Market Scale Analysis

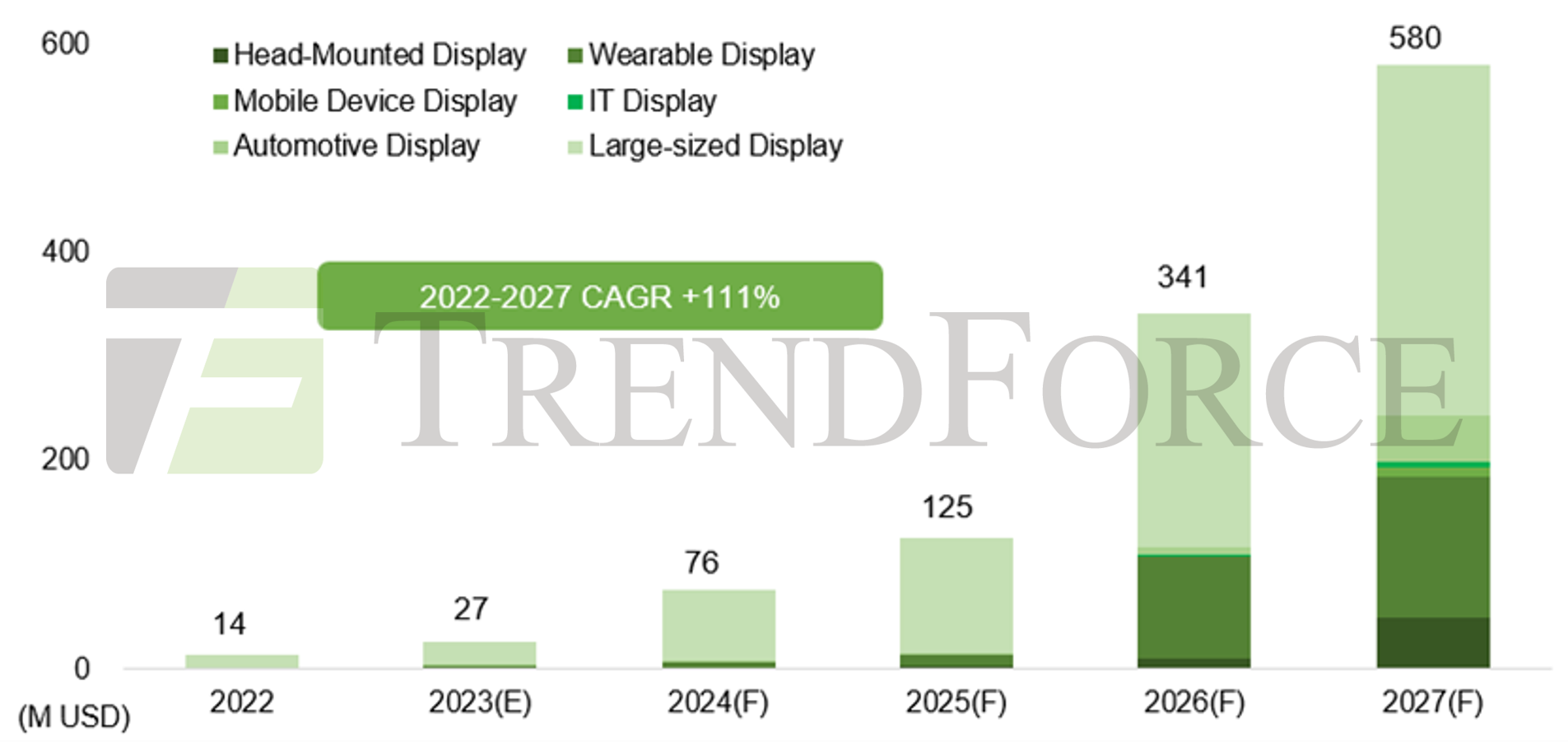

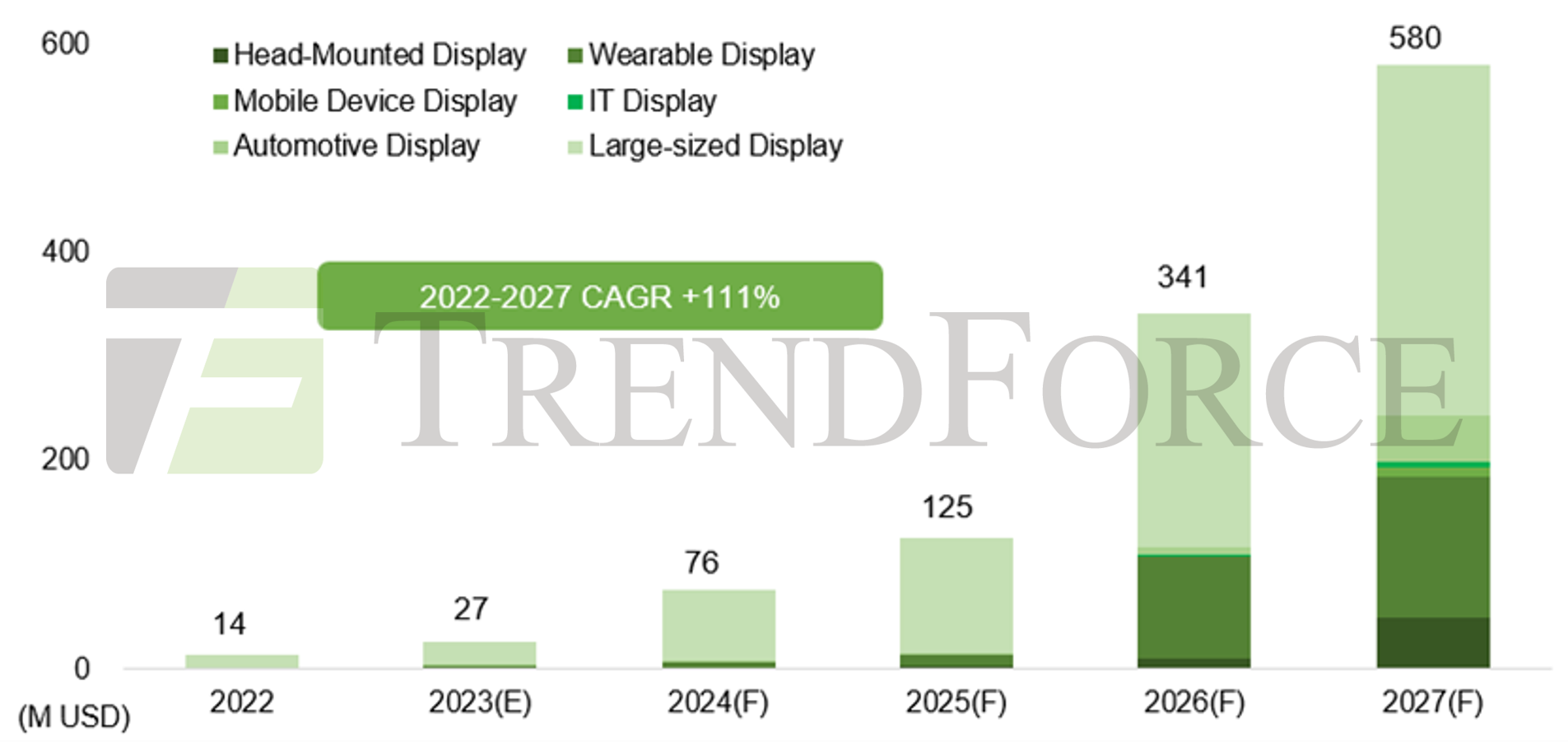

The year 2023 marks the commercialization of Micro LED as a display technology. For example, Samsung announced large-sized Micro LED displays. Although less than a hundred of such displays have been shipped throughout the year, the shipment of Micro LED displays is likely to jump by 10 times in 2024 with an expected increase in the yield rate of relevant components. Despite its mass production being postponed to 2026, the high-profile Micro LED Apple Watch has prompted the entry of 8-inch production lines into the Micro LED manufacturing process as well as the adoption of <10x10µm vertical chips, which will redirect the trend of cost reduction. The said changes will be critical benchmarks for industrial development in the coming years. TrendForce forecast the Micro LED chip market to be valued at nearly USD 600 million in 2027, with a 111% CAGR between 2022 and 2027, making Micro LED the most promising among various LED applications.

Trends in Application and Supply Chain Development

Micro LED supply chains have been optimized constantly. AUO, a leading Taiwanese panel manufacturer allocating considerable resources to Micro LED technologies, has partnered with the leading Micro LED chip maker PlayNitride to vertically integrate its COC (chip-on-carrier) 1 process. With existing mass transfer techniques which it has been focusing on, AUO achieved cost management more effectively, brining advantages to the cost rationalization of Micro LED displays. LG Display is set to be responsible for the mass transfer process of the Apple Watch. The leading South Korean panel maker decided to stop using the originally planned static electricity transfer and turned to adopt the combination of stamp transfer and laser bonding, enabling the advancement of manufacturing processes surely.

Head-Mounted Display Market

Despite the yet-to-come growth of metaverse headset demand, competition between near-eye display technologies has become fierce, including Micro LED. The resolution of Micro LED devices has increased rapidly, with 3,000 PPI being the basic requirement. Through multi-point scanning, laser beam scanning—with the low resolution problem that has long existed—has seen its resolution grow constantly, which merits a follow-up. By adopting color sequential front-lit LCOS displays, manufacturers have cut the volume of display modules to 0.5cc, possibly solving the bulkiness issue facing headset displays. Micro LED has competitive advantages over other technologies regarding light engine size, brightness, resolution, and contrast ratio, but it has to improve its performance in each aspect to seize business opportunities given by AR glasses, as competing technologies are catching up quickly.

Technology Analysis

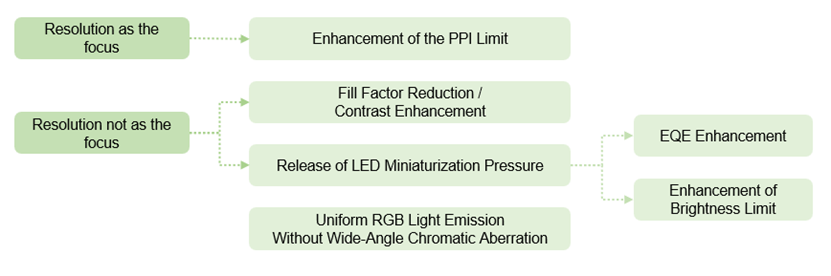

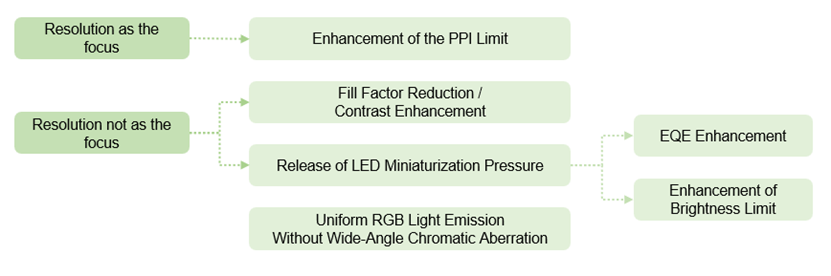

Vertical stacking has been the focal point of Micro LED development in 2023. Centering on Z-axis stacking, a vertically stacked structure allows the red, blue, and green light sources to overcome planar area constraints and exceed the PPI limit while being small in size. Without strictly regarding PPI limit maximization as the major goal, vertical stacking helps improve EQE by increasing the size of LED chips, and then level up the peak brightness or save more energy. In practice, Seoul Viosys and Jade Bird Display (JBD) have invested in vertical stacking and applied the technique to product development; the technique has also drawn widespread academic attention.

Micro LED Player Dynamic Updates

Micro LED manufacturers have constantly invested in product and technological development, creating refreshing industry highlights. By using QD color conversion, Mojo Vision has developed customizable Micro LED display modules for AR glasses. Ennostar and affiliated Unikorn focus on Micro LED OEM services, offering chips as small as 3x3µm to satisfy diverse customer needs. Using proprietary techniques, JBD fabricates Micro LEDs by bonding 4-inch LED wafers with 4-inch CMOS cut through 12-inch wafers. The process not only is efficient but effectively solves the offset problem caused by thermal expansion. Sitan combines nanoimprint lithography with QD solutions to achieve full-color display, aiming to produce energy-efficient display modules featuring high PPI.

As the Micro LED industry is booming, TrendForce gives up-to-date information on relevant technological advances, enterprise competition and collaboration, new applications, and market outlooks semi-annually, serving as the optimal references for readers to stay updated with the Micro LED market development.

