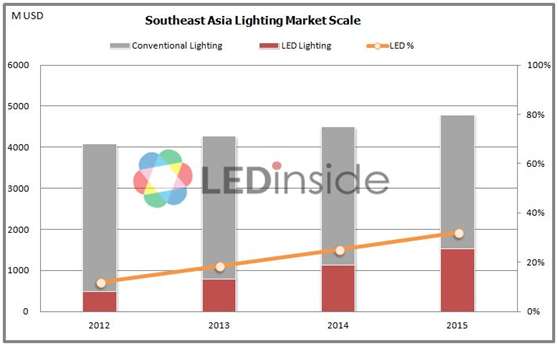

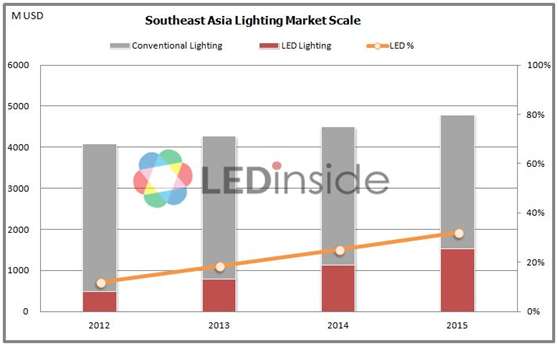

According to a recent estimation made by LEDinside, a division of Trendforce, the total lighting market value of the six major Southeast Asian countries - Thailand, Singapore, Malaysia, Vietnam, Indonesia, and Philippines - will reach about USD 4.8 billion in 2015. Out of that amount, about USD 1.5 billion comes from the LED lighting market. Southeast Asia’s LED lighting market had the fastest pace of growth in 2013 with a year-on-year increase of 63%. Though growth lagged during the 2014-2015 period, the rate was still kept at 30% and above. Moreover, the market penetration rate of LED lighting in Southeast Asia has risen with each passing year and at an accelerating speed. Overall, the market penetration rate of LED lighting in the region is projected to grow from 12% to 32% within 2012-2015. Southeast Asia is growing into the most dynamic and promising LED lighting market.

|

|

|

LED lighting developed rapidly in Southeast Asia thanks to its infrastructure construction, in addition, the development and impact of the Association of South-East Asian Nations (ASEAN) is also remarkable. ASEAN is an inter-governmental international organization gathering countries in Southeast Asia. Established in 1967, ASEAN is one of the world's fastest growing economic regions.

ASEAN not only actively negotiates free trade agreements, but also sets a goal that setting up the "ASEAN Economic Community" in 2015. The establishment of the ASEAN Community will enable the ASEAN to be a single market and production base. ASEAN Economic Community will be available by the end of 2015, with the purpose of facilitating the free circulation of goods, services and labors, as well as the capital movement among member states.

In terms of policy and standard, after the establishment of the ASEAN Economic Community, electronic devices will be in accordance with uniform standard AHEEERR. By 2016, as long as electronic equipments obtain safety certification in any one of member states, they can be sold across this region. The implementation of uniform standard will undoubtedly be a huge boost for exports to Southeast Asia. For LED manufacturers, it saves a lot of cost and time to enter the Southeast Asian market without the needs of multi-standard certifications, and also increases trading opportunities since exports to Southeast Asia can be sold across the entire ASEAN region. As for the local market and consumers, the implementation of uniform standard will lead to a benign competition environment, which is conducive to enhancing product quality and specifications, thus improving market acceptance.

Under the impetus of fast-growing market and favorable policies, the Southeast Asian market is bound to become a significant overseas battlefield for Chinese LED manufacturers in the future. However, manufacturers can only seize the market quickly and effectively when they choose appropriate channels and development patterns.

Take lighting products imported from China for instance, can be divided into five categories according to Southeast Asian lighting industry chain structure: a. Chinese manufacturers provide components for the local lighting firms; b. imported semi-finished products to be assembled by local firms; c. imported retrofit lamps plus local assembly; d. Chinese manufacturers work as ODM and ship productsworldwide; e. Chinese manufacturers sell own-brand products through local projects or wholesale channels.

Overall, since Southeast Asia market lacks manufacturing capacity, it is still dominated by international giants such as Philips, GE and Toshiba, followed by local large manufacturers. The international and local companies prefer to use Chinese manufacturers as ODM to produce and ship products to Southeast Asia, keeping large amount of orders and stable relationships, so this pattern accounts for the highest proportion, with an average of above 50%. In addition, Chinese manufacturers' own-brand products sold in the Southeast Asia's market accounts for about 25% of market share.

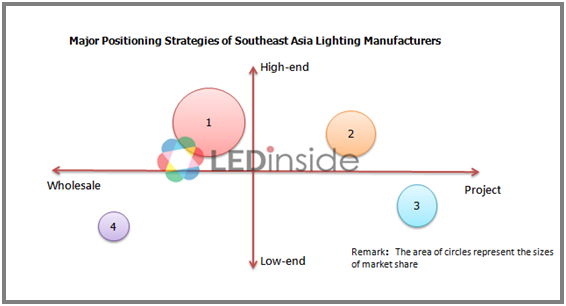

As the residential market is still untapped, the LED lighting demands in Southeast Asia still derive from commercial use and outdoor projects, so local large manufacturers generally rely on project channels, rarely on retail and wholesale channels. However, international companies, as the market pioneers, generally rely on both of them, even more on retail and wholesale channels, with higher prices than local manufacturers. In addition, some small and medium sized manufacturers primarily sell products through retail and wholesale channels, with lower price to seize the low-end market, taking up the smallest proportion.

There are four positioning strategies as follows:

a: Rely on both B2C channels and project channels, but mostly more on B2C channels.

b: Mainly rely on project channels, rarely on B2C channels.

c: Almost all products are sold through project channels.

d: Sell products through retail and wholesale channels, mostly small and medium sized firms.

It can be seen that Chinese manufacturers play an important role in current Southeast Asian industry chain model. Building collaborate relationship with local enterprises and obtaining ODM/OEM orders can assist Chinese manufacturers to open up the Southeast Asian market fast and effectively. In addition, for large-scale and well-known Chinese manufacturers, it’s better to establish a brand image, grasp the local channels and then export own-brand products to this market, so they can earn both higher profits and a place in Southeast Asian market.

To sum up, through rational self assessment to select appropriate channels, and determine product specifications and prices in accordance with local market demands are necessary for manufacturers who intend to enter the market. Regardless of what pattern is chosen: high-end or low-end, project channels or retail channels, own brand or ODM/OEM; an accurate positioning strategy is the key to enter the Southeast Asian market.

2015 Southeast Asian Lighting Market Report

Release: February 2015

Language: English

Format: PDF

Pages: 145

Price: USD3,500

Chapter One: Report Structure and Key Factors

-

Introduction to Chapters and Study Methods

-

Southeast Asia (SEA) Lighting Market Key Factors

-

Factor Conditions

-

Demand Conditions

-

Related and Supporting Industries

-

Government

-

Firm Strategy, Structure, and Rivalry

-

Chance

Chapter Two: SEA Market Macroeconomics

-

SEA Market Macroeconomics Overview

-

Basic Index

-

Average Electricity Price

-

Power Consumption

Chapter Three: Lighting Market Scale and Trend Analysis

-

Lighting Market Scale and Trend

-

Southeast Asian Lighting Market Scale and Trend

-

Thailand Lighting Market Scale and Trend

-

Singapore Lighting Market Scale and Trend

-

Malaysia Lighting Market Scale and Trend

-

Vietnam Lighting Market Scale and Trend

-

Indonesia Lighting Market Scale and Trend

-

Philippines Lighting Market Scale and Trend

-

Southeast Asia Countries – China Import Scale and Trend Analysis

-

Thailand – China Import Scale and Trend Analysis

-

Singapore– China Import Scale and Trend Analysis

-

Malaysia – China Import Scale and Trend Analysis

-

Vietnam – China Import Scale and Trend Analysis

-

Indonesia – China Import Scale and Trend Analysis

-

Philippines – China Import Scale and Trend Analysis

Chapter Four: Manufacturers Introduction and Strategies Analysis

-

Manufacturers Introduction and Strategies Analysis Overview

-

LED Lighting Industry Chain Structure Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Major Positioning Strategies of Southeast Asia Lighting Manufacturers

-

Major Lighting Manufacturers Company Profile

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Two Local Manufacturers Company Profile for Each Country

Chapter Five: LED Lighting Products Specifications and Prices Analysis

-

Major LED Lighting Products Overview

-

Major Lighting Manufacturers’ LED Bulb Pricing Strategy Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

LED Bulb Specification and Price

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Major Lighting Manufacturers’ LED Tube Pricing Strategy Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

LED Tube Specification and Price

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

LED Street Light Specification and Price

Chapter Six: Lighting-Related Policies and Regulations

-

Introduction

-

Thailand

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Singapore

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Malaysia

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Vietnam

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Indonesia

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Philippines

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

Chapter Seven: ASEAN Developments and Impact on Lighting Industry

Part 1: ASEAN Introduction and Development

-

ASEAN Introduction and Development

-

ASEAN-China Free Trade Area

-

Global Economic Development Overview

-

Analysis of ASEAN Free Trade Area & ASEAN Economic Community

Part 2: ASEAN’s Impact on Lighting Industry

-

ASEAN’s Impact on Lighting Industry

-

FTA’s Impact on China LED Manufacturers - Tariff Preferential

-

ASEAN Economic Community’s Impact on Chinese LED Manufacturers

-

Chinese LED Manufacturers’ Advantages Analysis

-

Chinese LED Manufacturers Recommended Strategies

Chapter Eight: Proposal on Entering into SEA Lighting Market

-

Proposal on Entering into Southeast Asia Lighting Market

-

Lighting Product Positioning Strategy in Southeast Asian Market

-

Specification Strategy

-

Pricing Strategy

-

Strategic Analysis of Entering into Southeast Asian Lighting Market

-

Product Requirements

-

Product Positioning

-

Channels Selection

-

Government Relations

For further information please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972

CN

TW

EN

CN

TW

EN