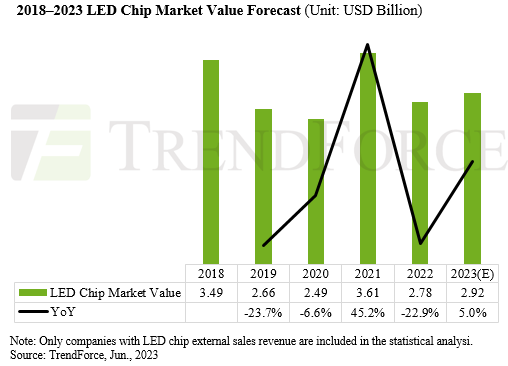

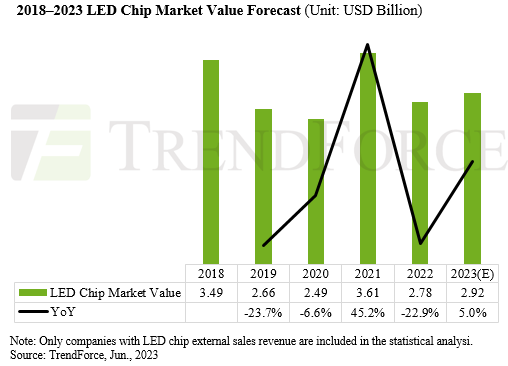

Jun. 1, 2023 ---- TrendForce has reported a significant decline in global LED demand throughout 2022, resulting in a noticeable downturn in both LED lighting and video wall markets. The industry was faced with an LED chip surplus, which led to a continuous drop in prices throughout the year.

The combined impact of volume and price reduction resulted in a sharp 23% annual decrease in the market value of global LED chips in 2022, shrinking to just US$2.78 billion. Despite this challenging landscape, it is predicted that the LED industry will recover in 2023, primarily driven by a resurgence in the LED lighting market. The anticipated rebound could elevate the LED chip production value, with estimates placing it at US$2.92 billion for 2023.

LED Commercial lighting is expected to lead the comeback charge in the broader LED lighting market. From a supply chain perspective, the LED lighting industry hit a low point in 2018, leading to an exodus of several small and medium-sized enterprises. Moreover, some lighting LED chip manufacturers have been consistently transitioning into more profitable sectors such as display technology. This shift resulted in reduced supply and correspondingly lower inventory levels.

In response to these changes, several LED companies opted to increase their prices. The primary increase has been seen in the price of LED chips specifically used for lighting applications. The most significant price increase was observed for low-power light chips with an area of 300 mil2 or less, which saw a price rise of about 3–5%. In certain cases, the price hike for chips of unique sizes reached up to 10%.

TrendForce survey data indicated a growing trend among LED supply chain companies toward raising prices. This trend is anticipated to persist due to the high demand for LED chips. Many companies see this price adjustment as a means to mitigate losses and actively reduce orders with low-gross margins.

TrendForce analysis underscores that the majority of the world’s LED chip suppliers are based in China. In recent years, heightened industry competition has forced some companies to exit the LED chip market. At the same time, Chinese LED chip manufacturers have decreased their focus on the chip sector. Most of the suppliers who have remained in the market have reported consistent losses over an extended period.

In China, the recent price rise for low-power light chips is viewed as a short-term strategy to bolster profitability. Looking ahead, TrendForce predicts that by striking a balance between supply and demand, and increasing industry concentration, the LED industry will gradually return to a state of normalcy.

Gold+ Member Report

Gold+ Member Report

|

Report Title

|

Content

|

Format

|

Publication

|

|

LED Industry Demand

and Supply Database

|

Demand Market Analysis: |

PDF / Excel

|

1Q (Mid Mar)

3Q (Early Sep)

|

|

2023-2027 Demand Market Forecast |

|

(Backlight and Flash LED / General Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / Horticultural Lighting / UV LED / IR LED / Micro LED / Mini LED) |

|

Supply Market Analysis: |

|

1. LED Chip Market Value (External Sales, Total Sales) |

|

2. WW New GaN LED and As/P LED MOCVD Chamber Installations / WW Accumulated GaN LED and As/

P LED MOCVD Chamber Installations

|

|

3. GaN LED and As/P LED Wafer Market Demand

(By Region / By Wafer Size)

|

|

4. GaN LED and As/P LED Wafer Market Demand and Supply Analysis |

|

LED Player Revenue

and Capacity

|

LED Chip Market Analysis: |

PDF / Excel

|

2Q (Early Jun)

4Q (Early Dec)

|

|

Top 10 LED Chip Manufacturers by Revenue and

Wafer Capacity

|

|

LED Package Market Analysis: |

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis |

|

Top 10 LED Package Providers by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED |

|

LED Industry Price Survey

|

Price Survey- Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED, IR LED, VCSEL) |

Excel

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

LED Industry

Quarterly Update

|

Major Players Quarterly Update: |

PDF

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

EU / U.S- Lumileds, ams OSRAM, Cree LED

(Smart Global Holdings)

|

|

JP- Nichia, Citizen, Stanley, ROHM |

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys |

|

ML- Dominant |

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride |

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS |

|

Micro/Mini LED

Exhibit Report

|

CES 2023 / Touch Taiwan 2023 / Display Week 2023 |

PDF

|

Aperiodically;

<20 Pages

|

If you would like to know more details , please contact: