the level in 2017 due to higher restructuring payments.