According to TrendForce’s observations, the LED video wall market in Europe and North America, particularly for LED outdoor displays, will continue to grow. However, the indoor display market’s growth has slowed coupled with intense price competition. Overall, the demand in these regions is expected to remain stable throughout 2024. In contrast, the Chinese market is experiencing declining demand, reduced government budgets, and weakened social investment intentions, exacerbating competitive pricing, which is likely to lead to a downturn in the LED video wall market value in 2024. In Asia, including the Middle East and Southeast Asia, the demand for LED video walls continues to grow rapidly, making it the best-performing region in 2024. Other markets, such as Africa, Latin America, and Oceania, are expected to grow, albeit on a smaller scale. As the applications for LED video walls continue to expand with higher penetration rates throughout the world, coupled with high-resolution display requirements, the global LED video wall market scale is expected to reach USD 7.991 billion in 2025. Indoor and outdoor fine pitch displays will remain the main drivers of market growth, with a CAGR of 10% and 4% respectively, from 2023 to 2028.

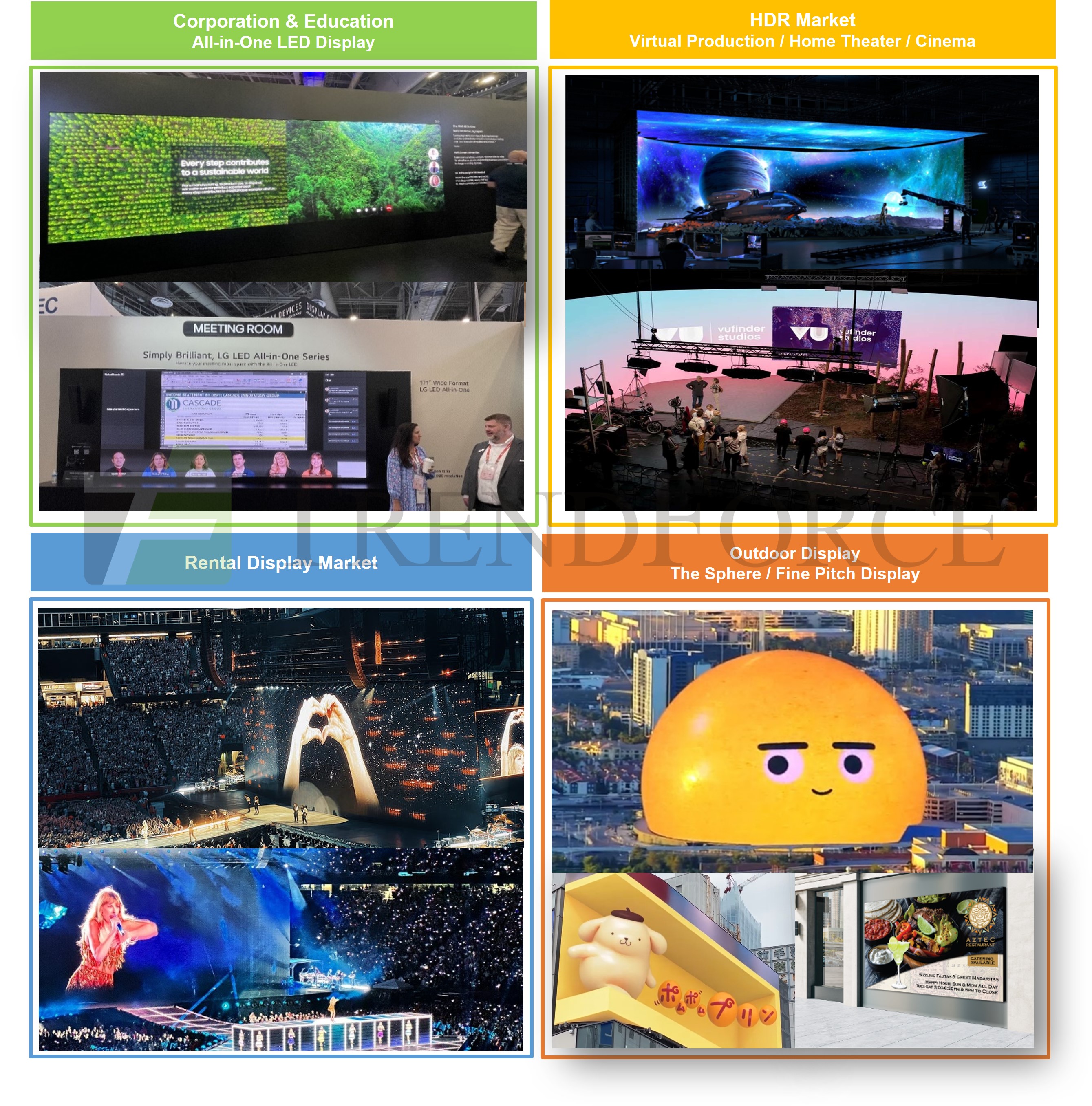

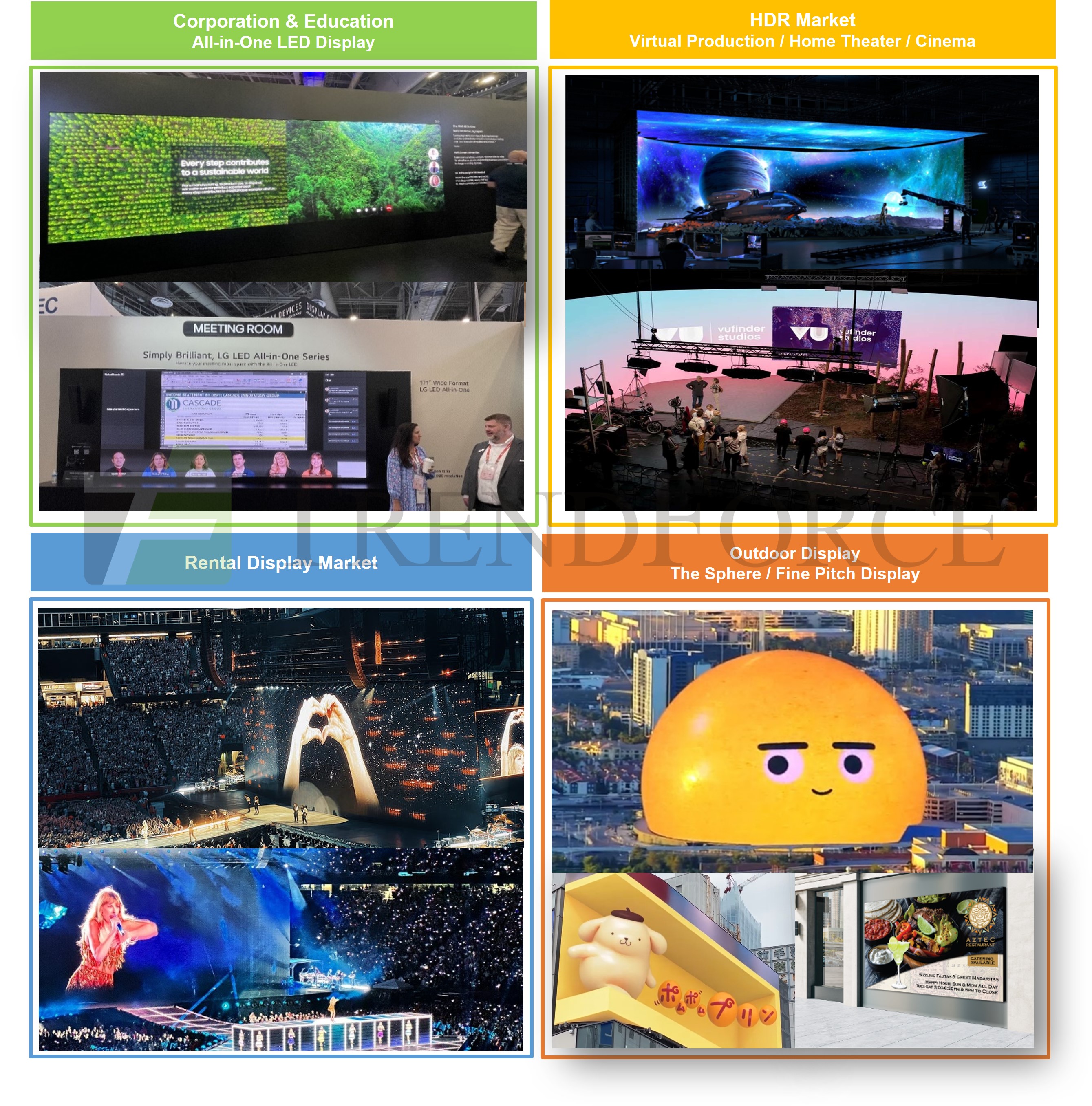

Indoor Displays: Benefiting from the rising demand for high-resolution and HDR capabilities, markets such as corporation & education, virtual production, home theaters, and cinemas are expected to experience steady growth. The specifications for all-in-one LED displays are moving towards 135-146 inches with a 2K 16:9 resolution, while the demand for 21:9 displays for video conferencing and 32:9 displays for lectures is rising in Europe and North America. In Southeast Asia, virtual production is booming, and the filming of concert movies (e.g., Taylor Swift’s concert film) is driving opportunities in the premium virtual production market. After their debut, Micro LED TVs are being applied to home theaters, exhibitions, and the corporation & education sector. Micro LED transparent displays are highly suitable for retail spaces, art venues (galleries, museums, and aquariums), and the hospitality industry, providing auxiliary product presentations. Both Micro LED TVs and transparent displays will start to take off in 2025.

