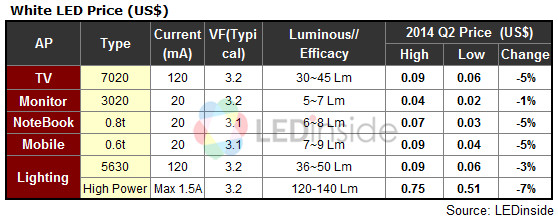

LED price for lighting applications have dropped around 3-7 percent in 2Q14. Similarly, backlight-use LED prices have also seen a decline, dipping around 5-10 percent, with direct-type TV backlight-use LEDs decreasing by 13 percent due to fierce market competition, according to the recent price report from LEDinside, the green energy research division of TrendForce.

Prices of high-power and mid-power lighting-use LEDs continue to show a slight decline this quarter. For mid-power 5630, Korean manufacturers represented by Samsung are still adopting price strategy to seize market share. High-power LED price drops were more dramatic, especially in prices for products with higher brightness (120-140lm), which had a drop rate of 7 percent this quarter. Product line extensions and performance improvements remain the major focus of manufacturers in terms of COB products. At present, lighting manufacturers will only place orders once LED manufacturers have completed under-30W product lines. Backlight order visibility on average has reached 1-2 months, said Jack Kuo, Assistant Research Manager of LEDinside. LED chip and package manufacturers continue to increase utilization rates. Even though LED manufacturers have maintained high utilizations rates, price drops of 10-15 percent each year have impacted revenue and profit. Although booking orders of 3Q14 can be seen, manufacturers have a conservative outlook on expanding production capacity in response to the order demands.

LED manufacturers are hence turning their attention towards developing niche markets and high value-added LED products this year and gradually reduce backlight-use LED product proportion, said Kuo. The niche LED markets that will garner manufacturers’ attention include automotive lighting, flash LED, and UV LED. In terms of high value-added LED products, focus will be on high color gamut backlight-use LED and high CRI lighting-use LED. With the Brazil World Cup right around the corner in June, market demand for large-sized and 4K high resolution TV has increased.

2Q14 Silver+ Member Report

Topic One: 2Q14 Commercial Lighting Market Trend

Global LED Commercial Market Trend Analysis

-

Global LED Commercial Lighting Penetration Rate

-

Major Commercial Lighting Application Fields Analysis

-

Main Commercial Lighting Products Analysis

Europe

-

2012-2018 European Commercial Lighting Market Demand Volume Forecast- Divided by Product

-

Standards of European LED Commercial Lighting Market

-

The Specification and Price of Main European LED Commercial Lighting Products (Tube / PAR38)

-

Main European LED Luminaire Manufacturer’s Strategies (Philips / Osram / Zumtobel)

-

LEDinside Analyses European Lighting Manufacturers Strategy Strengths

North America

-

2012-2018 North American Commercial Lighting Market Demand Volume Forecast- Divided by Product

-

Standards of North America LED Commercial Lighting Market

-

The Specification and Price of Main North American LED Commercial Lighting Products (Troffer / Tube / Panel Light)

-

Main North American LED Luminaire Manufacturer’s Strategies (Cree / GE+Walmart / Philips)

-

LEDinside Analyses Major North American Lighting Manufacturers Strategy Strengths

Japan

-

2012-2018 Japanese Commercial Lighting Market Demand Volume Forecast- Divided by Product

-

Standards of Japanese LED Commercial Lighting Market

-

The Specification and Price of Main Japanese LED Commercial Lighting Products (Tube / Integrated Luminaires)

-

Main Japanese LED Luminaire Manufacturer’s Strategies (Panasonic / Toshiba / Iris Ohyama /KOIZUMI / Rohm / Endo / Mitsubishi)

-

LEDinside Analyses Major Japanese Lighting Manufacturers Strategy Strengths

China

-

2012-2018 Chinese Commercial Lighting Market Demand Volume Forecast- Divided by Product

-

Market Share Distribution of Chinese LED Commercial Lighting

-

The Specification and Price of Main Chinese LED Commercial Lighting Products (Tube)

-

Main Japanese LED Luminaire Manufacturer’s Strategies (Philips / Foshan / Yankon Lighting / NVC Lighting / PAK / OPPLE / MLS Lighting)

-

LEDinside Analyses Major Chinese Lighting Manufacturers Strategy Strengths

Emerging Markets

-

Indian, UAE and African Commercial Lighting Market Status and Outlook

Topic Two: 2Q14 LED TV Backlight and Flash Market Trend

New Generation LED TV To Add Value

-

High Color Gamut TV

-

Secondary Lens To Help Develop Direct Type LED TV

-

TV Brand Vendors Release More Energy Saving Direct Type TV To Gain Subsidies

-

Flip Chip LED Technology To Further Lower Costs

2H13-1H15 TV Backlight LED Roadmap

-

Edge-Type LED TV

-

Direct-Type LED TV

Flash LED

-

Mainstream Flash LED Specification

-

Flash LED Specification And Manufacturer Movement

-

1Q14 Flash LED Price And Supply Chain

-

2013-2018 Flash LED Market Value and Volume Analysis

Contacts

Taipei

Ms. Joanne Wu

Tel: +886-2-7702-6888 ext. 972

E-mail: joannewu@ledinside.com

Ms. Lilia Huang

Tel: +886-2-7702-6888 ext 640

Mobile: +886-972-803801

LiliaHuang@TrendForce.com

Shanghai

Mr. Allen Li

Tel: +86-21-64-399830 ext 608

AllenLi@TrendForce.com

CN

TW

EN

CN

TW

EN