The value of the global

LED market has been growing at a crawling pace as demand for backlight LEDs contracts. Automotive LEDs, however, are one of the few sizable application markets that are developing rapidly along with other smaller markets for niche industrial LED products. The latest analysis by

LEDinside, a division of

TrendForce, finds the replacement of traditional light bulbs with LED light sources continues steadily in the automotive lighting market despite the slowing growth in the regional automobile markets worldwide during the second quarter. While the percentage of LED-based products in developed markets continues to expand, emerging markets are also seeing gradual adoption. LEDinside projects that the value of the exterior automotive LED market will reach US$1.57 billion this year and will grow at a CAGR of 6% in the 2016~2020 period.

In the case of China’s automotive lighting market, Duff Lu, research manager for LEDinside, said the use of LEDs is still mainly influenced by cost considerations. LEDs used in interior automotive lighting and rear position lamps, for example, share similar specifications with LEDs used in the general lighting and backlight applications. Hence, the penetration rates of LEDs in China’s interior automotive lighting and rear position lamp segments are now over 70%, respectively. These figures are close to the international average. Chinese automotive lighting manufacturers have also made rapid progress in the technological development of daylight running lights (DRLs) in recent years and some have begun to use standard LEDs for their DRL products. LEDinside projects that the penetration rate in China’s DRL segment will reach 47% in 2016. As for high-power LED packages used for high and low beams, Chinese manufacturers still rely on imports because most domestic suppliers are not mature enough technologically to produce these components. Hence, LED penetration rate China’s high/low beam market is currently less than 3%.

Lu pointed out replacing traditional light bulbs in an automotive luminaire can only be done by opening up the luminaire’s back cover and pull the light bulbs out from their sockets. However, LED products tend to be integrated or systematic in design and most LED automotive lighting products in the OEM market come as an entire luminaire assembly. They thus are not suited for the conventional replacement method. To expand the adoption of LEDs, LED module suppliers are developing replacement or plug-in light bulb products that can substitute traditional light bulbs in an automotive luminaire. The growth of these replacement products are expected to become a major trend within the market. Currently, LED replacement automotive light bulbs are mainly for the performance market (PM), particularly China’s. While high-intensity discharge (HID) lamp is the leading technology in the Chinese PM, LED has an opportunity to break into the mid-range segment between high-end and low-end HID replacement products for headlamps. Eventually, LED may erode HID’s market shares in both high- and low-end of the PM.

Lu added that the penetration rate of LED headlamp luminaires in the global headlamp market is on the rise due to declining prices and increase in products’ luminous efficacy. The market positioning of LED headlamp luminaires has also expanded from the high-end to the mid-range vehicle models. On the other hand, LED replacement light bulbs for headlamps could later become a challenge to the integrated design of LED headlamp luminaires on account of better pricing.

As LED headlamp luminaires are still in the early development phase, standards governing their design and production are relatively incomplete. Furthermore, these products are mainly for retail sales, so consumers’ selections are based primarily on pricing. “An assortment of packages will enter the market for LED headlamp luminaires in this initial period,” noted Lu, “However, only packages that can arrange LED light sources in stripes or line arrays will be the mainstream in the future because they can be adjusted to imitate different original reflective structures. These stripe/line-array packages will be instrumental in changing the competitive landscape of the automotive lighting market.”

LEDinside: Chinese Automotive LED Penetration Market Analysis / EU & US Car Supply Chain

China

Chinese automotive light’s development is still price-oriented when adopting LEDs. Current spec for interior automotive lights and RCL are similar with lighting LEDs and even backlight LEDs, the LED penetration rate is relatively high and similar to international level. As DRL is closely linked to the recognition of vehicles, it has seen rapid development in Chinese market over the past few years. Moreover, some Chinese automotive makers turn to low-power LEDs for DRL applications. Therefore, the market penetration of DRL in China rose to 47% in 2016.

Slow mid and high-power LED in Chinese automotive market: Due to the high technical requirement of high-power LED product segments, such as high / low beam and fog light. These light sources are mainly from international source and have low penetration rate.

US Car Market Supply Chain

US automotive makers mainly adopt automotive lamps from Visteon and Hella. As North America is notorious for its tariff protection, automotive lamp factories and modules are constructed relatively close to each other, focusing on market opportunities and the reduction of assembly costs. Mexico is a popular location of such plants over the past few years.

As the suppliers of headlamps and tail lamps are not necessarily the same, the main concern lie in design and mass production ability. Meanwhile, the suppliers of tail light and interior lights are usually the same as the technical difficulties is relatively low and can be potentially purchased together.

