WitsView, a division of

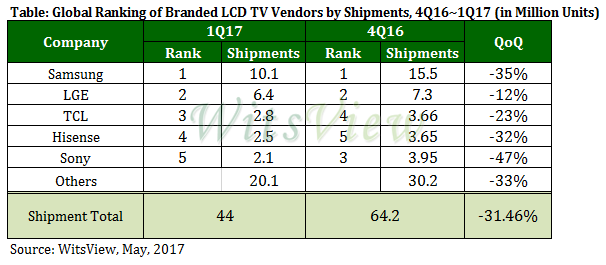

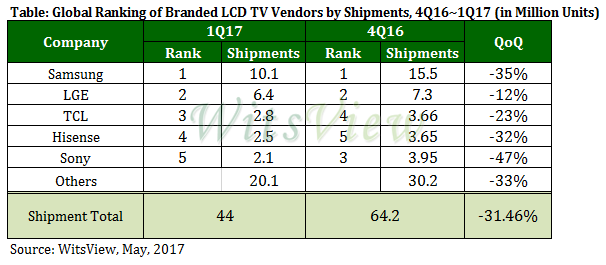

TrendForce, reports shipments of LCD TV sets for the first quarter of 2017 came to 44.05 million units, a decrease of 31% from the prior quarter and a year-on-year decline of 8.4%. Poor sales results in China during the Chinese New Year holiday period was a major factor behind the year-on-year shipment drop.

For this second quarter, WitsView estimates that global TV set shipments will grow by just 8% from the first quarter. The market arrival of new products will help shipments bounce back a bit. However, sales momentum has been sluggish in China since the Chinese New Year period, and the situation is expected to continue through the Chinese Labor Day sales in May and the promotion period for the online channels in the middle of June.

The outlook for the entire year is not too bright as well. Besides the weak Chinese market, TV sales in North America are going to be impacted by channel distributors’ price hikes. At the same time, prices of LCD TV panels remain high and will keep constraining TV brands’ ability to pursue promotional activities. Taking account of all these factors, WitsView has lowered its projection of this year’s global TV shipments. The original estimation was around 224 million units. According to the latest revision, global TV shipments will reach 219 million units for 2017, a cut of 2.2% from the original projection. The revised estimation roughly matches last year’s volume.

Samsung remained leader in the brand ranking while LGE posted the smallest shipment decline

Samsung’s performance in the first quarter did not reveal significant changes. Shipments from the brand plunged by 35% compared with last year’s fourth quarter due the seasonal effect. Nonetheless, Samsung retained first place in the ranking.

With only a 12% drop versus the preceding quarter, LG Electronics (LGE) had the smallest shipment drop compared with all other TV brands. The shipment outlook for LGE is fairly positive as the company has sufficient panel supply coming from its in-house supplier LG Display. Samsung, on the other hand, is expected to have its shipments adversely affected by the closure of its panel fabs and the break-off of ties with Sharp. On the whole, LGE’s first-quarter result has raised market expectations of better performances in the future.

WitsView also points out that numerous TV brands have recently made agreements with major North American distributors BestBuy and Walmart to raise prices by 5~20% on new models released this second quarter. Though hiking up prices offset high panel costs, the move can also hurt consumer demand. Whether TV brands will benefit from their agreements with the distributors remains to be seen.

Most Chinese TV brands posted declines of more than 30% because of weakening domestic demand

Chinese TV brands have raised prices of their products several times to compensate for the rising panel costs that are eroding their profit margins. However, their actions have also

led to significant slowdown in domestic demand. Among Chinese brands, TCL managed to offset shipment decline in the domestic market with better sales performances abroad. TCL shipped 2.8 million units this first quarter, down 23% from the preceding three-month period. Nonetheless, TCL returned to third place in the global ranking.

Other Chinese brands such as Hisense, Skyworth and Changhong posted declines of 30~40% this first quarter versus the prior quarter because of the sluggish domestic market.

Internet brands have seen their shipments retreat, whereas Sharp’s shipments have expanded owing to the brand’s “Sky Tiger Plan”

China’s LeEco has been the leading Internet brand on the TV set market by offering economically priced and high-performing products. However, the company is struggling with a serious financial crisis and its TV shipments for this first quarter plunged by 61% versus last year’s fourth quarter. The outlook on LeEco’s shipments for the later quarters is on the conservative side as the company has to deal with challenges related to its operation, product portfolio and relationship with OEMs.

Just as Internet brands are losing their luster, Sharp is making progress in China as it carries out the “Sky Tiger Plan” that was formulated under Foxconn’s leadership. Sharp was among the few major TV brands that managed to register year-on-year growths in their shipments for this first quarter. WitsView estimates that shipments of Sharp TVs in China will reach at least 500,000 units per month during this second quarter. The Chinese market, together with its home market Japan and its presence in Southeast Asia and Europe, will help push Sharp’s global annual shipments of TVs to around 7.5 million units this year, according WitsView’s latest analysis.