Outdoor Displays: Driven by live events and sports / education applications, the demand for outdoor displays is steadily growing. Moreover, innovative displays such as spheres and glasses-free 3D installations significantly enhance urban landscapes and attract public attention, providing visual impact. LED outdoor fine pitch displays are primarily used for street furniture displays and bus shelter displays, with growing demand in the United States and Europe (e.g., the UK, Netherlands, and Germany). Notably, NBC has adopted Leyard’s LUO-1.5 LED outdoor fine pitch display for broadcasting the 2024 Paris Olympics.

Micro/Mini LED Video Wall Market

In 2025, with stable growth in shipments from Samsung and LG as well as plans of BOE, Vistar, Tianma, and Hisense to enter the market, the Micro LED TV market value in 2025 is expected to reach USD 185 million, with a 119% CAGR from 2023 to 2028.

Benefiting from increasing market demand and brand promotion, the Mini LED video wall market scale is expected to reach USD 676 million in 2024. P1.2 displays will be the mainstream, accounting for up to >55% of the total, and Samsung’s 110-inch The Wall will be the major product for ≤P0.625 models. With the annual maturity of Mini LED technology and increased production capacity, the Mini LED video wall is expected to extend from P1.2 models to ≥P1.5-P1.6 and ≤P0.625 products.

Global LED Fine Pitch Display Market

With price reductions, the penetration rate of fine pitch displays will increase not only in Europe and North America but also in Asia, Africa, and Latin America in 2024. Overall, despite a lackluster demand in the Chinese market, overseas markets are expected to maintain growth. Looking ahead to 2025, the penetration rate of LED fine pitch displays is expected to further increase in overseas, particularly in Asia. The increased penetration is expected to drive the global market value of LED fine pitch displays to USD 4.866 billion in 2025. As TrendForce analyzes, top 10 LED fine pitch display manufacturers in 2023 include Unilumin, Leyard, Absen, Qiangli Jucai, Hikvision, Samsung, Cai Liang, GKGD, LG, and Dahua.

