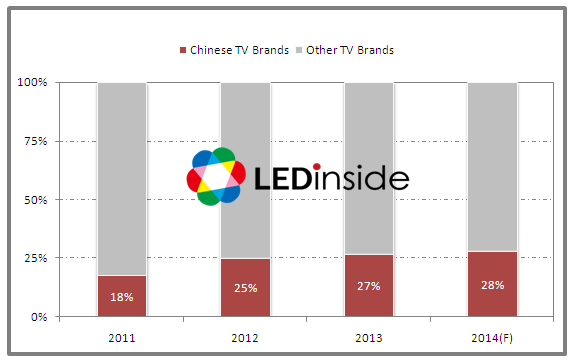

Global shipment proportions for Chinese TV brands are increasing yearly, with the possibility to reach 28 percent in 2014, according to the latest China LED Package Industry Market Report from LEDinside, a division of research organization TrendForce. Six Chinese TV brands will benefit the most from domestic demands in 2014. LED manufacturers beginning to pay more attention to opportunities in this market segment due to low in-house LED production capacity of Chinese TV brands and low strategic alliance among LED manufacturers. The supply chain for Chinese TV brands has started to change. Once reliant on Taiwanese and Korean LEDs, Chinese package manufacturers is starting to change as price competition heats up and technology matures.

|

Graph 1: Market share percentage of Chinese TV brands |

|

|

Data source:LEDinside |

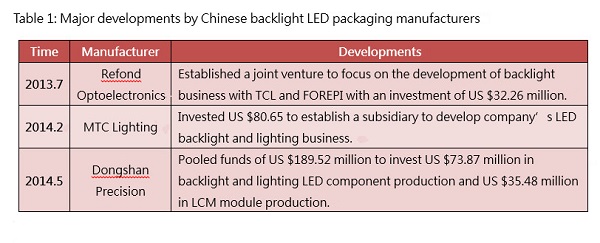

Chinese packaging manufactures entrance into TV backlight supply chains drives revenue growth and market expansion plans

China-based backlight LED manufacturer Refond Optoelectronics (Refond Opto) entered the TV backlight sector in 2010. The company has already successfully become part of the supply chain for brands TCL, Skyworth, Konka, and Chang Hong. Refond Opto’s backlight business revenue has grown 67% to US $46.80 million. In order to strengthen the company’s presence in the backlight market, Refond Opto formed an alliance with TV manufacturers TCL and Taiwanese chip manufacturer FOREPI, investing US $32.26 to establish the joint venture Huarui Optoelectronics Technology (Huizhou) which focuses on backlight LED packaging to further cement Refond Opto’s position in the LED TV backlight market.

MTC Lighting and Dongshan Precision pooled resources to break into the LED TV backlight sector. The companies revenue performance this year have shown rapid growth. MTC Lighting is already part of TCL, Hisense, Skyworth, Chang Hong, and Haier’s backlight supply chain. The company’s 2013 revenue reached close to US $80 million. In February this year, MTC Lighting invested US $80.65 million in establishing a subsidiary in Jiangxi to focus on its LED backlight and lighting business.

Dongshan Precision has drawn from its conventional precision sheet metal business to develop its backlighting business. In May of 2014, Dongshan Precision announced raised funds of over US $189.52 million, with plans to invest US $73.87 million in LED component production and US $35.48 in LCM module production. The funds will boost the company’s competitiveness in the backlighting field.

Other Chinese manufacturers include Shine On and APT Electronics, who have recently increased efforts in the TV backlighting sector. lighting LED component manufacturers Honglitronic and Mason are also turning their sights towards TV backlighting, and have already entered into brand supply chains.

2014 Chinese LED Package Industry Report

Chapter 1 Industry Chain Overview

LED Industry History

LED Industry Chain

Definition of LED Packaging

Supporting Industries of LED Packaging

• Lead Frame

• Silicon

• Phosphor

Chapter 2 China LED Industry Overview

The Upstream LED Chip Industry

• Excess capacity and over supply

• Industry polarization, first-tier manufacturer is bigger and bigger

The Downstream Application Industry

• Lighting Industry : Product prices fall, drive the penetration increased

• Display Industry : Intense competition, enters into the industry reshuffle

• Backlight Industry : Domestic package manufacturers rised

Chapter 3 Chinese LED Packaging Industry Overview

China LED Package Industry Development And Introduction

China LED Package Industry Scale And Development Trend

Major LED Package Manufacturers And Revenue Rankings

Major LED Application Analysis

• Lighting

• Backlight

• Display

• Decorative Lighting

Chinese Packaging Manufacturers' Technology Development Capability

• Research Expenditure

• R&D Staff

• Patents

Chapter 4 Major Chinese LED Package Manufacturers

Nationstar

Refond

Jufei

Hongli

ChangFang Lighting

Mason

Ledman

MLS

Jingtai

Smalite

Hkled

Wenrun

DSBJ

• Revenue and Profit

• Product Mix

• Business And Expansion Plan

• Operating Analysis

• Profitability Analysis

• Product Specification

Chapter 5 International LED Manufacturer Business in China

U.S. and European LED Manufacturer Business in China

• Philips Lumileds, OSRAM, Cree

Japanese LED Manufacturer Business in China

• Nichia, Toyoda Gosei

Korean LED Manufacturer Business in China

• Samsung, LG Innotek, Seoul Semiconductor

Taiwanese LED Manufacturer Business in China

• Everlight, Lextar, Lite-on,Unity Opto, Harvatek, Bright LED Electronics

Other Regional LED Manufacturer Business in China

• Dominant

Major LED Manufacturer Business in Chinese Market / Global Market Analysis

International LED Manufacturer Business in China Affecting the Chinese LED Package Industry

Chapter 6 The Major Supporting Business in LED Packaging Industry

Analysis on Supporting Business of Packaging Industry

Equipment Industry

• Die Bonder

• Wire Bonder

• Adhesive Dispensing Machine

Major Materials

• Chip

• Phosphors

Supporting Business

• Lead Frame

• Adhesive (Silicon, Epoxy)

• Gold Wire

Chapter 7 Chinese Package Manufacturers Strengths

Industry Cluster

Industry Integration Trend

Industry Opportunities and Threats

Chapter 8 Discussion on New LED Packaging Technology and Hot Topics

COB Package

EMC Package

Flip Chip LED Package

• Overview

• Strengths

• Market Trend

• Conclusions

Chapter 9 Conclusions and Suggestions

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 JoanneWu@TrendForce.com