LEDinside: LED Perspective from B.J. Lee, Chairman of Epistar

Epistar is a Taiwan-based professional LED chipmaker. In recent years, it has been quite active with a series of M&A and joint-venture strategies, making it the leader of Taiwan chipmakers. LEDinside is privileged to have invited B.J. Lee, its chairman to share Epistar’s business experiences and strategies.

M&A Strategy: to Reduce the Risk of Excess Capabilities and to ProvideComprehensive Solutions for LED Chip Design

In terms of M&A policies, Epistar has different tasks and targets in various stages, not all based on the consideration of economic scale. It is the technology that is taken into account when initially merging with the United Epitaxty Co. (UEC). Because UEC had entered red LED business earlier, the M&A decision was made considering the technical complementarities among AlGaInP LEDs plus suitable timing. While in the case of new Epistar merging and acquiring Epitech Technology Corp. (ET), both makers with large production capacities were planning to expand facilities at that time. If there had been no M&A, the hidden risks of excess capacity would have been worse. The real decisive factor was that Epistar had accounted for less than 10% of mainland China market while China market counts for 80% of ET’s sales. Thus Epistar hoped to obtain channels and market opportunities through M&A. In light of the latest M&A case of Huga OptotechInc, market segmentation has been under consideration. Epistar expects to increase the Huga brand status with Huga chip’s advantage in good electrostatic discharge (ESD) level and create market segmentation in order to increase its total chip market share or even further to provide one-stop shopping solutions for their clients within the group.

Joint-venture Strategy: Focus on the Outlets to Avoid the Price War

Currently more and more competitors have entered the LED competition by means of the vertical integration model. In this context, Epistar is actively seeking for an outlet through its joint-venture strategy. In addition, Epistar will also extend its customer groups from package makers to system providers and international giants and help customers with ODM (design in) in light of product lines. With regard to serving systems providers as Epistar’s customer management strategy, chip design together with system providers is likely to turn out superior products and boost sales of end application products.This strategy will enable system providers to find suitable package makers or depend on Epistar to provide advice on appropriate package makers. This model has the following two advantages: first, there will be less likely the risk of excess capacity if production is expanded according to the market demand. Second, system providers, who attach importance to product quality, brand image and IPs are willing to pay higher prices. Thus, the vicious circle of price competition is less likelyto be a factor. Epistar’s other customer management strategy is to ODM for international giants, most of which are rivals of industry players with vertical integration models but are able to cooperate with a pure chip supplier.

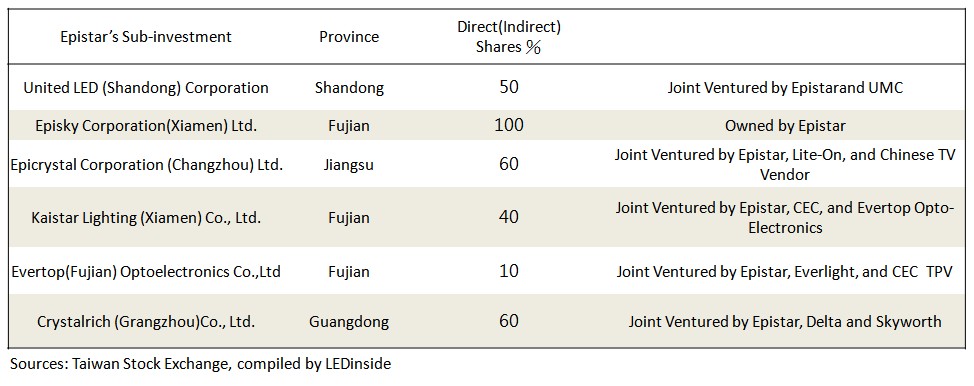

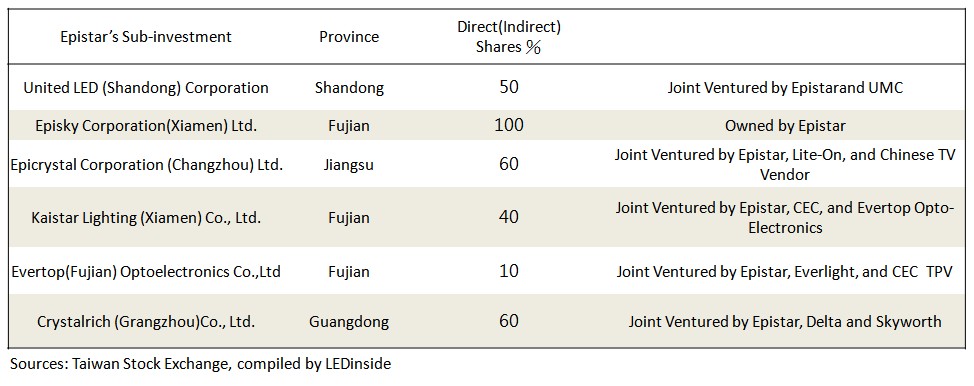

Epistar’s Investment in Mainland China: Chip Supply is As Near As Possible

Consider Evertop Optoelectronics in Fujian as an example. The major shareholders are Everlight Electronics, TPV under China Electronics Corporation (CEC) and Epistar. TPV, which is counted into CEC’s consolidated financial statements in 2008, specializes in producing LCD monitors and TVs and ranks as the largest monitor OEM in the world in addition to the procession of its own brand. In 2010, TPV produced 53 million monitors in total. Some of the backlight sources were with chips from Epistar and packaged and mounted at Everlight into light bar. With that, TPV was able to assemble into BLU and enter the market.

Moreover, Epistar has worked together with LiteOn in Changzhou. LiteOne has set an East-China operation center in Changzhou, Jiangsu Province to offer LED packaging and a variety of other products. Therefore, Epicrystal has become the base nearby to provide LiteOn with LED chips. As for Crystalrich, Epistar’s joint venture with Delta Electronics and Skyworth, has also taken the backlight and lighting market as the decisive factor. In sum, Epistar’s investment in mainland China is aimed at becoming the nearest possible source for the outlet and supply of mid- and downstream materials.

Diversified Investment: to Maintain the Core Technology While Stake Hopes on CPV Technology

Epistar is taking efforts in the development of High Concentration Photovoltaic (HCPV) solar cells. It is hoped that Epistar’s supply of chips after being packaged will be shipped to module makers to produce HCPV solar modules and systems. Epistar has achieved 39% solar energy conversion efficiency at present. With MOCVD use and technical improvement of the same core technology, Epistar remains in the role of a epiwafer or chip supplier.

LED Market Outlook: With Backlight Market Penetration Rate Higher Than Expected, LED Lighting Market Demand to Quickly Take Off

In 2010, large-sized LED backlight penetration rate rapidly soared to nearly 20%. LEDinside indicated that the penetration rate of LED backlight for LCD TVs will rise to 40~50% in 2011. It indicates that the average penetration rate is likely to rise to 60%~70% in 2012 and to nearly 80% by the end of 2012 when the growth of LED backlight will slow down. Hence, it is necessary for LED lighting demand to catch up so that the performance growth can offset the speed of declining prices.

Thus, LED lighting demand needs to take off in 2013. In the short term, replacement and commercial lighting are the fastest-developing areas. In view of commercial lighting, approximately twelve-hour use a day enables quicker cost payback in comparison with residential products. Nevertheless, the requirement for the product level is also tougher。

In the outlook for LED backlight product specifications, from the initial 0.15W per unit to the current 0.5W, the current trend indicates that LED backlight specifications will come close to those of LED lighting and 1W per unit is likely to occur in the future. Currently, the development of high power LED products has met some challenges: the luminous efficacy drops when current density goes high; temperature control and thermal management in packaging; IP barriers. Thus the rapid development of LED lighting depends on efforts of all parties. In light of the goal set by the Department of Energy, USA, LED package will fall to 500 lm/$, equivalent to USD2/Klm and the retail price of 800-1,000lm LED light bulbs willreduce to less than USD 10 in the market and we will see the parity of LED and CFL lights. As the current retail price is about USD 40, reaching a widely acceptable price and quality will become the common goal for all LED industry players.

From our observation of LED upstream materials, excess capacity may occur with current MOCVD number especially after Chinese makers have purchased a greater quantity of MOCVDs. However, whether all these MOCVDs will be put into the mass production is still questionable. In the short term, the demand and supply of sapphire substrate is subject to the MOCVD use of Chinese LED makers. In terms of current demand and supply, the contract price of materials is trend-down season by season so it will finally return to the balance in the long term. Regarding MO sources whose supply was the tightest in 2010, raw materials makers are expanding facilities in response to the market demand, it is unlikely that there will be the same undersupply as in 2010.

Long-term Target: As AProfessional Chip Supplier to Have a Share in the Lighting market

In light of the rapid LED growth and increasing competitors in the field, Epistar, with its capacity scale and technology ability, expects to be able to provide downstream package makers with products of the best price/performance ratio and become partners with system providers and international giants. Furthermore, Epistar expects to play a major role in the backlight and lighting market as well.

CN

TW

EN

CN

TW

EN