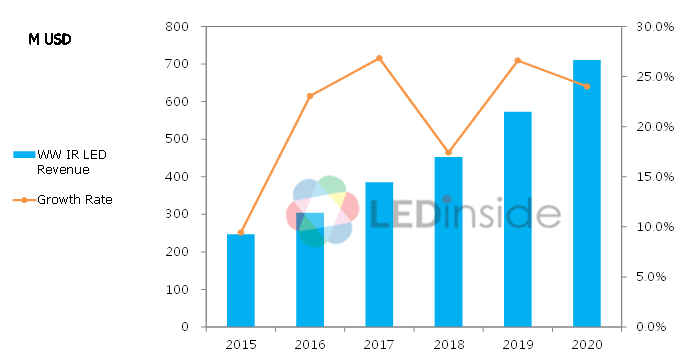

IR LEDs have a long history of development and are used in a wide range of applications on a daily basis. Following the introduction of biometric sensors and biometric identification to smartphones and wearable devices, IR LED can also be used in Internet of Things (IoT) applications. Varied applications of IR LEDs hold great potential in the future. LEDinside estimates that the market value of IR LED (excluding sensors) will reach US $710 million at 24% CAGR by 2020, making it the new blue sea for LED manufacturers.

2015 - 2020 Market Value of IR LED

In 2016, heavy losses from backlighting and lighting applications urged LED manufacturers to seek niche applications. Manufacturers started to shift their focus from conventional backlighting and lighting applications to invisible light applications that were previously less explored, including UV LEDs and IR LEDs.

The technology of IR LED is relatively matured, which promises stable profit. With the emergence of varied new applications, IR LED is expected to become highlighted technology to LED manufacturers again.

Conventional IR LED applications include sensors of automatic faucet, remote controls of TV or air conditioner and infrared security camera. Technologies include sensors and image identification play important parts in the emerging Internet of Things (IoT), biometric identifications, and wearable devices. Infrared LED becomes essential supportive light source for these emerging technologies. With the combination of sensors and identification technologies, IR LEDs can be utilized in special applications include iris identification and facial identifications. Meanwhile, it can also be installed to wearable devices for biometric sensors that monitor and analyze body status for health management tools.

With the maturing technologies of novel applications, IR LED is expected to hold great market potential. LEDinside estimates that the market value of IR LED (excluding sensors) is to reach US $710 million at 24% CAGR by 2020, making it the new blue sea for LED manufacturers.

2016 UV LED and IR LED Application Market Report

Release: 08 April 2016

Language: Chinese / English

Format: PDF

Page: 271

PART ONE 2016 UV LED Application Market

-

UV LED Market Overview

-

UV LED Market Forecast Analysis

-

2015-2020 UV LED Market Scale- By Product

-

2015-2020 UV LED Market Scale- By Application

-

2013-2015 UV LED Market Price Survey

-

UV LED Market Opportunities and Challenges

-

UV-A LED Market Technology

-

UV-A LED Product Specification and Application Requirement- Epi Wafer, Chip, Package, Module

-

UV-A LED Player Progress

-

UV-A LED Chip Product Analysis

-

UV-A LED Package Product Analysis

-

UV-A LED Application Market Opportunities and Challenges

-

General Curing Market

-

UV Technology Requirements in Curing Application Markets

-

Superior UV Curing Processing Factors

-

UV LED Module Manufacturer List

-

UV Curing Machine List

-

UV Adhesive Manufacturer List

-

General Curing Market v.s. Eqposure Machine Curing Market

-

General Curing Market

-

Coating Application Market Requirement and Equipment Manufacturer List

-

Laminating Application Market Requirement and Equipment Manufacturer List

-

Inkjet Printing Application Market Requirement and Equipment Manufacturer List

-

Nail Curing Application Market Requirement and Equipment Manufacturer List

-

3D Printing Application Market Requirement and Equipment Manufacturer List

-

Air Purification Application Market Requirement and Equipment Manufacturer List

-

Special Curing Market

-

Exposure Machine Market Requirement and Equipment Manufacturer List

-

UV-A LED Major Players and Business Model Analysis (Chip, Package, Module, System)

-

Europe

-

USA

-

Japan

-

Korea

-

Taiwan

-

China

-

UV-C LED Market Technology

-

UV-C LED Product Specification and Application Requirement- Epi Wafer, Chip, Package, Module

-

UV-C LED Player Progress

-

UV-C LED Chip Technology Challenges and Product Analysis

-

UV-C LED Package Technology Challenges and Product Analysis

-

UV-C LED Application Market Opportunities and Challenges

-

UV-C LED Market Opportunities

-

UV-C LED Market Opportunities- Application Market and Equipment Manufacturer List

-

UV-C LED Major Players and Business Model Analysis (Chip, Package, Module, System)

-

2016-2018 UV Market Value Chain Analysis

-

2015 UV Market Value Chain Analysis

-

2016-2018 UV Market Value Chain Analysis

PART TWO 2016 IR LED Application Market

-

Infrared LED Market Overview

-

Infrared LED Market Scale

-

Infrared LED Market Scale- By Application

-

Infrared LED Market Technology

-

Infrared LED Chip

-

Infrared LED Package

-

Infrared LED Application Market Opportunities and Challenges

-

Security Surveillance Market

Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

Iris v.s. Face Recogenition

Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

Optical Sensor- Reflective Pulse Oximetry Sensing Module

Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

Optical Sensor- Proximity Sensor

Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

IR LED in Automated Drive System

Product Design, and Opportunity and Challenge

-

Infrared LED Major Players and Business Model Analysis (Chip, Package / IR LED, Optical Sensor)

-

EU and USA

-

Japan

-

Korea

-

Taiwan

-

China

If you would like to know more details, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912