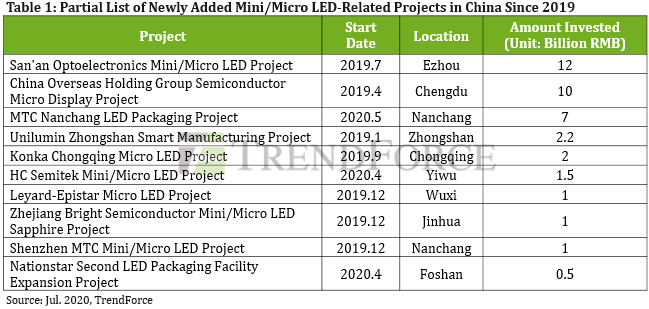

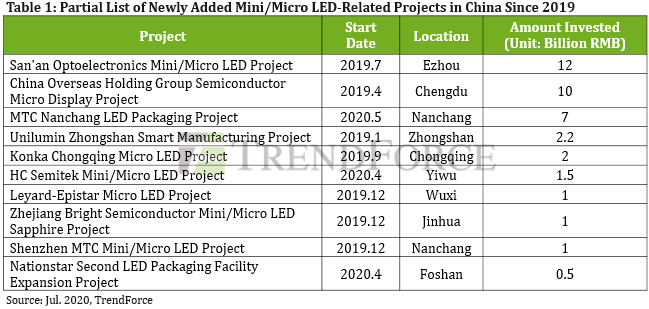

TrendForce’s latest LED Industry Demand and Supply Data Base finds that, by 2024, the global Mini/Micro LED market is projected to reach US$4.2 billion in revenue. The positive outlook of the Mini/Micro LED industry has attracted many investors. Since 2019, total investments in Mini/Micro LED-related projects in China have reached RMB 39.1 billion, with more than 14 newly added projects, according to TrendForce’s investigations. This massive influx of capital is expected to accelerate the overall pace of Mini/Micro LED commercialization.

TrendForce analyst Allen Yu indicates that, given the recent delays in Mini LED commercialization this year, some manufacturers are likely to push back their original plans of ramping up Mini LED TV and monitor mass production in mid-2020. On the other hand, since Micro LED is still in the R&D stage for most manufacturers, the technology has a long way to go before it is ready for commercial use. Nevertheless, investors are still relatively hopeful towards the future of Mini/Micro LED. For instance, LED chip and packaging suppliers, such as San’an Optoelectronics, Epistar, HC Semitek, Nationstar, and Refond, as well as video wall and panel manufacturers, such as Leyard, Unilumin, TCL CSOT, and BOE, have all launched Mini/Micro LED-related projects in an effort to drive the industry forward.

In July 2019, San’an Optoelectronics commenced its Mini/Micro LED wafer and chip development and production project in Ezhou, Hubei. This project is mostly aimed at developing new Mini/Micro LED displays and projected to involve RMB 12 billion worth of investment capital. In December 2019, Leyard and Epistar jointly invested RMB 1 billion to set up a Mini/Micro LED production center in Wuxi, Jiangsu. Also, in May 2020, MTC established its headquarters and its LED packaging facilities in the Qingshanhu District of Nanchang, Jiangxi. MTC is expected to build 5,000 production lines for LED packaging operations, which include Mini/Micro LED packaging, with an investment totaling RMB 7 billion.

TrendForce believes that the participation of the above companies in Mini/Micro LED R&D will inject a corresponding influx of capital in all aspects of Mini/Micro LED technology development, including new equipment, materials, and manufacturing technologies, with these investment efforts resulting in the maturation of the related supply chain as well.

Learn more Mini/Micro LED market dynamics and technology progresses with our 2020 Micro LED Forum! Industry experts across the world are going to share their insights of the market and the on-going technology breakthroughs of the mergering display technologies. Register now!

Gold+ Member Report

-

LED Industry Demand and Supply Data Base- Backlight / General Lighting / Architectural Lighting / Automotive Lighting / Digital Display / Projection & Horticultural Lighting / UV LED / IR LED / μLED Mini LED Applications

-

LED Player Revenue and Capacity- Chip Market and Player Capacity & Revenue / Package Market and Player Capacity & Revenue / LED Player Revenue Ranking in Each Application

-

LED Industry Price Survey- Sapphire / Chip / LED Package (Backlight / Lighting / Automotive / Digital Display / UV LED / IR LED)

-

LED Industry Quarterly Update- Major LED Player Quarterly Update (EU, US, Japan, Korea, Taiwan, China)

-

Micro / Mini LED Market Prospective Analysis- Vendor Dynamics, New Technology Import

|

LED Industry Demand and Supply Data Base |

Demand Market Forecast:

2019-2024 Demand Market Forecast

(Projection and Display / General Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck / Digital Display / SSL Like / UV LED / IR LED / Micro LED & Mini LED) |

PDF / Excel |

1Q (February) / 3Q (August) |

Supply Market Analysis:

1. Chip Market Revenue (External Sales, Total Sales)

2. WW new GaN & AlInGaP MOCVD Chamber Installation volume / WW Accumulated GaN & AlInGaP MOCVD Chamber Installation

3. GaN & AlInGaP Epi Wafer Market Demand (Total / By size)

4.GaN & AlInGaP Sufficiency |

|

LED Player Revenue and Capacity |

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue

|

PDF / Excel |

2Q (May) / 4Q (November) |

LED Package Market Analysis:

LED Package Vendors’ Revenue and LED Revenue, and Capacity

Top 10 LED Package Revenues in Backlight, Lighting, COB, Automotive, Display, UV LED |

|

LED Industry Price Survey |

Price Survey- Sapphire & GaAs Substrate / Chip / LED Package (Backlight, Lighting, Automotive, Digital Display, UV LED / IR LED, VCSEL)

|

Excel |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November) |

|

LED Industry Quarterly Update |

Major Players Quarterly Update

EU- Lumileds, Osram Licht AG, and Osram OS

US- Cree

ML- Dominant

JP- Nichia, Citizen, Stanley, and Rohm

KR- Samsung, LG Innotek, Seoul Semi, and Lumens

TW- Epistar, Opto Tech, Epileds, Everlight, Lextar, Lite-on, AOT, Unity-Opto, Harvatek,

CN- San’an Opto, Changelight, HC SemiTek, Aucksun, Focus Lightings

Nationstar, Hongli, Refond, Jufei, MTC, ChangFang Lighting, MLS

|

PDF |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November)

|

|

Micro / Mini LED Market Prospective Analysis |

Vendor Dynamics, New Technology Import

|

10-15 Pages

PDF

|

March, June, September 2020

|

|

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|