Amphenol LTW provides connectors for marine electronics, industrial automation, machine vision, horticulture lighting, LED lighting and video walls, heavy-duty machinery, servers and many other applications. With over 300 global patents, the company designs, manufactures, and customizes a wide range of waterproof connector solutions for harsh and rugged environments, along with solid partnerships with lighting giants such as Signify and GE. LEDinside had the honor to interview Charles Wu, the Global BD Director at Amphenol LTW, to share some insights into the market trends in LED horticulture lighting based on his extensive experience.

Trends in the Horticulture Lighting Market

“In the fourth quarter of 2023, there was a slight uptick in horticulture lighting, with signs of orders returning. There are mainly two points worthy of observation: one being the resurgence in lighting fixture orders, and the other being sustained procurement of LEDs. There is a noticeable increase in the procurement of two types of LEDs, one being the far red LEDs and the other being the high-power white LEDs. The use of high-power white LEDs, besides general lighting, is primarily for agricultural lighting. In recent years, the use of high-power white LEDs in general lighting has decreased, mainly due to pricing becoming less competitive. We have observed a certain growth in shipments in this aspect, leading us to assume that the LED demand in agricultural lighting is growing.” Wu shared his insights on the pulse of the horticulture lighting market.

What are the reasons behind the recent growth in the procurement of horticulture lighting products? Wu believes that the recovery is not simply the replenishment demand in the downstream segment, but rather a certain degree of sustained demand returns, and he provided the rationale behind this assumption.

Momentum for Rapid Development of Plant Factories in 2024

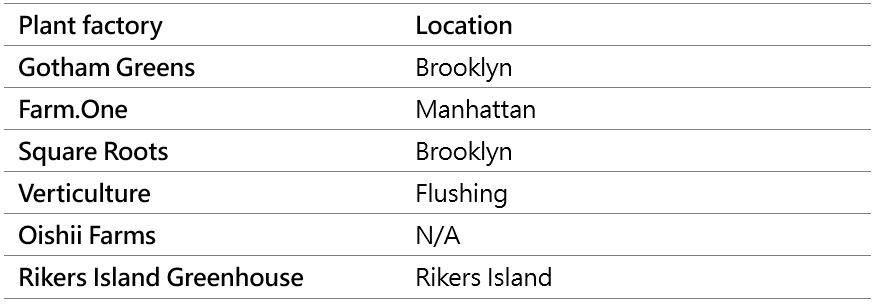

"We can see that in the first half of 2024, the market demand for agricultural lighting in North America mainly comes from vertical farms, no longer the greenhouses. It’s not the large-scale vertical farms, but rather smaller ones. Lighting accounts for less than 20% of the construction costs in vertical farming, with the majority of the investment going into hardware equipment, particularly automation systems. Due to the high capital expenditure and long return on investment cycle for large projects, projects worth from tens to hundreds of million dollars have been cancelled. By contrast, mid- and small-scale vertical farms are thriving for two reasons: first, they require smaller investments and generate returns faster, with consistent government support. Second, from a production perspective, mid- and small-scale farms offer higher flexibility and can be established on the outskirts of major cities. By collaborating with large supermarkets, they can provide crops tailored to local needs, enabling rapid monetization with lower investments and quicker returns, making them increasingly attractive for investors.”

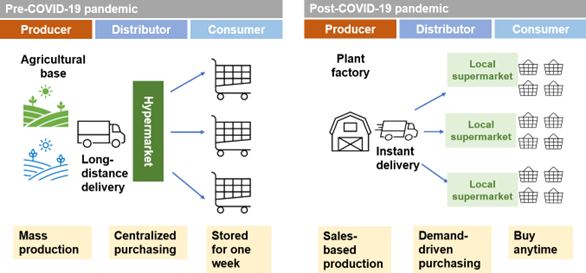

“Another key change post-pandemic is the shift in consumer behavior. While large retailers like Walmart used to dominate the US market, there is now a growing emphasis on smaller community stores. Even giant retailers increasingly value these stores. Consumers are less price-sensitive and prefer buying fresh produce at smaller stores. Although the logistics costs for these community stores are higher, suburban plant factories that can provide local supply have a competitive advantage considering factors like time and delivery efficiency, leading to an increase in demand. Overall, we see growth in this sector.”

Fig. 1 Consumer behavior has largely changed in North America

Data source: Charles Wu; summarized by LEDinside

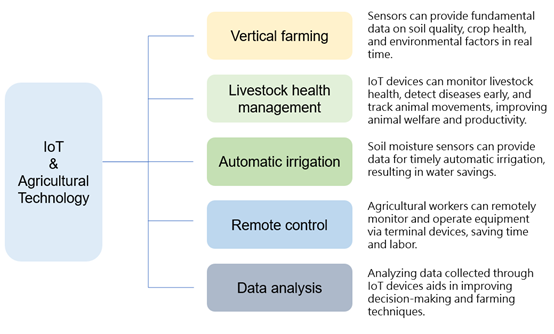

“For example, there is a vertical farm in the outskirts of New York City, which specializes in supplying fresh fruits and vegetables to the city. This six-floor structure used to be an arena, accounting for a total of around 2,000 square meters. The farm is able to generate $200,000-300,000 every month with only 10 staff, demonstrating extremely good profitability. Indeed, the facilities inside adopt state-of-the-art technologies from automation to AI. The number of regular racks are only one third of that in a conventional farm, while vertical growing racks account for the majority. The configuration allows robots to pick produce more easily. There are many similar mid- and small-scale indoor farms like this, and they are all quite profitable.”

Fig. 2 A plant factory located at the outskirts of New York City

Credit: fluence-led, farm.one

"With this trend going on, we're seeing a lot of light fixtures getting standardized. The length, width, brightness, all that stuff. It's because the small and medium-sized manufacturers don't want to design their own fixtures. They just want to put them into operation faster and shorten the investment cycle. In the past, companies could wait for fixtures to be delivered slowly, but now there's no time to wait. They're looking for standardized fixtures to quickly get the installations done. This might end up giving a big advantage to leading luminaire manufacturers, while some of the smaller ones or those at the back of the pack might get left behind. This trend towards standardization could also lower the entry costs for mid- and small-scale vertical farms, further expanding the use of standardized devices."

Fig. 3 Typical plant factories in New York City

Data source: Charles Wu, COE; summarized by LEDinside

Regarding long-term growth of plant factories, Wu believes that companies have found the right business model after going through trial and error in the early stages. Currently, mid- and small-scale vertical farms have undoubtedly proven to be a viable model after surviving market competition. Moreover, various factors are conducive to promoting the widespread adoption and penetration of this model.

Vertical farms Are More Promising than Greenhouses in the Long Run

Vertical farming and greenhouse cultivation are currently the two main forms in plant factories, each having its own advantages. Wu decisively aligns himself with the future of vertical farming and shared his reasoning behind this preference with LEDinside.

“From what we see now, the demand for lighting in vertical farms may not be as high as in greenhouses because greenhouses have a large existing stock. However, such demand in vertical farms may surpass greenhouses in the future. Greenhouses have a clear limit as they are just retrofitted structures. On the other hand, vertical farms have almost no constraints for future growth and are likely to become the primary form of plant factories. The biggest issue with greenhouses is that they are flat and rely on sunlight for nutrient supplementation, so their use is greatly restricted.”

“The controllability of vertical farms is much better, especially with the concept of automation. In fact, the hardware is never a problem; the software is more critical. For instance, in terms of crop conversion rate, vertical farms have a significant advantage. They can easily switch between different varieties, adjust formulas immediately, change production modes quickly, and expedite shipments. For investors in this industry, the advantages of flexibility and controllability will undoubtedly be taken into consideration. All of these align with the trend towards IoT, and all these connections are in line, even with future industrial automation trends like Industry 4.0 and potentially 5.0. Thus, it is definitely a mainstream feature, with many more intelligent technologies likely to be applied in the future. On the other hand, greenhouses have more limitations. Although they also have the said potential, greenhouses tend to offer fewer opportunities to leverage.”

Based on insights into the general development of agricultural technological advancement, Wu firmly believes in the undeniable prospects of vertical farms surpassing greenhouse structures. The fundamental transformation of agricultural development models by AI and modern technology is underway, and it may not be long before his assumption is verified.

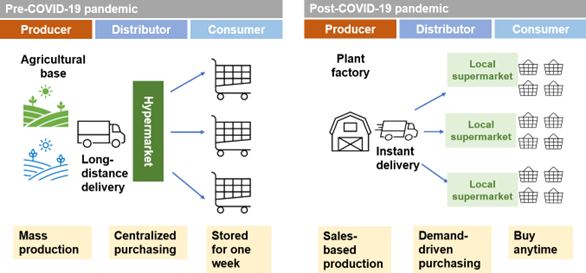

Influence of IoT on Technological Advancement in Agriculture

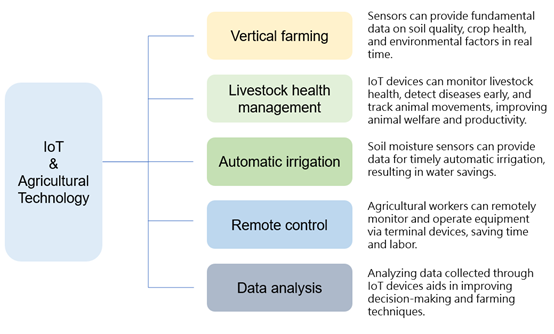

Wu highly expects that IoT and industrial automation can provide assistance for agriculture. The integration of IoT with agriculture has brought about more efficient and productive agricultural operations. For instance, using smart sensors to monitor soil moisture levels and environmental conditions helps optimize irrigation and fertilization plans, leading to water conservation and healthier crop growth. Cameras running on tracks detect the appearance of crops, and then promptly transmit data to enable analysis of crop growth status and adjust spectral formulas accordingly.

Not only during the process of crop growth, but also from an operational perspective, the implementation of IoT in supply chain management helps in real-time tracking of agricultural products from the farm to the market, ensuring quality and reducing waste. These IoT applications significantly enhance agricultural operational efficiency and contribute to sustainable agricultural practices.

Fig. 4 IoT will shape the future of agriculture

Data source: Charles Wu, Ambitas; summarized by LEDinside

Some of Wu’s clients are startups that are attempting to integrate IoT systems and AI algorithms to optimize the operations of agricultural systems including vertical farming. This is a sector that did not exist in the past, but has found opportunities for development within the advancement of agricultural technology. These agricultural practices that have incorporated modern technology have already revolutionized people’s perceptions of agriculture.

Some Highlights of Other Markets

From a regional market perspective, at the beginning of 2018, cannabis became a driving force that propelled the horticulture lighting market, but the US cannabis cultivation market has lost its dominance in recent years, giving way to the rise of the European market. The legalization of recreational cannabis use in Germany in 2024 is bound to drive related industries, and the demand for horticulture lighting required for cannabis cultivation will usher in a new wave of market opportunities

In addition, the market for greenhouse horticulture lighting in China cannot be ignored. There is a significant demand for horticulture lighting in Shandong and Central China. Due to the lack of relevant data for reference, it is difficult to estimate the exact market size, but the total output is likely not lower than that of Europe and North America.

The development of vertical farming in Southeast Asia is another highlight. As local vertical farms grow vegetables and fruits at temperate climate, they have capitalized on the advantages of local supply to save on import and transportation costs, offsetting the high production costs of plant factories. More industry players are recognizing the business opportunities, with new plant factory projects being launched in Singapore, Malaysia, and Thailand. Local governments are also placing considerable emphasis on promoting agricultural technology, including horticulture lighting, to diversify the variety of locally supplied fruits and vegetables.

Latest Solutions for Smart Agriculture

From the perspective of smart agriculture, whether it is the integration and combination of sensors, cameras, and AI, or the automation, unmanned operation, and electrification of large farms, Amphenol LTW offers high-efficiency, high-quality products that engage in these advancements. In terms of wire harness technology upgrades, there has been an increase in the demand for products with single interface and multiple transmission functions, such as connectors for simultaneous power and data transmission, for which Amphenol LTW also provides relevant products. Particularly in waterproofing, Amphenol LTW has a significant advantage and has introduced new products tailored to the UL8800 specifications. “Connectors themselves are primarily the link between power and signals. Amphenol LTW offers diversified choices, quick plug-and-pull, high-power connectors, and are certified by standards adopted in the European and American markets (UL/CUL/TUV/VDE),” stated Wu.

Conclusion

As the head of the connector and lighting applications division at Amphenol LTW, Wu has been actively involved in the efforts of numerous well-known clients to advance the development of the horticulture lighting market. Leveraging his extensive experience and unique insights, Wu sincerely shared his in-depth perspectives on the trends in horticulture lighting development, aiming to draw attention from industry to the forefront of this market. The data compiled and summarized by LEDinside are offered for reference only.

TrendForce 2024 Global LED Lighting Market Analysis

Release Date: 01 February / 31 July 2024

Language: Traditional Chinese / English

File format: PDF and EXCEL

Number of pages: 100 (in each publication)

|

If you would like to know more details , please contact:

|