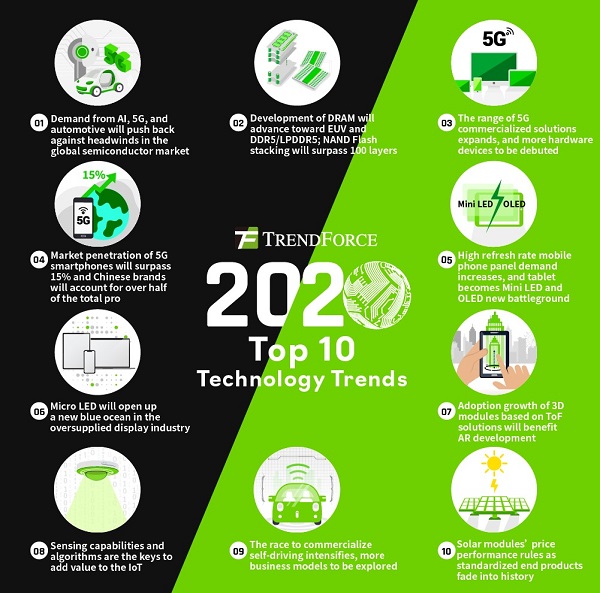

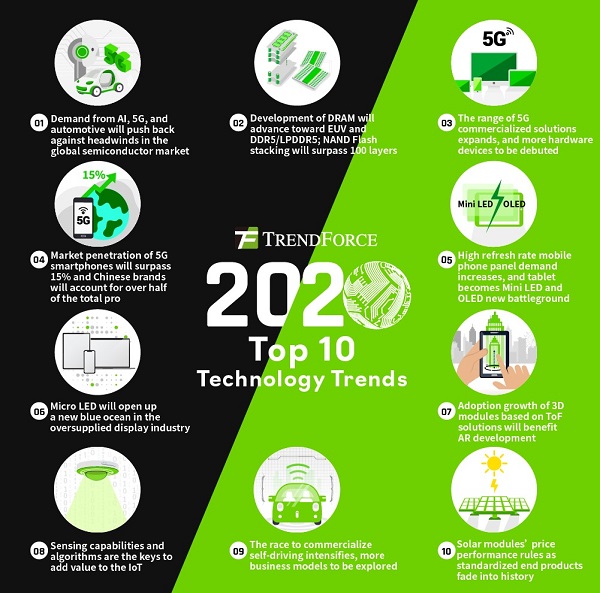

In this press release, TrendForce provides predictions of the information and communication technology industry for 2020, focusing on 10 key themes.

Demand from AI, 5G, and automotive will push back against headwinds in the global semiconductor market

The global semiconductor market has been in a slump this year on account of the fallout from the US-China trade dispute. Although the demand outlook remains uncertain for 2020, TrendForce expects the market to make a gradual recovery on the back of the demand related to 5G, AI, and automotive applications. The strategies of IC design companies for next year will mainly revolve around introducing next-generation IP cores and strengthening capabilities related to chip customization and the development of ASICs. IC design companies will also accelerate their adoption of next-generation process technologies, including the 7nm EUV and the 5nm.

Regarding trends on the manufacturing side during 2020, the usage of the 7nm will continue to increase. Furthermore, the schedules for volume production on the 5nm and for R&D of the 3nm will become clearer. The latest cutting-edge process technologies will account for a greater share of the overall production next year.

Additionally, there will be an increasing focus on the development and usage of compound semiconductor materials such as SiC, GaN, and GaAs. These materials feature high voltage resistance, high frequency switching and low resistance. They are thus suitable for power discretes, RF switch ICs, and other products that are gaining traction in the supply chains for 5G technologies and electric vehicles.

Finally, the continuing demand for chip products to feature smaller process pitch and higher computing power has resulted in a steady shift toward SiP in the development advanced IC packaging technologies. The SiP architecture is more effective in meeting the requirements of AI, 5G, and automotive applications because it offers greater flexibility and lower cost compared with the SoC architecture.

Development of DRAM will advance toward EUV and DDR5/LPDDR5; NAND Flash stacking will surpass 100 layers

DRAM manufacturing is approaching the physical limit of Moore’s Law as the development of process technologies moves into the 10nm class (i.e. 1X-nm, 1Y-nm, and 1Z-nm). Not only is it the case that further die shrinking no longer brings significant supply bit growth, but cost reduction is also becoming increasingly difficult. DRAM suppliers are now working to double the density per chip from the current 8Gb to 16Gb using the 1Y-nm and 1Z-nm technologies. This, in turn, will help gradually raise the market penetration of high-density modules.

EUV machines may also find their way into the development of the 1Z-nm processes and replace the existing double patterning techniques. A generational shift will also take place in the DRAM market in 2020 with the debut of DDR5/LPDDR5. Even though DDR5/LPDDR5 products will just be entering the stage of initial adoption and sample testing, their advantages over DDR4/LPDDR4 such as less power consumption and faster data rate will immediately get noticed.

In the NAND Flash market, suppliers will be attempting to cross the 100-layer threshold in the development of the stacking technology during 2020. They will also be working to increase the maximum density per chip to the 1Tb level from the current 512Gb. The trend toward more layers and higher chip density is mainly in response to the growing demand stemming from the continuing progress in the fields of 5G, AI, and edge computing. To support these emerging applications, end devices and systems including smartphones, servers, and data center equipment will require larger storage capacity.

At the same time, the physical dimensions of storage solutions will have to be scaled down further. Apart from the evolution of NAND Flash chips themselves, the interface specification of the smartphone storage solutions will upgrade from UFS 2.1 to UFS 3.X that offers faster data rate. Regarding storage solutions for the server/data center market, next year will see the adoption of PCIe G4 in Enterprise SSDs. Being the more advanced interface technology, PCIe G4 offers double the speed and performance of PCIe G3. The launching of UFS 3.X and PCIe G4 products next year will be targeting the high-end segment of their respective markets.

The range of 5G commercialized solutions expands, and more hardware devices to be debuted

Developments in the global telecom sector during 2020 will continue to revolve around 5G. Major communication chip manufacturers (e.g. Qualcomm, HiSilicon, Samsung, and MediaTek) and telecom equipment providers (e.g. Huawei, Ericsson, and Nokia) will be introducing various kinds of solutions as they compete for a piece of the 5G market. The focus in the development of the network architecture will be on Standalone (SA) 5G technologies, so rising demand for 5G New Radio (NR) equipment and core network solutions is expected.

The main emphasis of SA technologies is to ensure that the wireless network, the core network, and the backhaul architecture can meet the 5G requirements for the uplink rate, the network latency, and the number of connections when supporting applications such as networking slicing and edge computing.

Also, following the scheduled completion of the development of the R16 standard in the first half of 2020, telecom companies in countries around the world will begin planning for the rollout of the 5G infrastructure. In addition to the deployment of 5G networks in heavily populated metropolitan areas, the range of commercially available 5G-enabled services will also expand. Hence, more 5G devices and wireless base stations are expected to arrive in the market in the near future.

Market penetration of 5G smartphones will surpass 15%, and Chinese brands will account for more than half of the total pro

The focus of external design for smartphones in 2020 will remain on creating as perfect a full-screen device as possible through the maximization of the display area. The optimization of the full-screen design, in turn, will also lead to greater adoption of in-display fingerprint sensors, an increase in the angle at which the screen curves to the sides, and further advancement in the development of in-display camera. Other hardware specifications that smartphone makers will be targeting for improvement are the onboard memory and the front and rear cameras. Regarding memory, the density of DRAM and NAND Flash components will continue to increase next year. As for cameras, smartphone makers will upgrade resolutions and introduce more sophisticated multi-cam setups for the rear camera.

On the topic of 5G, smartphone makers are becoming more proactive in developing 5G-enabled models. Furthermore, the Chinese government continues to aggressively push for the commercialization of the 5G network and related services. As a result, the demand for 5G smartphones will gain momentum in 2020. TrendForce currently forecasts that the share of 5G models in the global annual smartphone production will leap upward from less than 1% for 2019 to over 15% for 2020. Also, TrendForce expects devices under Chinese brands to account for more than 50% of the total 5G smartphone production in 2020. On the other hand, purchases of 5G smartphones by consumers will still hinge on a few fundamental factors such as the progress made in the deployment of the 5G infrastructure worldwide, the data plans offered by telecom companies, and the pricing of the devices themselves.

High refresh rate mobile phone panel demand increases, and tablet becomes Mini LED and OLED new battleground

In terms of mobile phone panel, so far, OLED or LCD panel specifications have been able to meet the needs of all kinds of consumers, but with the 5G deployment, its high transmission efficiency and low latency characteristics can improve the dynamic performance of mobile phone content and develop mobile phone applications in other areas such as AR, boosting the demand for 90Hz or even 120Hz panels.

In terms of the most popular esports application, in addition to the existing high refresh rate panels, the production conditions are becoming more abundant for higher-end products that enhance contrast performance through Mini LED backlight. After many years of LCD adoption, the market also announced that the 2020 iPad may be simultaneously introduced with Mini LED backlight and OLED, making the tablet become another opportunity for OLED and Mini LED.

Micro LED will open up a new blue ocean in the oversupplied display industry

In terms of the progress of Micro LED self-emissive display, more and more panel manufacturers introduced Micro LED with glass backplane, but due to yield rate problem, currently the maximum size is 12 inches. The larger size of the display can be achieved through glass splicing. Although the cost of Micro LED is still high in the short term, because Micro LED with mass transfer technology can be combined with different display backplanes to produce transparent, projected, curved, flexible and other display effects, in the future, there will be opportunities to create a new blue ocean market in the oversupplied display industry. Take foldable display market as an example, because the material structure is robust and does not require many protective layers and polarization, Micro LED may be a proper solution.

Adoption growth of 3D modules based on ToF solutions will benefit the development of AR applications

The advantages that Time of Flight (ToF) has over Structured Light in the area of mobile 3D sensing include a lower technological barrier for development and a larger number of solution suppliers. Hence, ToF modules are expected to become one of the mainstay options for branded smartphone makers when designing the multi-cam setup for the rear cameras of their devices. Although the growth in applications for mobile 3D sensing is not expected to be significant in 2020, more smartphone makers will expand their model offerings that are equipped with ToF modules during that year.

Consequently, the adoption of ToF modules and 3D sensing modules in general will become more widespread in the smartphone market in the future. As smartphones including iPhone devices start to incorporate ToF modules, they are able to enhance augmented reality (AR) capabilities through accurate 3D depth mapping. Advances in the mobile 3D sensing technology thus drive consumers’ demand for AR apps. This, in turn, encourages more software developers to build AR apps, thus reinforcing the demand for the technology.

Sensing capabilities and algorithms are the keys to add value to the IoT

Innovative solutions for different levels of the Internet of Things (IoT) have already entered testing and commercialization phase this year on account of the maturation of related technologies and the built-up of the necessary infrastructure. Hence, the IoT market as a whole is also starting to deliver returns on investments. Looking ahead to 2020, the IoT will penetrate deeper into different vertical application markets and do to agriculture and healthcare what it has already done to manufacturing and retail.

This means that IoT-related technologies will continue to transform whole industries by driving process optimization and creating value-added services. Regarding sensing technologies for IoT-related applications, efforts are underway to improve capabilities of sensors so that smart devices and systems can have a wider range of responses to changes in the physical environment.

Moreover, continuing breakthroughs in AI algorithms will result in deeper machine learning capabilities that can take advantage of the huge volumes of data produced by various connected devices. The growing demand for data processing and analysis is expected to spur the integration of AI and edge computing in end devices in the near future. This, in turn, will generate new opportunities for hardware and software upgrades in the IoT market.

The race to commercialize self-driving intensifies, more business models to be explored

Regarding the commercialization of self-driving technology in 2020, there are three main fields of interests, namely commercial vehicles, specific driving routes and region-specific applications. Most manufacturers aim to develop the autonomous vehicles which meet SAE Level 4.

There will be an increase in the quantity as well as types of self-driving commercial applications in 2020. One of the driving forces comes from the various platforms, such as NVIDIA Drive, which is a self-driving development platform powered by AI. Baidu Apollo is also an open platform providing solutions for different self-driving scenarios, which helps car manufacturers and developers at all levels to accelerate the implementation of self-driving technology in their products.

However, the development cost of self-driving technology is high. Car manufacturers or developers need to explore more possibilities of self-driving technology, which must maintain its profitability, optimize costs and solve problems. Consequently, finding a business model that can fulfill this potential is also the focus of 2020.

Solar modules’ price performance rules as standardized end products fade into history

The development of solar energy technology is constantly evolving. The modules in 2018 and before are made of the standard 60 or 72 cells. The cells are also deployed in their original size.

In 2019, the layout of the cells has changed. The micro-technology development of the module has diversified, including half-cut, paved, shingled, multi-busbar cells, glass-to-glass, bifacial (cells) modules. Multiple technologies are combined for different applications, which the output power of the modules—the solar end products—has increased by 1~2 power steps (5W/ power step).

However, the core competitiveness of solar modules depends on levelized cost of electricity (LCOE). To create greater power generation and ensure the long-term reliability of the product, LCOE is to be reduced. It is necessary to increase cell efficiency and module power output to lower the LCOE. The manufacturers no longer call the shots in terms of the product pricing in the future market. The market demand and the buyer acceptance will be the ones making the rules now.

LEDinside 2019 Micro LED Next Generation Display Key Technology Report

Release Date: January 31, 2019

Format: PDF

Language: Traditional Chinese / English

Pages: 219

Quarterly Update: Micro / Mini LED Market Perspective Analysis - Vendor Dynamics, New Technology Import, Display Week / Touch Taiwan Direct Strike (March, June, September 2019; Approx. 10-15 pages/quarter)