TrendForce 2023 Micro LED Market Trend and Technology Cost Analysis

Release Date: 31 May / 30 November 2023

Language: Traditional Chinese / English

Format: PDF

Page: 160 / Year

Chapter I. Micro LED Self-Emitting Display Market Analysis

-

2023-2027 Micro LED Market Scale Analysis- Large-Sized Displays

-

2023-2027 Micro LED Market Scale Analysis- Wearable Displays

-

2023-2027 Micro LED Market Scale Analysis- Head-mounted Devices

-

2023-2027 Micro LED Market Scale Analysis- Automotive Displays

-

2023-2027 Micro LED Market Value Analysis- Mobile Devices

-

2023-2027 Micro LED Market Value Analysis- IT Displays

-

2023-2027 Micro LED Market Value Analysis

-

2023-2027 Micro LED Wafer Market Demand Analysis

Chapter II. Micro LED Large-sized Display / Automotive Display Markets

-

Fine Pitch Display LED Product Overview

-

Fine Pitch Display LED Technology Overview

-

Display LED Technology Analysis- MiP / COB / 4-in-1 Mini LED

-

MiP (0202 / 0404 LED) Pros and Cons Analysis

-

Micro LED Video Wall- Chip Yield Rate and Brand Target

-

Micro/Mini LED Video Wall- AM / PM LED Video Wall Product Design

-

COG (Side Wiring) Technology Challenge Analysis / Player Roadmap

-

2023-2024 Micro/Mini LED COG Video Wall Specification and Progress

-

Micro LED Video Wall Manufacturing Analysis

-

LTPS (Side Wiring) Analysis- Samsung / LG / BOE Manufacturing Analysis

-

P0.625 LED Video Wall / TV Cost Analysis- Active Matrix vs. Passive Matrix

-

Samsung 89-inch 4K P0.51 LED Video Wall / TV Cost Analysis

-

Samsung 101-inch 4K P0.51 LED Video Wall / TV Cost Analysis

-

Samsung 114-inch 4K P0.51 LED Video Wall / TV Cost Analysis

-

LG Micro LED Video Wall Cost Analysis- Active Matrix vs. Passive Matrix

-

BOE Mini LED Video Wall Cost Analysis- Active Matrix vs. Passive Matrix

-

Home Theater Application Market Definition

-

Home Theater Market Trend

-

- LED Video Wall vs. Projector Market Scale, Specification and Price

-

Home Theater Market Opportunities and Potentials

-

LED Video Wall Size and Pixel Pitch Analysis

-

Micro LED Transparent Display Application Market

-

2023 Micro LED Transparent Display Cost Analysis

-

2023 Micro LED Automotive Transparent Display Cost Analysis

Chapter III. Micro LED Wearable Display- Smart Watch Market

-

Apple Micro LED Watch Progress

-

Apple Micro LED Watch Specification and Cost Analysis

-

Apple Micro LED Watch- Mass Transfer Technology Progress

-

Tag Heuer Micro LED Watch Specification and Cost Analysis

Chapter IV. Micro LED Head-Mounted Display Market

-

Display / Optical Sensing Technologies

-

Optical System Trend

-

Light Engine vs. Optical System

-

Optical Analysis Landscape

-

AR/VR Display Challenges- Vergence Accommodation Conflict (VAC)

-

Augmented Reality Display Technology Matrix

-

Light Source Specification and Sweet Spot Price

-

Micro OLED- Sony / eMagin / Kopin / RAONTECH

-

Laser Beam Scanning- Size / Resolution

-

LCOS- Display Module Size Shrinks to 0.47cc

-

Waveguide- Geometric Waveguide vs. Diffractive Waveguide

-

Micro LED / LCOS / LBS Light Engine Specification Analysis

-

Micro LED Microdisplay Key Technology Analysis

Chapter V. Micro LED Technology Analysis

-

Vertical Stacking Micro LED Technology

-

Vertical Stacking Micro LED Technology Challenges

-

Vertical Stacking Micro LED Technology Analysis- Seoul Viosys / JBD

-

Vertical Stacking Micro LED Technology Advantages

Chapter VI. Micro LED Player Dynamic Updates

-

Mojo Vision

-

ITRI (Industrial Technology Research Institute)

-

Lumus

-

Instrument Systems

-

Unikorn

-

Porotech

-

Kulicke & Soffa

-

Nitride Semiconductors

-

Tianma

-

Sitan

-

Jade Bird Display (JBD)

If you would like to know more details , please contact: