Intense market competition from Chinese manufacturers and deluge of LED suppliers on the market has made cost reducing strategies crucial for LED chip manufacturers’ survival. To cope in an increasingly low profit industry, LED chip manufacturers are developing more advanced and efficient LED chip technologies, finding cheaper chip materials, or exploring untapped niche markets. Representatives from global top LED chip manufacturers Epistar, Osram, Philips Lumileds (Lumileds), and Cree addressed these pressing issues recently at 2015 LED Executive Summit hosted by SEMI at TILS 2015, TWTC Nangang Exhibition Hall.

|

|

Left to right: Yun-Li Lee, CEO, PlayNitride; Walter Chen, General Manager of Marketing, APAC, Cree; B. J. Lee, Chairman, Epistar; Michael Schmitt, APAC Marketing Director, SSL, Osram; Sean Zhou, Marketing Director, Asia Regional, Philips Lumileds. (LEDinside) |

Backlight market outlook remains dim

Finding the next big application market will be increasingly important for traditional backlight LED suppliers, as demands dwindle in this sector. The backlight sector, which remained the largest LED market sector till 2014, has become highly saturated that it will be nearing 0% growth in the next few years, observed Epistar Chairman B.J. Lee. LEDs high market penetration in this sector has left “almost no room for growth,” said Lee. In addition, emergence of quantum dot technology and high power LEDs has reduced LED usage volume in display backlight products. His observation of stagnant market developments in the LED backlight industry was backed by Michael Schmitt, APAC Marketing Director, SSL, Osram, who also agreed backlight market growth was slowing.

Lighting application growth might slow down

Lighting applications has emerged as a popular choice among LED manufacturers in recent years, due to its market growth potential. Based on LEDinside’s estimation, the global LED lighting industry would grow at a Compound Annual growth Rate (CAGR) of 3% per year, due to price erosion from 2015 onwards. Both Lee and Schmitt agreed lighting would eventually replace backlight to become the industry’s main growth driver in the next five years. Schmitt was optimistic the quantity of LED for residential lighting would exceed 50% in the near future, but Lee was less optimistic.

Lee forecasted LED replacement lights would deliver good performance in the next five years, but revenue is expected to come down. LEDs long lifetimes of 20 years or more would reduce the annual global LED retrofit market annual demands from about 12 billion bulbs to an estimated 8 billion bulbs by 2019, indicating the total LED retrofit volume would drop, said Lee.

|

|

Epistar Chairman B.J. Lee speaking to reporters prior to TILS 2015 opening. (LEDinside) |

Moreover, it is increasingly difficult for LED chip manufacturers to profit from light bulbs as backlighting LED technologies are adopted in LED luminaires. “It is possible to buy a light bulb for less than US $10 in the retail market, and export is less than $3,” said Lee. The low costs are made possible from mass production technology found in LED backlight sector, which leads to very low cost package, noted Lee. “LED light bulbs have come down from $30 to $50, to now $ 10 to $15.”

To illustrate, EMC package is driving down bulb prices in 800 lumen LED bulbs, which some Epistar clients told Lee would be selling at $5 on the retail market. This roughly is equivalent of exporting LED bulbs for only $2, said Lee.

Manufacturers need to find alternative markets

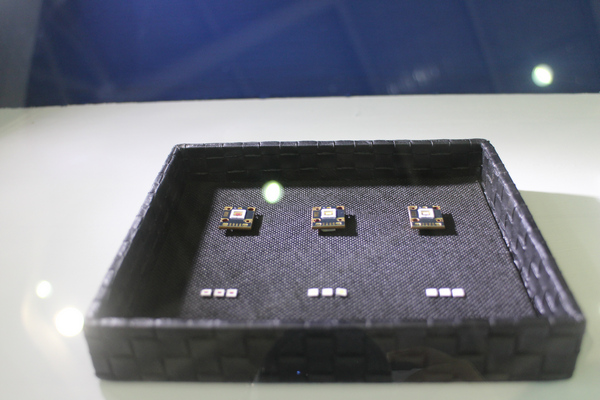

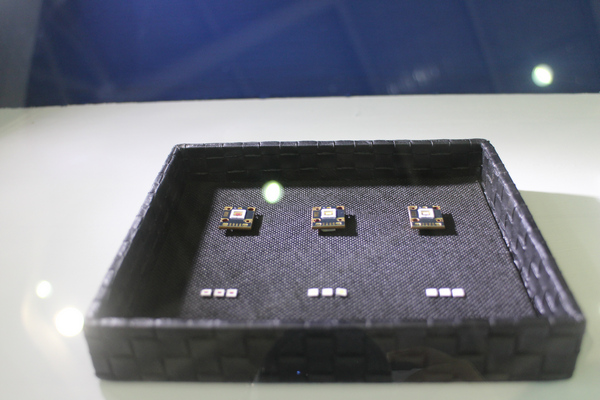

To conclude, LED manufacturers need to find alternative application markets as backlight market saturates, and cutthroat price wars rage on in the bulb market. Smart lighting might emerge as a blue market for manufacturers, said Lee. However, it will not be a market Epistar will be entering in anytime soon. At Epistar’s booth at TILS 2015, it can be observed the company has started to look into new application markets, such as LED projectors, IR LED and other HV LED application markets.

|

|

Epistar's LED chips for LED projectors showcased at TILS 2015. (LEDinside) |

Another market sector highlighted by Schmitt was the automotive lighting sector, which continues to hold high growth potential. Automotive headlamps are very lucrative, so even if interior automotive lighting product prices decline, manufacturers can still profit, said Schmitt. In either case, LED manufacturers will need to keep their eyes open for potential business opportunities.

(Author: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN