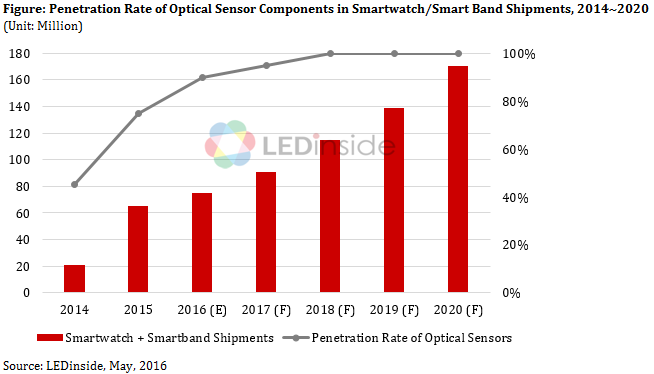

The combined shipments of smartwatches and smart bands will reach 7.5 million units this year, and 90% of which will be equipped with optical sensor components used for pulse rate monitoring, according to the 2016 UV

LED and IR LED Application Markets Report by

LEDinside, a division of

TrendForce. Shipments of smartwatches and smart bands together will total 170 million units by 2020, and all of them are expected to incorporate optical sensor components. A common sensor system that measure pulse rate and blood oxygen concentration is the reflective photoplethymography (PPG) sensor. Due to opportunities in health and fitness trends, the reflective PPG sensor is gradually becoming an integral part of most wearable devices. Additionally, wearable optical sensors that can track pulse rate and other health-related data have huge potential in the home healthcare market.

oanne Wu, assistant research manager for LEDinside, said PPG is based on an optical sensor technology that uses LED light sources, so it is less susceptible to power supply noise and electromagnetic interference. Compared with other sensor technologies, PPG can take measurements on different parts of a person’s body and can be placed in various positions. Thus, PPG is compatible with wearable designs. Moreover, this optical sensor technology can also detect blood oxygen concentration. In sum, convenience along with wider capability is PPG’s major advantage in the growing home healthcare market.

A reflective PPG sensor uses a green LED for measuring pulse rate, and compares the relative strengths of light from red LED and IR LED to determine blood oxygen concentration. After the processing the signals generated by the reflections of both red and IR LED light, the sensor can calculate the level of oxygen concentration in a person’s blood.

Wu pointed out that there are companies that offer complete solutions for reflective PPG sensors, such as U.S.-based AMS-TAOS, Taiwan’s Pixart Imaging and Lite-on Technology. Their main business model include selling their IC modules and computing software. Their products are available for testing and simulation to further improve accuracy. There are also sensor manufacturers that do not develop their own software but can provide IC modules and partial solutions from their partners in the supply chain.

2016 UV LED and IR LED Application Market Report

Release: 08 April 2016

Language: Chinese / English

Format: PDF

Page: 271

PART ONE 2016 UV LED Application Market

-

UV LED Market Overview

-

UV LED Market Forecast Analysis

-

2015-2020 UV LED Market Scale- By Product

-

2015-2020 UV LED Market Scale- By Application

-

2013-2015 UV LED Market Price Survey

-

UV LED Market Opportunities and Challenges

-

UV-A LED Market Technology

-

UV-A LED Product Specification and Application Requirement- Epi Wafer, Chip, Package, Module

-

UV-A LED Player Progress

-

UV-A LED Chip Product Analysis

-

UV-A LED Package Product Analysis

-

UV-A LED Application Market Opportunities and Challenges

-

General Curing Market

-

UV Technology Requirements in Curing Application Markets

-

Superior UV Curing Processing Factors

-

UV LED Module Manufacturer List

-

UV Curing Machine List

-

UV Adhesive Manufacturer List

-

General Curing Market v.s. Eqposure Machine Curing Market

-

General Curing Market

-

Coating Application Market Requirement and Equipment Manufacturer List

-

Laminating Application Market Requirement and Equipment Manufacturer List

-

Inkjet Printing Application Market Requirement and Equipment Manufacturer List

-

Nail Curing Application Market Requirement and Equipment Manufacturer List

-

3D Printing Application Market Requirement and Equipment Manufacturer List

-

Air Purification Application Market Requirement and Equipment Manufacturer List

-

Special Curing Market

-

Exposure Machine Market Requirement and Equipment Manufacturer List

-

UV-A LED Major Players and Business Model Analysis (Chip, Package, Module, System)

-

Europe

-

USA

-

Japan

-

Korea

-

Taiwan

-

China

-

UV-C LED Market Technology

-

UV-C LED Product Specification and Application Requirement- Epi Wafer, Chip, Package, Module

-

UV-C LED Player Progress

-

UV-C LED Chip Technology Challenges and Product Analysis

-

UV-C LED Package Technology Challenges and Product Analysis

-

UV-C LED Application Market Opportunities and Challenges

-

UV-C LED Market Opportunities

-

UV-C LED Market Opportunities- Application Market and Equipment Manufacturer List

-

UV-C LED Major Players and Business Model Analysis (Chip, Package, Module, System)

-

2016-2018 UV Market Value Chain Analysis

-

2015 UV Market Value Chain Analysis

-

2016-2018 UV Market Value Chain Analysis

PART TWO 2016 IR LED Application Market

-

Infrared LED Market Overview

-

Infrared LED Market Scale

-

Infrared LED Market Scale- By Application

-

Infrared LED Market Technology

-

Infrared LED Chip

-

Infrared LED Package

-

Infrared LED Application Market Opportunities and Challenges

-

Security Surveillance Market:Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

Iris v.s. Face Recogenition:Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

Optical Sensor- Reflective Pulse Oximetry Sensing Module:Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

Optical Sensor- Proximity Sensor:Product Design, Manufacturer Supply Chain, Market Scale, and Opportunity and Challenge

-

IR LED in Automated Drive System:Product Design, and Opportunity and Challenge

-

Infrared LED Major Players and Business Model Analysis (Chip, Package / IR LED, Optical Sensor)

-

EU and USA

-

Japan

-

Korea

-

Taiwan

-

China

Further information, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912

CN

TW

EN

CN

TW

EN