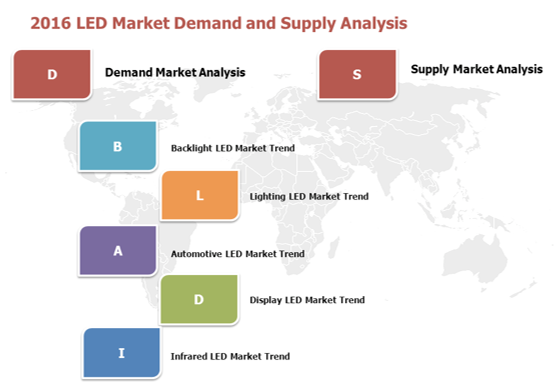

LEDinside Gold Member: 2H16 LED Market Demand and Supply Analysis

Topic One: Demand Market

IT Display Market Trend- Outline

Price Trend

-

Backlight LED Prices Stabilizing after Steep Fall

-

Market Trend

-

Market of Consumer Electronic Devices Saturated

-

Rising OLED Edges Out Backlight Needs- Mobile and Tablet

-

Rising OLED Edges Out Backlight Needs- TV

-

Smartphone Market Growth Enters Single Digit Phase

-

Tablet Shipment Volume Continuous Decline Over Past Few Years

-

Incremental TV Shipment Growth in 2016

-

Wearables Strong Growth Momentum, But Still Limited LED Demand Growth

-

Market Opportunity of VR and AR Lies in Sensor

Product Trend

-

Mobile Backlight LED Continuously Downsizes

-

Three Flash LED Specs Where 1016 LED is Set to Grab Market Share in Low-End Market in 2016

-

Nichia Might Enter Flash LED Market Competition?

-

Lighting Market Trend- Outline

Market Demand

-

LED Luminaires Major Export From China to the World- Monthly Trend

-

LED Luminaires Major Export From China to the World- Region Trend

-

LED Luminaires Major Export From China to the World- Amount Trend

Price Trend

Product Trend

-

DOB LED Accounted For 5% COB Market- Product Market Demand is Small, Only Suitable for Project

-

7070 LED - Gradually Becoming New Market Focus, Aimed at 15-20W COB Market

-

7070 LED - Cree’s 7070 LED Products Used in The Niche Market Have High Light Intensity and Can Be Applied in Automotive and Outdoor Lighting Market

Automotive LED Market Trend- Outline

Market Demand

-

Slowing Global Economic to Limit Car Market Growth in 2016

-

China- LED Penetration Rate in Product Segments

Regional Supply

-

Europe- LED Highly Implemented in Automotive Lamps

-

North America- Tariff Protection Urges Close Production

Product Trend

-

LED Headlamp Replacement- Primary Opportunity to Start by Entering PM Market

-

LED Headlamp Replacement Enter Shakeout Stage

-

LED Headlamps Replacement Opportunities in OE Market

-

LED Headlamp Replacements Still Incompatible

-

LED Headlamp Replacement Implement Speed and Price

-

LED Headlamp Replacement Market Grows

Display Market Trend- Outline

Market Demand

-

2014-2015 LED Display Finished Product Market Scale

-

Display Finished Product Market Size

-

2015-2020 Fine Pitch LED Display Market Scale

Price Trend

Product Trend

-

Sony Launches New Ultrafine LED Display Technology

-

Fine Pitch Display LED and General Display LED

-

Fine Pitch Display Market Supply Chain Overview

Infrared LED Market Trend

-

Wearable Devices Emerge From Health and Fitness, Moving Toward Home Care Service in the Future

-

Photoplethysmography (PPG) : Measuring Pulse and Oximetry

-

PPG Supply Chain – Optical Sensor Modules

-

PPG Module Business Model

-

Potential PPG Customers List

-

2015-2020 Pulse / Oximetry Sensor Market Volume in Wearable Devices

Topic Two Supply Market

Price Trend

-

Oversupply Resulted in Sharp Price Drop in LED Chips in 2015

-

2-inch Wafer Price Close to Production Cost

Market Demand

-

Restocking To Encourge Utilization Rate Recovery

Industry Trend

-

2015-2020 MOCVD Installation Volume By Region

-

Some of LED Manufacturers Turn to Niche Market in 2016

-

Chinses LED Chip House Continued to Expand LED Capacity

-

2-inch and 4-inch LED Wafer Cost Analysis

-

Chinese LED House Towards 4-inch Wafer Production to Lower Costs

Customized Report / Consulting Service

LEDinside provide customized report and consulting service, please call or email to us.

If you would like to know more details , please contact:

|

Joanne Wu +886-2-8978-6488 ext. 912 joannewu@trendforce.com |

|