LED market trends observed at Guangzhou International Lighting Exhibition 2015 (GILE 2015) that took place in Guangzhou, China in mid-June can be summed up in this short poem:

Top players plan their withdrawal, the LED industry is vexed by their gains and losses.

Although, smart lighting is beautiful, in the short term it remains exuberant and impractical.

Anemic innovation plagues the industry, but new technology developments is still good.

Even though manufacturers are unscrupulous, cutthroat pricing has gradually diminished.

Industry insiders whisper rumors about manufacturers with exponential growth falling like shooting stars

The author’s observations may seem exaggerated, but it has become evident that the scale of GILE has declined somewhat this year. In the LED industry where large enterprises dominate the market, what manufacturers are doing has become far more important than whether they plan to stay in the industry. In an exclusive interview with LEDinside, Liu Pang Yen, General Manager Production Business Group Sales and Marketing Greater China, EVERLIGHT outlined the company’s strategy as the LED lighting industry enters the second generation.

|

|

Liu Pang Yen, General Manager Production Business Group Sales and Marketing Greater China, EVERLIGHT. (LEDinside) |

C/P ratio and optimization increasingly important as LED package manufacturers technology narrows

Taiwanese LED manufacturers consolidated revenues in May 2015 dropped compared to the company’s revenues in April, due to easing LED backlight demands and major European and U.S. lighting manufacturers decision to clear out inventory, according to LEDinside’s latest research report published in May.

EVERLIGHT was also affected by the slowing market, and reported revenues in May dropped 9.24% compared to April to NT$ 2.2 billion (US $70 million). On an annual basis, the company’s revenue slid 15.39% in May 2015. Although, the current situation is abnormal compared to previous years, investors should not be too concerned, said Liu. “EVERLIGHT’s orders is lined up well into July 2015,” he added.

|

|

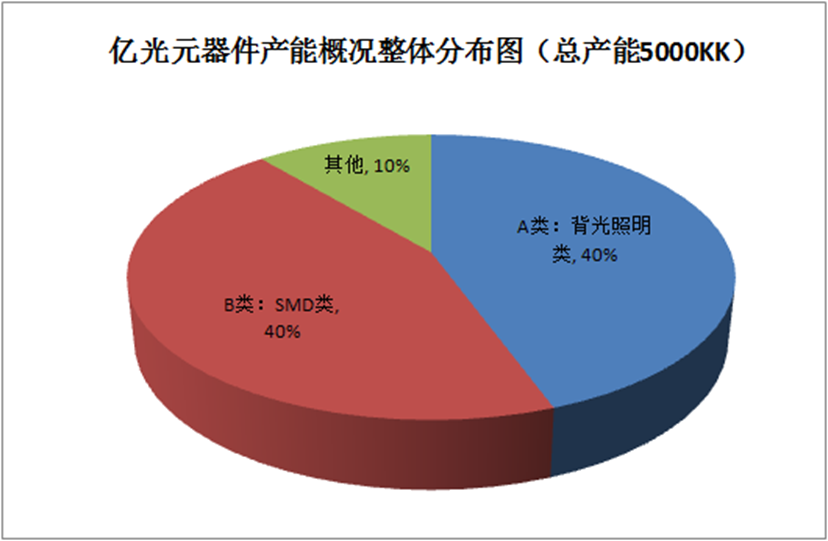

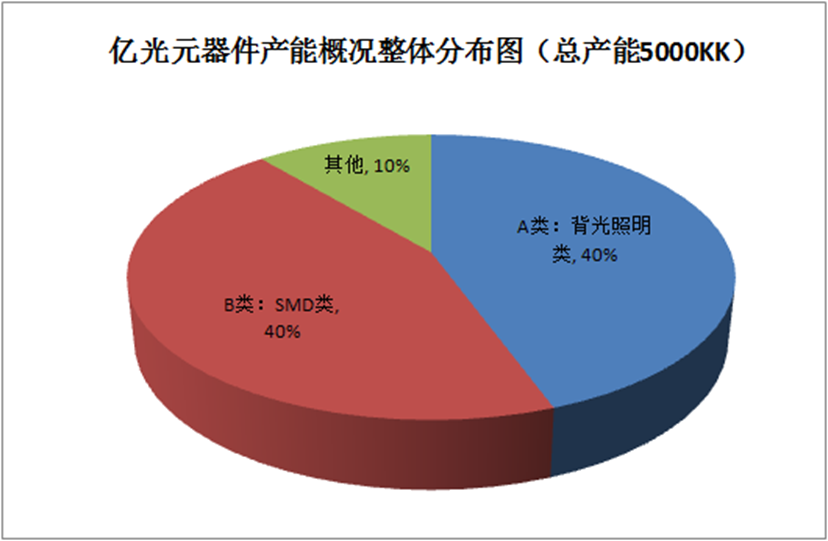

EVERLIGHT component production capacity according to different application sectors. The total monthly production capacity is 5000KK. Type A products (LED light bulbs, backlight and other white LED products) 2000KK, type B products (SMD), type C products(LED display, grow lights and others). (LEDinside) |

EVERLIGHT’s total monthly production capacity has reached 5000 KK. Broken down into different LED product applications, the company’s standard type A light bulbs and backlight production capacity reached 2000KK, type B LEDs for SMD applications has also reached 2000KK, while other type C light LED display, grow lights and other reached 1000KK. However, client demands still exceed EVERLIGHT’s production capacity, and in response the company is aggressively expanding production capacity.

The global LED lighting market has grown 90% during first quarter of 2015, said Liu, adding even Dutch lighting conglomerate Philips has projected global LED lighting market penetration rates will exceed 30% this year. For large LED package manufacturers in the industry, optimizing products and improving its Cost/Performance (C/P) ratios has become crucial in the industry competition.

The epitome of high C/P ratio products is the 2835 LED that is in high demand in the market, and also EVERLIGHT’s bestselling LED package. The company upgraded its existing 2835 LEDs, and has released a new XI2016W series, with a greatly reduced 2835 LED size. By taking advantage of its broad beam angle, fewer LEDs are required to achieve the same lighting distribution, which in turn can greatly reduce overall LED tube costs.

EVERLIGHT upgrade and optimizes products, while deploying diversified technology market strategy

Lighting component export market comprises 80% of EVERLIGHT’s business, while sales in the Greater China region has been less than 20%, due to competitive pricing, said Liu. However, he was optimistic that future price cuts in LED lighting products would occur in LED driver and auxiliary components rather than in LED components (LED chip, LED package and LED modules).

What is EVERLIGHT’s product strategy in the price war prone LED market?

In the Chip On Board (COB) product sector, EVERLIGHT has released low power COB lighting products XI5050W, XI7070W, and XI9595W to replace 10W and below COB products on the market. Liu explained C/P ratio drove EVERLIGHT’s decision to release low power COB products instead of following the industry norm of manufacturing high power COB products.

In terms of LED grow light products, EVERLIGHT’s LED package products has become increasingly comprehensive to cover plants average wavelength absorption, such as 430 nm, 660nm, and 730nm. These wavelengths can stimulate nutrient absorption in a plant’s root, stem, and leaves, thus facilitating plant growth. The company has especially designed 0.2W and 0.5W 2835 LEDs, and 1W 3535 LED chips with the capacity to emit the above three wavelengths, and achieve real high quality grow light package.

Aside from the popular COB products on the market, EVERLIGHT has also invested in Epoxy Molding Compound (EMC) products, and is mostly manufacturing the material for 1W LED products.

In the flip chip LED and CSP market sector, Liu noted flip chip LEDs is more suitable for high power LED applications. Using flip chip LEDs for small power LED product applications can cost nearly three times the same price, resulting in a very low C/P ratio. EVERLIGHT has mostly adopted flip chip LEDs in its backlight products. As for the LED industry’s highly promoted package-free CSP technology, the technology remains immature, analyzed Liu.

According to EVERLIGHT’s analyses, thermal dissipation is the main cause behind international lighting manufacturers CSP quality issues. The thermal dissipation issue is caused by directly using package free process and eliminating the usage of ceramic substrates. Hence, EVERLIGHT CSP technology still uses LED packaging and is being applied in the company’s backlight products and has entered mass production phase. The company still needs to advance its thermal dissipation technology before it can develop package free CSP products.

As for small pitch LED products, the company is mostly manufacturing SMD 1010 LED and 0808 LED products. The company’s business strategy will enable it to manufacture 0606 LED for LED displays with a 0.75 pitch.

In the global IR LED market for surveillance and security control applications, Joanne Wu, Associate Manager, Research Division, LEDinside noted in the future SMD package products in IR LEDs will replace traditional lamp package products. EVERLIGHT, which has been developing the IR LED market for many years, noted there is huge market potential IR LED, but prices in China have become too low.

In emerging UV LED and smart lighting markets, EVERLIGHT has upgraded its products or chosen to optimize products. The company has deployed a diversified technology market strategy to reduce the size of lighting products while raising its C/P ratio. In the LED display sector the company is developing smaller pitch products, while in flash LED sector it is developing 300lm and above high-end flash products.

Patent lawsuit win assists EVERLIGHT’s emerging market strategy

In the emerging market sector, EVERLIGHT established a new subsidiary in India. The company has mainly been selling IR LED and LED lighting products. However, in terms of revenue scale, the company business in the emerging market consists a very small market share. The average Indian household income is moderate, hence the market is mostly price driven. EVERLIGHT is shipping LED products from Taiwan to meet India market demands, and plans to employ an economics of scale strategy to lower product costs.

The Indian government’s energy saving policies has allowed EVERLIGHT to successfully acquire a 20 million LED bulbs government project. The company has completed the Indian government’s supplier review process, and projects market growth in this sector to increase in the near future.

In response to Indian market low pricing factors, EVERLIGHT is considering to use Chinese LED chips in its future products to meet the local market demand.

As for LED patents that are “nukes” for LED manufacturers to enter the emerging market, the company possesses more than 1,700 global LED patents. The company is an industry leader in terms of its LED patent strategies. In addition, EVERLIGHT has also signed cross-license patent agreements and other license agreements with Osram, GE and other manufacturers to offer clients comprehensive intellectual property (IP) and technology protection.

In addition, after a decade long patent war with Nichia, two important Nichia YAG phosphor patents was invalidated by the jury in the U.S. District Court for the Eastern District of Michigan this year. The company’s patent market strategy will also propel EVERLIGHT’s entry into other emerging markets in the future.

(Author: LEDinside staffhttp:// Translator: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN