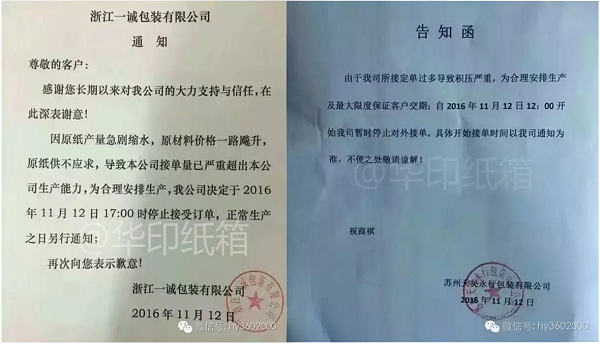

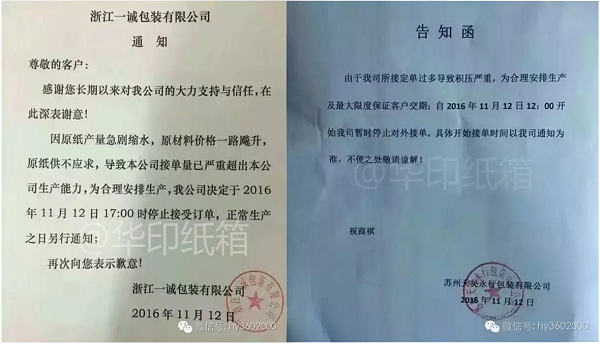

Since early November, many Chinese carton factories began to reject new orders or restrict orders. The situation has been ongoing till now, with factories in Jiangsu, Zhejiang and Shanghai areas responded the most. As many as 18 local large and medium-sized carton factories issued emergent notices of the rise in price on the single day of November 12. Paper suddenly became in short supply. Carton factories couldn’t buy base paper even with cash in hand, causing a chain reaction of the entire manufacture industry.

|

|

Official announcements from carton factories regarding the rise of paper price and deadline for taking new orders. (Photo credit: WeChat: hy3602000) |

Buyers could see not only the price of cardboard paper and corrugated paper rise sharply since July, 2016, but also that of coated duplex board with grey back increases by 50-200RMB per ton. The rising wood pulp and paper prices inevitably flow on to paper-based packaging products and services, thus directly influenced B2B buyers and manufactures. Businesses who are very sensitive and responsive to market shifts have already put down big orders to carton factories to hedge against this fluctuation, at the same time, lock down carton factories’ production capacity for themselves.

This situation is predicted to continue for a period of time, causing broad price fluctuations in December and January. As Chinese gears up for Chinese New Year during Jan. 28th to Feb. 3rd, 2017, the robust demand and the usual insufficient factory production capacity will lead to additional price hikes of products.

For troubled buyers, how to counteract the price rises on paper and packaging material? You could definitely plan ahead, check inventory, estimate the turnovers from retail channels and adjust your purchase plan accordingly. A smart move now is to order early to guard against increased costs later on.

Shanghai Wellmax Lighting Industry has launched a campaign to address the problems buyers usually have during this season. The Fast 20 Challenge campaign shortened the lead time for the most popular 9W LED bulbs to 20 days. This campaign aims to help overseas buyers to effectively prepare 2017 Q1 inventory plan before everything gets hectic in January due to the CNY. Now facing the added challenge of the rise in packaging price, buyers should act immediately to minimize risks of incurring more cost and time for future orders.