≤P1.0 Ultra-Fine Pitch Display Market

According to TrendForce’s analysis of the ≤P1.0 ultra-fine pitch display market, in 2024, the penetration rates for ≤P0.625 and P0.7-P0.8 LED displays are expected to reach 20% and 25%, respectively. As Micro/Mini LED technology matures annually and applications expand, the market value for ≤P0.625 LED displays is expected to reach USD 334 million by 2028, with a CAGR of 66% from 2023 to 2028.

Virtual Production Market Trend

According to TrendForce, the LED video wall market scale for Entertainment & Cinema is estimated to grow by 18%. Applications in this sector include virtual production, home theaters, and cinemas, emphasizing high resolution, high grayscale, high refresh rates, and HDR imaging, making it a competitive market for LED display manufacturers.

Looking ahead to the development of the virtual production market in 2024, the Thai government has announced a certain rebate for foreign film production companies conducting location shoots in Thailand. Therefore, growth in virtual production in Southeast Asian countries is expected to flourish. The production of concert films (such as the Taylor Swift concert film) is also driving opportunities in the high-end virtual production market, extending the industry into movies, television, theater, music, and advertising production. In brief, TrendForce estimates the market value of virtual production LED displays in 2024 to reach USD 311 million.

With budget concerns, mainstream specifications for general background displays are typically >P2.1, such as P2.3, P2.6, and P2.8. However, premium film and television production demands higher brightness and display quality. For close-up shots, P1.2-P1.6 Mini LED video walls are used. The specifications for floor displays are mostly P2-P4, with the adoption of Mini LED video walls for better immersive experiences, while ceiling screens typically range from P3.9 to P6, emphasizing high brightness. Combining Mini LED video walls with common-cathode drive ICs can help enhance brightness (+30-40%), and display effect (wide viewing angle, high contrast, moiré-free), and offer significant energy savings up to 50-60%.

