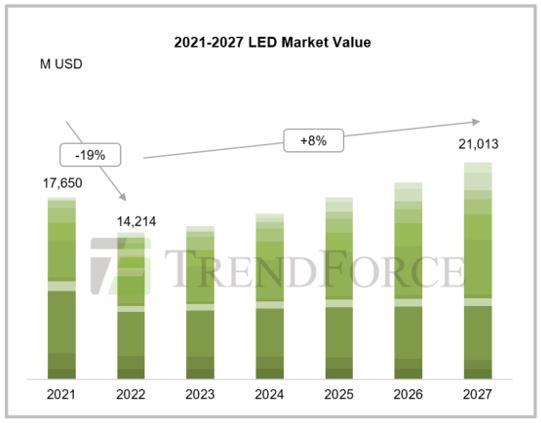

According to TrendForce’s latest report “Gold+ Member: Global LED Industry Data Base and LED Player Movement Quarterly Update”, soaring raw material costs and high inflation caused by the Russia–Ukraine war and pandemic woes in China have slashed consumer market demand and increased end product inventories. Therefore, TrendForce analyzes that the LED market value shrunk to USD 14.214 billion in 2022 (-19% YoY). Except for the 40% growth rate of the Mini LED backlight market, general lighting, architectural lighting, agricultural lighting, and UV LED sectors all suffered noticeable declines throughout the year. Despite the continuing gloomy macroeconomic outlook and a great deal of uncertainty in 2023, end product inventories are expected to go back to the normal level in late 2Q23, which will also benefit order placements. Therefore, TrendForce forecasts that the LED market value will achieve single-digit growth in 2023.

Looking into the future, Micro LED will be installed in wearables, automotive displays and large-sized displays; Mini LED video walls will continue thriving, along with increased automotive LED penetration, stable growth in HDR / Mini LED automotive displays, rising energy-saving demand for agricultural lighting, and expanded LED video wall applications. TrendForce predicts that the LED market value will jump to USD 21.013 billion in 2027 with a 2022-2027 CAGR of 8%. To satisfy the technical requirements of Micro/Mini LED in the coming years, however, LED manufacturers will gradually shift to produce 6-/8-inch epi-wafers, with Nichia, ams OSRAM, Epistar, PlayNitride, Samsung LED, San’an and HC Semitek being major manufacturers. TrendForce discovered that ≧6-inch GaN LED epi-wafers accounted for 5% of total production in 2022 and expects the share to reach 15% in 2027.

TrendForce has summarized applications with high growth potential in various markets as follows.

1. Micro LED Application: Wearables are likely to become the most suitable application of Micro LED second to large-sized displays as the products per se do not need a high PPI level and that they require high brightness for outdoor use. As TrendForce reported, what makes the market attractive is that combining Micro LED with Apple Watches signifies a giant leap for display–sensor integration. To Apple, using the display technology will redefine its smart watch products and lay the foundation for market development in the future.

2. Automotive LED Market: Weak macroeconomic conditions, end of the 50-percent purchase tax reduction scheme in late 2022, and policy uncertainty will lead to low single-digit growth in global vehicle shipments throughout 2023. Nevertheless, advances in technologies related to intelligent headlights (ADB), logo lamps, intelligent ambient lights, Mini LED taillights, and automotive Mini LED/HDR displays as well as the products’ increasing penetration rates will jointly raise the automotive LED market value.

3. LED Video Wall: The inventory of final display products worldwide is expected to be digested in 2Q23, plus demand recoveries in China, which will improve the visibility of display LED orders. However, gloomy economic conditions in Europe and North America will curb the display LED market value at single-digital growth. From a long-term perspective, the demand for displays in the virtual production, corporation and education, control room, and sports event sectors will boost the display LED market value.

Benefiting from rising demand for high-end products and special projects in China, Mini LED video wall (COB) companies—including Samsung Electronics, LG Electronics, Leyard, Unilumin, Absen, BOE, Ledman, MTC, Cedar, CREATELED and HCP—have established their own production capacities, thereby stimulating development of relevant technologies and yield rates. However, this trend has also affected the long-term market value of indoor fine-pitch display LED packages.

4. Agricultural Lighting: Considering the growing demand for energy-efficient and high-efficacy agricultural lighting LEDs among greenhouses and vertical farms as well as diversification of relevant crops thanks technological advances, TrendForce forecasts the CAGR of agricultural lighting LED market to reach 11% during 2022-2027.

5. Invisible LED Market: Entering 2023, plans to introduce UV-C LEDs are likely to be relaunched after China lifted strict COVID restrictions. In addition, Sony, Apple, and other brands unveiled AR/VR products engineered with eye tracking, while the European New Car Assessment Programme (Euro NCAP) plans to introduce active driver monitoring systems in 2023 and mandate their installation in 2025. Last but not least, the next-gen PPG (Photoplethysmography) will be introduced to smart watch applications, providing new bio-sensing features including monitoring of body hydration, blood glucose, blood lipids, and blood alcohol concentration (BAC). Combined with the existing heart rate and blood oxygen sensors, smart watches are expected to have more LEDs and photodiodes, to drive the IR LED market value.

Gold+ Member Report

Gold+ Member Report

|

Report Title

|

Content

|

Format

|

Publication

|

|

LED Industry Demand

and Supply Database

|

Demand Market Analysis:

|

PDF / Excel

|

1Q (Mid Mar)

3Q (Early Sep)

|

|

2023-2027 Demand Market Forecast

|

|

(Backlight and Flash LED / General Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / Horticultural Lighting / UV LED / IR LED / Micro LED / Mini LED)

|

|

Supply Market Analysis:

|

|

1. LED Chip Market Value (External Sales, Total Sales)

|

|

2. WW New GaN LED and As/P LED MOCVD Chamber Installations / WW Accumulated GaN LED and As/

P LED MOCVD Chamber Installations

|

|

3. GaN LED and As/P LED Wafer Market Demand

(By Region / By Wafer Size)

|

|

4. GaN LED and As/P LED Wafer Market Demand and Supply Analysis

|

|

LED Player Revenue

and Capacity

|

LED Chip Market Analysis:

|

PDF / Excel

|

2Q (Early Jun)

4Q (Early Dec)

|

|

Top 10 LED Chip Manufacturers by Revenue and

Wafer Capacity

|

|

LED Package Market Analysis:

|

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis

|

|

Top 10 LED Package Providers by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED

|

|

LED Industry Price Survey

|

Price Survey- Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED, IR LED, VCSEL)

|

Excel

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

LED Industry

Quarterly Update

|

Major Players Quarterly Update:

|

PDF

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

EU / U.S- Lumileds, ams OSRAM, Cree LED

(Smart Global Holdings)

|

|

JP- Nichia, Citizen, Stanley, ROHM

|

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys

|

|

ML- Dominant

|

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride

|

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS

|

|

Micro/Mini LED

Exhibit Report

|

CES 2023 / Touch Taiwan 2023 / Display Week 2023

|

PDF

|

Aperiodically;

<20 Pages

|

If you would like to know more details , please contact: