According to the latest report by the LEDinside research division of TrendForce, titled 2020 Mini LED Next-Generation Display Technology and Supply Chain Analysis, as Apple pushes forward the development of Mini LED backlight technology, the company is expected to incorporate Mini LED backlight technology to improve the performance its existing products such as the iPad and Pro Display. The application of Mini LED backlight technology is expected to reach 18% penetration rate in the overall market for IT products in 2025.

TrendForce Assistant Research Manager Max Chen indicates that LED companies are currently in the process of CAPEX expansion. For instance, the Mini LED chip production capacity in the Taiwanese market is expected to reach more than 10 billion chips per month by the end of the year. The massive expansion of the LED industry has also stimulated a corresponding surge in the peripherals market, which benefits both existing and newly developed LED process equipment.

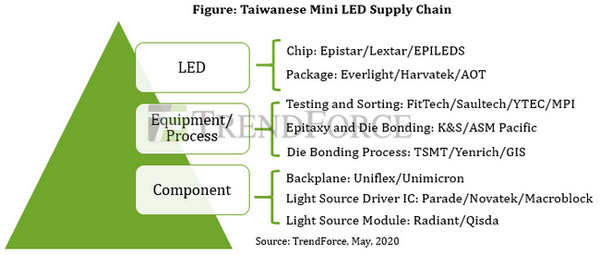

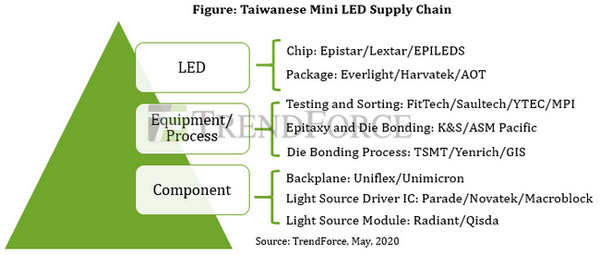

The Taiwanese Mini LED supply chain can be examined in terms of three segments: LED light source, equipment/process, and components. With regards to the LED light source segment, LED chip suppliers include Epistar, Lextar, and EPILEDS. Some LED package suppliers, such as Everlight, Harvatek, and AOT, are aiming to enter the Mini LED backlight market by leveraging their existing die bonding production lines or providing Mini LED packages.

With regards to the equipment and process segment, due to the high variance in specifications such as wavelength and other electrical characteristics in LED epitaxy production, suppliers must rely on extensive testing and sorting processes to ensure that the LED chips produced have a high degree of consistency. In addition, given the sharply rising demand for Mini LED chips, suppliers’ testing and sorting capacities have become critically important. At the moment, the primary Taiwan-based suppliers of testing and sorting equipment are FitTech, Saultech, and YTEC. In particular, FitTech has built a reputation of producing highly accurate equipment, in turn attracting OEM orders from Mini LED chip suppliers. FitTech occupies more than 80% share in the Mini LED testing and sorting market in Taiwan. As well, since the Mini LED die bonding process requires equipment with high speed and high accuracy, surface-mount technology solutions provider TSMT has procured high-speed die attach equipment from Kulicke & Soffa in response to large-scale, high-spec OEM orders from Apple.

With regards to the LED component segment, representative backplane suppliers include Uniflex and Unimicron, while light source driver IC suppliers include Parade, Novatek, and Macroblock. The primary light source module houses are Radiant and Qisda. Although these components have existed since the traditional LED backlight era, the rise of Mini LED backlight technology means clients are placing a higher demand on both component cost and technical specifications, in turn creating new challenges and opportunities in the LED component market.

Nonetheless, the current worldwide pandemic situation means future developments in the market for end devices remain highly uncertain. Brands are therefore looking to increase their R&D spending to improve their product specifications, in turn incentivizing the public’s willingness to purchase. At the same time, brands’ R&D efforts may also prompt midstream and upstream vendors in the Mini LED supply chain to upgrade their current technology and seek continual technical breakthroughs in order to meet the brands’ demand for new product developments.

2020 Mini LED Next-Generation Display Technology and Supply Chain Analysis

Release Date: April 30, 2020

Format: PDF

Language: Traditional Chinese / English

Pages: 120

Chapter I. Mini LED Definition and Market Size Analysis

- Mini LED Chip Size Definition

- Mini LED Backlight Display Architecture

- Mini LED Self-emitting Display Architecture

- 2020-2025 Mini LED Production Value Analysis and Forecast

- 2020-2025 Mini LED Production Volume Analysis and Forecast

- 2020-2025 Mini LED Display Penetration Rate Forecast

Chapter II. Mini LED Backlight Display Development Trend

- Mini LED Backlight Display Product Overview

- Product Positioning Analysis- Display Effect

- Product Positioning Analysis- Reliability

- Product Positioning Analysis- Cost Competitiveness

- Mini LED Applications- Cost Analysis of Different Display Light Sources for Tablet

- Mini LED Applications- Tablet Backlight Display Cost Analysis

- Mini LED Applications- Tablet Backlight Display Shipment Volume and Competitiveness Analysis

- Mini LED Applications- Cost Analysis of Different Display Light Sources for NB

- Mini LED Applications- NB Backlight Display Cost Analysis

- Mini LED Applications- NB Backlight Display Shipment Volume and Competitiveness Analysis

- Mini LED Applications- Cost Analysis of Different Display Light Sources for MNT

- Mini LED Applications- MNT Backlight Display Cost Analysis (Passive Matrix)

- Mini LED Applications- MNT Backlight Display Cost Analysis (Active Matrix)

- Mini LED Applications- MNT Backlight Display Shipment Volume and Competitiveness Analysis

- Mini LED Applications- Cost Analysis of Different Display Light Sources for Automotive Display

- Mini LED Applications- Automotive Backlight Display Cost Analysis

- Mini LED Applications- Automotive Backlight Display Shipment Volume and Competitiveness Analysis

- Mini LED Applications- Cost Analysis of Different Display Light Sources for TV

- Mini LED Applications- TV Backlight Display Cost Analysis (Passive Matrix)

- Mini LED Applications- TV Backlight Display Cost Analysis (Active Matrix)

- Mini LED Applications- TV Backlight Display Shipment Volume and Competitiveness Analysis

Chapter III. Mini LED Self-emitting Display Development Trend

- Mini LED Self-emitting Display Product Overview

- Mini LED Applications- LED Digital Display Cost Analysis

- Mini LED Applications- LED Digital Display Shipment Volume and Competitiveness Analysis

Chapter IV. Mini LED Component Supply Chain and Challenges

- Mini LED Technology Process Overview

- LED Light Source Development Trend

- Mini LED Self-emitting Packaging Type Classification

- Mini LED Backlight Packaging Type Classification

- Manufacturing process of Mini LED component technology

- Mini LED- LED Chip Process Cost Analysis

- Analysis on Mini LED component technology and its challenges

- Analysis on Mini LED packaging technology and its challenges

- Analysis on Mini LED component supply chain

- Analysis on major Mini LED epitaxy and chip suppliers- Epistar

- Analysis on major Mini LED epitaxy and chip suppliers- San’an Optoelectronics

- Analysis on major Mini LED epitaxy and chip suppliers- HC Semitek

- Analysis on major Mini LED epitaxy and chip suppliers- Lextar

- Analysis on major Mini LED epitaxy and chip suppliers- Seoul Semiconductor

- Analysis on major Mini LED packagers- Everlight

- Analysis on major Mini LED packagers-ProLite Opto

- Analysis on major Mini LED packagers- NationStar

- Analysis on major Mini LED packagers- Refond Optoelectronics

- Analysis on major Mini LED packagers- Harvatek

- Mini LED Probing and Sorting Technology Bottleneck Analysis

- Mini LED Probing and Sorting Supply Chain Analysis

- Analysis on Mini LED SMT technology key players- SAULTECH

- Analysis on Mini LED SMT technology key players- YTEC

- Analysis on Mini LED SMT technology key players- FitTech

Chapter V. Mini LED SMT technology supply chain and challenges

- Mini LED SMT technology process

- Mini LED- SMT Processing Cost Analysis

- Analysis on bottlenecks of Mini LED SMT technologies

- Analysis on Mini LED SMT transfer supply chain

- Analysis on Mini LED SMT technology key players- ASM

- Analysis on Mini LED SMT technology key players- K&S

- Analysis on Mini LED SMT technology key players- Rohinni

- Analysis on Mini LED SMT technology key players- CyberOptics

- Analysis on Mini LED SMT technology key players- TSMT

- Analysis on Mini LED SMT technology key players- Yenrich Technology

Chapter VI. Mini LED Drive and Backplane Technology Bottleneck and Supply Chain Analysis

- Mini LED Drive and Backplane Technology Flow

- Mini LED PCB Process Cost Analysis

- Mini LED Drive IC Cost Analysis

- Mini LED Passive Matrix Classification

- Mini LED Drive Technology Bottleneck Analysis

- Mini LED Drive Technology Supply Chain Analysis

- Mini LED Drive Technology Manufacturer Analysis- Macroblock (Self-emitting Application)

- Mini LED Drive Technology Manufacturer Analysis- Macroblock (Backlight Application)

- Mini LED Drive Technology Manufacturer Analysis- CHIPONE

- Mini LED Drive Technology Manufacturer Analysis- Backlight- Novatek

- Mini LED Drive Technology Manufacturer Analysis- Backlight- Parade

- Mini LED Backplane Technology Bottleneck Analysis

- Advantages of Mini LED with PCB Backplane

- Challenges of Mini LED with PCB Backplane

- Advantages of Mini LED with Glass Backplane

- Challenges of Mini LED with Glass Backplane

- Mini LED Backplane Technology

- Mini LED Driver Backplane Technology Trend

- Mini LED Backplane Technology Supply Chain Analysis

- Mini LED Backplane Technology Manufacturer Analysis- PCB Manufacturer- Uniflex

- Mini LED Backplane Technology Manufacturer Analysis- Panel Manufacturer- AUO

- Mini LED Backplane Technology Manufacturer Analysis- Panel Manufacturer- Innolux

- Mini LED Backplane Technology Manufacturer Analysis- Panel Manufacturer- BOE

- Mini LED Backplane Technology Manufacturer Analysis- Panel Manufacturer- CSOT

- Mini LED Backplane Technology Manufacturer Analysis- Panel Manufacturer- Tianma

Chapter VII. Mini LED Regional Manufacturers’Layout and Competition Situation Analysis

- Mini LED Backlight Supply Chain Analysis

- Global Main Mini LED Makers’Supply Chain Analysis

- Regional Manufacturers Development Dynamics Analysis--Taiwan Makers

- Regional Makers’Development Dynamics Analysis--Mainland Chinese Makers

- Regional Makers’Development Dynamics Analysis--Japanese and Korean Makers

- Regional Makers’Development Dynamics Analysis--Euramerican Makers

Chapter VIII. Analysis on Development Dynamics of Mini LED Key Makers

- List of Display Technologies in Brand Makers’ Products-Apple

- Analysis on Mini LED Development Dynamics of Brand Makers-Apple

- Mini LED Supply Chains of Brand Makers-Apple

- List of Display Technologies in Brand Makers’ Products--Samsung

- Analysis on Development Dynamics of Brand Makers--Samsung

- Mini LED Supply Chains of Brand Makers--Samsung

- List of Display Technologies in Brand Makers’ Products-LG

- Analysis on Development Dynamics of Brand Makers-LG

- Mini LED Supply Chains of Brand Makers-LG

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|

CN

TW

EN

CN

TW

EN