All-in-One LED Display Market Trend

All-in-One LED displays are controller-integrated standardized products, mainly applied to corporate meeting rooms, event, retail and exhibition, lecture halls, control rooms, gaming events, and even home theaters. In 2023, all-in-one LED display manufacturers ramped up their efforts in overseas market promotion. In addition to the Chinese market, shipments to Europe, America, and Asia also continued to increase. Overall, the global shipments of all-in-one LED displays grew by 34% in 2023, with significant increases from Leyard and Samsung. As more manufacturers enter the all-in-one LED display market, global shipments are expected to reach 6,400 sets in 2024.

TrendForce’s analysis focuses on 2025 LED video wall market outlook and application market trends; major LED video wall players’ revenue and product development; LED video wall price and cost analysis; suppliers’ technology and product specification cost development of the Micro/Mini LED and ≤P1.0 ultra-fine pitch display markets, etc. TrendForce aims to provide readers with a comprehensive understanding of marketing and sales in the LED video wall market.

Author: Joanne, Allen

TrendForce 2025 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 30 September 2024

Language: Traditional Chinese / English

Format: PDF

Page: 302

Chapter I. LED Video Wall Market Trend and Analysis

-

LED Video Wall Market Definition

-

2024-2028 Global LED Video Wall Market Scale

-

2022-2023 Top 20 LED Video Wall Player Revenue Ranking

-

2023 Top 20 LED Video Wall Player Market Share Analysis

-

2024(E) Top 10 LED Video Wall Player Revenue vs. Market Share

-

2023-2024(E) Top 10 LED Video Wall Player Revenue vs. Shipment

-

2024-2028 Global LED Fine Pitch Display Market Scale

-

2024-2028 Global LED Fine Pitch Display Market Shipment

-

2022-2023 Top 20 LED Fine Pitch Display Player Revenue Ranking

-

2023 Top 20 LED Fine Pitch Display Player Market Share Analysis

-

2024(E) Top 10 LED Fine Pitch Display Player Revenue vs. Market Share

-

2023-2024(E) Top 10 LED Fine Pitch Display Player Revenue vs. Shipment

-

2023-2024(E) Global LED Video Wall Regional Market Scale

-

2023-2024(E) Global LED Fine Pitch Display Regional Market Scale

-

2023 Global LED Fine Pitch Display Regional Market- By Application

-

2024(E) Global LED Fine Pitch Display Regional Market- By Application

-

2023-2024(E) Global LED Fine Pitch Display Application Market Analysis

-

2023-2024(E) P2.1-P2.5 LED Video Wall Application Market Analysis

-

2023-2024(E) P1.7-P2.0 LED Video Wall Application Market Analysis

-

2023-2024(E) P1.2-P1.6 LED Video Wall Application Market Analysis

-

2023-2024(E) ≤P1.0 Ultra-Fine Pitch Display Application Market Analysis

-

2024-2028 ≤P1.0 Ultra-Fine Pitch Display Market- Product Pitch Analysis

-

2024-2028 ≤P1.0 Ultra-Fine Pitch Display Market- Technology Analysis

-

2022-2023 ≤P1.0 Ultra-Fine Pitch Display Player Revenue vs. Market Share

Chapter II. Micro/Mini LED Video Wall Market Trend

-

Micro/Mini LED Video Wall

-

2024-2028 Mini LED Video Wall Market- Product Pitch Analysis

-

2022-2023 Mini LED Video Wall Player Revenue Ranking

-

2024-2028 Micro LED Video Wall Market- Product Pitch Analysis

