(Author: Skavy Cheng, Editor, LEDinsidehttp:// Translator: Judy Lin, Chief Editor, LEDinside)

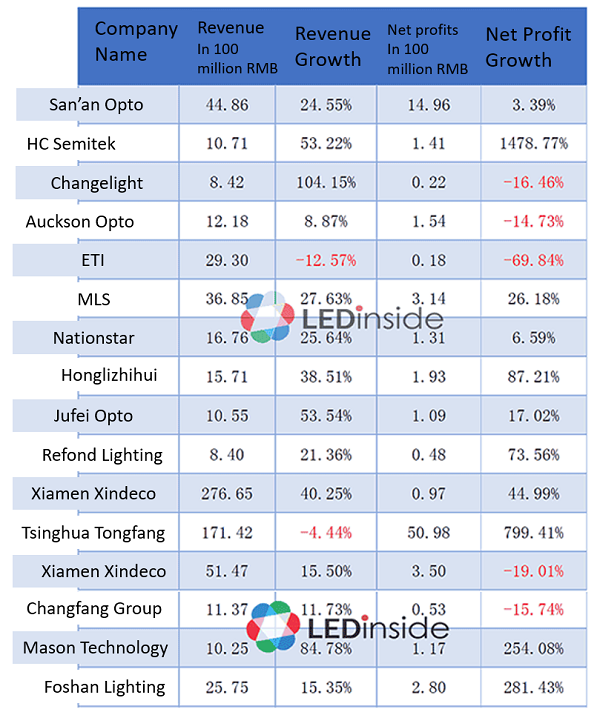

After numerous LED manufacturers forecasted their future earnings, Chinese LED enterprises finally released their financial results for 3Q16. For those with irrational fear that the LED industry is still in the phase of “increasing revenues but stagnant profits,” LEDinside has collected third quarter earnings from 32 LED companies for further evaluation of the credibility of market claims about current development.

Data collected from 32 LED manufacturers by LEDinside indicated 29 had shown revenue growth, while three including Lens Technology, Tongfang Lighting, and ETI posted losses. Overall most LED companies delivered solid net profit growth, a majority of 23 companies reported revenue growth but nine declined.

Upstream: San’an Opto and HC Semitek deliver stellar performance

An overview of LED supply chain in China shows, San’an Opto is still the leading manufacturer in the LED chip segment. HC Semitek also delivered strong performance in 2016, mainly due to surging net profits after the company consolidated revenues from Crystaland, in addition the company’s LED business also soared.

Moreover, Changlight also delivered strong performance even though its net profits slid down, its revenue climbed up. However, Changelight has a bright outlook because it is one of the biggest AlInGaP (red) LED chip maker in China, and has very good prospects in the future red light market.

Auckson Opto is a diverse company with many different businesses, but it did not especially list its LED business situation in its third quarter financial results. It can be observed from its financial report from first half of 2016 that profits from its LED business amounted to approximately 19% of its net revenue. Despite its LED revenue for first half of the year dropping 37.12%, the business has rebounded in third quarter to deliver 8.87% revenue growth.

ETI has continued to see its revenue and net profit plummet during third quarter, but considering it has been deploying its market strategy in the flip chip market, the maturing market the prospects of the company remains a positive one.

China’s LED midstream sector delivers excellent performance, Changfang and Mason Technology accelerate transformation

In the LED package sector, Nationstar, Jufei Opto, and Refond Opto revenue and net profit continued an upward climb during the first three quarters of 2016. LED package enterprises have become much larger, and prices are starting to stabilize. LED package manufacturers net profits are steadily rebounding, and LED package manufacturers price uptick initiated by Forest Lighting (MLS) and Nationstar indicate the industry is becoming increasingly concentrated, and enterprises are accelerating expansions.

In contrast to LED package manufacturers that are accelerating their market deployment, such as Nationstar, Jufei Opto, Mason Technology and Honglizhihui, formerly known as Honglitronic, Changfang Lighting is starting to focus on developments in the education sector. The company has established an education fund during third quarter of 2016, and basically completed its digital marketing strategy. Honglizhihui for instance is extending its business scope from LEDs to connected automobiles, and seems to be in the process of acquiring an Internet connectivity technology company Esfast. As these enterprises pick up developments in emerging markets, manufacturers are further deploying their market strategies to lower LED revenue share in future company earnings.

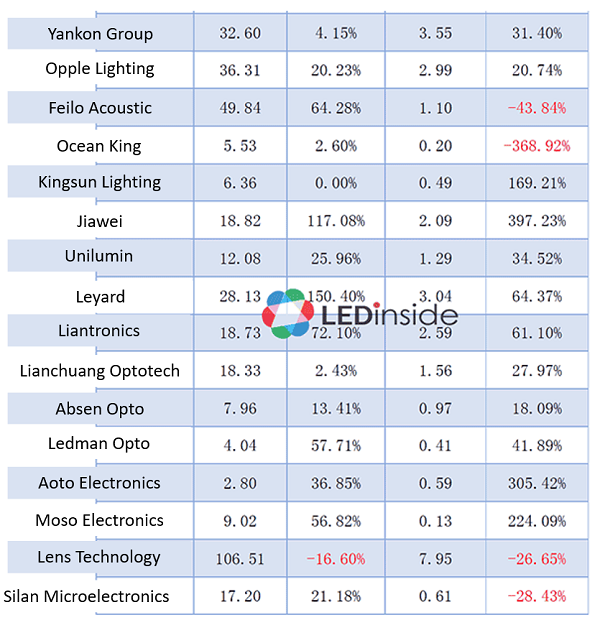

Downstream lighting and display manufacturers performance mediocre

In the end market sector, Opple Lighting, Yankon Lighting and Foshan Lighting are some of the top representatives. Opple Lighting has been successfully listed on the market, and jointly deployed its smart lighting solutions for residential markets, which provides future potential growth.

Foshan Lighting has finally emerged from the shadows of lawsuits, and has transformed its LED business and successfully entered the LED lighting market. The company’s net profits have grown at an accelerated rate of more than 280% in third quarter, while Yankon Lighting has used its spun out LED brand to accelerate its market deployment in the future smart lighting sector. It can be viewed that traditional lighting manufacturers are transforming their business models to accelerate their entry into major distribution channels, and emerging lighting manufacturers are under a lot of pressure, where their distribution channel advantages are becoming less obvious while they gradually switch their businesses.

Meanwhile, OLEDs rapid developments impacted the backlight market, and has forced LED display technology to redefine itself and offer a more flexible design, which explains why micro-LEDs are starting to take the center stage of attention in the industry.

In 2016, LED chip and flip chip applications in the lighting sector reveals large LED enterprises are just becoming larger, while the LED industry is highly concentrated with intensifying market competition. This has caused LED manufacturers to look towards high gross margin markets in LED and non-LED sectors, while the industry is starting to pick up pace, and LEDs are becoming increasingly marginalized.

Note: The table lists 32 LED manufacturers revenue for the first nine months of 2016 and listed net profits reflects listed companies net profits attributable to shareholders. (US $1 is equivalent to RMB 6.76).

CN

TW

EN

CN

TW

EN