-

Mini LED Chip Specification, Yield Rate, Price Trend, and Brand Target

-

Mini LED Pick-and-Place Technology Trend

-

Micro LED Chip Yield Rate and Brand Target

-

2021-2028 6-inch Micro LED COC Price Trend

-

Micro LED Mass Transfer Technology Analysis and Trend

-

Backplane Technology Analysis

-

COG (Side Wiring) Technology Challenge Analysis / Player’s Roadmap

-

TGV Glass Pros and Cons Analysis

-

Active / Passive Matrix Analysis

-

Controller Market Trend

-

Micro/Mini LED Video Wall Manufacturer’s Supply Chain Analysis

-

Mini LED Video Wall Specification and Player Progress

-

Micro LED Video Wall Manufacturing Analysis

-

Micro LED (COG) Video Wall Specification and Player Progress

-

Micro/Mini LED (COG) Video Wall Specification and Player Progress

-

Samsung / LG / BOE / Vistar’s Side Wiring Manufacturing Analysis

-

Samsung / AUO LTPS Driving Matrix Analysis

-

P0.625 LED TV / Video Wall Cost Analysis- Active Matrix vs. Passive Matrix

-

Samsung 89-inch 4K P0.51 Micro LED TV Cost Analysis

-

Samsung 101-inch 4K P0.51 Micro LED TV Cost Analysis

-

Samsung 114-inch 4K P0.51 Micro LED TV Cost Analysis

-

LG 136-inch 4K P0.78 Micro LED TV Cost Analysis

-

LG 136-inch 4K P0.78 Micro LED TV / Mini LED Video Wall Cost Analysis

-

BOE Mini LED Video Wall Cost Analysis- Active Matrix vs. Passive Matrix

-

LED Video Wall Size and Pixel Pitch Analysis

-

Micro LED Transparent Display Application Market

-

2024 Micro LED Transparent Display Cost Analysis

-

2023-2024 OLED Transparent Display Market Scale

Chapter III. 2025 LED Video Wall Market Outlook and Highlight

-

2025 LED Video Wall Market Outlook and Highlight

3.1 Corporation and Education Market

-

2023-2024(E) Corporation & Education- LED Video Wall Product Trend

-

All-in-One LED Display Product Strengths and Applications

-

2022-2024(E) All-in-One LED Display Market Value and Shipment Analysis

-

2023 All-in-One LED Display Player Shipment Ranking vs. Market Share

-

2023-2024(E) All-in-One LED Display Demand Market Analysis

-

All-in-One LED Display Product Overview

-

2024 All-in-One LED / LCD Display Price Analysis

-

2024 All-in-One LED Display Brand Product and Price Analysis

3.2 HDR Market Trend- Virtual Production, Cinema, and Home Theater

-

2023-2024(E) Entertainment & Cinema- LED Video Wall Product Trend

-

Virtual Production Market Strength Analysis

-

Virtual Production Application Market Analysis

-

2023-2024(E) Virtual Production LED Display Market Scale Analysis

-

2022-2023 Virtual Production LED Display Player Revenue Ranking

-

2024 Virtual Production LED Display Product Specification Overview

-

Virtual Production LED Display Product Specification Analysis

-

Virtual Production Case Study Analysis

-

Virtual Production Market Landscape Analysis

-

Premium Cinema- Definition vs. Policy Support

-

Cinema LED Display- Market Opportunities and Challenges

-

Cinema LED Display Specification Analysis

-

2018-2024 Cinema LED Display Player Progress Analysis

-

2018-2024 Global Cinema LED Display Market Scale

-

Home Theater Application Market Definition

-

Home Theater Market Trend- LED Video Wall vs. Projector Market Scale, Specification and Price

-

Home Theater Market Opportunities and Potentials

-

2024 Home Theater LED Display / TV Brand Price

3.3 LED Rental Display Market

-

LED Rental Display Market Applications

-

2024-2028 LED Rental Display Market Scale Analysis

-

2023 LED Rental Display Player Revenue Ranking vs. Market Share

-

LED Rental Display Specification Analysis

-

LED Rental Display Specification Requirement

3.4 LED Outdoor Display Market

-

LED Outdoor Display Application Market Overview

-

2024-2028 LED Outdoor Display Market / 2023-2024(E) Application Analysis

-

P1.2-P10 LED Outdoor Display Specification Definition

-

2024 P1.2-P10 LED Outdoor Display Price Analysis

-

LED Outdoor Fine Pitch Display Application Market Analysis

-

LED Outdoor Fine Pitch Display Specification Overview

-

LED Outdoor Fine Pitch Display Specification Analysis

-

2024 Outdoor Display LED Specification and Price Survey

-

Glasses-Free 3D Display Product Overview

-

The Sphere

-

Appendix: ePaper Outdoor Display Market

Chapter IV. LED Video Wall Market Price and Cost Analysis

-

LED Video Wall Market Price Survey- Methodology and Definition

-

2024-2025(E) LED Video Wall Price Analysis

-

2024-2025(E) P2.5 LED Video Wall Price Analysis

-

2024-2025(E) P1.9 LED Video Wall Price Analysis

-

2024-2025(E) P1.5-P1.6 LED Video Wall Price Analysis

-

2024-2025(E) P1.2 LED Video Wall Price Analysis

-

2024-2025(E) P0.9 LED Video Wall Price Analysis

-

2024-2025(E) P0.7-P0.8 LED Video Wall Price Analysis

-

2024-2025(E) P0.625 LED Video Wall Price Analysis

-

2024 4K LED Video Wall / TV Price

-

2024 P1.68 LED Video Wall Cost Analysis

-

2024 P1.26 LED Video Wall Cost Analysis

-

2024 P0.9375 LED Video Wall Cost Analysis

-

2024 P0.84 LED Video Wall Cost Analysis

-

2024 P0.78 LED Video Wall Cost Analysis

-

2024 P0.625 LED Video Wall Cost Analysis

Chapter V. LED Video Wall Player Strategies

-

Global LED Video Wall Player List

-

LED Video Wall Player’s ODM/OEM Supply Chain Analysis

-

≤P1.0 Ultra-Fine Pitch Display Player Progress Analysis

-

LED Video Wall Player Product Strategy and Sales Performance

Samsung Electronics

LG Electronics

Sony

BOE

Leyard

Unilumin

Absen

Liantronics

Ledman

Qiangli Jucai

INFiLED

CVTE / MaxHub

HCP

Cedar

AOTO

CREATELED

Hikvision

Dahua

GKGD

Cai Liang

Sansi

LP Display

MTC

CSOT

Daktronics

Chapter VI. Display LED Market Trend and Product Analysis

6.1 Indoor Fine Pitch Display LED Product Analysis

-

Display LED Product Application Market

-

Fine Pitch Display LED Technology Overview

-

2024-2025 Display LED Technology Trend

-

Display LED Technology Analysis- MiP / COB / 4-in-1 Mini LED

-

MiP (0202 / 0404 LED) Pros and Cons Analysis

-

2023-2024(E) Mini LED Video Wall Player Capacity Ranking

-

Virtual Resolution- Principle

-

Virtual Resolution- Solution Analysis

-

Virtual Resolution- Cost Analysis

-

Virtual Resolution- Controller Requirement

-

Virtual Resolution- Market Landscape Analysis

-

Virtual Resolution- LED Video Wall Specification / Price Analysis

6.2 Display LED Market Trend and Analysis

-

2024-2028 Display LED Market Value Analysis

-

2024-2028 Display LED Market Volume Analysis

-

2024-2028 Display LED Market Value Analysis- Incl. Micro/Mini LED

-

2024-2028 ≤P2.5 Display LED Market Value- LED Product Analysis

-

2024-2028 ≤P1.0 Display LED Market Value- LED Product Analysis

-

2021-2024 Display LED Price Trend- SMD LED / MiP (0202 / 0404 LED)

-

2021-2024 Display LED Price Trend- 4-in-1 Mini LED

-

2021-2024 Display LED Price Trend- RGB Mini LED Chips

-

2022-2023 Display LED Chip Player Revenue Ranking

-

2022-2023 Display LED Package Player Revenue Ranking

Chapter VII. Driver IC Market Trend and Player Strategies

-

2024-2028 LED Display Driver IC Market Value / Shipment Analysis

-

2022-2024(E) LED Display Driver IC Player Revenue Ranking

-

2022-2023 LED Display Driver IC Player Revenue Market Share Analysis

-

2022-2024(E) LED Display Driver IC Player Shipment Ranking

-

2022-2023 LED Display Driver IC Player Shipment Market Share Analysis

-

2023-2024(E) Common-Cathode Driver IC Market Penetration Rate Analysis

-

LED Display Driver IC Product Trend vs. Specification Summaries

-

2023-2024 LED Display Driver IC Price Survey

-

Driver IC Player Revenue Performance and Product Analysis

Macroblock

Chipone

Xm-Plus

Novatek

Developer

SHIXIN

Sunmoon

Fine Made

Chipfountain

Appendix. Pro A/V System Integrator / Distributor (Dealer) List

-

North America- Pro A/V System Integrator List

-

North America- Pro A/V Distributor (Dealer) List

-

EMEA- Pro A/V System Integrator and Distributor (Dealer) List

-

APAC- Pro A/V System Integrator and Distributor (Dealer) List

-

China- LED Video Wall Distributor (Dealer) List

|

If you would like to know more details , please contact:

|